Stock selloff deepens, gas tops $4.32, Elon Musk’s warning

Get the latest market news on stocks, bonds and commodities with FOX Business. Real-time updates on the markets and corporate news that will impact your portfolio.

Coverage for this event has ended.

The S&P 500 fell below 4,000, a key pyschological level, for the first time since 2021.

Andrew Thrasher and Kevin Paffrath provide insight on the state of the stock market on 'Making Money.'

Russell Vought, former White House OMB director, weighs in on Treasury Secretary Janet Yellen's push to let Europeans help reconstruct the U.S.'s tax code.

The Fitz-Gerald Group principal Keith Fitz-Gerald argues the Fed should tell the American people the 'truth' in that it made 'one of the worst calls in financial history' and are subsequently re-evaluating their moves.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LMT | $449.43 | +6.28 | +1.42% |

U.S. equity futures were sharply lower Monday as first-quarter earnings season is winding down, with about 20 companies in the S&P 500 set to report.

Meanwhile, oil prices fell, with West Texas Intermediate futures trading at around $107 a barrel and Brent crude futures trading at about $110 per barrel.

Bitcoin fell to its lowest level since January on Monday as slumping equity markets continued to hurt cryptocurrencies, which are currently trading in line with so-called riskier assets like tech stocks.

Bitcoin dropped to as low as $33,266 in morning trade, testing the January low of $32,951. A fall below that level would be it lowest since July last year.

It then steadied to trade around $33,500, down 1.4%. At nearly 4 a.m. ET, Coindesk reported Bitcoin continued to trade at approximately $33,500, down 3.23%, while Ethereum and Dogecoin also traded lower at approximately $2,440, down 4.39% and 12.08 cents, down 3.94%, respectively.

The tech-heavy Nasdaq fell 1.5% last week, and has lost 22% year to date, hurt by the prospect of persistent inflation forcing the U.S. Federal Reserve to hike rates despite slowing growth. Nasdaq futures were down a further 0.8% in Asia trade on Monday morning.

- Coindesk contributed to this report.

As inflation soars around the world, the world’s second-largest economy has kept it at bay.

Consumer prices in China increased just 1.5% in March from a year earlier, after rising 0.9% in 2021 from the year before.

By contrast, the U.S. annual inflation rate was 8.5% in March and 7.5% in 2021, the steepest since 1982. In the eurozone, annual inflation reached a record 7.5% in April. Some 71% of 109 emerging and developing economies experienced 5% or higher inflation in 2021, twice as large as at the end of 2020, the World Bank says.

Although Chinese inflation is expected to tick up a bit more when fresh data is released this week, most economists believe it won’t surpass the government’s full-year target of around 3% in 2022.

Partly that is because consumer demand, an important source of U.S. inflation, is extremely weak in China right now. It is also because China uses aggressive tactics, including price controls and protectionist trade actions, to keep imported inflation from flowing through to consumers.

Analysts say while those strategies have helped China in the short run, they have long-term costs, and would be hard to replicate in more market-oriented economies.

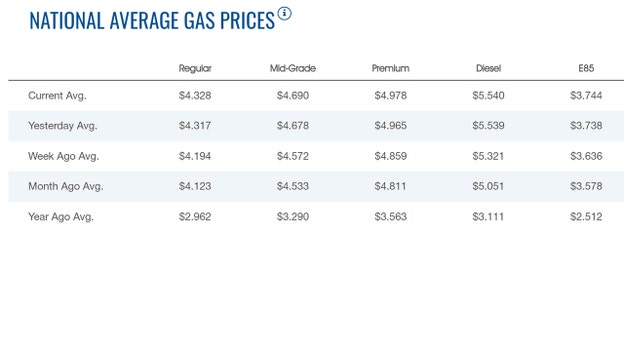

The average price for a gallon of gasoline in the U.S. rose early Monday morning to $4.328, up $0.11 cents from Sunday, according to the latest numbers from AAA.

The price of a gallon of regular gasoline nationwide is now $0.02 from the all-time record high.

The price on Saturday was $4.301.

The record high was $4.33, set on Friday March 11, 2022.

Tesla CEO Elon Musk ignited a firestorm on social media by suggesting that he might die "under mysterious circumstances."

While some on Twitter rushed to the conclusion that he might fear the Clintons, it seems the CEO may have been referencing a potential threat from Russia.

"If I die under mysterious circumstances, it’s been nice knowin ya," Musk, who is also the CEO of SpaceX and who recently acquired Twitter, posted on the social media platform.

When Musk's mother Maye Musk responded, "That's not funny," her son replied, "Sorry! I will do my best to stay alive."

Many commentators suggested that Musk might be afraid of former President Bill Clinton and his wife, former Secretary of State Hillary Clinton, playing off of the conspiracy theory that the Clintons were involved in Jeffrey Epstein's suicide.

"Do you have dirt on the Clintons?" digital strategist Greg Price asked."Wait… what do you know about Hillary Clinton?" comedian Tim Young asked.

"The Clintons" began trending on Twitter, in part due to Musk's tweet, which garnered more than 52,000 "retweets" Sunday night.

Oil prices slipped on Monday, along with stock markets in Asia, sparked by weak China data and fears a global recession could dampen oil demand, with investors eyeing European Union talks on a Russian oil embargo that could tighten global supplies.

Brent crude lost 41 cents, or 0.4%, to $111.98 a barrel by 0603 GMT.U.S. West Texas Intermediate crude was at $109.24 a barrel, down 53 cents, or 0.5%.

Both contracts briefly turned positive after falling more than $1 earlier in the session.

Global financial markets have also been spooked by concerns over interest rate hikes and recession worries as tighter and wider COVID-19 lockdowns in China led to slower export growth in the world's No. 2 economy in April.

Gold prices edged down on Monday as elevated U.S. Treasury yields and a firm dollar pressured demand for greenback-priced bullion.

Spot gold fell 0.1% to $1,880.56 per ounce, as of 0049 GMT in Asia, while U.S. gold futures were down 0.2% to $1,879.30.

While gold is seen as a safe store of value during times of political and economic crises, it is highly sensitive to rising short-term U.S. interest rates and bond yields, which raise the opportunity cost of holding bullion.

Live Coverage begins here