STOCK MARKET NEWS: Snap shares plunge, oil inches higher, 10-year Treasury yield above 4%

Investors wind down a volatile week for stocks as 20% of S&P 500 companies report results. Soaring energy costs worry consumers as winter approaches and Elon Musk plans massive Twitter workforce layoffs. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Moody's Investors Service today changed the outlook on the U.K. government to negative from stable and affirmed the domestic and foreign-currency long-term issuer and domestic-currency senior unsecured ratings at 'Aa3'.

The credit rating agency cited the government's unpredictable policy making.

The outlook on the Bank of England's ratings has also changed to negative from stable.

Aa is Moody's second highest grade below 'Aaa'.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MAT | $19.82 | 0.57 | 2.96 |

Toymaker Mattel has agreed to pay $3.5 million to settle charges relating to misstatements in its third and fourth quarter 2017 financial statements, the Securities and Exchange Commission announced.

Separately, the SEC initiated litigation against Joshua Abrahams, a former audit partner at PricewaterhouseCoopers LLP, or PwC, to determine whether he engaged in improper professional conduct and violated auditor independence rules.

According to the SEC’s order, Mattel understated the tax-related valuation allowance for Q3 2017 by $109 million and overstated the tax expense for Q4 2017 by the same amount.

As a result, Mattel’s Q3 and Q4 2017 net loss and net loss per share were understated by 15% and overstated by 63%, respectively.

The SEC’s separate order against Abrahams alleges that he violated numerous professional standards in the interim review and annual audit of Mattel’s financial statements.

According to the order, Abrahams failed to verify that the uncorrected $109 million error was documented, despite knowing of it, and failed to communicate the error to Mattel’s audit committee.

U.S. stocks turned in a strong Friday performance with all the major S&P sectors gaining led by materials and financials. All three of the benchmark’s showed the biggest weekly gains since June rising roughly 5% apiece. This as the yield on the 10-year Treasury settled at 4.212%. In commodities, oil inched up 0.5% for the week to $85.05 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLF | $32.16 | 0.90 | 2.88 |

| XLB | $72.30 | 2.40 | 3.43 |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAL | $13.71 | 0.24 | 1.82 |

American Airlines is eliminating first-class seats on international flights, the airline revealed.

"The quality of the Business Class C has improved so much," explained Chief Commercial Officer Vasu Rajaon on the airline’s recent investor call. "And frankly, by removing it, we can go provide more business class seats, which is what our customers most want or most willing to pay for."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAPL | $146.87 | 3.48 | 2.43 |

Apple Inc's vice president for industrial design, Evans Hankey, is leaving the company, Bloomberg News reported on Friday, citing people with knowledge of the matter.

Hankey's departure was announced inside the Cupertino, California-based firm this week, with Hankey telling colleagues that she will remain at Apple for the next six months, according to the report, which added that a replacement has not been named so far.

She took over the role in 2019 after famed Apple designer Jony Ive moved out. Apple launched iPhone 12 through iPhone 14 models and M1 MacBooks while Hankey headed industrial design.

Apple did not immediately respond to a Reuters request for comment.

Hankey's exit comes as Apple pushes forward on work on new devices, including mixed reality headsets, and potentially an electric car that is expected to be produced many years down the line.

Workers will be able to contribute more money in 2023 to their 401(k) plans. The IRS raised the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan is increased to $22,500, up from $20,500.

The limit on annual contributions to an IRA increased to $6,500, up from $6,000. The IRA catch‑up contribution limit for individuals aged 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NVO | $104.23 | 0.17 | 0.16 |

Celebrities including billionaire Elon Musk are fueling demand for Novo Nordisk’s diabetes-related drugs Ozempic and Wegovy, causing short-term manufacturing issues.

The influencers are using those drugs for weight control. Ozempic was approved for use for treating Type 2 diabetes while Wegovy was cleared for chronic weight management. However, neither drug is "intended to be used as a lifestyle medication," according to Novo Nordisk.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CNI | $111.89 | 2.21 | 2.01 |

| CP | $70.41 | 1.46 | 2.12 |

| CSX | $27.48 | 0.40 | 1.46 |

| NSC | $207.22 | 2.35 | 1.15 |

The consortium of U.S. freight railroads is rejecting demands to modify a tentative deal brokered by the Biden administration.

The decision by the National Carriers' Conference Committee increases chances of a nationwide railroad strike as soon as Nov. 19.

The third largest railroad union, the Brotherhood of Maintenance of Way Employes Division, wants sick time.

The Treasury Department said Friday the federal budget deficit was 562% higher on a monthly basis compared with September 2021, largely reflecting President Joe Biden's plans to forgive student debt as several years' worth of costs were compressed into one month.

Despite the monthly increase, over the fiscal year that ended last month, the federal budget deficit fell $1.4 trillion. It roughly halved in size because of the end of spending tied to coronavirus pandemic relief and higher tax revenues as more Americans found jobs.

The federal budget deficit totaled $1.38 trillion this year. That's down from $2.78 trillion in fiscal 2021. Biden intends to speak about the figures on Friday as a sign that he has been responsible with federal finances.

Biden in August announced $10,000 in federal student debt cancellation for those with incomes below $125,000 a year, or households that make less than $250,000 a year. Those who received federal Pell Grants to attend college are eligible for an additional $10,000 in forgiveness.

Biden's plan makes 20 million people eligible to get their federal student debt erased entirely.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SLB | $48.73 | 3.04 | 6.65 |

Schlumberger on Friday reported its strongest quarterly profit since 2015 with results that topped Wall Street forecasts on oilfield drilling and equipment sales that surged on high oil and gas prices.

Oil and gas producers are increasing production with crude prices near eight-year highs, boosting demand for Schlumberger's equipment, services and technology.

Brent crude prices averaged $98.96 a barrel during the quarter, up 33% from the third quarter of 2021.Schlumberger's net income was $907 million, or 63 cents a share, for the quarter ended Sept. 30, compared with $550 million, or 39 cents per share, a year ago. Analysts had expected earnings of 55 cents per share, according to Refinitiv IBES.

Adjusted earnings and pre-tax segment operating margin was 18.7%, the highest since 2015, the company said.

Revenue this quarter will grow by more than 20% while pre-tax margins will expand 200 basis points compared with the same period in 2021, Schlumberger said.

Schlumberger boosted this year's capital spending by 10% to $2.2 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PFE | $44.57 | 1.66 | 3.87 |

| BNTX | $126.19 | 7.76 | 6.55 |

Pfizer's plan to as much as quadruple current U.S. prices for its COVID-19 vaccines going forward could spur revenue for years, analysts said.

The drugmaker, which developed and sells the vaccine with Germany's BioNTech said on Thursday evening that it is targeting a range of $110 to $130 a dose for the vaccine once the United States moves to a commercial market next year.

Outside the United States, Pfizer said it already has contracts with governments in many developed markets that extend through 2023 with prices that have already been set.

Wells Fargo analyst Mohit Bansal said the new pricing range could add around $2.5 billion to $3 billion in annual revenue for the shots.

"This is much higher than our assumption of $50 per shot and even assuming $80 per shot net price in high-income countries, we see $2 per share upside to our estimates" from the new prices, he wrote in a research note.

Wall Street was expecting such price hikes due to weak demand for COVID vaccines, which meant manufacturers would need to hike prices to meet revenue forecasts for 2023 and beyond.

So far, the U.S. rollout of updated COVID-19 booster shots that target both the original version of the coronavirus and circulating Omicron subvariants has lagged last year's rate despite more people being eligible for the shots.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VZ | $34.89 | -2.11 | -5.70 |

Verizon Communications Inc posted a 23% slide in third-quarter profit and missed market estimates for wireless subscriber additions on Friday, as several customers opted for cheaper plans from rivals AT&T Inc and T-Mobile US Inc.

Verizon lost 189,000 monthly bill-paying phone subscribers in its consumer business in the quarter after the U.S. carrier raised prices for its plans in June through additional charges, which was over and above its already pricier plans.

Verizon added 8,000 net new monthly bill paying wireless phone subscribers in the quarter, well below Factset estimates of 35,400 additions.

The carrier's net income for the quarter fell 23.3% to $5 billion. Adjusted earnings per share came in at $1.32 per share.

Total revenue, however, rose 4% to $34.2 billion, above expectations of $33.78 billion, according to Refinitiv data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $116.07 | 0.82 | 0.71 |

| HA | $15.73 | 1.65 | 11.72 |

| EADSY | $24.67 | 0.07 | 0.28 |

Amazon is teaming with Hawaiian Airlines for air cargo services, a regulatory filing said.

The initial deal, starting in the fall of 2023, is for 8-years, with options to extend for an additional five years.

Hawaiian will maintain and fly Amazon’s Airbus A330s under Hawaiian’s FAA air carrier certificate to move cargo between airports near the online retailer’s operations facilities.

The initial 10 aircraft will enter into service in 2023 and 2024. The agreement also contemplates the ability to expand the fleet depending on Amazon’s future business needs.

Additionally, Hawaiian Holdings issued warrants, giving Amazon the option to acquire up to 15% of the company. The warrants are exercisable over the next 9 years.

Middle America is not a happy a place when it comes to the economy and the prospects of building wealth.

U.S. stocks drifted as investors wind down a choppy trading week after roughly 20% of S&P 500 companies reported quarterly earnings. Snap shares plunged by double digits after a poor revenue update. In commodities, oil inched higher to the $85 per barrel level.

Tesla CEO and the world's richest person is the latest to take on the Federal Reserve over their handling of inflation and the looming recession.

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin were all lower early Friday.

At approximately 5:15 a.m. ET, Bitcoin was trading at nearly $18,970 (-0.37%), or lower by $65.

For the week, Bitcoin was trading lower by nearly 1.9%. However, for the month, the cryptocurrency was higher by nearly 0.85%.

Ethereum was trading at approximately $1,277.4 (-0.35%), or lower by more than $4.6.For the week, Ethereum was trading lower by almost 0.35%. For the month, it was trading lower by approximately 3.15%.

Dogecoin was trading at $0.057995 (-2.64%), or lower by approximately $0.001571.

For the week, Dogecoin was lower by nearly 0.32%. For the month, the crypto was higher by more than 2%.

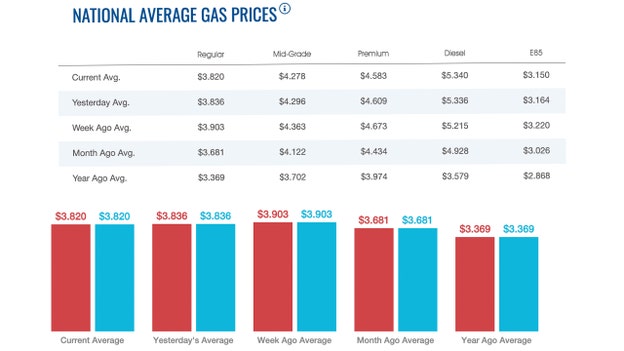

The average price of a gallon of gasoline nationwide fell to $3.82 early Friday morning, AAA reported.

The nationwide price for a gallon of regular gasoline on Thursday was $3.836. On Wednesday, the price was $3.854.

A week ago, gasoline sold for $3.903 per gallon. A month ago, that same gallon of gasoline nationwide was $3.681. A year ago, gasoline sold for $3.369 nationwide.

Gas hit an all-time high of $5.016 on June 14, approximately 18 weeks ago.

Meanwhile, diesel's price rose slightly Friday to $5.34 per gallon nationwide. On Thursday, the price was $5.336. Early Wednesday morning, the price was $5.324.

A week ago, diesel sold for $5.215 per gallon. A month ago, that same gallon of diesel nationwide sold for $4.928. A year ago, diesel was selling for $3.579 per gallon nationwide.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $30,333.59 | -90.22 | -0.30 |

| SP500 | $3,665.78 | -29.38 | -0.80 |

| I:COMP | $10,614.84 | -65.66 | -0.61 |

U.S. stocks moved lower early Friday after losing ground on Thursday as as investors weighed the latest batch of corporate earnings and the question of how aggressively central banks will raise interest rates to moderate inflation.

The S&P 500 fell 29.38 points, or 0.8%, to 3665.78 near the end of the trading day. The tech-focused Nasdaq Composite dropped 65.66 points, or 0.6%, to 10614.84 and the Dow Jones Industrial Average lost 90.22 points, or 0.3%, to 30333.59.

The U.S. employment market remains strong, with the latest government data showing the number of Americans applying for unemployment benefits fell last week and remains historically low.

The healthy jobs market is a sticking point since it suggests the Fed will have to persist in raising interest rates. The central bank has raised its key interest rate to a range of 3% to 3.25%. Just over six months ago, it was near zero.

The increases are putting pressure on other areas of the economy, including the housing market, where mortgage rates are now at 15-year highs. Mortgage buyer Freddie Mac reported Thursday that the average on the key 30-year rate ticked up this week to 6.94% from 6.92% last week.

The Federal Reserve has raised interest rates five times this year and is likely to increase its benchmark federal-funds rate by another 0.75 percentage point at its meeting next month as it tries to bring down high inflation.

"At the moment, we keep getting upside surprises on inflation everywhere you look," said Hugh Gimber, a strategist at J.P. Morgan Asset Management. "No one really has a good grasp yet of where the central banks -- particularly the Fed -- are going to be able to stop."

The uncertainty around both inflation and the extent of the Fed's monetary tightening is at the core of what's been weighing on markets in recent days, according to Arthur Laffer Jr., president of Laffer Tengler Investments, a Nashville, Tenn.-based registered investment adviser that manages more than $1 billion in assets.

"Markets are a little bit stunned that the Fed has shown that it's going to stay the course at least through year-end," Laffer said. "If these inflation numbers don't come down and they don't come down consistently over several months, you are not going to get a pivot anytime soon."

Stocks have been volatile in recent sessions, buoyed by a batch of mixed though better-than-expected earnings results. Still, some investors believe that earnings expectations are too high across the board and a downward recalibration is likely ahead.

Meanwhile, Asian shares were mostly lower Friday in muted trading, as investors kept an eye on inflation and awaited the outcome of a Communist Party congress in China. Benchmarks fell in most regional markets but rose in Mumbai.

In other developments, Japan's core consumer prices rose 3.0% in September from a year earlier, according to government data released Friday. That was the highest increase in eight years. It would also have been the highest in more than 30 years if the impact of introducing and raising the consumption tax was excluded.

The Bank of Japan has kept an ultra-low interest rate policy, while the Federal Reserve and other central banks have been raising rates to counter surging prices. Until recently, the Japanese central bank had devoted its efforts to fending off deflation, or the continued downward spiraling of prices.

Japan's benchmark Nikkei 225 declined 0.4% in afternoon trading to 26,892.67. Australia's S&P/ASX 200 shed 0.8% to 6,676.80. South Korea's Kospi edged down 0.3% to 2,212.61. Hong Kong's Hang Seng fell 0.8% to 16,157.32, while the Shanghai Composite gained 0.2% to 3,041.21. Shares rose 0.4% in Mumbai.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $70.18 | 0.14 | 0.20 |

| CVX | $168.96 | 0.96 | 0.57 |

| XOM | $103.93 | 0.14 | 0.13 |

Oil prices were little changed on Friday as optimism about a possible rise in demand in China faded and the market again weighed the impact of sharp interest rate rises on energy consumption.

Brent crude futures slipped 12 cents to trade at $92.26 a barrel by 0625 GMT. U.S. West Texas Intermediate futures were down by 11 cents to $84.40 a barrel.

Brent was on track for a weekly gain of 0.6%, while WTI was expected to fall 1.5% following a rollover in front-month contracts.

To fight inflation, the U.S. Federal Reserve is trying to slow the economy and will keep raising its short-term rate target, Federal Reserve Bank of Philadelphia President Patrick Harker said on Thursday.

"With several key Fed members taking turns at the hawk's pulpit this week arguing for even higher interest rates, it blunted optimism from China's reduced quarantine hopes," Stephen Innes, managing director at SPI Asset Management said in a note. "Everyone is pining for a China-reopening-driven commodity boost, but we are not there yet."

Beijing is considering cutting the quarantine period for visitors to seven days from 10 days, Bloomberg news reported on Thursday, citing people familiar with the matter. There has been no official confirmation from Beijing.

China, the world's largest crude importer, has stuck to strict COVID-19 curbs this year, weighing heavily on business and economic activity and lowering demand for fuel. Many analysts believe the zero tolerance policy will be largely maintained well into next year.

But oil prices have been supported recently by a looming European Union ban on Russian crude and oil products, as well as the output cut from the Organization of the Petroleum Exporting Countries and allies including Russia, known as OPEC+.

"OPEC's move to cut production by two million barrels per day could be a turning point for the oil market. With the risk of Russian supply disruptions due to the price cap, it could tighten the market," said ANZ Research in a Friday note. "A slowing global economy and sustained soft demand from China are key headwinds, but the oil market is fundamentally in a stronger position than it has been in previous economic downturns."

OPEC+ had agreed on a production cut of 2 million barrels per day in early October, leading the White House to claim that Saudi Arabia had pushed other member nations into the output cut.

Labor Department data showed 214,000 workers filed for unemployment benefits in the week ended Oct. 15, down from the week prior.

Continuing claims, or the number of Americans who are consecutively receiving unemployment aid, rose to 1.385 million, up by 21,000 from the previous week's revised level. One year ago, more than 3.27 million Americans were receiving unemployment benefits.

The strong jobs data comes as the Federal Reserve tries to crush runaway inflation with the most aggressive rate hikes in decades.

Economic projections released by the Fed in September show that most officials expect unemployment to climb to 4.4% by the end of next year, up from the current rate of 3.7%. That is significantly higher than June when policymakers saw the jobless rate inching up to 3.7%.

Chair Jerome Powell conceded during the post-meeting press conference that higher rates could "give rise to increases in unemployment."

For more on the story, click here: Unemployment figures, mortgage cold feet and more: Friday's 5 things to know

Billionaire Elon Musk reportedly said he had plans to cut Twitter’s workforce by almost 75% should his deal to buy the social media platform close.

While speaking to potential investors, Musk said he planned to reduce Twitter’s staffing from about 7,500 to around 2,000 employees, a nearly 75% decrease, according to The Washington Post.

The outlet cited interviews and documents as the basis of its reporting published Thursday.

Musk offered to buy Twitter in April and sought to end the acquisition a few months later, resulting in a legal battle between him and the company.

In a reversal, he said earlier this month he would go through with the original deal.

For more on the story, click here: Twitter workforce may be cut nearly 75% by Elon Musk

Live Coverage begins here