STOCK MARKET NEWS: Dow drops 400 points, 10-year Treasury yield hits 4%, oil’s weekly slide

Dow drops 400 points and the Nasdaq hits a 52-week low. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NKLA | $3.06 | -0.04 | -1.29 |

Nikola Corp founder Trevor Milton on Friday was convicted by a U.S. jury of fraud in a case alleging he lied to investors about the electric vehicle company's technology.

The jury found Milton guilty on one count of securities fraud and two counts of wire fraud after deliberating for around five hours. Milton was acquitted on an additional count of securities fraud.

During the trial in federal court in Manhattan, prosecutors depicted Milton, 40, as a "con man" who sought to deceive investors about the electric- and hydrogen-powered truck maker's technology starting in November 2019.

The defense and the prosecution delivered closing arguments to the jury on Thursday in a trial that began on Sept. 13. The prosecution said Milton was obsessed with the company's stock price and made the statements to inflate it and his own net worth. The defense said prosecutors had distorted Milton's statements about Nikola's plans to shake up the automotive industry.

U.S. stocks closed out a wild week of swings with losses on Friday for all three of the major benchmarks. This as the 10-year Treasury yield hit 4.005% - the highest since October 2008. In commodities, oil lost over 7% for the week closing at $85.61 per barrel.

For the week, the Dow Jones Industrial Average posted a gain of 1.3%, while the S&P 500 and Nasdaq Composite retreated by 1.5% and 3%, respectively.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ALF | $0.22 | -0.62 | -73.84 |

| UBER | $24.77 | -0.23 | -0.90 |

| LYFT | $11.78 | -0.21 | -1.75 |

Alfi has filed for Chapter 7 bankruptcy. The company provides a network of AI-powered screens at the back of Uber and Lyft rideshare vehicles and uses computer vision technology to match audiences with relevant advertising in real-time and in a privacy-compliant process.

A Chapter 7 trustee will be appointed by the Bankruptcy Court and will assume control over the assets and liabilities of the company. The assets will be liquidated and claims paid in accordance with the Bankruptcy Code, the company said in a regulatory filing.

Federal Reserve Chairman Jerome Powell has ordered an independent review of Atlanta Federal Reserve President Raphael Bostic's financial disclosures after "inaccuracies" were discovered.

Treasury Secretary Janet Yellen says inflation remains a top priority for the Biden administration. Yellen spoke at the annual meetings of the International Monetary Fund and World Bank in Washington.

“Inflation is elevated in many countries, growth is slowing globally, we’re also seeing swings in capital flows and strong movements in financial markets but we’re taking strong actions both in the United States and globally to contend with these headwinds,” Yellen said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NTNX | $26.07 | 4.92 | 23.29 |

Cloud data-storage firm Nutanix Inc is exploring a sale after receiving takeover interest, the Wall Street Journal reported on Friday, citing people familiar with the matter.

Shares of the San Jose, California-based company jumped nearly 23% in morning trade.

Nutanix is expected to target private equity and industry players, the report said, adding that it is far from certain there will be a deal.

The company declined to comment on "market rumors or speculation" when contacted by Reuters.

Federal food safety officials are proposing a new strategy to control Salmonella contamination in poultry products and reduce foodborne illnesses attributed to these products.

The proposed framework would:

• Require that incoming flocks be tested for Salmonella before entering an establishment;

• Enhance establishing processes to control monitoring and verification; and

• Implement an enforceable final product standard.

Bank of America analysts expects stocks to fall further until they bit bottom something next year.

Strategist Michael Hartnett said the Federal Reserve will continue to raise interest rates to lower inflation, causing more market pain.

Hartnett had previously said that past bear markets show an average peak-to-trough decline of about 37% for the S&P 500, the benchmark index, over 289 days. That would suggest the current bear market – which began in early June – will end with the gauge around 3,020 points. That would mark a nearly 16% decline from current levels.

The Dow Jones Industrial Average fell over 300 points early afternoon pressured by American Express, Apple and Chevron, while JPMorgan, United Health and Boeing managed to inch higher.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AXP | $137.22 | -4.33 | -3.06 |

| AAPL | $139.19 | -3.80 | -2.66 |

| CVX | $161.15 | -4.13 | -2.50 |

| JPM | $112.26 | 2.89 | 2.64 |

| UNH | $518.25 | 8.35 | 1.64 |

| BA | $132.90 | 0.49 | 0.37 |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ABT | $101.91 | -0.56 | -0.55 |

| HOLX | $63.23 | -0.17 | -0.28 |

| DGX | $125.80 | 0.09 | 0.07 |

| LH | $210.63 | 1.34 | 0.64 |

The United States on Thursday extended the COVID-19 pandemic's status as a public health emergency for another 90 days, thereby preserving measures like high payments to hospitals and expanded Medicaid.

The extension was announced by U.S. Health Secretary Xavier Becerra on Thursday. Last month, President Joe Biden said in an interview that "the pandemic is over," which prompted criticism from health experts.

The toll of the COVID-19 pandemic has diminished significantly since early in Biden's term when more than 3,000 Americans per day were dying, as enhanced care, medications and vaccinations have become more widely available.

But hundreds of people a day continue to die from the coronavirus in the United States, according to the U.S. Centers for Disease Control and Prevention.

Biden has asked Congress for $22.4 billion more in funding to prepare for a potential case surge.

Former President Donald Trump had declared a national emergency in 2020 to free up $50 billion in federal aid.

British Prime Minister Liz Truss fired her finance minister Kwasi Kwarteng on Friday and scrapped parts of their economic package in a desperate bid to stay in power and survive the market and political turmoil gripping the country.

Kwarteng said he had resigned at Truss's request after being forced to rush back to London overnight from IMF meetings in Washington.

Truss, in power for only 37 days, then told a news conference she would now allow a key business levy to rise from next year, raising 18 billion pounds, as she accepted she had gone "further and faster" than markets had been expecting.

“As U-turn’s go it’s a doozy,” said AJ financial analyst Danni Hewson. “There are approximately 18 billion reasons not to go ahead with the freeze. Eighteen billion pounds is now expected to swell government coffers, which will help to offset the rising cost of borrowing and additional spend required to deal with the energy crisis."

Truss appointed Jeremy Hunt, a former foreign and health secretary, to replace Kwarteng.

The pound slid against the dollar after she spoke, trading 1.2% lower on the day at $1.1198 and two-year British government bonds, or gilts turned negative.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JPM | $113.72 | 4.35 | 3.98 |

| MS | $77.07 | -2.25 | -2.84 |

| C | $44.37 | 1.42 | 3.29 |

| WFC | $44.52 | 2.13 | 5.04 |

Profits slid at Wall Street's biggest banks in the third quarter as they braced for a weaker economy while investment banking was hit hard as dealmaking dried up, but investors saw a silver lining with some shares gaining and JPMorgan Chase & Co beating estimates.

JPMorgan, Morgan Stanley, Citigroup Inc and Wells Fargo & Co's reported earnings on Friday, showing a slide in net income after turbulent markets choked off investment banking activity and lenders set aside more rainy-day funds to cover losses from borrowers who fall behind on payments.

JPMorgan reported a 17% drop in third-quarter profit to $9.74 billion, although that was less than had been feared.

Others reported similar slides. Morgan Stanley reported a 30% slump in profit to $2.49 billion. Wells Fargo posted a 31% decline to $3.53 billion. And Citi reported a 25% drop to $3.5 billion.

Banks set aside more money in preparation for a hit from a potential economic slowdown. JPMorgan set aside $808 million in reserves, Citi added $370 million to reserves and Wells had a $385 million increase in the allowance for credit losses.

U.S. stocks rallied across the board as investors celebrated solid earnings from the likes of JPMorgan which is benefiting from higher interest rates. Deal news also helped sentiment with Kroger buying Albertson’s in a $24 billion grocer tie-up. In commodities, oil fell 2% to the $87 per barrel level.

Kroger and Albertson's, two of the nation's largest grocers, are combining in a deal valued around $24 billion that is promising to shake-up the food shopping industry.

Grocery chain Kroger will buy rival Albertsons for $34.10 a share in a deal valued at $24.6 billion, the companies announced on Friday.

As of June 18, Albertsons operated 2,273 retail, food and drug stores with 1,720 pharmacies, 402 associated fuel centers, 22 dedicated distribution centers and 19 manufacturing facilities across 34 states and the District of Columbia.

Meanwhile, Kroger operates nearly 2,800 stores in 35 states operating under 28 different names, including Fred Meyer, Ralphs, King Soopers and Harris Teeter.

U.S. equity futures were trading lower ahead of the start of earnings season for the big banks and the release of a slew of economic reports.

The major futures indexes suggest a decline of 0.4% when the trading day begins on Wall Street.

Oil prices were searching or direction with both contracts down 3% for the week.

U.S. West Texas Intermediate (WTI) crude futures traded around $88.00 per barrel.

Brent crude futures traded around $93.00 per barrel.

The yield on the 10-year Treasury, which helps set rates for mortgages and many other loans, was at 3.91% Friday morning.

The big banks unofficially kick off third-quarter earnings season Friday morning.

JPMorgan Chase, Wells Fargo, Citigroup, and Morgan Stanley are all scheduled to report ahead of the opening bell.

Rising interest rates should help the banks by boosting net interest margin and net interest income. On the flip side, the jump in borrowing costs could mean that loan demand takes a hit.

On the economic calendar, reports are due on retail sales, import & export prices and consumer sentiment.

Asian stock markets surged Friday after Wall Street rebounded from a slump caused by worse-than-forecast inflation numbers.

Japan's Nikkei soared 3.3%, Hong Kong jumped 1.2% and China's Shanghai Composite gained 1.8%.

Wall Street's benchmark S&P 500 index rebounded to end up 2.6% for its biggest daily gain in 2 1/2 years.

The Dow Jones Industrial Average rose 2.8% at 30,038.72. The Nasdaq composite climbed 2.2% at 10,649.15.

The big banks unofficially kick off third-quarter earnings season Friday morning.

JPMorgan Chase, Wells Fargo, Citigroup, and Morgan Stanley are all scheduled to report ahead of the opening bell.

Rising interest rates should help the banks by boosting net interest margin and net interest income. On the flip side, the jump in borrowing costs could mean that loan demand takes a hit.

The falloff in deal-making and underwriting fees will take a bite out of profits, but that will be at least partially offset by a pickup in trading activity thanks to the latest market volatility.

Finally, investors will pay close attention to the banks’ outlooks in the face of global economic uncertainty and the growing risk of recession.

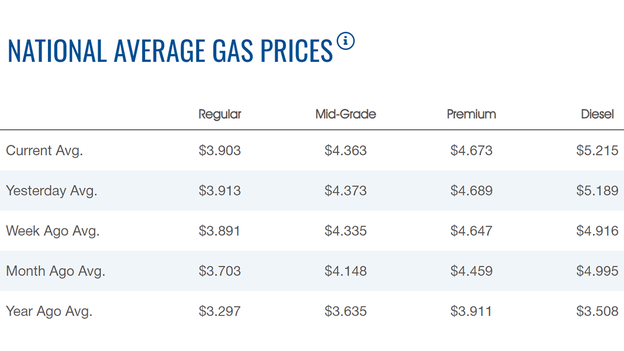

The average price of a gallon of gasoline slipped for the third straight day after a recent run of increases.

The price on Friday was $3.903, according to AAA. Thursday's price was $3.913.

A week ago, gasoline was at $3.703. Gas hit a high of $5.016 on June 14.

Diesel's price gained to $5.215 per gallon.

Oil prices turned negative overnight on Friday.

U.S. West Texas Intermediate (WTI) crude futures traded around $88.00 per barrel.

Brent crude futures traded around $93.00 per barrel.

Both contracts were down about 3% for the week after two prior weeks of gains amid recession concerns.

Oil prices were also supported by a steep drawdown in distillate stocks as heating oil demand is expected to rise as winter approaches.

Bitcoin was trading around $19,000, after gaining for two consecutive days.

Bitcoin has lost more than 2% in the past week. The cryptocurrency is off 0.1% for the month and down more than 58% year-to-date.

Ethereum was trading around $1,300, after losing more than 4% in the past week.

Dogecoin was trading at 6 cents, after losing more than 5% in the past week.

NYDIG switching its focus toward more promising businesses means job cuts.

The bitcoin trading and banking firm laid off about a third of its workforce last month, people familiar with the matter told the Wall Street Journal.

The cutbacks came less than two weeks before NYDIG announced it had replaced its top two executives.

On Oct. 3, NYDIG said that Chief Executive Robert Gutmann and President Yan Zhao had stepped down from their roles, although they will remain parent company Stone Ridge Holdings Group.

They were replaced by Tejas Shah, formerly head of institutional finance, and Nate Conrad, global head of payments, respectively.

The reason for the executive changes was not disclosed.

A company statement said it was on pace for record revenue this year, with sales up 130% during the first half.

Live Coverage begins here