STOCK MARKET NEWS: Jobs data sinks Dow, S&P, Nasdaq, oil tops $92 after OPEC punch

Investors sell off stocks as September jobs report shows lowest monthly gain since April 2021. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

The U.S. Postal Service wants to raise prices, effective Jan. 22, 2023. The new rates include a three-cent increase in the price of a First-Class Mail Forever stamp from 60 cents to 63 cents.

If favorably reviewed by the Postal Regulatory Commission (PRC), the proposed increases will raise First-Class Mail prices approximately 4.2% to offset the rise in inflation.

• Letters (1 oz.): 60 cents to 63 cents

• Letters (metered 1 oz.): 57 to 60 cents

• Domestic postcards: 44 cents to 48 cents

• International postcards: $1.40 to $1.45

• International Letter (1 oz.): $1.40 to $1.45

Here's why stock investors got a scare following the September jobs report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CVS | $91.04 | -7.54 | -7.65 |

| CANO | $9.37 | 0.53 | 6.00 |

CVS Health fell more than 10% Friday. The world’s second largest healthcare company is reportedly in exclusive talks to acquire primary care provider Cano Health, according to media reports.

Cano rose over 9%. The company expects to operate 189 medical centers by the end of 2022.

U.S. stocks ended the session lower across the board after the September jobs report stoked views that the Federal Reserve will remain aggressive with interest rate hikes. The yield on the 10-year Treasury rose for the 10th consecutive week, topping 3.88%. In commodities, oil soared 16.5% for the week closing at $92.64 per barrel following OPEC’s production cut.

Despite the selloff, stocks rose for the week.

DJIA: +2%

S&P 500: +1.5%

Nasdaq Composite: +0.7%

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $5.47 | -0.40 | -6.87 |

Moody's Investors Service downgraded Bed Bath & Beyond’s credit rating by two notches but upgraded its speculative grade liquidity rating.

Moody’s cut the domestic merchandise retailer’s corporate family rating to 'Ca' from 'Caa2' on the company’s announcement that it may pursue liability transactions to address its $284 million of bonds. Both 'Ca' and 'Caa2' ratings are considered “junk.”

The ratings agency raised the speculative grade liquidity rating because Bed Bath & Beyond increased its borrowing capacity and issued $30 million of equity.

Moody’s also changed its outlook for the company to stable from negative.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CS | $4.37 | 0.08 | 1.86 |

Credit Suisse plans to buy back 3 billion Swiss francs ($3 billion) of debt to assuage investors concerns over its financial health.

The Swiss bank will make a cash tender offer in relation to eight euro or pound sterling-dominated senior debt securities for up to 1 billion euros ($985.8 million).

A separate cash tender offer will be made in relation to 12 U.S. dollar-denominated senior debt securities for up to $2 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PRVB | $6.96 | 0.73 | 11.82 |

| SNY | $38.91 | 0.01 | 0.03 |

Provention rose as much as 14% in intraday trading. The biopharmaceutical company entered into a co-promotion agreement with Sanofi U.S. for the launch of Provention's lead investigational drug candidate teplizumab.

Teplizumab is currently under review by the Food and Drug Administration user fee goal date of November 17 for the Biologics License Application. The drug has the potential to delay clinical type 1 diabetes in at-risk individuals.

Under the terms of the agreement, Sanofi will commit commercial resources in the U.S., including diabetes field specialists, account directors, field-based reimbursement and medical science liaisons. In exchange, Provention will reimburse expenses.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMBC | $14.65 | 1.85 | 14.45 |

| BAC | $30.60 | -0.86 | -2.73 |

Ambac Financial is trading higher. The financial services company announced Bank of America agreed to pay its subsidiary Ambac Assurance Corporation (AAC) $1.84 billion to settle all of its claims.

The settlement materially exceeds the $1.48 billion subrogation recovery recorded on Ambac’s second quarter financial statements, including $1.38 billion related to Bank of America litigation.

As a result, Ambac estimates it will record a gain with respect to the settlement of approximately $390 million, net of reinsurance and discount accretion and call premiums on AAC’s secured debt.

The settlement stems lawsuits related to the 2008 mortgage crash.

The Department of Energy (DOE) on Friday revealed the names of the entities that won bids to purchase the latest oil released from the Strategic Petroleum Reserve by President Biden.

Seven of the eight buyers announced Friday are headquartered in the U.S.: Atlantic Trading & Marketing Inc., Equinor Marketing & Trading, Macquarie Commodities Trading U.S., Marathon Petroleum Supply and Trading, Motiva Enterprises, Phillips 66, and Valero Marketing and Supply Company.

The only foreign-based company to purchase from the last release is Shell Trading (US), which is mostly owned by Royal Dutch Petroleum Company headquartered in the Netherlands.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MSFT | $234.69 | -12.10 | -4.90 |

| INTC | $25.91 | -1.27 | -4.69 |

| WBA | $30.89 | -1.36 | -4.22 |

| MRK | $87.87 | 0.43 | 0.49 |

| CVX | $162.22 | 0.80 | 0.49 |

Afternoon selling of U.S. stocks picked up momentum as a volatile and losing week winds down. Friday's jobs report, which showed growth is slowing, is rattling investors.

Microsoft, Intel and Walgreens are the Dow's biggest losers, while Merck and Chevron held up.

Euro Pacific Capital chief economist Peter Schiff tells 'Making Money' global markets are starting to realize the Fed will have to return to quantitative easing to prevent a financial crisis and 'worsening recession.'

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TLRY | $3.21 | -0.69 | -17.63 |

| CGC | $2.98 | -0.77 | -20.53 |

Tilray Brands is plunging in Friday trading. Shares jumped 30% Thursday on news President Biden pardoned people convicted of marijuana possession.

The cannabis maker missed Wall Street revenue and profit estimates. Tilray reported fiscal first quarter revenue down 8.8% to $153.2 million; analysts expected $156.09.

The net loss widened to $65.8 million from $34.6 million. The net loss basic and diluted was 13 cents. Analysts were looking for 7 cents.

The company maintained its top position in Canada with 8.5% cannabis market share, driven by Tilray’s comprehensive portfolio of adult-use brands.

Tilray competitor Canopy Growth is also lower Friday. Shares gained 22% Thursday on Biden's announcement.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ALGT | $68.34 | -5.31 | -7.21 |

Allegiant Travel is delaying room sales for Sunseeker Resort – Charlotte Harbor in Southwest Florida following Hurricane Ian. The resort was previously selling rooms for as early as May 2023.

Allegiant said it appears the property was protected to a significant degree by its decision to build 16 feet above the mean high tide line and to install a seawall along the length of the resort’s boundary with Charlotte Harbor.

“The company has begun and will continue to evaluate damage caused by the Hurricane and has engaged outside specialists, including structural engineers, to evaluate the damage and advise as to the course of action to assure the safe completion of the resort,” Allegiant said in a regulatory filing.

“The company maintains robust insurance coverage against damage from hurricanes and will be pursuing claims to recover losses.”

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $228.81 | -9.32 | -3.91 |

| PEP | $162.24 | -0.56 | -0.34 |

Telsa’s electric semi-trucks are coming in December, with PepsiCo first in line for the haulers with a 500-mile range. The beverage maker had previously reserved 100 of the vehicles.

Elon Musk's truck is expected to cost $180,000. It will, however, qualify for a congressional tax break of up to $40,000.

U.S. stocks fell across the board after employers added 263,000 positions in September, the lowest monthly gain since April 2021. A softening labor market signals broader economic weakness may be emerging. Bond yields move higher with the 10-year Treasury at 3.89%. In commodities, oil continued its climb after OPEC’s production cut, now nearing $90 per barrel.

Advanced Micro Devices is under pressure after lowering its third quarter revenue projections to $5.6 billion down from $6.7 billion.

"Preliminary results reflect lower than expected Client segment revenue resulting from reduced processor shipments due to a weaker than expected PC market and significant inventory correction actions across the PC supply chain" the chip giant company diclosed in its financial update.

Other chipmakers fell in sympathy including Nvidia and Intel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| INTC | $27.18 | -0.46 | -1.66 |

| NVDA | $131.30 | -0.79 | -0.60 |

A look at job growth from January 2021 to date.

Employers added 263,000 jobs in September, the Labor Department said in its monthly payroll report released Friday, slightly topping the 250,000 jobs forecast by Refinitiv economists. It marks the lowest monthly gain since April 2021.

The jobs report for September rose but marked another slowing month for growth.

U.S. equity futures were trading mixed ahead of the release of the most anticipated economic report of the month - the September employment report.

The major futures indexes suggest a gain on the Dow Industrials when the opening bell rings on Wall Street.

The Nasdaq is taking a hit due to news from chipmakers. Samsung saw profits plunge as demand fell.

AMD provided third-quarter revenue estimates that fell well short of its previous forecast, citing lower-than-expected demand and significant inventory corrections across the personal computer market supply chain.

Oil prices steadied on Friday ahead of the jobs report.

WTI crude futures traded around $88.00 a barrel.

Brent crude futures traded around $94.00 a barrel.

Both benchmarks were headed for weekly gains, fueled by the production cut announcement by OPEC+.

Economists surveyed by Refinitiv say the U.S. economy likely added 250,000 new nonfarm jobs in September. That’s down from 315,000 the previous month and would mark the weakest job growth since December 2020.

"Employment and jobless claims data suggest the job market remains firm. Even with some companies announcing layoffs or plans to cut jobs," said Bankrate.com senior economic analyst Mark Hamrick. "It appears that many individuals have been able to transition to new employment opportunities in quick order."

The unemployment rate is anticipated to hold steady at 3.7%.

The yield on the 10-year Treasury, which helps set rates for mortgages, rose to 3.84%.

In Asia, the Nikkei 225 in Tokyo sank 0.7% and Hong Kong's Hang Seng tumbled 1.5%. Chinese markets were closed for a holiday.

On Wall Street, the S&P 500 fell to 3,744.52. The index is up 4.4% for the week following its best two-day rally in 2 1/2 years.

The Dow Jones Industrial Average lost 1.1% to 29,926.94. The Nasdaq composite slid 0.7% to 11,073.31.

U.S. job growth in September likely cooled from a frenzied pace earlier this year, but hiring probably remained solid despite growing headwinds from higher interest rates and scorching-hot inflation.

The Labor Department on Friday morning is releasing its closely watched September jobs report, which is projected to show that payrolls increased by 250,000 last month and that the unemployment rate held steady at 3.7%, according to a median estimate by Refinitiv economists.

That would mark a drop from the 315,000 recorded in August and would be the weakest monthly job growth since December 2020.

Samsung Electronics reported a worse-than-expected 32% drop in quarterly operating earnings on Friday.

The company says an economic downturn slashed demand for electronic devices and the memory chips that go in them.

Samsung's memory chip shipments likely came in below already downgraded expectations and prices could fall further this quarter.

Analysts say customers are reacting to rising inflation, higher interest rates and the impact of Russia's invasion of Ukraine.

Oil prices steadied on Friday ahead of the release of the monthly jobs report.

Oil gained over 1% in the last session on cuts to OPEC+ production targets.

WTI crude futures traded around $88.00 a barrel.

Brent crude futures traded around $94.00 a barrel.

A stronger dollar added pressure on oil prices. Markets are closely watching the U.S. nonfarm payrolls report due on Friday, with economists forecasting 250,000 jobs to have been added last month.

Both benchmarks were headed for weekly gains, fueled by the production cut announcement by OPEC+.

The decision would squeeze supplies in an already tight market, adding to inflation.

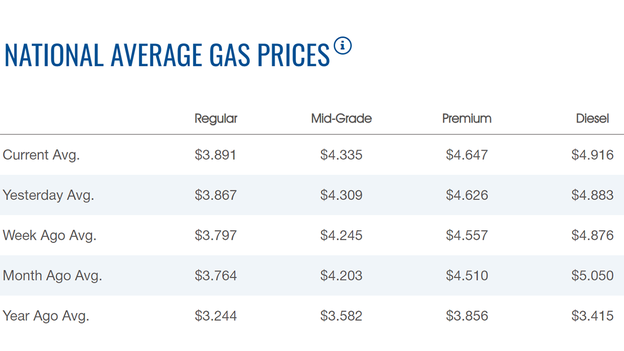

The average price of a gallon of gasoline gained again on Friday to $3.891, according to AAA. Thursday's price was $3.867.

Gas hit a high of $5.016 on June 14.

Diesel's price gained to $4.916 per gallon.

Bitcoin was trading around $20,000, after trading higher in three of the last four days.

For the week, Bitcoin has gained more than 2%.

The cryptocurrency has lost more than 63% year-to-date.

Ethereum was trading around $1,300, after gaining more than 1% in the past week.

Dogecoin was trading at 6 cents, after gaining more than 4% in the past week.

Live Coverage begins here