STOCK MARKET NEWS: Pinterest jumps, stocks choppy, Google’s CEO warns employees

Investors kickoff the new month on a cautious note, Pinterest moves higher after earnings report and oil is in focus ahead of OPEC meeting: FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PINS | $19.99 | +0.51 | +2.62% |

Pinterest is extending gains after reporting second quarter financial results. Revenue rose 9% to $665.9 million, which just missed analysts' estimate of $667 million, according to IBES data from Refinitiv.

The social media company posted a net loss of $43.1 million, or 7 cents per share, compared to profit of $69.4 million, or 10 cents per diluted share, in the prior year quarter. Pinterest accelerated its investment in shopping and ecommerce this quarter.

Global Monthly Active Users (MAUs) decreased 5% year over year to 433 million, down 5% from a year ago. Average revenue per user rose 17% to $1.54.

The company expects revenue will grow by the mid-single digits next quarter.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PG | $142.95 | +3.93 | +2.83% |

| KMB | $135.37 | +3.54 | +2.69% |

| XOM | $96.93 | +4.29 | +4.63% |

| CVX | $163.78 | +13.39 | +8.90% |

U.S. stocks swung between losses and gains in what was a choppy session that left all three of the major equity benchmarks with modest losses. Consumer staples, including Procter & Gamble and Kimberly Clark, help register the sector as the top S&P group, while energy fell to the bottom as oil dropped 4.80% to $93.89 per barrel on concerns that fresh global demand data came in weak.

Stock market experts Danielle Shay and Ayesha Tariq give advice on investing in the stock market on 'Making Money with Charles Payne.'

Apple is planning to issue up to four series of bonds of investment grade bonds, ranging in maturity from seven to 40 years.

The tech giant plans to use the proceeds for general corporate purposes, which may include share buybacks, dividend payments and repayment of debt.

Apple is rated “Aaa” by Moody’s, the agency’s highest grade, and “AA+” by Standard & Poor’s, the second highest grade.

S&P said it believes the global hardware and services provider will maintain its target of a net cash-neutral position over time.

Apple had cash and investments of $179 billion as of June 25 and $120 billion of debt, S&P said.

West Virginia State Treasurer Riley Moore (R) discusses his state's action to fight financial firms who are refusing to back coal companies by shutting them out of the state

Minneapolis Federal Reserve President Neel Kashkari warned that inflation is far from over and may in fact be getting worse.

U.S. stocks kicked off the new month on a down note after July notched the best performance for equities since 2020. Boeing, bucked downtrend, as shares jumped over 4% after regulators cleared the plane maker to resume deliveries of its 787 Dreamliner. In commodities, oil fell over 5% to the $93 per barrel level.

Investors celebrated a strong July for equities but August may bring more volatilty before stocks fully recover say experts.

Google CEO Sundar Pichai told employees productivity needs to improve, according to a CNBC report. The warning came last week as the tech company joined Facebook in reminding employees that the economy is weakening.

Cryptocurrency prices were mixed early Monday with Ethereum and Dogecoin higher and Bitcoin lower.

At approximately 4:15 a.m. ET, Bitcoin was trading at nearly $23,350 (-0.23%), or lower by more than $47.

For the week, Bitcoin was trading higher by nearly 3.5%. For the month, the cryptocurrency was higher, gaining more than 20%.

Ethereum was trading at approximately $1,700 (+0.62%), or higher by about $10.

For the week, Ethereum was trading higher by about 5.05%. For the month, it was trading higher by more than 61.6%.

Dogecoin was trading at 0.069337 (+1.50%), or higher by approximately $0.001026.

For the week, Dogecoin was higher by nearly 0.79%. For the month, the crypto was higher by more than 4.5%.

In the United States illegally?

No problem. That is if you're looking for a government job in Los Angeles County.

The Los Angeles County Board of Supervisors voted unanimously with no discussion to allow the county to no longer require U.S. citizenship for government jobs. The policy includes exceptions for positions where U.S. citizenship is required by state and federal law.

The motion was authored by Chair Hilda L. Solis, and co-authored by Sheila Kuehl. The vote took place last week. Those wishing to work for the Los Angeles County Sheriff’s Department, as well as any peace officers hired by the county, will still be subject to citizenship requirements.

According to the adopted motion, the new policy "ensures that applicants for employment are fairly and equitably considered, without regard to national origin, citizenship or other non-merit factors that are not substantially related to successful performance of the duties of the position," the Los Angeles Daily News reported.

Last year, the Board of Supervisors had asked the Office of the County Counsel and the Department of Human Resources for an analysis of whether scrapping citizenship requirements for board-appointed county officers or department heads was legal.

The report said the citizenship requirement for workers could be waived as long as state or federal law did not explicitly impose a requirement.

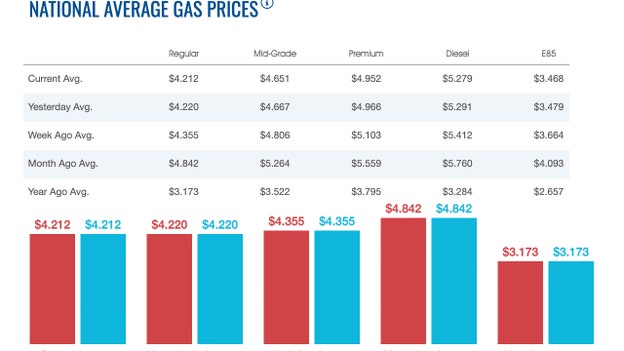

The average price of a gallon of gasoline slipped Monday morning to $4.212, according to AAA.

Gas prices nationwide were two-cents lower than Sunday's $4.232.

Prices have been on the decline since hitting a high of $5.016 on June 14.

Last week, the average price of a gallon of gasoline was $4.355. One month ago, that same gallon of gasoline was $4.842. One year ago, a gallon of gasoline was $3.173 according to AAA.

Diesel prices dropped early Monday as well, with the national average for a gallon of diesel at 5.279. A gallon of diesel cost $5.291 on Sunday.

A week ago, a gallon of diesel sold for $5.412. A month ago, that same gallon of diesel sold for $5.76. One year ago, a gallon of diesel cost $3.284, AAA reported.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,845.13 | +315.50 | +0.97% |

| SP500 | $4,130.29 | +57.86 | +1.42% |

| I:COMP | $12,390.69 | +228.09 | +1.88% |

U.S. stocks were moving higher from session lows overnight, but remained lower overall as a new month began Monday.

Major stock indexes rose Friday to end their best month since 2020, clawing back some of their losses from a dismal first half.

The S&P 500 gained 9.1% in July, while the Dow Jones Industrial Average rose 6.7%, the strongest monthly showing for each index since November 2020. The tech-heavy Nasdaq Composite climbed 12% for its best month since April 2020.

Investors have taken comfort in recent days from the idea that slowing economic growth might encourage the Fed to raise rates at a slower clip. They also have been encouraged by positive signals during earnings season, as expectations for quarterly profit growth rose over the past month.

But money managers and strategists are also debating whether stocks can hold on to the recent gains in the face of continued monetary tightening and worrisome signals about the economy. Many are skeptical.

"It seems like the market has prematurely declared victory over inflation," said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute. "It's completely out of step with what the Fed and Chair Powell laid out this week."

On Friday the S&P 500 rose 57.86 points, or 1.4%, to 4130.29. The Dow industrials added 315.50 points, or 1%, to 32845.13. The Nasdaq Composite advanced 228.09 points, or 1.9%, to 12390.69. All three gauges ended the week with gains.

Still, the major indexes are deep in negative territory for 2022, after the S&P 500 ended June with its worst first half since 1970. The benchmark is now down 13% for the year.

Conflicting economic signals are forcing investors to chart their paths forward without a clear view into how business conditions will develop in the months ahead.

Data Thursday showed the U.S. economy shrank for a second quarter in a row, meeting one popular definition of a recession. At the same time, employers have continued to add jobs and the unemployment rate has remained low.

Data Friday showed robust growth in consumption and wages, potentially keeping pressure on the Federal Reserve to raise interest rates to bring inflation under control. Worker pay and benefits rose 1.3% in the second quarter -- a near record pace -- and consumer spending rose 1.1% in June, accelerating from May. Friday's gains were broad-based, with nine of the S&P 500's 11 sectors advancing.

Meanwhile, shares were mostly higher in Asia on Monday after the strong close on Wall Street last week, though the latest manufacturing surveys showed weakening factory activity in the region’s biggest economies, China and Japan.

Tokyo's Nikkei 225 index gained 0.7% to 27,993.35 while the Shanghai Composite index edged 0.2% higher, to 3,259.96. In Sydney, the S&P/ASX 200 rose 0.7% to 6,993.00. The Kospi in Seoul ended nearly unchanged at 2,452.25 and Hong Kong's Hang Seng edged 0.1% higher to 20,179.94.

Chinese manufacturing’s recovery from anti-virus shutdowns faltered in July as activity sank, a survey showed Sunday, adding to pressure on the struggling economy in a politically sensitive year when President Xi Jinping is expected to try to extend his time in power.

In Europe, inflation surged in July, hitting 8.9% in the 19 European countries that use the euro currency.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $78.05 | +0.92 | +1.19% |

| CVX | $163.78 | +13.39 | +8.90% |

| XOM | $96.93 | +4.29 | +4.63% |

Oil prices dropped on Monday, as weak manufacturing data from China and Japan for July weighed on the outlook for demand, while investors braced for this week's meeting of officials from OPEC and other top producers on supply adjustments.

Brent crude futures were down 82 cents, or 0.8%, at $103.15 a barrel at 0608 GMT. U.S. West Texas Intermediate crude was at $97.44 a barrel, down $1.18, or 1.2%.

Fresh COVID-19 lockdowns snuffed out a brief recovery seen in June for factory activity in China, the world's largest crude oil importer. The Caixin/Markit manufacturing purchasing managers' index (PMI) eased to 50.4 in July from 51.7 in the previous month, well below analysts' expectations, data showed on Monday.

"China's disappointing manufacturing PMI is the primary factor that pressed on oil prices today," CMC Markets analyst Tina Teng said. "The data shows a surprising contraction of economic activities, suggesting that the recovery of the world-second-largest economy from the covid lockdowns may not be as positive as previously expected, which darkened the demand outlook of the crude oil markets.

Brent and WTI ended July with their second straight monthly losses for the first time since 2020, as soaring inflation and higher interest rates raise fears of a recession that would erode fuel demand.

Reflecting this, analysts in a Reuters poll reduced for the first time since April their forecast for 2022 average Brent prices to $105.75 a barrel. Their estimate for WTI fell to $101.28.

The Organization of the Petroleum Exporting Countries (OPEC)and allies including Russia, a group known as OPEC+, will meet on Wednesday to decide on September output.

Two of eight OPEC+ sources in a Reuters survey said a modest increase for September would be discussed at the Aug. 3 meeting, while the rest said output would likely be held steady.

The meeting comes after U.S. President Joe Biden visited Saudi Arabia last month.

Meanwhile, U.S. oil production continued to climb as the rig count rose by 11 in July, increasing for a record 23rd month in a row, data from Baker Hughes showed.

A break for Brent prices below key support level of $102.68 could trigger a drop into the range of $99.52 to $101.26, Reuters technical analyst Wang Tao said.

Live Coverage begins here