Oil jumps after OPEC+ move, stocks fall, FTX’s Sam Bankman-Fried latest

OPEC+ keeps cuts ahead of EU ban, price cap begins on Russian oil, stocks fall ahead of key economic reports, FTX's Sam Bankman-Fried remains vocal on fallout. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Crypto bank Silvergate Capital says it conducted significant due diligence on FTX and its related entities including Alameda Research, both during the onboarding process and through ongoing monitoring, in accordance with its risk management policies.

The firm also says it operates in accordance with the Bank Secrecy Act and the USA PATRIOT Act and has a track record of closing accounts that are used for purposes outside of the expected use.

“It has been a very difficult few weeks for the digital asset industry, as we have all come to terms with the apparent misuse of customer assets and other lapses of judgment by FTX and Alameda Research,” Silvergate said.

The provider of innovative financial infrastructure solutions to the digital asset industry previously said it has no outstanding loans to nor investments in FTX, and FTX is not a custodian for Silvergate’s bitcoin-collateralized SEN Leverage loans.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $185.31 | -9.55 | -4.90 |

Tesla plans to cut December output of the Model Y at its Shanghai plant by more than 20% from the previous month, two people with knowledge of electric vehicle maker's production plan said on Monday.

The planned production cut comes after Tesla reported record sales in China for November.

The output reduction was first reported by Bloomberg, which said the move was a reflection of sluggish demand.

Reuters was not able to determine the reason for the planned reduction in output at the Shanghai factory, Tesla's largest production hub.

A Tesla representative did not initially respond to a Reuters request for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PEP | $183.12 | -2.57 | -1.38 |

PepsiCo is reported laying off headquarter workers, The Wall Street Journal reports.

A person familiar with the matter told the Journal that hundreds of jobs are being cut in the head office of the North American snacks and beverages divisions.

Employees in Purchase, N.Y., Chicago, Ill. and Plano, Tex. are said to be impacted.

The Journal suggests the layoffs indicate that companies outside of technology are beginning to look at cost control.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HTZ | $16.39 | -0.48 | -2.87 |

Hertz says it will pay approximately $168 million by the end of the year to settle the majority of the lawsuits brought against the rental car company by some of its customers who were wrongly accused of stealing cars they had rented.

n April Hertz CEO Stephen Scherr, who took over the role in February, said that he was working to fix a glitch in the company's systems that led to the incidents.

Hertz Global Holdings Inc. said Monday that the settlement of 364 pending claims related to vehicle theft reporting would bring resolution to more than 95% of the pending theft reporting claims.

“As I have said since joining Hertz earlier this year, my intention is to lead a company that puts the customer first. In resolving these claims, we are holding ourselves to that objective,” Scherr said in a statement.

Hertz anticipates recovering a “meaningful portion" of the settlement amount from its insurance carriers. The Estero, Florida-based company doesn't expect the resolution of the claims to have a material impact on its capital allocation plans for the balance of the year or for 2023.

Selling momentum kicked in for U.S. stocks on Monday with all three of the major U.S. averages closing with losses after a string of better-than-expected economic reports on factory orders and ISM services which raised concerns the Federal Reserve will remain aggressive on interest rate hikes. In commodities, oil reversed gains falling 3.8% to $76.93 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XOM | $107.18 | -2.68 | -2.44 |

| CVX | $176.80 | -4.23 | -2.34 |

| COP | $120.12 | -2.06 | -1.69 |

| USO | $68.08 | -1.76 | -2.52 |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SP500 | $3,998.18 | -73.52 | -1.81 |

The S&P 500 may fall 20% in 2023, warn Bank of America analysts.

The S&P has already plummeted about 16% this year as investors weigh concerns about stubbornly high inflation, steeper interest rate hikes and the likelihood of an economic downturn next year.

"Average and median SPX declines associated with recessions are 32.5% and 27.1%, respectively, and lasted 13.1 and 14.9 months, respectively," they wrote. "This equates to SPX 3,500 to SPX 3,240 in February to April 2023, which aligns with the SPX peak to trough declines associated with the cross of the 12-month MA below the 24-month MA on the SPX."

Pension funds and other 'non-bank' financial firms have more than $80 trillion of hidden, off-balance sheet dollar debt in FX swaps, the Bank for International Settlements (BIS) said.

The BIS, dubbed the central bank to the world's central banks, also said in its latest quarterly report that 2022's market upheaval had largely been navigated without major issues.

Its main warning concerned what it described as the FX swap debt "blind spot" that risked leaving policymakers in a "fog".

The $80 trillion-plus "hidden" debt estimate exceeds the stocks of dollar Treasury bills, repo and commercial paper combined, the BIS said. It has grown from just over $55 trillion a decade ago, while the churn of FX swap deals was almost $5 trillion a day in April, two thirds of daily global FX turnover.

For both non-U.S. banks and non-U.S. 'non-banks' such as pension funds, dollar obligations from FX swaps are now double their on-balance sheet dollar debt, it estimated.

The report also focused on findings from the recent BIS global FX market survey, which estimated that $2.2 trillion worth of currency trades are at risk of failing to settle on any given day due to issues between counterparties, potentially undermining financial stability.

The amount at risk represents about one third of total deliverable FX turnover and is up from $1.9 trillion from three years earlier when the last FX survey was carried out.

FX trading also continues to shift away from multilateral trading platforms towards "less visible" venues hindering policymakers "from appropriately monitoring FX markets," it said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GM | $39.25 | -0.65 | -1.63 |

The first electric delivery trucks rolled off production lines at BrightDrop's new factory in Canada on Monday, when the upstart unit of General Motors Co also announced DHL Express Canada as its first customer outside the United States.

GM spent seven months transforming its 2 million-square-foot CAMI Assembly plant in Ingersoll, Ontario, into Canada's first large-scale electric vehicle (EV) factory for BrightDrop Zevo delivery trucks. Before the switch, the site manufactured the gasoline-powered Chevy Equinox.

BrightDrop's relationship with GM gives it manufacturing and financial heft that several of its rival EV startups lack, experts said.

BrightDrop launched in 2021 and is forecast to reap its first $1 billion in sales next year, said Katz, who added that it took Tesla Inc TSLA.O a decade to hit the same milestone.

BrightDrop already has delivered 150 electric trucks to package carrier FedEx Corp. Its other U.S. customers include retailer Walmart Inc and communications provider Verizon Communications Inc.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NKE | $109.65 | -2.55 | -2.27 |

Nike Inc has cut ties with Kyrie Irving, a month after suspending its relationship with the Brooklyn Nets star in the aftermath of his promotion of an anti-Semitic documentary, The Athletic reported on Monday.

Irving faced heavy criticism after he posted a link to the 2018 documentary film on Twitter in late October and later defending the post. The seven-time All Star has since deleted the post and apologized.

Nike did not immediately respond to a request for comment on The Athletic's report. Irving could not be immediately reached for comment.

The sportswear giant in November canceled its next Irving-branded shoe release. Several media outlets have reported the sneaker deal to be worth $11 million, but Reuters could not confirm that.Irving returned to play for The Nets last month, ending a team-imposed eight-game suspension.

Elon Musk’s SpaceX is launching a national security version of its satellite network, the private space company's website said.

Starshield will leverages SpaceX's Starlink technology and launch capability to support national security efforts. While Starlink is designed for consumer and commercial use, Starshield is designed for government use, with an initial focus on three areas:

• Earth observation: Starshield launches satellites with sensing payloads and delivers processed data directly to the user.

• Communications : Starshield provides assured global communications to government users with Starshield user equipment.

• Hosted payloads: Starshield builds satellite buses to support the most demanding customer payload missions.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRM | $139.62 | -4.94 | -3.42 |

Workplace messaging platform Slack's Chief Executive Officer Stewart Butterfield plans to leave the company in January, the Business Insider reported on Monday.

Lidiane Jones will take over as CEO, Insider reported, citing an internal memo.

Salesforce Inc, which acquired Slack last year, did not immediately respond to a Reuters' request for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VERV | $20.48 | -3.52 | -14.67 |

Verve Therapeutics has received a letter from the Food and Drug Administration outlining information required to resolve the clinical hold on its U.S. clinical trial evaluating VERVE-101 in patients with heterozygous familial hypercholesterolemia, a prevalent and potentially life-threatening subtype of atherosclerotic cardiovascular disease.

The FDA also requested available clinical data from the ongoing heart-1 trial.

The company intends to submit a response as expeditiously as possible.

Verve continues to enroll patients in the heart-1 clinical trial in New Zealand and the United Kingdom and plans to report initial safety and pharmacodynamic data from the dose-escalation portion of the heart-1 trial in the second half of 2023.

VERVE-101, is designed to be a single-course in vivo liver gene editing treatment. The company plans to develop VERVE-101 initially for patients with HeFH. Individuals with FH may harbor one mutant allele and are thereby heterozygous for the disease.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BP | $35.62 | 0.26 | 0.72 |

| CVX | $180.06 | -0.97 | -0.54 |

| SHEL | $58.04 | 0.32 | 0.55 |

| TTE | $60.99 | 0.38 | 0.63 |

| XOM | $109.01 | -0.85 | -0.77 |

Oil prices rose 3% on Monday after OPEC+ nations held their output targets steady ahead of a European Union ban and the start of a G7 price cap on Russian crude.

At the same time, in a positive sign for fuel demand in the world's top oil importer, more Chinese cities eased COVID-19 curbs over the weekend.

Brent crude futures were up $2.53, or 3%, at $88.10 a barrel by 1330 GMT. WTI crude futures gained $2.40, or 3%, to $82.38.

The Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, together called OPEC+, agreed on Sunday to stick to their October plan to cut output by 2 million barrels per day (bpd) from November through 2023.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VFC | $30.50 | -2.72 | -8.19 |

VF Corporation chair and CEO Steve Rendle is retiring. He’ll be replaced on an interim basis by lead independent director Benno Dorer, the company said.

The owner of brands including Vans, The North Face, Timberland, and Dickies also revised its fiscal 2023 outlook to reflect the impact of weaker than anticipated consumer demand across its categories, primarily in North America.

Lower demand has resulted in greater than expected promotional activity as well as order cancellations in the wholesale channel.

VF now expects total revenue growth in the second half of FY23 to be modestly lower than previously outlined, with revenue for the full year expected to increase 3% to 4% in constant dollars (excluding the impact of translating foreign currencies into U.S. dollars), compared to the previous guidance of up 5% to 6% in constant dollars.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VOD | $11.21 | -0.04 | -0.31 |

Nick Read will step down as Vodafone chief executive by the end of the year, ending a four-year tenure during which the British telecom group's share price has nearly halved.

Vodafone's shares, which have fallen 45% since Read took over in October 2018, are trading just off two-decade lows.

“Investors will be hoping that a change at the top at Vodafone might inject a new longer-term lease of life in the company’s share price. Although any change of Chief Executive is unsettling, the restructuring strategy Nick Read headed up, hasn’t yet reaped rewards,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

Once one of the biggest mobile operators in the world, Vodafone has been selling assets to focus on Europe and Africa, but the deals have not arrested its stock's decline.

Vodafone's board was unhappy with Read's lack of progress in delivering growth and has tasked his interim replacement, finance director Margherita Della Valle, with accelerating "the execution of the company's strategy to improve operational performance and deliver shareholder value".

The company warned on profit last month as energy costs soared, an already poor performance in its biggest market Germany worsened, and intense competition in Spain and Italy showed no sign of easing.

“His successor will need some bright ideas about how to differentiate the company when consumers are so super-sensitive to price in the mobile market,” Hargreaves said.

Reuters contributed to this report.

Sam Bankman-Fried, the embattled former CEO of FTX, continues speaking out.

U.S. stock futures are lower on Monday as investors await data on services sector activity and factory orders.

Dow Jones Industrial Average futures fell 169 points, or 0.49%, while S&P 500 futures and Nasdaq Composite futures fell 0.59% and 0.51%, respectively.

In commodities, West Texas Intermediate crude futures rose 2.7% to $82.14 a barrel on Monday, while gold slipped to $1,809.40 an ounce.

On the economic front, the Institute for Supply Management will release its non-manufacturing PMI for November at 10 a.m. The gauge of services sector activity is expected to slip for the third straight month to 53.3.

Also at 10, the Commerce Department is expected to say factory orders rose 0.7% in October from the prior month.

Cryptocurrency prices edged higher early Monday with Bitcoin, Ethereum and Dogecoin all showing gains.

At approximately 4:45 a.m. ET, Bitcoin was trading at nearly $17,319 (+1.05%), or higher by $180.

For the week, Bitcoin was trading higher by nearly 4.25%. For the month, the cryptocurrency was lower by nearly 19%.

Ethereum was trading at approximately $1,296 (+1.12%), or higher by more than $14.30.

For the week, Ethereum was trading higher by nearly 7.3%. For the month, it was trading lower by approximately 22%.

Dogecoin was trading at $0.10757 (+3.02%), or higher by approximately $0.00318.

For the week, Dogecoin was higher by more than 5.35%. For the month, the crypto was higher by lower by nearly 17.25%.

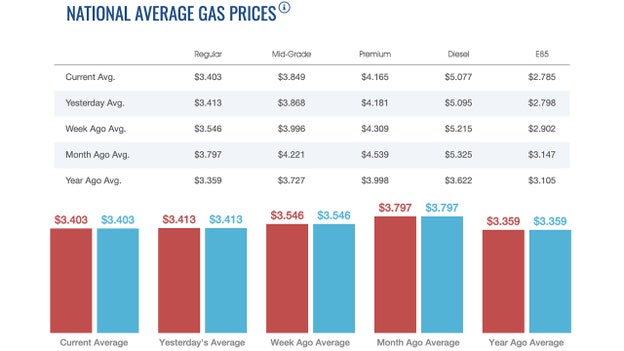

The nationwide price for a gallon of gasoline slipped Monday to $3.403. On Sunday, the price stood at $3.413, according to AAA. The average price of a gallon of gasoline on Saturday was $3.425.

One week ago, a gallon of gasoline cost $3.546. A month ago, that same gallon of gasoline cost $3.797. A year ago, a gallon of gasoline cost $3.359.

Gas hit an all-time high of $5.016 on June 14.

Meanwhile, on Monday a gallon of diesel cost $5.077 after declining to $5.095 on Sunday.

One week ago, a gallon of diesel cost $5.215. A month ago, that same gallon of diesel cost $5.325. A year ago, a gallon of diesel cost $3.622.

U.S. stocks were lower early Monday after finishing mixed Friday on Wall Street.

Shares were mixed Friday on Wall Street as investors fretted over inflation after a report showed U.S. wages were accelerating.

That revived worries that the Federal Reserve may not be able to ease back as much as hoped on its big interest-rate hikes.

The S&P 500 edged 0.1% lower and the Dow industrials gained 0.1%. The Nasdaq composite fell 0.2%.

Stocks have been on the upswing for the last month on hopes inflation may have peaked, allowing the Federal Reserve to dial down rate hikes that aim to undercut inflation by slowing the economy and dragging down prices for stocks and other investments.

But Friday’s labor market report showed that wages for workers rose 5.1% last month from a year earlier. That’s an acceleration from October’s 4.9% gain and easily topped economists’ expectations for a slowdown.

U.S. employers added 263,000 jobs last month. That beat economists’ forecasts for 200,000, while the unemployment rate held steady at 3.7%. Many Americans also continue to stay entirely out of the job market, with a larger percentage of people either not working or looking for work than before the pandemic, which could increase the pressure on employers to raise wages.

Still, a growing number of economists are forecasting the U.S. economy will dip into a recession next year, mainly because of higher interest rates.

Meanwhile, world shares were mixed and oil prices rose Monday after the European Union and the Group of Seven democracies agreed on a boycott of most Russian oil and committed to a price cap of $60 per barrel on Russian exports.

Germany's DAX slipped 0.3% to 14,490.99 and the CAC 40 in Paris lost 0.2% to 6,728.57. Britain's FTSE 100 edged 0.1% higher, to 7,562.40. The future for the S&P 500 gave up 0.4% and the contract for the Dow future lost 0.3%. Hong Kong’s benchmark jumped 4.5% to 19,518.29. The Shanghai Composite added 1.8% to 3,211.81.

Market players are betting that disruptions to manufacturing and trade will abate as Chinese authorities lift some of the most onerous restrictions imposed to contain outbreaks of the coronavirus, while saying their “zero-COVID” strategy — which aims to isolate every infected person — is still in place.

The curbs have included lockdowns of neighborhoods or buildings, frequent mandatory testing and shutdowns of factories and other businesses. China recently saw several days of protests across cities including Shanghai and Beijing as public frustration with the COVID-19 curbs boiled into unrest.

Some demanded Chinese President Xi Jinping step down in an extraordinary show of public dissent in a society over which the ruling Communist Party exercises near total control.

Tokyo's Nikkei 225 climbed 0.2% to 27,820.40 and the Kospi in Seoul shed 0.6% to 2,419.32. In Sydney, the S&P/ASX 200 advanced 0.3% to 7,325.60. Shares fell in Mumbai but rose in Singapore and Taiwan. Thailand's markets were closed for a holiday.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $69.84 | -0.61 | -0.87 |

| CVX | $181.03 | -1.46 | -0.80 |

| XOM | $109.86 | -0.94 | -0.85 |

Oil prices edged up on Monday after OPEC+ nations held their output targets steady ahead of a European Union ban and a price cap kicking in on Russian crude.

At the same time, in a positive sign for fuel demand, more Chinese cities eased COVID-19 curbs over the weekend, though the partial easing in policies sowed confusion across the country on Monday.

While prices rose as much as 2% earlier in the day, both the Brent and U.S. West Texas Intermediate (WTI) contracts have since pared some gains.

Brent crude futures were last up 49 cents, or 0.6%, to $86.06 a barrel at 0700 GMT, while WTI crude futures gained 51 cents, or 0.6%, to $80.49 a barrel. The Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, together called OPEC+, agreed on Sunday to stick to their October plan to cut output by 2 million barrels per day (bpd) from November through 2023.

Analysts said the OPEC+ decision was expected as major producers wait to see the impact of the EU import ban and Group of Seven (G7) $60-a-barrel price cap on seaborne Russian oil, with Russia threatening to cut supply to any country adhering to the cap.

The OPEC+ decision to keep production unchanged, along with weak economic data out of China, however, could reverse oil's price gains, said Leon Li, a Shanghai-based analyst at CMC Markets.

"The current economic data of China is still weak, with a sharp decline in imports and exports, which reflects the sluggish domestic demand and the declining trend of the overseas economy. It is challenging to drive the demand for crude oil," said Li. "OPEC+ kept its output unchanged. Without further production reduction measures, oil prices may fall again."

Business and manufacturing activity in China, the world's second largest economy and top crude oil importer, have been hit this year amid strict zero-tolerance measures to curb the spread of the coronavirus.

Live Coverage begins here