Corporate earnings, economic data this week, US markets closed, crypto, gas higher

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Cryptocurrency was trading higher early Monday morning as Bitcoin, Ethereum and Dogecoin were making solid gains overnight.

Bitcoin was trading at nearly $30,625, up 4.13% or about $1,216 per coin for the day. For the week, however, Bitcoin was trading down almost 3%. For May, Bitcoin was trading down nearly 24%.

Ethereum was around $1,910 per coin, up 5.35% or about $95 for the day. For the week, Ethereum was trading lower by almost 11.40% and for May, it was trading down more than 35.5%.

Dogecoin was also higher, trading at approximately 8.5 cents during the overnight hours, up nearly 3.7% or $0.003. For the week, Dogecoin was trading down nearly 4%. For the month, it was down approximately 38.75%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $33,212.96 | +575.77 | +1.76% |

| SP500 | $4,158.24 | +100.40 | +2.47% |

| I:COMP | $12,131.13 | +390.48 | +3.33% |

Wall Street will pause on Monday to mark the Memorial Day holiday .

There will be no trading in stocks as U.S. equity markets will be closed.

The U.S. bond market is also closed, so no trading in Treasuries.

Stock futures will trade on an abbreviated schedule.

They will trade until 1:00 PM ET. Energy futures will trade until 2:30 PM ET.

U.S. stocks turned in a broad rally on Friday ahead of the long holiday weekend with all three of the major averages rising.

Click here to read more.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HPQ | $38.78 | +2.02 | +5.48% |

| CRM | $165.10 | +2.64 | +1.63% |

| VSCO | $42.67 | -1.88 | -4.22% |

| ABNB | $120.50 | +6.20 | +5.42% |

Though the New York Stock Exchange will be closed Monday in observance of the Memorial Day holiday, investors will still have another jam-packed week of corporate earnings and key economic data related to housing, manufacturing and jobs.

Investors will also take in the Case-Shiller home price index, the Federal Housing Finance Agency's monthly home price index and consumer confidence.

Kicking off the week for earnings will be HP, Salesforce and Victoria's Secret after the bell.Also on Tuesday, Airbnb will end COVID-related refunds.

The earnings parade will continue Tuesday with Capri Holdings, Hovnanian and Vera Bradley reporting before the market open and Chewy, GameStop, Hewlett-Packard Enterprise, NetApp and PVH Corp delivering results after the bell.

On the economic data front, investors will digest the Federal Reserve's Beige Book, construction spending, vehicle sales, the ISM manufacturing PMI and weekly mortgage applications.

The Federal Reserve is also expected to start reducing its balance sheet.

On Thursday, more economic data will be released as investors will be watching the ADP employment report, factory orders, labor costs, productivity, the latest in initial and continuing jobless claims and the Energy Information Administration's weekly crude stocks.

Click here to read more.

The dollar suffered losses last week and was headed toward its first monthly decline in five months on Monday as investors have eased their bets that rising U.S. rates will result in additional gains.

Concerns about a global recession have begun to wane a little as well.

Trade was expected to be lessened through Monday as U.S. stock and bond markets close for Memorial Day.

The dollar was slightly weaker on the euro in the Asia session at $1.0728, which is just above a five-week low. It took a dip last week of about 1.5% on the common currency.

The Australian and New Zealand dollars stayed firm while the yen was slightly weaker at 127.28 per dollar.

Click here to read more.

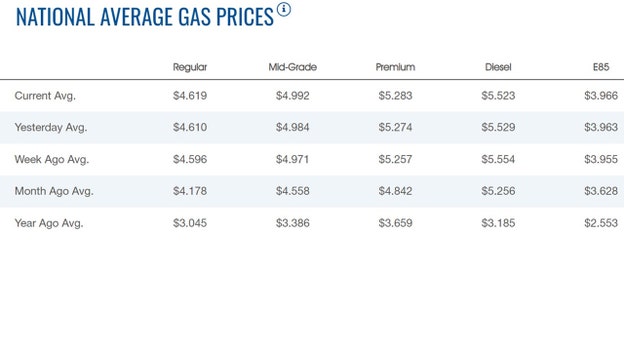

The average price for a gallon of gasoline in the U.S. continued to rise over the Memorial Day weekend, hitting $4.619 up $0.009, according to the latest numbers from AAA.

On Saturday, the average price per gallon was $4.601.

One week ago, the price stood at $4.59.6, while a month ago, gas sold on average at $4.178.

One year ago, the average price for a gallon of gasoline in the U.S. sold for $3.04 per gallon.

Meanwhile, the price of a gallon of diesel was little changed, dropping from Sunday’s high of $5.529 to $5.523 early Monday morning.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $85.46 | +0.87 | +1.03% |

| CVX | $178.29 | +1.59 | +0.90% |

| XOM | $97.59 | +0.95 | +0.98% |

Oil prices rose on Monday, hitting their highest in more than two months, as traders waited to see whether the European Union would reach an agreement on banning Russian oil imports.

The Brent crude futures contract for July, which will expire on Tuesday, was up 47 cents, or 0.4%, at $119.90 a barrel at 0659 GMT, after rising as high as $120.50 earlier in the session.

The August Brent contract, which is more active, rose 61 cents, or 0.5%, to $116.17 a barrel.

U.S. West Texas Intermediate (WTI) crude futures jumped 72 cents, or 0.6%, to $115.79 a barrel, extending solid gains made last week.

The EU is due to meet on Monday and Tuesday to discuss a sixth package of sanctions against Russia for its invasion of Ukraine, actions Moscow calls a "special military operation."

"If we look at the recent price movement, it seems that market has factored in that the European Union may reach a deal on some form of restrictions on Russian crude," said Madhavi Mehta, commodity research analyst at Kotak Securities.

"We may see further upside only if it is a complete ban. Any watered-down deal or one which includes exemptions may not have much positive impact," she added.

EU governments failed to agree on an embargo on Russian oil on Sunday but will continue talks on a deal to ban seaborne deliveries of Russian oil while allowing deliveries by pipeline, ahead of the summit on Monday afternoon, officials said.

"It's still quite difficult for the European group to reduce its energy dependency on Russia in the near term. That said, an immediate import ban is less possible, and the demands may keep oil prices afloat in the near term," said Leona Liu, analyst at Singapore-based DailyFX.

Any further ban on Russian oil would tighten a crude market already strained for supply amid rising demand for gasoline, diesel and jet fuel ahead of the peak summer demand season in the United States and Europe.

Sky-high refining margins for diesel and gasoline in Europe and the United States have sent prices for some types of physical crude oil to record highs, according to traders.

Underscoring market tightness, the Organization of the Petroleum Exporting Countries and allies including Russia, together called OPEC+, are set to rebuff Western calls to speed up increases in their additions to oil output when they meet on Thursday. They will stick to existing plans to add 432,000 barrels per day in July, six OPEC+ sources told Reuters.

The oil market was also on edge after Iran on Friday said its navy had seized two Greek oil tankers in retaliation for the confiscation of Iranian oil by the United States from a tanker held off the Greek coast.

Crude prices are also finding support from a weaker U.S. dollar, and China's easing of virus related restrictions, said Sunil Katke, head of commodities retail business at Kotak Securities.

A weaker dollar makes oil less expensive for importers holding other currencies.

Click here for more.

Live Coverage begins here