STOCK MARKET NEWS: Fed’s inflation gauge rises, Nike shares fall, stocks wrap rough September

The S&P 500 is set to lose about 8% in September as oil heads for the first winning week in the last five. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

U.S. stocks wrapped the month and quarter with losses as volatility spiked on recession and inflation concerns driving the Dow Jones Industrial Average into a bear market. For the month, the Dow and the S&P 500 lost 9%, while the tech-heavy Nasdaq Composite fell 10.5%. The 10-year Treasury yield clocked its third straight quarter of gains settling at 3.802%. In commodities, oil fell 25% this quarter to $79.49 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ARGGY | $3.87 | -0.33 | -7.86 |

| GELYY | $27.73 | -1.86 | -6.29 |

Chinese automaker Geely Holding has taken a 7.60% stake in Aston Martin Lagonda, the U.K. maker of famous for James Bond cars.

Geely did not disclose the value of the investment, but Reuters said it was worth $8.39 billion.

Separately, Aston Martin said it successfully completed a £654 million ($714.8 million) equity capital raise to allow the company to “both meaningfully deleverage its balance sheet, and to strengthen and accelerate its long-term growth.”

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CCL | $7.74 | -1.43 | -15.56 |

Carnival Corp on Friday missed Wall Street estimates for quarterly revenue as inflation forced consumers to restrain from splurging on cruise travel, sending its shares down.

The company also said it expects breakeven to slightly negative adjusted earnings before interest, taxes, depreciation, and amortization for the fourth quarter ending Nov. 30.

Carnival, which has a higher exposure to the mass-market category that's more affected by inflation, has been heavily discounting and ramping up advertisements to attract passengers after a long pandemic-led interval.

The cruise operator's revenue in the third quarter ended August 31 rose to $4.31 billion from $546 million a year earlier, but missed analysts' average estimate of $4.90 billion, according to IBES data from Refinitiv.

Net loss narrowed to $770 million, or 65 cents per share, from $2.84 billion, or $2.50 per share, a year earlier.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RCII | $18.66 | -3.67 | -16.44 |

Rent-A-Center dropped 14% as U.S. trading opened Friday. The provider of leased household goods and furniture lowered its third quarter guidance.

The company now sees revenue coming in between $1 billion and $1.02 billion, down from previous guidance of $1 billion to $1.06 billion.

Non-GAAP diluted earnings per share are expected to be 85 cents to 95 cents instead of $1.05 to $1.25.“External economic conditions have continued to deteriorate over the past few months,” said CEO Mitch Fadel. “This has affected both retail traffic and customer payment behavior.”

“While the recent inflationary conditions have been especially challenging for our customers, we remain confident in the longer-term resiliency of the business even during economic downturns,” Fadel concluded.

Rent-A-Center also announced that Fahmi Karam, currently Chief Financial Officer of Santander Consumer USA, will join as CFO, effective October 31, 2022.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| META | $136.41 | 0.00 | 0.00 |

Facebook-parent Meta Platforms will freeze hiring and further restructure amid an uncertain macroeconomic situation, Bloomberg News reported on Thursday, quoting Chief Executive Mark Zuckerberg's communication with employees.

"I had hoped the economy would have more clearly stabilized by now, but from what we're seeing it doesn't yet seem like it has, so we want to plan somewhat conservatively," Zuckerberg told employees during a weekly Q&A session, Bloomberg News reported.

The social media company had cut plans to hire engineers by at least 30% this year, Reuters reported in June.

Zuckerberg also said on Thursday that Meta would reduce budgets across most teams and that individual teams will have to resolve how to handle headcount changes, the report added.

Meta declined to comment on Bloomberg report. The company referred to Zuckerberg's warning of reduction in headcount over the next year in the second-quarter earnings call.

The company had confirmed hiring freezes in broad terms in May, but exact figures have not previously been reported.

Stocks slip as S&P 500 heads for worst September since ’08 U.S. stocks slipped as investors wrap one of the worst September’s in history. This comes as the Fed’s preferred measure of inflation, on Friday, came in higher than expected rising 4.9% annually. In commodities, oil fell 1% to the $80 per barrel level.

Shares of Regal Cinemas U.K. parent Cineworld are down in London trading. The world’s second largest movie theater chain expects admissions in both fiscal 2023 and fiscal 20224 to remain below pre-pandemic levels.

Cineworld reported a 417% increase in revenue in the first half of 2022. Revenue rose to $1.5 billion as admissions increased 487% to 82.8 million.

The after tax loss narrowed to $293.8 million from $515.2 million.

Analysts were concerned about the group’s cash situation. AJ Bell investment director, Russ Mould said: “Alongside first-half results showing a recovery in revenue and profit, unsurprising given the comparison was with a Covid restrictions blighted period, it is revealed that Cineworld has continued to hemorrhage cash and the company has revised down its expectations on admissions.”

Cash burn as $144.9m compared to $271.0m for the same period a year ago, reflecting the slower-than-expected recovery in H1 2022.

Cineworld filed for bankruptcy in the U.S. on September 7.

In another worrisome sign of rising prices, the Federal Reserve's prefered measure of inflation ticked up more than expected last month.

U.S. equity futures were trading higher Friday morning, rebounding after the S&P 500 hit its lowest level in almost two years.

The major futures indexes suggest a gain of 0.8% when trading begins on Wall Street.

Oil prices were trading higher Friday morning, heading for the first weekly gain in five weeks.

U.S. West Texas Intermediate (WTI) crude futures traded around $81.00 a barrel.

Brent crude futures traded around $88.00 a barrel.

Both Brent and WTI are on track to rise by about 3% for the week.

The yield on the 10-year U.S. Treasury, or the difference between its market price and the payout if held to maturity, was at 3.71% on Friday.

Traders will be watching a slew of economic data including income and spending, the PCE price index, Chicago purchasing and consumer sentiment.

In Asia, the Nikkei 225 in Tokyo fell 1.8%, the Hang Seng in Hong Kong gained 0.3% and China's Shanghai Composite Index lost 0.6% after surveys of manufacturers showed factory production, new export orders and manufacturing employment declined in September.

On Wall Street, the S&P 500 fell to 3,640.47. putting it on track to end September with an 8% loss for the month.

The Dow Jones Industrial Average fell 1.5% to 29,225.61 and the Nasdaq composite lost 2.8% to 10,737.51.

It's been an abysmal year for the U.S. stock market, but some experts say that it's the perfect time to for investors to buy the dip.

In an analyst note obtained by FOX Business, Wells Fargo analysts said the market has likely dropped enough to account for what comes next in the economy and that the worst has surfaced already, making it an opportune time to buy.

"Seek to take advantage of this correction and any further downside that may occur by incrementally putting cash to work," the analysts, led by senior global market strategist Scott Wren, wrote.

Toyota Motor on Friday lowered its October production target by about 50,000 to about 750,000 vehicles due to a shortage of chips.

The Japanese automaker said its 9.7 million vehicle production target for the current financial year through March 2023 has not changed, according to Reuters.

Toyota said last week, it planned to produce about 800,000 vehicles worldwide in October, about 100,000 short of its average monthly production plan, due to semiconductor shortages.

Nike shares are down 9% in premarket trading after the company said inventories rose 44% to $9.7 billion in the latest quarter, and higher discounts and freight costs squeezed profit margins.

Nike reported revenue of $12.7 billion, up 4% compared with a year earlier. Earnings fell 22% to $1.5 billion — largely in line with analysts’ expectations.

Selling and administrative expense increased 10% to $3.9 billion.

The athletic apparel maker posted revenue of $12.69 billion in the period, which topped Street forecasts. Eleven analysts surveyed by Zacks expected $12.33 billion.

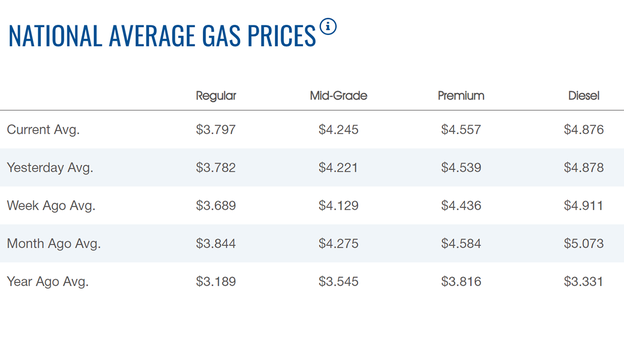

The average price for a gallon of regular gasoline in the U.S. continues to gain.

Friday's price rose to $3.797, up from Thursday's $3.782 a gallon, according to AAA.

The price started rising again a little over a week ago, after declining for nearly 100 days in a row during the summer driving season.

That makes it nine straight days of increases. The average price a week ago was $3.689.

Diesel's price is at $4.876 a gallon.

Oil prices were little changed Friday morning, while heading for their first weekly gain in five weeks.

Supporting oil this week was a weaker U.S. dollar and the possibility that OPEC+ may agree to cut crude output at its October meeting.

U.S. West Texas Intermediate (WTI) crude futures traded around $81.00 a barrel.

Brent crude futures traded around $88.00 a barrel.

Both Brent and WTI are on track to rise by about 3% for the week, their first weekly rise since August, after hitting nine-month lows earlier in the week.

For all of September, Brent is set to drop by 8.4%, down for a fourth month. WTI is set to fall by 9.3% in September, also its fourth monthly decline.

Bitcoin was trading around $19,000, after falling in three of the last four days.

For the week, Bitcoin has gained less than 1%.

The cryptocurrency is down more than 3% for the month and more than 57% year-to-date.

Ethereum was trading around $1,300, after gaining 0.7% in the last week.

Dogecoin was trading at 6 cents, after gaining more than 1% in the past week.

Live Coverage begins here