Stocks fall on recession fears, oil higher as demand grows

Stocks fell for a fourth day while oil prices rose for the fourth time in six sessions. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Government spending is projected to raise the national debt to more than twice gross domestic product by 2050, according to the Penn Wharton Budget Model, a nonpartisan group at the University of Pennsylvania's Wharton School.

The group says current U.S. fiscal policy is in permanent imbalance as current debt plus projected future spending outstrips future tax revenue.

Achieving fiscal balance would require the federal government to permanently increase tax revenues by over 40% or reduce expenditures by 30% or some combination of both.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSE | $22.22 | -0.80 | -3.48 |

Trinseo is reducing capacity to improve profitability by $60 million, the company said.

The specialty material solutions provider will close manufacturing operations at the styrene production facility in Boehlen, Germany and one production line in Stade, Germany.

Trinseo will also consolidate the PMMA sheet manufacturing site in Matamoros, Mexico into the continuous sheet manufacturing operation of Aristech Surfaces in Florence, Ky.

The company is also reducing capacity of SB latex at the Hamina, Finland site starting mid-year 2023 due to over-capacity of SB latex in Europe.

U.S stocks ended the day lower.

• The Dow Jones Industrial Average lost about 5%.

• The S&P 500 fell about 0.9%.

• The Nasdaq composite dropped 1.49%.

Investors are growing more concerned about a possible recession.

The National Association of Home Builders/Wells Fargo Housing Market Index showed builder confidence fell for the twelfth consecutive month to 31, marking the worst stretch for the housing market since the survey launched in 1985.

On Thursday, the government issues revised figures from third quarter gross domestic product.

Front Month Nymex Crude for January delivery gained 90 cents per barrel, or 1.21% to $75.19 today.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WMT | $142.01 | -0.74 | -0.52 |

Walmart is recalling more than 6,000 pounds of chicken products due to mislabeling and an undeclared allergen.

The recall was issued after a customer complained that they found shrimp in their product, although it had been labeled as a Crispy Chicken with Almonds entrée.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AJRD | $55.73 | 0.83 | 1.52 |

| LHX | $204.53 | -8.74 | -4.10 |

U.S. defense contractor L3Harris Technologies Inc said on Sunday it would buy Aerojet Rocketdyne Holdings Inc in a $4.7 billion all-cash transaction, as it looks to tap into rising demand for missiles amid the Ukraine conflict. Reuters had first reported on Saturday that L3Harris was nearing the deal to acquire U.S. rocket maker Aerojet. The offer price of $58 per share represents a premium of 5.7% to Aerojet's close on Friday.

Aerojet develops and manufactures liquid and solid rocket propulsion and hypersonic engines for space, defense, civil and commercial applications.

L3Harris, which has been investing in the space and cyber industries, is looking to solidify its position among top aerospace and defense firms as one of the leading contractors to the Pentagon.

The Federal Trade Commission has secured agreements requiring Epic Games to pay $520 million to settle allegations the maker of the Fortnite video game violated the Children’s Online Privacy Protection Act (COPPA) and deployed design tricks, known as dark patterns, to dupe millions of players into making unintentional purchases.

The FTC’s action against Epic involves two separate record-breaking settlements.

As part of a proposed federal court order filed by the Department of Justice on behalf of the FTC, Epic will pay a $275 million monetary penalty for violating the COPPA Rule—the largest penalty ever obtained for violating an FTC rule.

Additionally, in a first-of-its-kind provision, Epic will be required to adopt strong privacy default settings for children and teens, ensuring that voice and text communications are turned off by default.

Under a separate proposed administrative order, Epic will pay $245 million to refund consumers for its dark patterns and billing practices, which is the FTC’s largest refund amount in a gaming case, and its largest administrative order in history.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HON | $210.08 | 0.34 | 0.16 |

The Securities and Exchange Commission today announced charges against Honeywell International Inc. for violations of the Foreign Corrupt Practices Act (FCPA) arising out of bribery schemes that took place in Brazil and Algeria. The company has agreed to pay more than $81 million to settle the SEC’s charges.

The SEC’s order finds that Honeywell, a U.S.-based global manufacturer of aerospace, building technologies, and automation products, engaged in a bribery scheme involving intermediaries and employees of its U.S. subsidiary to obtain business from the Brazil state-owned entity Petrobras.

Specifically, the order finds that, in 2010, Honeywell offered at least $4 million in bribes to a high-ranking Brazilian government official in connection with the bidding process at Petrobras. The SEC’s order also finds that, in 2011, employees and agents of Honeywell’s Belgian subsidiary paid more than $75,000 in bribes to an Algerian government official to obtain and retain business with the Algerian state-owned entity Sonatrach.

"For years, Honeywell neglected to implement sufficient internal accounting controls to mitigate against known corruption risks in countries like Brazil and Algeria," said Charles Cain, Chief of the SEC Enforcement Division’s FCPA Unit. "This failure created an environment in which Honeywell employees and agents could and did facilitate bribes."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| META | $115.90 | -3.53 | -2.96 |

The European Commission on Monday said it has warned Facebook parent company Meta that it is breaching EU antitrust laws by distorting competition in markets for online classified advertising and abusing its dominant position.

The Commission said in a preliminary view that it would further investigate and that it could impose a fine of up to 10% of the company's annual global turnover, if there is sufficient evidence of an infringement of European Union rules.

European Union's antitrust chief Margrethe Vestager said in a statement that she is concerned that Meta ties its dominant social network Facebook to its online classified ad services, which is called Facebook Marketplace.

"This means Facebook users have no choice but to have access to Facebook Marketplace," she said.

Meta denied its business practices were anti-competitive.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SP500 | $3,826.76 | -25.60 | -0.66 |

History favors a Santa Claus rally in the stock market, though Wall Street investors aren’t counting on an end of the year stock bounce.

The Dow Jones Industrial Average is down 10% year to date, the S&P 500 is 20% lower and the Nasdaq Composite Index has lost 33%.

Typically, the last five trading days of December and the first two of the new year have been good for traders. A study by LPL Research showed the S&P 500’s average return performance during the seven-day period is 77.9% more likely to yield positive returns than any other seven-day period.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MESA | $1.30 | 0.13 | 11.11 |

| AAL | $12.68 | -0.13 | -1.04 |

| UAL | $38.22 | -0.21 | -0.55 |

Mesa Air Group is restructuring in its operations with American Airlines and United Airlines.

As a result of ongoing unprofitable operations with American Airlines, driven primarily by higher pilot wages and block hour utilization penalties driven by the ongoing industry wide pilot shortage, Mesa initiated and has finalized a consensual wind down of its American operations.

Mesa is finalizing a new-five-year agreement with United Airlines that would place the associated aircraft into United Express operations and compensate Mesa for the higher costs associated with regional jet flying. The new agreement would cover all of Mesa’s existing flying at American and could increase to 38 CRJ-900 aircraft, dependent upon the number of E-175s that Mesa is operating.

Operations with American will cease on April 3, 2023.

The expected agreement with United anticipates Mesa would begin to place aircraft with United in March 2023 and continue to utilize all of its crew and maintenance locations currently operated for American Airlines in Phoenix, Dallas, El Paso, and Louisville through the transition and beyond. The agreement also provides for Mesa to open a CRJ-900 crew base in Houston and a new pilot base in Denver, CO, with the potential for other incremental crew bases.

Builder confidence in the market for newly built single-family homes posted its 12th straight monthly decline in December, dropping two points to 31, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

This is the lowest confidence reading since mid-2012, with the exception of the onset of the pandemic in the spring of 2020.

“In this high inflation, high mortgage rate environment, builders are struggling to keep housing affordable for home buyers,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga.

“Our latest survey shows 62% of builders are using incentives to bolster sales, including providing mortgage rate buy-downs, paying points for buyers and offering price reductions. But with construction costs up more than 30% since inflation began to take off at the beginning of the year, there is little room for builders to cut prices. Only 35% of builders reduced homes prices in December, edging down from 36% in November. The average price reduction was 8%, up from 5% or 6% earlier in the year.”

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DNUT | $11.46 | -0.28 | -2.43 |

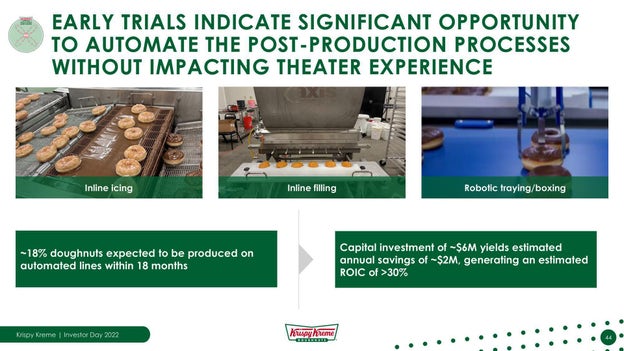

Krispy Kreme plans to automate approximately 18% of its doughnut production within 18 months, the company said in an investor presentation.

A capital investment of $6 million will save $2 million annually, generating a 30% return on investment capital.

Krispy Kreme said current doughnut production and processing is manually intensive and costly with $100 million spent each year on doughnut production labor in the U.S.

The company has five doughnut factories, along with 240 production facilities in theater hubs.

Krispy Kreme reiterated its full-year 2022 guidance that was provided in conjunction with its second and third quarter 2022 results.

• Net Revenue of $1.49 billion to $1.52 billion

• Organic Revenue growth of 10% to 12%

• Adjusted Diluted EPS of $0.29 to $0.32

Crypto firm Voyager Digital Ltd said on Monday it will sell its assets to Binance.US in a deal valued at about $1 billion following a review.

Palo Alto, California-based Binance.US, which operates as an independent legal entity and has a licensing agreement with Binance.com, will make a $10 million deposit and reimburse Voyager for certain expenses up to $15 million.

Nearly $2 trillion in value has been wiped out from the crypto sector this year on rising interest rates and exacerbating worries of an economic downturn. The slump has eliminated key industry players such as Three Arrows Capital and Celsius Network.

However, the bigger blow came after larger crypto exchange FTX filed for bankruptcy protection last month. Its swift fall has also sparked tough regulatory scrutiny of how major exchanges hold user funds.

In September, Voyager Digital said FTX won an auction for its assets, in a bid valued at about $1.42 billion after Voyager filed for Chapter 11 bankruptcy protection in July.

Voyager said on Monday it will seek Bankruptcy Court approval for the deal with Binance.US at a hearing on Jan. 5, 2023.

Stocks opened little changed in the week ahead of the Christmas holiday as investors look for signs of a Santa Claus rally, the traditional year-end lift of stocks.

‘’As a chill settles on markets, there is not much sign of a sustained Santa rally instead there is still a lack of overall cheer with investors mulling more interest rate rises and the never-ending story of the pandemic,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

There is a full week trading this week. The markets will close Mon., Dec. 26 for Christmas.

Notable earnings this week include FedEx, General Mills and Nike on Tue., Micron Technology and Rite Aid on Wed. and CarMax and Paychex on Thur.

Oil is trading higher.

Overseas, most major Asian indices finished lower.

European indices are higher.

“Despite some weakness in Asian markets overnight, the FTSE 100 starts the last week before Christmas with a sprinkling of cheer as it looks to recover last week’s losses,” says AJ Bell investment director Russ Mould. “US releases on consumer confidence on Wednesday and core inflation on Friday look the only scheduled announcements likely to shift the market’s mood this week but after an unpredictable year it would be foolish to rule out one last big surprise before 2022 is out.”

U.S. stock futures are rebounding on Monday after traders went on a selling frenzy last week following another interest rate hike from the U.S. Federal Reserve.

The Dow Jones Industrial Average futures is up roughly 60 points, or 0.18%, while the S&P and Nasdaq futures are approximately 0.28% and 0.38% higher, respectively.

Over the last five days, the Dow remains down near 3.06%, the S&P is off nearly 3.28% and the tech-heavy Nasdaq is roughly 3.70% lower.

Pre-market, key retail stocks are gaining ground ahead of the holidays with Nike up approximately 4.2%, Best Buy is almost 1.16% in the green, while Macy’s is roughly 0.39% in positive territory.

Tech shares are up and down on Monday as the Nasdaq struggles for gains with Meta off nearly 1.76% pre-market, Apple is up approximately 0.42%, and Microsoft is up around 0.40% in the green.

In commodities, West Texas Intermediate crude futures spiked 0.81% to $74.89 a barrel, as gold jumped 0.11% to $1,802.10 an ounce.

Cryptocurrency prices were lower early Monday.

At approximately 4:45 a.m. ET, Bitcoin was trading at nearly $16,765 (-0.08%), or lower by $13.

For the week, Bitcoin was trading lower by nearly 1.85%. For the month, however, the cryptocurrency was higher by nearly 0.5%.

Ethereum was trading at approximately $1,185.10 (-0.13%), or lower by about $1.7.

For the week, Ethereum was trading lower by slightly more than 6%.

For the month, it was trading lower by approximately 2.15%.Dogecoin was trading at $0.077945 (-1.18%), or lower by approximately $0.000933.

For the week, Dogecoin was lower by almost 15%. For the month, the crypto was lower by nearly 6.65%.

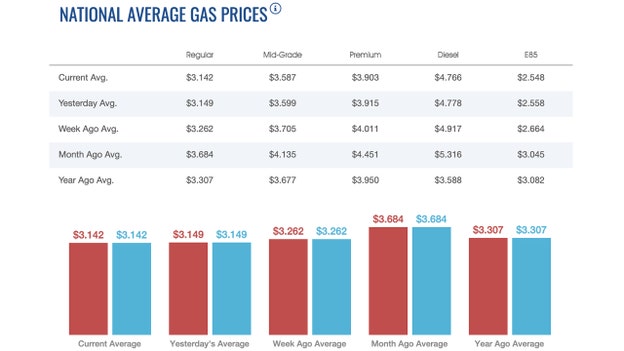

The nationwide price for a gallon of gasoline slipped Monday to $3.142, according to AAA. On Sunday, the price stood at $3.149, while on Saturday, the price was $3.159. A year ago, the price for a gallon of regular gasoline was $3.307.

One week ago, a gallon of gasoline cost $3.262. A month ago, that same gallon of gasoline cost $3.684.

Everyone remembers when gas hit an all-time high of $5.016 on June 14.

Diesel has slipped below $5.00 per gallon to $3.766, dropping more than 2 cents overnight, when it was selling for $4.778.

A week ago, diesel prices nationwide cost $4.917. A month ago, that same gallon of diesel cost $5.316.

Economic reports will dominate the news this coming week as we can expect reports on the troubled housing market beginning Monday with the homebuilder sentiment index and ending Friday with a flurry of data, notably personal income and spending for November, which includes the Federal Reserve’s favorite inflation gauge.

Keep an eye out for the Housing Market Index for December on Monday at 10 a.m. ET. This closely followed gauge of homebuilder sentiment is anticipated to rise a point to 34. That’s up from a 10-year low of 33 in November, indicating only one-third of NAHB members regard conditions as good.

It would mark the first increase in a year, following a record 11 consecutive monthly declinesas high inflation and soaring mortgage rates hurt buyer traffic and home sales.

Other reports to watch this week are housing starts and building permits on Tuesday and existing home sales on Wednesday. All reports are for the month of November.

Additional reports expected on Thursday include figures on the final third-quarter gross domestic product as well as jobless claims.

Closing out the week will be a report on new homes sales for November on Friday.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,920.46 | -,281.76 | -0.85 |

| SP500 | $3,852.36 | -43.39 | -1.11 |

| I:COMP | $10,705.41 | -,105.11 | -0.97 |

U.S. stocks turned higher overnight after whipsawing earlier in the morning following two straight weeks of losses for the first time since September and weary investors trying to shake off recession fears.

Wall Street fell Friday after the Fed raised its forecast of how long interest rates have to stay elevated to cool inflation that is near a four-decade high. The European Central Bank warned more rate hikes are coming.

Wall Street’s benchmark S&P 500 index turned in its second weekly decline after losing 1.1% to 3,852.36 on Friday for its third daily drop. It is down about 19% so far this year.

The Dow Jones Industrial Average dropped 0.8% to 32,920.46. The Nasdaq composite lost 1% to 10,705.41. More than 80% of stocks in the benchmark S&P 500 fell. Technology and health care stocks were among the biggest weights on the market.

Microsoft fell 1.7% and Pfizer slid 4.1%. U.S. inflation has eased to 7.1% over a year earlier in November from June’s 9.1% high but still is painfully high.

The Fed on Wednesday raised its benchmark short-term lending rate by one-half percentage point for its seventh hike this year. That dashed hopes the U.S. central bank might ease off increases due to signs inflation and economic activity are cooling.

The federal funds rate stands at a 15-year high of 4.25% to 4.5%. The Fed forecast that will reach a range of 5% to 5.25% by the end of 2023. Its forecast doesn’t call for a rate cut before 2024.

Meanwhile, Asian stock markets fell again Monday as investors wrestled with fears the Federal Reserve and European central banks might be willing to cause a recession to crush inflation. Shanghai, Tokyo, Hong Kong and Sydney declined.

The Nikkei 225 in Tokyo sank 1.1% to 27,218.28 and the Hang Seng in Hong Kong shed 0.7% to 19,316.58. The Kospi in Seoul retreated 0.4% to 2,350.27 and Sydney’s S&P-ASX 200 was 0.2% lower at 7,137.00. Singapore advanced while New Zealand and other Southeast Asian markets declined.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $64.90 | -1.25 | -1.89 |

| CVX | $168.72 | -2.32 | -1.36 |

| XOM | $104.70 | -0.74 | -0.70 |

Oil rose on Monday as the prospect of demand recovery, led by China's loosening of COVID-19 curbs and the United States' decision to buy back oil for its state reserves, gained the upper hand over global recession fears.

Brent crude futures gained 42 cents, or 0.5%, to $79.46 a barrel by 0753 GMT while U.S. West Texas Intermediate crude was at $74.67, up 38 cents, or 0.5%.

Both benchmarks plunged more than $2 a barrel last Friday, following hawkish remarks from U.S. and European central banks on interest rate hikes that sparked worries of possible recession.

China, the world's top crude oil importer and No. 2 oil consumer, is experiencing its first of three expected waves of COVID-19 cases after Beijing relaxed mobility restrictions.

"Despite a surge in COVID cases, the reopening optimism and accommodative policy improve oil's demand outlook," CMC Markets analyst Tina Teng said.

China's abrupt end to its "dynamic zero" COVID policy is breathing new life into its ailing aviation sector, with average jet fuel demand jumping by 75%, or nearly 170,000 barrels per day, in two weeks, according to satellite data firm Kayrros.

An announcement by the U.S. Energy Department on Friday that it will begin repurchasing crude oil for the Strategic Petroleum Reserve for delivery in February next year also supported the outlook for stronger prices.

This will be the United States' first purchase since this year's record 180-million-barrel release from the stockpile.

Live Coverage begins here