Stocks slip after Fed’s Powell signals recession risks, Biden’s gas tax holiday: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLE | $76.44 | +2.95 | +4.01% |

| IYH | $257.07 | +6.55 | +2.61% |

| XLU | $65.58 | +0.71 | +1.09% |

All three of the major averages bounced between losses and gains ultimately closing marginally lower on Wednesday after Federal Reserve Chairman Jerome Powell acknowledged engineering a soft landing for the economy may be challenging. In commodities, oil fell 3% to $106.19 per barrel.

As a result, energy shares slumped, while healthcare and utlities maintained gains in a down market.

Strategas head of technical research Chris Verrone gives his take on the strength of the labor market and the state of the economy on 'Making Money.'

Rogue States Project President Harry Kazianis weighs in on the Russia-Ukraine war on ‘Cavuto: Coast to Coast.’

| Symbol | Price | Change | %Change |

|---|---|---|---|

| META | $157.05 | -6.69 | -4.09% |

Former Reagan economist Art Laffer discusses Biden's federal gas tax and the importance of monitoring the stock market.

Thru the Cycle President John Lonski discusses the state of the economy and the likelihood of a recession on ‘Varney & Co.’

Altria holds a 30%+ stake in JUUL.

POWELL: WE HAVE THE TOOLS WE NEED AND THE RESOLVE IT WILL TAKE TO RESTORE PRICE STABILITY ON BEHALF OF MERICAN FAMILIES AND BUSINESSES

POWELL: INFLATION REMAINS WELL ABOVE OUR LONGER-RUN GOAL OF 2 PERCCENT

Cryptocurrency prices were lower early Wednesday morning with Bitcoin, Ethereum and Dogecoin all lower around 4 a.m. ET.

Bitcoin was trading at approximately $20,065 (-3.18%), or down nearly $660. For the week, Bitcoin was trading down nearly 6.5%. For the month, it was down nearly 30%.

Ethereum was trading at nearly $1,075 early Wednesday (-4.73%), or down nearly $54. For the week, Ethereum was down about 7.10%. For the month, it was lower by more than 43%.

Dogecoin was trading lower at $0.0612 (-6.72%), or down $0.0044. For the week, however, Dogecoin was up nearly 18.4%. For the month, it was lower by approximately 22.3%.

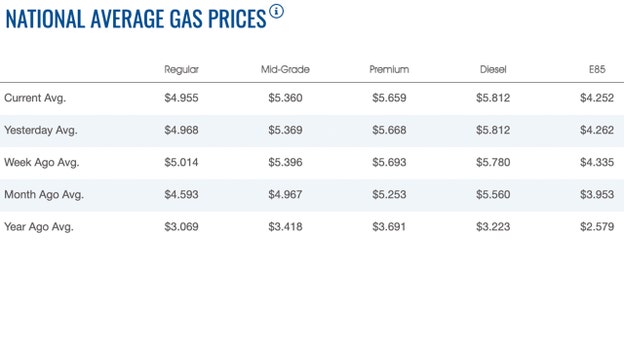

The average price for a gallon of gasoline slipped again on Wednesday, remaining below the $5 threshold for a fifth straight day, according to AAA.

Gas reached $5 a gallon more than a week ago. The price of a gallon of gasoline declined to $4.955, according to AAA. The price on Tuesday fell to $4.968. On Monday, that price was $4.981. A week ago, a gallon of gasoline sold nationally for $5.014, while a month ago, the national average was $4.593. One year ago, a gallon of gasoline sold nationally for $3.069.

Meanwhile, diesel remained at $5.812 for the second straight day, after settling at $5.815 on Monday.

One week ago, diesel was selling for $5.78 per gallon, while a month ago, the national average was $5.56. One year ago, the national average for a gallon of diesel was $3.223, AAA reported.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $30,530.25 | +641.47 | +2.15% |

| SP500 | $3,764.79 | +89.95 | +2.45% |

| I:COMP | $11,069.30 | +270.95 | +2.51% |

US stocks edged lower Wednesday after rallying Tuesday U.S. stocks were heading lower early Wednesday morning after rallying Tuesday off their worst week since March 2020, offering investors a reprieve from a recent stretch of whipsaw trading that had sent stocks and cryptocurrencies falling.

The S&P 500 gained 89.95 points, or 2.4%, to 3764.79, while the Dow Jones Industrial Average added 641.47, or 2.1%, to 30530.25. Meanwhile, the Nasdaq Composite Index jumped 270.95 points, or 2.5%, to 11069.30.

The U.S. stock market was closed Monday for the Juneteenth federal holiday. Investors scrambled to unload riskier assets amid growing fears that central bankers will plunge the U.S. economy into a recession.

The benchmark S&P 500 finished the week 5.8% lower, its largest one-week decline in more than two years.

Stocks have been mostly sliding in recent weeks as investors adjust to higher interest rates that the Federal Reserve and other central banks are increasingly doling out to temper record-high inflation.

Investors are worried that the Fed risks slowing economic growth too much and bringing on a recession. Investors are looking ahead to what Fed Chairman Jerome Powell will tell Congress on Wednesday, the first of two days of testimony as part of the central bank’s semi-annual monetary policy report.

“For now, the fundamental catalyst for a more sustained rebound seems fragile, with all eyes on Fed Chair Jerome Powell’s testimony ahead to further drive expectations of policy outlook and inflation,” Yeap Jun Rong, market strategist at IG in Singapore, said in a commentary.

The worries over inflation and interest rates have been worsened by a spike in energy prices following Russia's invasion of Ukraine. The price of U.S. crude oil is up about 52% for the year. That has taken a bigger bite out of people's wallets at the gas pump and is prompting a slowdown in spending elsewhere.

Meanwhile, Asian shares declined Wednesday. Japan’s benchmark Nikkei 225 shed 0.4% to finish at 26,149.55. Australia’s S&P/ASX 200 lost 0.2% to 6,508.50. South Korea’s Kospi tumbled 2.7% to 2,342.81. Hong Kong’s Hang Seng dropped nearly 2.0% to 21,132.42, while the Shanghai Composite sank 1.1% to 3,269.63

Click here for more.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $84.05 | +0.71 | +0.85% |

| CVX | $154.59 | +6.21 | +4.19% |

| XOM | $91.48 | +5.36 | +6.22% |

Oil prices dived more than $4 a barrel on Wednesday amid a push by U.S. President Joe Biden to bring down soaring fuel costs, including pressure on the country's major energy firms to help ease the pain for drivers during peak summer consumption.

By 0425 GMT U.S. West Texas Intermediate (WTI) crude futures were off lows but still down $4.04, or 3.7%, to $105.48 a barrel.

Similarly Brent crude futures dropped $3.87, or 3.4%, to $110.78 a barrel.

As the United States struggles to tackle soaring gasoline prices and inflation, Biden is expected on Wednesday to call for temporarily suspending the 18.4-cents a gallon federal tax, a source briefed on the plan told Reuters.

"I think the non-stop Biden headlines, with the administration seemingly in inflation panic mode, have played a part in the latest sell-off as investors hate any uncertainty, even if irrational in the context of the known supply concerns," said Stephen Innes, managing partner at SPI Asset Management, in a note.

Seven oil companies are set to meet Biden on Thursday, under pressure from the White House to drive down fuel prices as they make record profits.

Chevron Chief Executive Michael Wirth, however, on Tuesday, said criticising the oil industry was not the way to bring down fuel prices.

"These actions are not beneficial to meeting the challenges we face," Wirth said in a letter addressed to Biden, which sparked a response from Biden saying the industry was being too sensitive.

"The market is still coming to terms with the increasing disruption to Russian oil. European sanctions have yet to kick in," ANZ Research analysts said in a note.

Meanwhile, U.S. oil refining capacity fell in 2021 for the second year in a row, the latest government data showed on Tuesday, as plant shutdowns kept whittling away at their ability to produce gasoline and diesel. The official data showed a capacity decline of 125,790 barrels per day (bpd) last year on top of the 800,000 bpd drop in 2020.

Click here for more.

Live Coverage begins here