STOCK MARKET NEWS: Nasdaq slides on Micron warning, CPI inflation data on tap

Investors take a cautious tone ahead of two key inflation reports while Chipotle announces a workplace settlement and Sesame Place focuses on racial equity. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Chipotle Mexican Grill agreed to pay $20 million to 13,000 workers to settle alleged violations of the right to predictable schedules and paid sick leave under the Fair Workweek and Paid Safe and Sick Leave laws.

The restaurant chain will also pay $1 million in civil penalties.

Anyone who worked for Chipotle in an hourly position in New York City will receive $50 for each week worked from November 26, 2017 to April 30, 2022.

Coinbase Global Inc reported a loss for the second quarter on Tuesday, hurt by a plunge in trading volumes as this year's rout in risky assets curbed investor appetite for trading in cryptocurrencies.

Shares of the company were down 6% in extended trading.

Trading volumes slowed to $217 billion in the second quarter ended June 30, from $462 billion a year earlier when crypto's march to the mainstream attracted interest from traders.

Coinbase posted a net loss of $1.09 billion, compared with a profit of $1.61 billion a year earlier.

One of the largest cryptocurrency exchanges in the world, Coinbase has seen its market valuation decline more than 60% so far this year.

Roblox Corp missed estimates for quarterly bookings on Tuesday, as the gaming platform faced a slowdown in the pandemic-fueled surge in spending for its games including "Jailbreak" and "Adopt Me!."

Shares of the San Mateo, California-based company fell 11% in extended trading.

During the pandemic, more people turned to gaming as an alternate source of entertainment giving a boost to the mobile gaming sector, one of the largest sub-segment of the broader video gaming industry.

Earlier in June, Roblox also reported a hit from a stronger U.S. dollar with the company saying the impact of foreign currency fluctuations hurt its May bookings and led to a reduction of about 4% in the bookings growth rate.

The company, famous for its game "MeepCity," posted net bookings of $639.9 million in the second quarter, compared with $665.5 million a year earlier. Analysts were expecting net bookings of $644.4 million, according to Refinitiv data.

Net loss attributable to common stockholders widened to $176.44 million, or 30 cents per share for the quarter ended June 30, from $140.13 million, or 25 cents per share, a year earlier.

Sweetgreen is tumbling in after hours trading. The fast casual restaurant chain that serves salads reported second quarter profit that missed analysts’ estimates.

Revenue rose 45% to $124.9 million. The Wall Street estimate was $130.4 million.

Same-store sales rose 16%.The net loss was $40 million, or 36 cents per share, matching the Refinitiv estimate.

The company cut its workforce by 5% at its support center and moved to a smaller office.

For the full year, Sweetgreen is looking for revenue of $480 million to $500 million and same-store sales of 13%-15%.

Sesame Place has announced a series of initiatives as part of an expansion of its commitment to diversity, equity, and inclusion.

Initiatives include a comprehensive racial equity assessment, the development and implementation of an anti-bias training and education program, and enhancements to ensure a best-in-class diversity, equity, and inclusion (DE&I) program.

The announcement comes after a Baltimore family alleged SeaWorld's Sesame Place engaged “in pervasive and appalling race discrimination against children.”

U.S. stocks ended lower across the board led by the tech-heavy Nasdaq Composite’s 1.19% drop as Micron became the latest chip company to cut sales forecasts. Consumer discretionary names dragged on the S&P 500 ahead of the consumer price index, due Wednesday, which is expected to show prices remain elevated rising 8.7% for July. In commodities, oil closed fractionally lower at $90.50 per barrel.

Verona Pharma more than doubled in price Tuesday morning before giving back some gains.

The clinical-stage biopharmaceutical company announced its top-line Phase 3 ENHANCE-2 trial has successfully met its primary endpoint, as well as secondary endpoints demonstrating improvements in lung function, and significantly reduced the rate and risk of COPD exacerbations.

ENHANCE-2 delivers nebulized ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease (“COPD”).

“Ensifentrine has demonstrated clear improvements in lung function in addition to favorable safety results,” said Dr. Antonio Anzueto, Professor of Medicine and Section, Chief of Pulmonary at South Texas Veterans Healthcare System.

Verona Pharma expects to submit a New Drug Application to the U.S. Food and Drug Administration in the first half of 2023 for inhaled ensifentrine for the maintenance treatment of COPD.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| APP | $36.13 | -4.01 | -10.00 |

| U | $50.22 | 0.46 | 0.92 |

Gaming software company AppLovin Corp on Tuesday made an offer to buy peer Unity Software Inc in a $17.54 billion all-stock deal, looking to tap into growing demand for three-dimensional gaming.

Both companies make software used to design video games. Game-making software has also been expanding to new technologies such as the so-called metaverse, or immersive virtual worlds.

Unity's software has been used to build some of the most-played games such as "Call of Duty: Mobile," and "Pokemon Go," while AppLovin provides helps developers to grow and monetize their apps.

The enterprise value of the deal is $20 billion. AppLovin will offer $58.85 for each Unity share, which represents a premium of 18% to Unity's Monday closing price.

Shares of Unity rose 7%, while those of AppLovin fell 14% before the opening bell.

Under the proposed deal, Unity will own 55% of the combined company's outstanding shares, representing about 49% of the voting rights.

AppLovin Chief Executive Officer Adam Foroughi said the combined company will have the potential to generate an adjusted operating profit of over $3 billion by the end of 2024."Unity is one of the world's leading platforms for helping creators turn their inspirations into real-time 3D content," Foroughi said.

The world's leading retailer of diamond jewelry is acquiring online retailer Blue Nile in an all cash deal. Signet is also adjusting its financial forecasts as inflation softened customer demand in July.

U.S. vaccine maker Novavax slumped nearly 31% on Tuesday as falling demand for its COVID-19 shot from low- and middle-income nations led the company to cut its annual revenue expectation by half.

Demand for its vaccine is also waning in the United States, where it was authorized for use among adults last month and was expected to be preferred by the skeptics of messenger RNA-based shots from Moderna and Pfizer Inc.

But only 7,381 Novavax vaccine doses have been administered so far in the country, with Chief Executive Stanley Erck saying that its late launch could have hampered demand.

The company now expects 2022 revenue between $2 billion and $2.3 billion, compared with its prior forecast of $4 billion to $5 billion when it was hoping to benefit from the demand for its shots as part of the COVAX vaccine sharing program.

The forecast cut also dashes any hope of Novavax being able to garner a share of the market for the two-dose initial vaccination program, said Cowen analyst George Yordanov.

"We completely share and understand investors' frustration with management's execution and lack of accurate near-term guidance," he said in a note.

Analysts, however, expect the company to capture a small but meaningful share of a fast-developing market for COVID re-vaccinations.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NVDA | $173.20 | -4.73 | -2.66 |

| AMD | $97.83 | -2.24 | -2.24 |

| AMAT | $102.69 | -5.14 | -4.77 |

| INTC | $35.18 | -0.20 | -0.57 |

| CVX | $156.25 | 2.84 | 1.85 |

The Nasdaq Composite and S&P 500 drifted lower as investors await fresh data on consumer inflation due Wednesday and producer inflation out Thursday. The Dow Jones Industrial Average was little changed as Chevron notched gains. Technology in focus again as the chip sector sees more weakness on the heels of Nvidia lowering its revenue goals. Separately, President Biden will sign the CHIPS Act later today in an attempt to bolster U.S. manufacturing of the key components.

Cryptocurrency prices were mixed early Tuesday, with Bitcoin and Dogecoin higher and Ethereum whipsawing between negative and positive territory.

At approximately 4:30 a.m. ET, Bitcoin was trading at more than $23,825 (+0.06%), or higher by more than $13.50. For the week, Bitcoin was trading higher by nearly 2.25%. For the month, the cryptocurrency was higher, gaining more than 9%.

Ethereum was trading at approximately $1,775, or higher by about $0.03. For the week, Ethereum was trading higher by nearly 9%. For the month, it was trading higher by almost 44%.

Dogecoin was trading at $0.072592 (+3.75%), or higher by approximately $0.002626.

For the week, Dogecoin was higher by around 2.5%. For the month, the crypto was higher by more than 0.50%.

The fact that workers regret quitting during the Great Resignation underscores a more significant issue: worker needs are not getting met.

That's according to John Morgan, president of Lee Hecht Harrison (LHH), a global provider of talent acquisition and job recruitment solutions.

According to a recent survey by Joblist, about 26% of people who quit their job during what was dubbed the Great Resignation already regret it.

Additionally, 42% of people who found a new job after quitting said the new gig didn't live up to their expectations. Not only is this a sign that "Great Regret is happening but also that workers are looking for a better workplace culture, and are finding that these needs aren’t being met by either company," Morgan said.

Chad Carden, founder of consulting firm The Carden Group, said many employees had been lured away by promises of higher pay, better titles and better perks during the Great Resignation.

Younger professionals, in particular, also had a "heightened expectation" to have more paid time off, schedule flexibility and meaningful work and were willing to make a change to attain this, according to Kelly Lannan, senior vice president for emerging customers at Fidelty Investments.

In May, a survey from Fidelity revealed that approximately 61% of young professionals between the ages of 25-35 years old changed jobs in the last two years or plan to do so within the following two years.

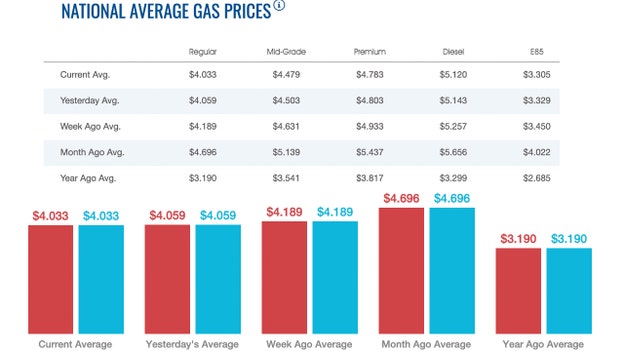

The average price of a gallon of gasoline nationwide slipped Tuesday to $4.033. On Monday, the price was $4.059. On Sunday, the price nationwide was $4.069, according to AAA.

Gasoline prices have been on the decline since hitting an all-time high of $5.016 on June 14, nine weeks ago.

A week ago, a gallon of gasoline cost $4.189, AAA reported, while a month ago, that same gallon cost $4.696. A year ago, a gallon of gasoline in the U.S. cost $3.19.

Diesel slipped as well Tuesday to $5.12. On Monday, the price was $5.143 on Monday, down from $5.158 Sunday.

A week ago, a gallon of diesel cost $5.257, according to AAA. A month ago, a gallon of diesel was $5.656. One year ago, a gallon of diesel sold for $3.299.

U.S. stocks were trading cautiously early Tuesday morning as investors await the release of July consumer price index reports.

Stocks wavered Monday as investors reviewed a series of earnings reports for insight into the impact of higher inflation on companies and consumers.

The S&P 500 fell 5.13 points, or 0.1%, to 4140.06. The Nasdaq Composite retreated 13.10 points, or 0.1%, to 12644.46 after spending much of the afternoon hovering between gains and losses. The technology-heavy index earlier flirted with a potential exit of its bear market. The Dow Jones Industrial Average added 29.07 points, or 0.1%, to 32832.54 points.

Shares of tech giant Nvidia fell $11.96, or 6.3%, to $177.93 after reporting preliminary quarterly revenue below analysts' forecasts. The company said it expects challenging market conditions to persist in the third quarter.

Shares of Palantir Technologies lost $1.63, or 14%, to $9.82 after it issued guidance that missed Wall Street's estimates.

Stocks have swayed in recent days, buffeted by shifting views on central bank policy. Friday's better-than-expected jobs report divided investors and analysts. Some raised concerns that the Federal Reserve could continue raising interest rates aggressively, while others questioned whether the U.S. economy could really be in recession.

"If we do technically get into recession, I think it's more likely to be shorter-lived and less severe because both the consumer and corporations are well suited going into this recession," said Wiley Angell, chief investment officer at Ziegler Capital Management.

Kiran Ganesh, a multiasset strategist at UBS, said the labor market "doesn't look like a recession in the sort of broad sense." "Investors seem to be in the mood to listen to the good news," he added.

Meanwhile, Asian shares mostly declined Tuesday amid a global fall in technology shares, including Japan's SoftBank, which has reported hefty losses caused by the market downturn.

Shares fell in Tokyo and Hong Kong but rose in other regional markets. Japan's technology investor SoftBank Group Corp. dropped more than 4% in Tokyo trading. On Monday it reported a record quarterly loss of $23 billion.

A global nose-dive of technology-related issues, such as Chinese e-commerce giant Alibaba, dragged on its sprawling portfolio of investments. Analysts monitoring Asian markets said regional tensions also remain a risk, because of the flareup between China and Taiwan after the recent visit of U.S. House Speak Nancy Pelosi to Taiwan. China has said it's extending threatening military exercises surrounding Taiwan, disrupting shipping and air traffic and raising up a notch worries about trade.

Japan's benchmark Nikkei 225 dipped 0.9% in afternoon trading to 27,999.96. Australia's S&P/ASX 200 edged up 0.1% to 7,029.80. South Korea's Kospi edged 0.5% higher to 2,504.60. Hong Kong's Hang Seng erased earlier gains and fell nearly 0.1% to 20,029.60, while the Shanghai Composite edged up 0.3% to 3,245.92.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $73.54 | 2.00 | 2.80 |

| CVX | $153.41 | -0.23 | -0.15 |

| XOM | $88.95 | 0.50 | 0.57 |

Oil prices slipped on Tuesday as traders eyed the latest progress in last-ditch talks to revive the 2015 nuclear accord with Iran, which would clear the way to boost its crude exports in a tight market.

Brent crude futures were down 86 cents, or 0.9%, at $95.79 a barrel at 0725 GMT, after gaining 1.8% in the previous session.

U.S. West Texas Intermediate (WTI) crude futures declined 88 cents, or 1%, to $89.88 a barrel, after climbing 2% in the previous session.

"Much attention remains with Iran nuclear deal talks, but it seems unlikely a breakthrough will happen anytime soon," said Edward Moya, a senior market analyst for OANDA."Tehran seems like they are willing to negotiate, but an imminent decision to agree to the EU's proposal seems unlikely."The European Union late on Monday put forward a "final" text to revive the 2015 Iran nuclear deal, awaiting approvals from Washington and Tehran. A senior EU official said a final decision on the proposal was expected within "very, very few weeks.”

Iran could boost its oil exports by 1 million to 1.5 million barrels per day, or up to 1.5% of global supply, in six months, he said."A revival of the 2015 nuclear accord will likely see oil prices fall sharply given that markets probably don't believe a deal will be reached," Dhar said.

However, signs that demand may not be dented by weakening global growth as much as feared are keeping a floor under the market for now, following stronger-than-expected trade data from China on the weekend and the surprising acceleration in U.S. jobs growth in July.

The oil market has remained under pressure recently over global recession fears, with Brent prices suffering their biggest weekly drop since April 2020 last week.

China, the world's largest crude oil importer, brought in 8.79 million barrels per day of crude in July, 9.5% less than a year earlier but up from June's volumes, according to China's customs data.

Traders will also be watching out for weekly U.S. oil inventory data, first from the American Petroleum Institute on Tuesday and then from the Energy Information Administration on Wednesday.

Five analysts polled by Reuters estimated crude stocks had fallen by around 400,000 barrels and gasoline stocks had declined also by about 400,000 barrels in the week to Aug. 5, while distillate inventories, which include diesel and jet fuel, had been unchanged.

Live Coverage begins here