STOCK MARKET NEWS: US stocks skid to levels not seen since mid-July

All three major U.S. stock indexes slid to levels not touched since mid-July, with the S&P 500 closing below 3,900, a closely watched support level. The S&P 500 lost 0.72% to end at 3,873.33 points, while the Nasdaq Composite lost 0.90%, to 11,448.40. The Dow Jones Industrial Average fell 0.45%, to 30,822.42. FedEx dominated the conversation. The package delivery company said it expects business conditions to further weaken in the current quarter after global volume softness accelerated in the final weeks the quarter ending August 31.

Coverage for this event has ended.

All three major U.S. stock indexes slid to levels not touched since mid-July, with the S&P 500 closing below 3,900, a closely watched support level.

The S&P 500 lost 0.72% to end at 3,873.33 points, while the Nasdaq Composite lost 0.90%, to 11,448.40. The Dow Jones Industrial Average fell 0.45%, to 30,822.42.

FedEx dominated the conversation. The package delivery company said it expects business conditions to further weaken in the current quarter after global volume softness accelerated in the final weeks the quarter ending August 31.

The announcement raised investors’ concerns about inflation and interest rates.

The two-year Treasury yield rose 0.290 percentage point to 3.859% this week, the largest one week yield gain since the week ended August 5.Ten-year Treasury yields also gained, rising 0.126 percentage point to 3.447%.

Nymex Crude for October delivery lost $1.68 per barrel, or 1.94% to $85.11 this week.

Comex Gold for September delivery lost $44.50 per troy ounce, or 2.59% to $1671.70 this week.

Uber eased worries about a security breach. The ride sharing app said it found no evidence he incident involved access to sensitive user data (like trip history).

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UBER | $31.79 | -1.34 | -4.06 |

Uber Technologies says a security breach did not touch sensitive data including users' trip history.

The ride sharing app said it has no evidence that the incident involved access to sensitive user data (like trip history).

All services including Uber, Uber Eats, Uber Freight, and the Uber Driver app are operational.

Internal software tools that were taken down as a precaution Thursday were coming back online Friday morning.

Chicago and New York City are most at risk to a potential downturn in the housing market, according to real estate data curator ATTOM.

The firm said data reveals that New Jersey, Illinois and California had 33 of the 50 counties most vulnerable to potential declines.

Consumer confidence improved slightly in September. The University of Michigan’s monthly index of consumer sentiment rose 1.3 points to 59.5 from 58.2 in August.

“After the marked improvement in sentiment in August, consumers showed signs of uncertainty over the trajectory of the economy,” researchers said.

With continued declines in energy prices, the median expected year-ahead inflation rate declined to 4.6%, the lowest reading since last September.

At 2.8%, median long run inflation expectations fell below the 2.9-3.1% range for the first time since July 2021.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FDX | $158.57 | -46.30 | -22.60 |

| PKG | $117.28 | -15.40 | -11.61 |

| UPS | $176.30 | -8.70 | -4.70 |

| DPSGY | $33.51 | -2.19 | -6.13 |

| GE | $65.52 | -3.39 | -4.92 |

The Dow Jones Industrial Average fell to as low as 30,550.08. The S&P 500 dropped as low as 3,837.45. The Nasdaq Composite skidded to 11,316.92.

A profit warning by FedEx is pulling down shares of shipping companies. FedEx lost more than 20% at the market open. UPS fell almost 4%. Packaging Corporation of America declined more than 5%. American depository receipts of DHL owner Deutsche Post fell almost 5%.

Industrial giant General Electric fell 3.8% after its chief financial officer said it was still bogged down by supply chain problems that were raising costs, the Associated Press reported.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AFLYY | $1.41 | -0.06 | -3.77 |

| RYAAY | $67.64 | -2.04 | -2.93 |

| ESYJY | $4.04 | -0.14 | -3.35 |

Air France said it has canceled 55% of its short- and medium-haul flights and 10% of its long-haul flights. The company could not rule out further delays and last-minute cancellations, it said in a statement.

Other companies operating in France, including Ryanair, Easyjet and Volotea, have also canceled flights.

France's main union of air traffic controllers, the SNCTA, called the one-day strike to demand higher pay amid soaring inflation and demanding more staff to be hired in the coming years.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JBLU | $7.89 | -0.19 | -2.36 |

JetBlue is raising its outlook for the third quarter. The discount carrier said in a regulatory filing that it continues to see the strong demand environment extend beyond the summer peak, with robust demand for travel in September and beyond.

The airline continues to expect cost per available seat mile, excluding fuel, to increase between 15% and 17%, year over three. Fuel costs are seen at $3.86 per gallon versus $3.68 previously guided.

Available seat miles versus the same quarter in 2019 is now estimated at (0.5%)-0.5%, an improvement from previous guidance of (3%)-0%.

Revenue per Available Seat Mile versus 2019 is expected to increase 22%-24%, up from 19%-23%.

U.S. stocks opened lower, mirroring losses in Europe and Asia as investors await next week’s decision by the Federal Reserve on interest rates.

The Dow started Friday trading down more than 300 points. The S&P 500 and Nasdaq opened lower by more than 1%.

“There is scope for this event to really upset investors so today’s retreat on European and Asian markets indicates that many people are trimming positions in case we get another big leg down,” said Russ Mould, investment director at AJ Bell.

The major European averages are trading lower at the U.S. market open. Japan’s NIKKEI 225 drooped 2.29% this week. Hong Kong’s Hang Seng fell 3.1% this week.

FedEx issued a profit warning Thursday, withdrawing guidance for fiscal 2023 and said it expects business conditions to further weaken in the current quarter.

FEDEX CLOSING STORES, OFFICES, DELAYING HIRES, PULLS FORECAST

| Symbol | Price | Change | %Change |

|---|---|---|---|

| IPAX | $9.74 | -0.03 | -0.31 |

Intuitive Machines plans to go public via a merger with special purpose acquisition company Inflection Point Acquisition that values the combination at about $1 billion.

Intuitive Machines is a diversified space exploration, infrastructure, and services company with marquee contracts supporting space exploration and NASA’s $93 billion Artemis program.

The company founded in 2013 is a leading participant in NASA’s Commercial Lunar Payload Services initiative, having been awarded contracts for three missions to date, more than any other contractor.

For its first mission scheduled for no earlier than the first quarter of 2023, an Intuitive Machines lunar lander, launched on a SpaceX Falcon 9 Rocket, is expected to transport government and commercial payloads to the surface of the Moon, marking the United States’ first return to the Moon since NASA’s last Apollo mission in 1972.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ACDVF | $14.46 | 0.22 | 1.54 |

Air Canada is buying 30 electric-hybrid planes under development by Heart Aerospace of Sweden.

The regional aircraft are expected to enter service in 2028. The hybrid planes will generate zero emissions by flying on battery power and will yield significant operational savings and benefits.

The aircraft will be powered by lithium-ion batteries. It will also be equipped with reserve-hybrid generators that can use sustainable aviation fuel.

Under the agreement, Air Canada has also acquired a $5 million equity stake in Heart Aerospace.

The Biden administration is moving one step closer to developing a central bank digital currency, known as the digital dollar, saying it would help reinforce the U.S. role as a leader in the world financial system.

The White House said on Friday that after President Joe Biden issued an executive order in March calling on a variety of agencies to look at ways to regulate digital assets, the agencies came up with nine reports, covering cryptocurrency impacts on financial markets, the environment, innovation and other elements of the economic system.

Treasury Secretary Janet Yellen said one Treasury recommendation is that the U.S. “advance policy and technical work on a potential central bank digital currency, or CBDC, so that the United States is prepared if CBDC is determined to be in the national interest.”

“Right now, some aspects of our current payment system are too slow or too expensive,” Yellen said on a Thursday call with reporters laying out some of the findings of the reports.

Central bank digital currencies differ from existing digital money available to the general public, such as the balance in a bank account, because they would be a direct liability of the Federal Reserve, not a commercial bank.

U.S. equity futures were trading lower Friday morning, adding to the previous day's decline.

The major futures indexes suggest a loss of 0.8% when the opening bell rings on Wall Street.

Oil prices are heading for a third straight losing week on concerns about tight supply.

U.S. West Texas Intermediate crude futures traded around $85.00 a barrel, after tumbling 3.8% in the previous session.

Brent crude futures traded around $91.00 a barrel after sliding 3.5% to a one-week low in the previous session.

On the economic agenda, the University of Michigan will release its consumer sentiment preliminary index for September. It’s expected to rise almost 2 points to 60.0, the third straight monthly increase after tumbling to an all-time low of 50.0 in June when record-high gasoline prices fueled inflation fears.

In Asia, stock markets followed Wall Street lower.

The Nikkei 225 in Tokyo sank 1.1%, the Hang Seng in Hong Kong retreated 0.9% and China's Shanghai Composite index lost 2.3%.

Wall Street's benchmark S&P 500 index lost 1.1% to 3,901.35, the Dow Jones Industrial Average fell 0.6% to 30,961.82. The Nasdaq slid 1.4% to 11,552.36.

The yield on the 10-year treasury was 3.46% on Friday morning.

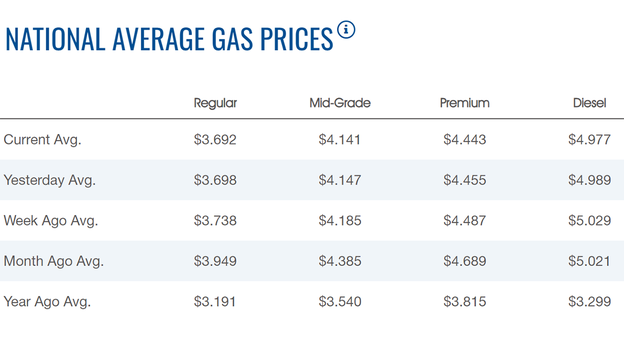

The average price of a gallon of gasoline slipped on Friday to $3.692, according to AAA. Thursday's price was $3.698.

Gas has been on the decline since hitting a high of $5.016 on June 14. Analysts and traders say wholesale gasoline prices are expected to keep falling in coming months as U.S. refiners overproduce fuel to try to rebuild low stocks of diesel and heating oil.

Diesel's price slipped to $4.977 per gallon.

Oil prices are heading for a third straight losing week on concerns about tight supply.

U.S. West Texas Intermediate crude futures traded around $84.00 a barrel, after tumbling 3.8% in the previous session.

Brent crude futures traded around $90.00 a barrel after sliding 3.5% to a one-week low in the previous session.

Both benchmarks are headed for a third consecutive weekly loss, hurt partly by a strong U.S. dollar, which makes oil more expensive for buyers using other currencies.

The market was also rattled this week by the International Energy Agency's outlook for almost zero growth in oil demand in the fourth quarter.

Bitcoin was trading at around $19,000, after a three-day decline. For the week, Bitcoin was trading 2% higher. For the month, the cryptocurrency was down more than 1%.

Bitcoin is down more than 57% year-to-date.

Ethereum was trading around $1,400, following a 9% decline in the past week.

Dogecoin was trading just shy of 6 cents, trading more than 3% lower in the past week.

FedEx says a drop-off in its global package delivery business has triggered a belt-tightening move.

The company said Thursday it is closing storefronts and corporate offices while putting off new hiring.

The news has FedEx shares plunging 19% in premarket trading.

The company also said it will likely miss Wall Street’s profit target for its fiscal first quarter, and it expects business conditions to further weaken in the current quarter.

"Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S.," FedEx CEO Raj Subramaniam said in a statement. "We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first-quarter results are below our expectations."

Audi has been unable to keep up with customer demand for its portfolio of electric vehicles due to supply chain challenges.

"We see a huge demand for electric vehicles, actually more demand than supply," Audi of America President Daniel Weissland told FOX Business. "The supply is challenged to a certain extent by the global supply issues we all have, and we constantly evaluate to see how we can increase our capacity to make sure that every customer gets to drive an electric vehicle."

Audi reported a total of 48,049 vehicle deliveries in the second quarter of 2022, down 28% year over year. However, its all-electric e-tron family model line saw year-over-year sales growth of 87% during the quarter. The e-tron SUV, Sportback and GT delivered a combined total of 4,777 units during the quarter.

Though Weissland is "pretty confident" in the automaker's ability to fulfill the majority of its EV orders, he expects that supply chain issues will likely persist for the next few years.

Read more on the story by clicking here: Audi bets big on electric vehicles as demand surges, supply chain snarls persist

Uber is investigating the extent of a hack of its computer systems.

The breach happened Thursday, causing the company to take several of its internal communications and engineering systems offline, according to the New York Times.

An Uber spokesman said the company was investigating the breach and contacting law enforcement officials.

Employees were told not to use the company’s internal messaging service, Slack, and found that other internal systems were inaccessible, two employees told The Times.

The person claiming to have carried out the hack told the outlet that he was able to convince an Uber employee that he was an IT person and got them to hand over a password that allowed him to gain access to Uber's systems.

The hacker said he was 18 years old and broke into Uber's system because the company had weak security.

Click here for more information: Uber looking into computer system hack

Live Coverage begins here