STOCK MARKET NEWS: Dow jumps 754 points in earnings rally, Twitter-Musk trial gets date

Halliburton, IBM and Netflix top the earnings parade, additionally inflation may strike Social Security recipients who may be pushed into a new tax bracket. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

U.S. stocks soared on Tuesday with the Nasdaq Composite tacking on 3%, while the Dow Jones Industrial Average and S&P 500 rose over 2% as 11 of the top sectors gained led by industrials and communication companies, while utilities, more defensive, rose the least. The gains came even as the 10-Year Treasury Yield rose to 3.017%. In commodities, oil climbed 1.6% to $104.22.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:COMP | $11,713.15 | +353.10 | +3.11% |

| SP500 | $3,936.62 | +105.77 | +2.76% |

| I:DJI | $31,827.05 | +754.44 | +2.43% |

The Dow Jones Industrial Average clocked a 600+ point gain led by Goldman Sachs, Nike and Boeing. 28 of the 30 Dow members rallied with the exception of IBM, which warned on the negative impact the stronger dollar will have on future results. J&J also turned lower mid-afternoon.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GS | $301.26 | +7.39 | +2.51% |

| NKE | $103.94 | -0.76 | -0.73% |

| BA | $147.72 | -0.02 | -0.01% |

| IBM | $129.99 | -8.14 | -5.89% |

| JNJ | $174.23 | -4.00 | -2.24% |

Valuable supplies of wheat, key to easing the potential of a global food shortage, may soon be released from Ukraine, FOX Business can exclusively report.

U.S. stocks rallied as earnings continued to roll in with Halliburton posting its strongest quarter since 2018. Elsewhere IBM fell after warning the stronger dollar will pressure future results. Netflix will report after the close of trading. In commodities, oil hovered at the $90 level.

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin moved lower early Tuesday morning.

At approximately 4 a.m. ET, Bitcoin was trading at about $21,800 (-2.27%), or lower by more than $500.

For both the week and month, however, Bitcoin was trading higher by nearly 11.5% and higher by nearly 17.5%, respectively.

Ethereum was trading at approximately $1,515 (-3.19%), or lower by almost $50.

For the week, Ethereum was making significant gains, trading higher by about 42.5%. For the month, it was trading higher by nearly 57.5%.

Dogecoin was trading at 0.065009 (-2.08%), or lower by approximately $0.001403.

For the week, Dogecoin was higher by more than 9%. For the month, the crypto was higher by more than 27%.

Red hot inflation is inflicting financial pain on millions of U.S. households, but the rising price of everyday necessities has squeezed one group in particular: retirees living on a fixed income.

Although Social Security recipients receive a cost-of-living adjustment, or COLA, that is indexed to inflation, the amount of benefits exempt from tax has remained unchanged for decades.

Since 1984, retirees have owed taxes on their benefits if half the amount they receive from Social Security plus their other income comes to more than $25,000 if they are single or $32,000 if they are married filing together.Individuals who earn more than $34,000 and couples who earn more than $44,000 can be taxed on up to 85% of their benefits.

Now, experts say the hottest inflation in a generation could ultimately push more seniors into higher tax brackets as a result of what's likely to be a record-high cost-of-living increase.

The Senior Citizens League, a nonpartisan group that focuses on issues relating to older Americans, estimated last week the COLA could be as high as 10.5% after June inflation data showed consumer prices soared 9.1% from the previous year, the fastest year-over-year jump since 1981.

An increase of that magnitude would raise the average retiree benefit of $1,668 by about $175.10 per month, the group said.

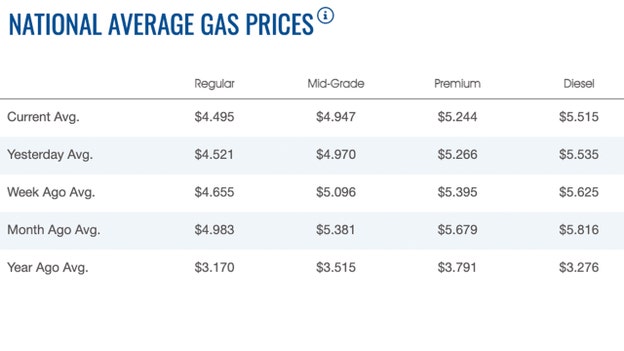

The average price of a gallon of regular gasoline nationwide fell Tuesday morning to $4.495.

On Monday, that same gallon cost $4.521, according to AAA. Sunday the price was $4.532, while Saturday the price was $4.548.

Gas has been on the decline since hitting a high of $5.016 on June 14.

A week ago, the average price of a gallon of gasoline in the U.S. was 16 cents higher, at $4.655.A month ago, that same gallon of gasoline in the US was $4.983. A year ago, the average price of a gallon of gasoline in the U.S. was $1.32 cheaper, AAA reported.

Diesel slipped on Tuesday by 2 cents to $5.515. On Monday, a gallon of diesel sold for $5.535, after dropping on Sunday to $5.544.

A week ago, a gallon of diesel sold for 11 cents higher at $5.625. A month ago, that same gallon of diesel fuel cost slightly more than 30 cents higher at $5.816.

Last year, diesel sold for $3.276, AAA reported.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $31,072.61 | -215.65 | -0.69% |

| SP500 | $3,830.85 | -32.31 | -0.84% |

| I:COMP | $11,360.05 | -92.37 | -0.81% |

U.S. stocks were cautiously higher early Tuesday after starting the week lower on Monday, as investors considered another set of earnings reports from major companies and looked ahead to a slate of key central-bank meetings.

Stocks were in the green for much of Monday's session before turning downward in the afternoon.

The S&P 500 fell 32.31 points, or 0.8%, to 3830.85. The broad index on Friday ended higher, snapping a five-day losing streak.

The blue-chip Dow Jones Industrial Average lost 215.65 points, or 0.7%, to finish at 31072.61, while the Nasdaq shed 92.37, or 0.8%, to 11360.05. The technology-heavy index closed lower after rising at least 1% intraday for the 13th time this year, which happened only twice in 2021.

Big financial firms kicked off a bumper week of earnings reports Monday. Goldman Sachs gained $7.39, or 2.5%, to $301.26 after reporting better-than-expected earnings. Synchrony Financial, which reported earnings per share that fell year over year but were better than analysts expected, gained 9 cents, or 0.3%, to $31.48.

Meanwhile, Bank of America finished up 1 cent, or less than 1%, after it said second-quarter profits declined 32%. Charles Schwab, which reported second-quarter profits that rose by 42%, lost 94 cents, or 1.5%, to $61.24.

In Asian trading, shares were mostly lower Tuesday, as investors weighed oil prices, inflation worries and corporate earnings. Tokyo’s benchmark was higher but other major indexes declined in morning trading after an early rally evaporated on Wall Street.

Japan's benchmark Nikkei 225 reversed early losses and added 0.7% in afternoon trading to 26,982.50. Australia's S&P/ASX 200 slipped 0.6% to 6,645.70. South Korea's Kospi dipped 0.2% to 2,370.57. Hong Kong's Hang Seng dropped 0.8% to 20,685.61, while the Shanghai Composite fell 0.1% to 3,276.07.

Analysts said the Tokyo market is seeing some buying after a three-day weekend. Monday was a national holiday in Japan.

Investors are playing catchup and so the rally may be short-lived. Among the issues picking up so far are Fast Retailing, the group company for the Uniqlo clothing retail chain, and Sony Corp.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $76.81 | +3.07 | +4.16% |

| CVX | $139.58 | +1.93 | +1.40% |

| XOM | $86.10 | +1.56 | +1.85% |

Oil prices rose slightly on Tuesday, paring earlier losses and after soaring by more than $5 barrel in the previous session, amid concerns about tight supply.

Brent crude futures for September settlement gained 17 cents to $106.51 a barrel by 0645 GMT. The contract rose 5.1% on Monday, the biggest percentage gain since April 12.

WTI crude futures for August delivery rose by 36 cent to $102.96 a barrel. The contract climbed 5.1% on Monday and the largest percentage gain since May 11. The August WTI contract expires on Wednesday and the more actively traded September future was at $99.74 a barrel, up 32 cents.

Oil prices have been whipsawed between concerns about supply as Western sanctions on Russian crude and fuel supplies over the Ukraine conflict have disrupted trade flows to refiners and end-users and rising worries that central bank efforts to tame surging inflation may trigger a recession that would cut future fuel demand.

Oil prices were backed by a softer U.S. dollar on Tuesday, which stood around a one-week low level, making greenback-dominated oil slightly cheaper for buyers holding other currencies.

The forecast of oil inventories in the U.S., the world's biggest oil consumer, was that crude and distillate supplies may have risen last week while gasoline stockpiles likely fell, according to a preliminary Reuters poll.

Live Coverage begins here