Gas prices hit new record, JetBlue’s hostile Spirit takeover, volatility hits stocks: LIVE UPDATES

Get the latest market news on stocks, bonds and commodities with FOX Business. Real-time updates on the markets and corporate news that will impact your portfolio.

Coverage for this event has ended.

Twitter shares are on pace for the seventh straight day of declines, off over 20% during the time frame.

In a twitter thread with CEO Parag Agrawal, Elon Musk indicated his comments stink...literally.

Former Acting US Attorney General Matthew Whitaker discusses the Title 42 policy, pro-abortion activists protesting outside of Supreme Court Justices' homes and Republicans on the FBI used anti-terror tools to target outspoken parents.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MCD | $245.04 | +0.85 | +0.35% |

McDonald's announced Monday it would sell its Russian business after more than 30 years of operations in the country as the war continues in Ukraine.

The announcement comes after McDonald's said in early March that it temporarily closed restaurants in Russia and paused operations in the market.

Read the full story: McDonald's to sell Russian business

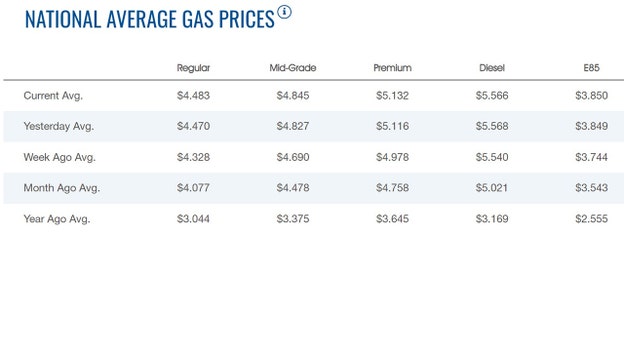

The national average for a gallon of gasoline hit a record high once again overnight, and is expected to continue rising as the energy supply crunch in the U.S. rages on.

The average price for a gallon of gasoline in the U.S. rose to a record Monday morning to $4.483, according to the latest numbers from AAA. The price on Sunday was $4.47 and the price on Saturday was $4.452.

Some states with higher-than-average prices include California at $5.92 a gallon and Hawaii at $5.32.

Diesel also hit its own highest recorded cost just above $5.56. Before Russia was hit with sanctions for invading Ukraine, threatening the already tight global oil market, the national average was at $3.53, according to Andy Lipow, the president of Lipow Oil Associates.

He estimated that the national average could soon surge as high as $4.50 per gallon.

JetBlue Airways Corp. plans to launch a hostile takeover attempt for discount carrier Spirit Airlines Inc., according to people familiar with the matter, after Spirit rejected JetBlue’s $3.6 billion offer in favor of an existing deal with Frontier Airlines.

JetBlue plans to appeal directly to Spirit’s shareholders by launching a tender offer for their shares, in hopes of pressuring Spirit’s management to re-engage in negotiations, the people said. At the same time, JetBlue plans to urge Spirit shareholders to vote against Spirit’s planned merger with Frontier Group Holdings Inc. on June 10 in a further effort to sway the company’s leaders, the people said.

JetBlue is offering $30 a share in cash in its tender offer, but would be open to paying its initial offer price of $33 a share if Spirit comes to the negotiating table and provides data JetBlue has requested, the people said.

The tender offer is slated to commence Monday, May 16, and remain open until June 30, though JetBlue could extend that period, one of the people said. JetBlue has started meeting with some of Spirit’s shareholders, another person familiar with the matter said.

Spirit has been the subject of a tug of war between two rival carriers that both consider the Florida-based airline as key to their ability to grow and challenge the big airlines that dominate the industry in the U.S. Either transaction, if approved, would create the fifth-largest U.S. airline.

Cryptocurrency prices were down early Monday morning.

Bitcoin was trading at around $29,550, down nearly 5.25% around 4 a.m., losing approximately $1,635 thus far. It was trading down 8.26% for the week and was down 23.20% for the month.

Both Ethereum and Dogecoin were also lower early Monday, trading at approximately $2,005 (-6.15%) and $0.087 cents, respectively.

Ethereum was down 14.8% for the week and down 29.65% for the month. Dogecoin was down 25.5% for the week and lower by almost 37% for the month.

U.S. stocks were choppy for most of the overnight, before trimming losses hours before the opening bell as the retail sector will be in focus this week with several key names set to report quarterly results.

Among the big names reporting will be Walmart and Home Depot on Tuesday; Target, Lowes and TJX Companies on Wednesday; Ross Stores, BJ’s Wholesale Club, and Kohl’s on Thursday; and Foot Locker on Friday morning.

Investors will pay close attention to the numbers, and especially guidance, for clues about the health of the consumer, and the impact that inflation pressures, supply-chain constraints and a tight labor market are having on profitability.

To date, 459 companies in the S&P 500, or just over 90% of the benchmark index, have posted January through March results, with the numbers coming in well ahead of forecasts.

Some analysts worry that if the U.S. Federal Reserve raises interest rates too quickly, or by too much, that could set of a recession. A slowdown in the U.S. would almost certainly hurt the Asian region, which exports and manufacturers for the U.S. economy.

The Fed has said it will continue to raise interest rates to temper rising inflation. The benchmark short-term interest rate was at a record low of near zero during much of the coronavirus pandemic.

Several of the largest defense contractors in the U.S. have ties to Beijing, a Fox News Digital review found.

Raytheon, Bell Flight, and Boeing — three American powerhouse defense firms — continue to maintain relationships with firms tied to the Chinese government, while Lockheed Martin has business interests in the country.

Issac Stone Fish, the CEO and founder of China risk consultancy company Strategy Risks, warned in a statement to Fox News Digital that defense contractors' Chinese ties present severe risks.

"Doing a relatively significant amount of business in China changes the risk profile now more than ever for any U.S. company, whether for compliance, cyber, reputation, security or other risks," Fish said.

"Those risks are particularly critical for companies that safeguard U.S. national defense and security," he continued. "U.S. defense contractors need to better understand their risk exposure to China and the Chinese Communist Party, so they can reduce their China risks to better serve the needs of the U.S. military and national security."

Click here to read more.

Former Goldman Sachs CEO Lloyd Blankfein said on Sunday he believes the economy is at risk of possibly going into a recession, as the U.S. Federal Reserve continues to raise interest rates to tackle rising inflation.

Speaking on "Face the Nation" on CBS, Blankfein said a recession is "a very, very high risk factor."

"There's a path. It's a narrow path," said Blankfein, who retired from Goldman Sachs several years ago and now holds the title of senior chairman.

"But I think the Fed has very powerful tools. It's hard to finely tune them, and it's hard to see the effects of them quickly enough to alter it, but I think they're responding well. It's definitely a risk.

"Last week, Federal Reserve Chairman Jerome Powell acknowledged that increasing interest rates will "include some pain," but added that a far worse outcome would be for prices to continue spiking.

Click here to read more.

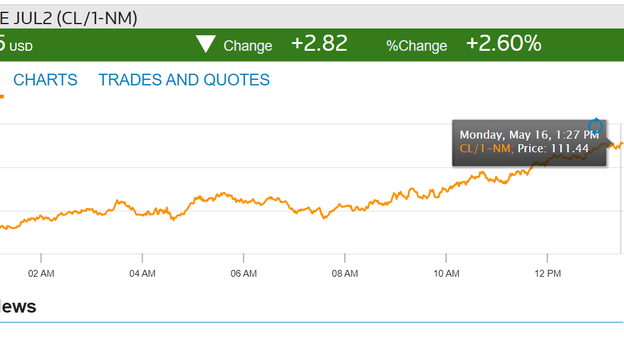

Oil prices slipped on Monday after economic data from China suggested that the country's latest struggle with COVID-19 is hurting fuel consumption. West Texas Intermediate, the U.S. standard, fell 1.1% to $109.27 a barrel. Brent crude, the global benchmark, slipped 1.6%.

Industrial output and retail sales in the world's second-biggest economy slumped more than expected in April as China brought in strict lockdowns to contain the spread of the disease. It was the first contraction in industrial production since February 2020. Unemployment also rose to the second-highest level on record.

While concerns that the global economy is weakening are keeping a lid on oil prices, crude is still up more than 40% this year after Russia invaded Ukraine in February, raising questions about energy supplies. German officials announced over the weekend that Europe's biggest economy will stop importing oil from Russia by the end of the year even if the European Union cannot agree on a ban for all members.

Higher crude prices lifted first-quarter profits more than 80% at Saudi Aramco, the state-backed oil company reported on Sunday.

The war has lifted fuel prices almost everywhere and also bolstered the cost of food and other commodities. U.S. gasoline futures are trading at record highs. Energy is driving the fastest consumer-price inflation in decades, prompting the Federal Reserve to raise interest rates.

Live Coverage begins here