STOCK MARKET NEWS: Uber, Pfizer earnings, Fed meeting begins, Elon Musk keeps tweaking Twitter

Investors brace for expected 75-point interest rate hike, jobs data in focus with JOLTS report, Elon Musk’s Twitter shake-up continues. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UAL | $42.99 | -0.09 | -0.21 |

| DAL | $34.02 | 0.09 | 0.27 |

United Airlines pilots overwhelmingly voted against a tentative contract, the union representing the workers said on Tuesday, saying the proposal fell short of what members were seeking.

The Air Line Pilots Association said 94% of the nearly 10,000 pilots voted to reject the contract offer and said pilots would immediately begin a series of pickets.

The tentative agreement, announced in June, offered more than 14.5% cumulative pay increases and enhanced overtime and training pay. However, some pilots were not happy with the deal, prompting the union to renegotiate its terms.

The development comes one day after Delta Air Lines pilots voted to authorize a strike.

99% of Delta pilots voting cast ballots in favor of a strike authorization.

DELTA PILOTS VOTE OVERWHELMINGLY TO AUTHORIZE STRIKE

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DD | $58.70 | 1.50 | 2.62 |

| ROG | $229.49 | -5.84 | -2.48 |

DuPont today announced the termination of the previously announced agreement1 to acquire the outstanding shares of Rogers Corporation, as the companies have been unable to obtain timely clearance from all the required regulators.

DuPont is paying Rogers a termination fee of $162.5 million in accordance with the agreement.

On September 30, DuPont and Rogers announced they received all regulatory approvals required to consummate the merger except for approval of the State Administration for Market Regulation of China.

Rogers entered into a definitive merger agreement to be acquired by DuPont for $277.00 per share in cash on November 2, 2021.Rogers' shareholders approved the merger agreement at a special shareholder meeting held on January 25, 2022.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FRPT | $59.42 | 0.47 | 0.80 |

Freshpet Inc. on Tuesday reported a loss of $18.4 million in its third quarter.

The Secaucus, New Jersey-based company said it had a loss of 39 cents per share.

The results missed Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for a loss of 23 cents per share.

The seller of refrigerated fresh pet food posted revenue of $151.3 million in the period, beating Street forecasts. Eight analysts surveyed by Zacks expected $147.8 million.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MTCH | $43.90 | 0.70 | 1.62 |

Match Group beat estimates for third-quarter revenue on Tuesday as more paying users, undeterred by decades-high inflation, signed up on its dating apps Tinder and Hinge, sending the company's shares up nearly 10% in extended trading.

The results are welcome news for the company that has been rocked this year by executive changes and analyst concerns about poor execution of new features on flagship app Tinder.

Shares of the company fell 66.1% this year.

The company's revenue rose 1% to $810 million in the three months ended September. Analysts on average had expected about $793 million, according to Refinitiv data.

Paying users for Tinder rose 7%. The app's total revenue grew 6%, aided by the return of the Desk Mode feature that lets users swipe right and left from their desktops.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CAKE | $34.13 | -1.68 | -4.69 |

The Cheesecake Factory is lower in extended trading.

The experiential dining chain missed Wall Street revenue and profit estimates.

Fiscal third quarter revenue grew 4% to $784.0 million. Analysts were expecting $799.383 million.

The net loss for the three months ended September 27 was $2.4 million compared to a year ago profit of $32.7 million.

The per share loss was 5 cents. Refinitiv's mean analyst estimate was for a profit of 28 cents per share.

Relative to fiscal 2019, third quarter comparable restaurant sales at The Cheesecake Factory restaurants increased 9.5%.

Through October 25th, fourth quarter-to-date comparable sales for The Cheesecake Factory restaurants increased approximately 2.8% year-over-year and 14.0% as compared to the same period in fiscal 2019.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MDLZ | $61.87 | 0.39 | 0.63 |

Mondelez International Inc raised its full-year sales and profit forecasts on Tuesday, betting that consumers would continue to purchase its chocolates and biscuits despite higher prices.

While surging inflation and fears of a recession have dampened consumer spending, shoppers still seem willing to indulge on "affordable luxuries" such as their favorite snacks and beverages instead of switching to cheaper brands.

Mondelez joins companies such as Cheerios maker General Mills Inc and soda giants Coca-Cola Co and PepsiCo Inc in lifting forecasts, as it has seen minimal pushback from consumers to higher prices.

The Oreo maker said it now expects 2022 organic net revenue to increase more than 10%, compared with its prior estimate for a more than 8% jump.

It forecast 2022 adjusted profit to grow over 10%, on a constant-currency basis, compared with its previous expectation for mid-to-high single-digit growth.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMD | $59.56 | -0.49 | -0.82 |

Advanced Micro Devices on Tuesday forecast fourth-quarter revenue below Wall Street estimates, saying a slowing PC market and data center business would weigh on its sales.

Shares of the chip designer fell 3% in trading after the bell.

AMD, which makes CPUs and graphics processors for PCs, was hit hard when inflation roiled consumer demand for laptops and other gadgets, prompting electronics makers to cut orders for its chips.

That led AMD to lower its forecast for third-quarter revenue by about $1 billion last month.

The company expects current-quarter revenue to be $5.5 billion, plus or minus $300 million.

Analysts on average expect revenue to be $5.85 billion, according to Refinitiv data.

Revenue at its client segment, which includes chips for desktops, fell 40% to $1 billion during the third quarter.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ABNB | $109.05 | 2.13 | 2.00 |

Airbnb Inc forecast fourth-quarter revenue below market estimates on Tuesday, saying a strong U.S. dollar had started to pressure its business and that bookings would moderate after a bumper third quarter.

The vacation rental firm expects fourth-quarter revenue between $1.80 billion and $1.88 billion, the midpoint of which missed analysts' expectations of $1.85 billion, according to Refinitiv IBES.

San Francisco-based Airbnb recorded its highest ever third-quarter bookings, with nearly 100 million nights and experiences booked, but it said current-quarter bookings will "slightly moderate" from those levels.

Net profit rose 45.6% to $1.21 billion, or $1.79 per share, while revenue increased 28.9% to $2.88 billion, beating estimates of $2.84 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TCS | $5.10 | -0.33 | -6.08 |

Container Store Group is falling in extended trading.

The specialty retailer of storage and organization products missed revenue estimates but beat on profit.

Consolidated net sales were $272.7 million, down 1.2%. Analysts expected $282.45 million.

Comparable store sales decreased 0.8%.

Fiscal second quarter net income for the three months ended October 1 was $15.7 million, down from $27.2 million a year ago.

Diluted earnings per share came in at 31 cents, beating the estimate of 23 cents.

“With the continued rise of inflationary pressures, coupled with increasing interest rates, we have seen customer traffic soften during the second quarter, and we expect these trends to continue until these external pressures subside. However, we remain committed to our strategic initiatives to support our long term growth and $2 billion revenue goal,” said CEO Satish Malhotra.

U.S. stocks fell across the board led by the tech-heavy Nasdaq Composite as investors await what is expected to be a 75 basis point rate hike by the Federal Reserve, the fourth consecutive increase. In commodities, oil rose over 2% to $88.37 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UBER | $30.48 | 3.90 | 14.70 |

Uber Technologies Inc on Tuesday forecast fourth-quarter operating profit above Wall Street estimates, betting on cost controls and rising demand for its rides as customers resume spending more on travel, sending its shares up 15%.Revenue rose 72% to $8.34 billion and adjusted profit was $516 million, both beating estimates. However, quarterly loss came in at $1.2 billion, hurt by Uber's equity investments.

Monthly active users on Uber's apps rose 14%, exceeding the levels seen in September 2019, helped by airport trips, while revenue from the rideshare segment rose 73% in the third quarter.

Uber, however, is looking to scale back hiring and reduce expenses to expand profitability as Chief Executive Dara Khosrowshahi warned of a potential hit from a strong dollar to its earnings from the overseas.

The company forecast fourth-quarter adjusted EBITDA, a profitability metric keenly watched by investors, between $600 million and $630 million. Analysts were expecting $569.39 million, according to Refinitiv data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| META | $95.59 | 2.43 | 2.61 |

| SNAP | $10.26 | 0.34 | 3.48 |

A desire to ban TikTok is helping lift shares of Meta Platforms and Snap.

Federal Communications Commissioner Brendan Carr told Axios the U.S. should ban the Chinese video-sharing app TikTok to protect the private data of Americans.

Meta Platforms owns Facebook, Instagram and WhatsApp.

Snap owns Snapchat.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| IDXX | $390.19 | 30.51 | 8.48 |

Idexx Laboratories is higher in Tuesday trading. The animal diagnostic and health care company upgraded its 2022 outlook and beat Wall Street expectations.

The company expects full-year revenue growth outlook to 3.5%-4.5% as reported and 6.5%-7.5% organically, compared to its previous guidance of 3%- 5.5% as reported and 5.5%- 8% organically.

Idexx on Tuesday reported third-quarter profit of $180.9 million.

The Westbrook, Maine-based company said it had net income of $2.15 per share.

The results surpassed Wall Street expectations. The average estimate of seven analysts surveyed by Zacks Investment Research was for earnings of $2.04 per share.

The animal diagnostic and health care company posted revenue of $841.7 million in the period, also beating Street forecasts. Six analysts surveyed by Zacks expected $829.2 million.Idexx expects full-year earnings to be $7.74 to $7.98 per share, with revenue in the range of $3.33 billion to $3.37 billion.

The Associated Press contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SEE | $43.35 | -4.27 | -8.97 |

Sealed Air Corp said on Tuesday it would acquire peer Liquibox for $1.15 billion, as the packaging firm aims to boost its presence in the quick service restaurants and liquid packaging segments.

The acquisition comes against the backdrop of a recent consolidation in the packaging sector, as firms focus on recyclable packaging materials.

Liquibox makes sustainable packaging for fresh foods, beverages and consumer goods.

Sealed Air also reported third-quarter earnings of $134.2 million.

On a per-share basis, the Charlotte, North Carolina-based company said it had profit of 92 cents. Earnings, adjusted for one-time gains and costs, came to 98 cents per share.

The results beat Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of 91 cents per share.

The packaging company posted revenue of $1.4 billion in the period, which did not meet Street forecasts. Eight analysts surveyed by Zacks expected $1.47 billion.

The Associated Press and Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ECL | $144.13 | -12.94 | -8.24 |

Ecolab Inc. (ECL) on Tuesday reported third-quarter net income of $347.1 million.

The Saint Paul, Minnesota-based company said it had profit of $1.21 per share. Earnings, adjusted for pretax expenses, came to $1.30 per share.

The results did not meet Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of $1.33 per share.

The cleaning, food-safety and pest-control services company posted revenue of $3.67 billion in the period, which also fell short of Street forecasts. Eight analysts surveyed by Zacks expected $3.68 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MPC | $117.41 | 3.79 | 3.34 |

| PSX | $108.35 | 4.06 | 3.89 |

Marathon Petroleum and Phillips 66 posted quarterly profits which cruised past Wall Street estimates on Tuesday, becoming the latest U.S. refiners to benefit from robust fuel demand and margins amid tight supplies.

U.S. refiners are posting strong profits with refineries running at record levels this year, strong export demand amid a squeezed supply due to Russia's invasion of Ukraine and plant closings.

Top bosses of both refiners said market environment continues to be favorable and product demand remains strong.On an adjusted basis, Marathon reported a profit of $7.81 per share, beating average analysts' estimate of $7.07 per share, according to Refinitiv data.

Phillips 66's adjusted profit of $6.46 per share smashed estimates of $5.04.Amid the bumper results, Marathon also increased its dividend by 30% to 75 cents per share on Tuesday.

The world must act swiftly to invest in oil to prevent future energy emergencies as global demand for the hydrocarbon grows in the long term, OPEC Secretary General Haitham Al Ghais said on Tuesday.

"If we don't get it right this time we are sowing the seeds for future energy crises — not just one, but multiple," he told Reuters in an interview.

He was speaking a day after the organization released its 2022 World Oil Outlook which estimated that $12.1 trillion were needed in investments to meet rising oil demand in the long term.

Of the total, $9.5 trillion would be for exploration and production, or upstream, investments, he said.

The OPEC forecast, which saw demand for oil plateau by 2035, put demand at 109.8 million barrels per day by 2045.

Oil prices rose on Tuesday, recouping losses from the previous session, as a weaker U.S. dollar offset widening COVID-19 curbs in China that have stoked fears of slowing fuel demand in the world's second-largest oil consumer.

U.S. West Texas Intermediate (WTI) crude rose $1.63, or 1.88%, to $88.16 at 1429 GMT after falling 1.6% in the previous session.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BP | $33.36 | 0.08 | 0.24 |

| SHEL | $56.40 | 0.77 | 1.38 |

| XOM | $111.30 | 0.49 | 0.44 |

BP more than doubled its third-quarter profit from a year earlier to $8.15 billion and expanded its share buybacks by $2.5 billion, joining rivals in reporting bumper profits that have sparked renewed calls for energy companies to pay more taxes.

Shares traded flat.

Sales and other operating revenue came in at $55 billion, lower than last year’s total of $67.9 billion, reflecting lower sales in gas and low carbon and also the customers and products division.

“BP continues to enjoy exceptional cash flows, helped in no small part from high prices in fossil fuels. It notes supply cuts by OPEC+, together with ongoing uncertainty about Russian oil exports as factors that are keeping prices elevated.

However, we are seeing some signs that these prices are starting to dent consumption by end users. BP is deploying its cashflows wisely by investing in strategic initiatives such as Cypre, BP’s third subsea gas development in Trinidad and Tobago,” wrote Derren Nathan, Head of Equity Research at Hargreaves Lansdown.

London-based BP joins rivals including Shell, Exxon Mobil and TotalEnergies which also reported bumper profits last week that also saw the sector pay out a record $29 billion to shareholders.

President Joe Biden on Monday called on major oil companies who are bringing in big profits to stop "war profiteering", threatening to hit them with higher taxes if they don't increase production.

BP, which increased its dividend by 10% in the quarter, will buy back $2.5 billion of shares after repurchasing $7.6 billion so far this year. BP has committed to using 60% of its excess cashflow for shareholder returns.

Reuters contributed to this report.

BIDEN SLAMS OIL COMPANY PROFITS, THREATENS WINDFALL TAXES AS PENALTY

Retirees are considering some important "wants" when looking for a place to spend their golden years.

Job seekers continue to have the upper hand amid a tight employment market.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| OCDDY | $14.85 | 3.85 | 35.00 |

| KR | $47.47 | 0.18 | 0.38 |

Ocado, the British online supermarket and technology group, has entered South Korea, one of the most mature e-commerce markets in the world, through a partnership deal with Lotte Shopping, the companies said Tuesday.

Lotte becomes Ocado's 12th partner across 10 countries.

Six CFCs are planned by 2028, with the first scheduled to go live in 2025. Ocado's in-store fulfillment technology will also be rolled out across Lotte stores from 2024.

“This is welcome news for a group that’s been struggling to drum up tangible deals for the Solutions businesses,” said Matt Britzman, equity analyst at Hargreaves Lansdown.

Ocado Group announced an exclusive US partnership with Kroger — America's largest grocery retailer — in May 2018, and an initial commitment to build capacity equivalent to 20 CFCs across the US.

In 2020, the partnership was extended to also include Ocado Group's in-store fulfilment solution (ISF), which was scheduled to be rolled out across Kroger stores from 2021 to support curbside pickup.

Reuters contributed to this report.

U.S. stocks kicked off the new month on a positive note as investors celebrated solid earnings from both Pfizer and Uber while also looking ahead to a possible rate hike by the Federal Reserve on Wednesday. In commodities, oil rose over 2% to the $88 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PFE | $46.55 | -0.88 | -1.86 |

| UBER | $26.57 | -0.93 | -3.38 |

Johnson & Johnson said on Tuesday it will acquire Abiomed Inc in a deal valued at $16.6 billion to boost the health care conglomerate's cardiovascular devices business.

The upfront payment of $380 per share represents a 50.7% premium to Abiomed's last closing price. Shares of Abiomed surged 48% in premarket trade.

Abiomed shareholders will also get a non-tradeable contingent value right entitling the holder to receive up to $35 per share in cash if certain commercial and clinical milestones are achieved.

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin were all higher early Tuesday.

At approximately 4:45 a.m. ET, Bitcoin was trading at nearly $20,600 (+0.44%), or higher by $91.

For the week, Bitcoin was trading higher by more than 6%. For the month, the cryptocurrency was higher by nearly 5.35%.

Ethereum was trading at approximately $1,587.9 (+0.80%), or higher by more than $11.80.

For the week, Ethereum was trading higher by more than 17.25%. For the month, it was trading higher by approximately 18.5%.

Dogecoin was trading at $0.14535 (+13.83%), or higher by approximately $0.01765.

For the week, Dogecoin was higher by more than 115.08%. For the month, was also higher by more than 106%.

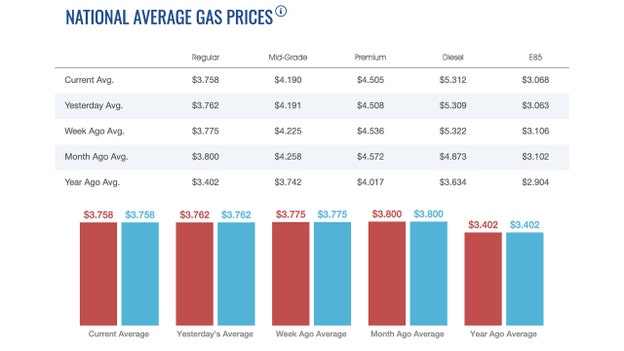

The nationwide price for a gallon of gasoline fell early Tuesday, one day after a temporary uptick.

The average price of a gallon of gasoline on Tuesday was $3.858. On Monday, the price was $3.762, up a penny from Friday, according to AAA.

One week ago, a gallon of gasoline cost $3.775 A month ago, that same gallon of gasoline cost $3.80. A year ago, a gallon of gasoline cost $3.402.

Gas hit an all-time high of $5.016 on June 14, nearly 20 weeks ago.

Diesel's reversed course early Tuesday and rose slightly nationwide.

The price of a gallon of diesel Tuesday was $5.312. On Monday, the price was $5.309. Over the weekend, the price of a gallon was $5.314, AAA, reported.

One week ago, a gallon of diesel cost $5.322. A month ago, a gallon of diesel cost $4.873. A year ago, a gallon of diesel cost $3.634.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,732.95 | -,128.85 | -0.39 |

| SP500 | $3,871.98 | -29.08 | -0.75 |

| I:COMP | $10,988.15 | -,114.31 | -1.03 |

U.S. stocks edged higher early Tuesday morning as investors awaited word from the Federal Reserve on possible interest rate hikes by as much as 75 percentage points.

The widespread expectation is for it to push through another increase that’s triple the usual size at 0.75 percentage points.

Wall Street is roughly split on whether it will do the same in December or shift to a smaller increase, according to CME Group.

The benchmark S&P 500 index closed down 0.7% at 3,871.98. That gave it an 8% gain for October, but the index still is down 18.8% from its Jan. 3 peak. The Dow Jones Industrial Average lost 0.4% to 32,732.95. It ended the month up 14%.

A market pullback in August and September, plus better quarterly earnings than expected at many companies, helped put investors in a buying mood. That was helped by optimism that the Federal Reserve might be ready to ease up on the aggressive pace of interest rate hikes as it tries to squash inflation.

Stocks gained ground throughout October as investors shifted focus to the latest round of corporate earnings. More than half of the companies within the S&P 500 have reported results and shown overall earnings growth of 2.3%, according to FactSet.

Companies have so far given investors a mixed bag of results and forecasts as Wall Street tries to get a better picture of the economy. Inflation is stubbornly hot. The Fed has been trying to rein that in by raising interest rates to slow economic activity. Investors worry that might send the economy into a recession.

Meanwhile, Hong Kong stocks jumped more than 5% and other Asian markets also rose and a survey showed Chinese manufacturing improved. The Hang Seng index in Hong Kong surged 5.1% to 15,441.77 and the Shanghai Composite Index gained 2% to 2,940.75.

The Nikkei 225 in Tokyo added 0.3% to 27,678.92. The Kospi in Seoul jumped 1.8% to 2,335.22 and Sydney's S&P-ASX 200 gained 1.6% to 6,976.90. India's Sensex opened up 0.6% at 61.124.72. New Zealand declined while Southeast Asian markets advanced.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $71.53 | -1.29 | -1.77 |

| CVX | $180.90 | 0.92 | 0.51 |

| XOM | $110.81 | 0.11 | 0.10 |

Oil prices rose more than 1% on Tuesday, paring losses from the previous session, as a weaker U.S. dollar offset widening COVID-19 curbs in China that have stoked fears of slowing fuel demand in the world's second-largest oil consumer.

Brent crude for January delivery rose $1.53, or 1.7%, to $94.34 per barrel at 0718 GMT. The December contract expired on Monday at $94.83 a barrel, down 1%.

U.S. West Texas Intermediate (WTI) crude rose $1.38, or 1.6%, to $87.91 a barrel, after falling 1.6% in the previous session.

The Brent and WTI benchmarks both ended October higher, posting their first monthly gains since May, after the Organization of the Petroleum Exporting Countries and allies including Russia said they would cut output by 2 million barrels per day (bpd).

"Oil prices cut early losses as the U.S. dollar weakened, with the major global equity markets rising in today’s Asian session ahead of the U.S. Federal Reserve's rate decision later this week," CMC Markets analyst Tina Teng said.

The greenback sank on Tuesday from a one-week high against a basket of major peers, as traders weighed the odds of a less aggressive Federal Reserve at Wednesday's monetary policy meeting.

A weaker dollar makes oil cheaper for holders of other currencies and usually reflects greater investor appetite for risk.

"OPEC+’s upcoming oil output cuts and the U.S.’s record oil export data also support oil prices fundamentally," Teng said.

OPEC raised its forecasts for world oil demand in the medium-and longer-term on Monday, saying that $12.1 trillion of investment is needed to meet this demand despite the transition to renewable energy sources.

COVID-19 curbs in China forced the temporary closure of Disney's Shanghai resort on Monday and have spurred worries of lower fuel demand in the world's top crude oil importer as it persists with its zero-COVID policy.

Strict pandemic restrictions have caused China's factory activity to fall in October and cut into its imports from Japan and South Korea.

Keeping a check on oil prices, though, U.S. oil output climbed to nearly 12 million bpd in August, the highest since the start of the COVID-19 pandemic, even as shale companies said they do not expect production to accelerate in coming months. T

hat is likely to lead to a rise in U.S. crude oil stocks in the week to Oct. 28 of about 300,000 barrels, a preliminary Reuters poll showed, while distillate and gasoline inventories were expected to fall. The poll was conducted ahead of reports from the American Petroleum Institute due at 4:30 p.m. EDT (2030 GMT) on Tuesday, and the Energy Information Administration due at 10:30 a.m. (1430 GMT) on Wednesday.

Live Coverage begins here