STOCK MARKET NEWS: Best Buy shares jump, FTX in bankruptcy court, US rail strike looms

Investors prepare for slew of economic reports, FTX makes first appearance in bankruptcy court, Disney's shakeup continues. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

The first day hearing for FTX is underway in the U.S. Bankruptcy Court in Wilmington, Del. Lawyers for the failed crypto exchange say they are working “day and night to bring order to disorder.”

James Bromley, a lawyer from Sullivan & Cromwell representing FTX said: “Unfortunately, the FTX debtors were not well run and that is an understatement.”

He noted management is now conducting a “serious investigation by serious adults” that includes constant communications with the Justice Department, Securities and Exchange Commission, Commodities Futures Trading Commission and state and foreign regulators.

He outlined management’s five core objectives:

Implement of controls. The firm is now run by an independent board with standard financial controls.

Asset protection and recovery. Bromley acknowledge that a “substantial amount” of assets have either been stolen or missing and that hacks against the company continue.

Transparency and investigation. FTX is working with federal, state and foreign regulators to coordinate efforts.

Efficiency and coordination. Joint provisional regulators in the Bahamas have agreed to move their Chapter 15 case to Delaware.

Maximization of value. FTX will likely file motions soon to sell parts of its business that are robust and self-sufficient.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBY | $76.98 | 6.16 | 8.69 |

Best Buy Co Inc on Tuesday forecast a smaller drop in annual sales than it had previously estimated, saying it was confident that a ramp up in deals and discounts will bring in more inflation-weary customers during the holiday season.

The retailer's shares rose 8% to $76.60 in premarket trading, after it also said it had resumed its share buyback program and would spend about $1 billion for repurchases this year.

Surging prices have driven down demand for non-essential products this year, forcing Best Buy and other retailers to opt for discounts and promotions to clear excess stock of products such as televisions, laptops and other electronics.

Best Buy expects full-year comparable sales to fall about 10%, compared with a previous forecast of a decrease of about 11%.On an adjusted basis, the company earned $1.38 per share in the third quarter, beating analysts' estimates of $1.03 per share, according to IBES data from Refinitiv.

Florida’s Miami-Dade County wants to remove FTX’s name off its arena. The county filed a motion with the bankruptcy court to end its 19-year, $135 million naming rights agreement with the failed cryptocurrency exchange.

“Given the recent collapse of FTX.US and the ensuing regulatory, civil and criminal investigations, it has come to light that the debtors have breached their obligations under the naming rights agreement (NRA) to comply with the laws governing their financial exchange platforms,” a court document said.

“These breaches appear to have been repeated, recurring and incurable. Therefore, there are material defaults that leave the county with no choice but to seek authority from this court to terminate the Naming Rights Agreement effective immediately,” the filing continued.

FTX.US and Miami-Dade county entered into a NRA in April 2021. FTX Arena is home of the Miami Heat basketball team.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DWAC | $22.52 | 1.01 | 4.72 |

Investors in the blank-check acquisition company that plans to merger with former U.S. President Donald Trump's social media firm on Tuesday voted to approve a one year extension.

This marks a victory for Digital World Acquisition Corp and its chief executive Patrick Orlando who has spent months trying to rally enough shareholder support for an extension to complete the deal.

Nordstrom Inc trimmed its annual profit forecast on Tuesday, signaling that steep discounts on outdated inventory, coupled with higher operating costs and supply chain pressures, are squeezing the company's profit margins.

Profit margins of global fashion retailers have been hurt by rising raw material and labor costs coupled with supply chain disruptions, that have been further aggravated by the ongoing conflict in Ukraine.

The company expects fiscal 2022 profit between $2.13 and $2.43 per share, compared to a prior forecast of $2.45 to $2.75.

Nordstrom reported a net loss of $20 million, or 13 cents per share for the quarter ended Oct. 29, compared to a profit of $64 million, or 39 cents per share, a year earlier.

The company's total revenues fell to $3.55 billion in the third quarter, from $3.64 billion a year earlier, but beat analysts' expectations of $3.47 billion, according to Refinitiv data.

However, the company reaffirmed its annual revenue and adjusted profit forecast.

| Symbol | Price | Change | %Change |

|---|---|---|---|

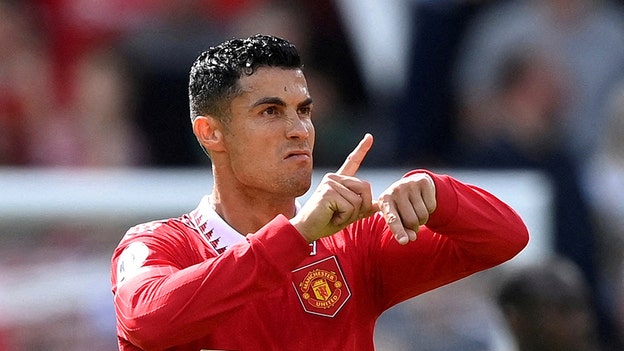

| MANU | $14.94 | 1.91 | 14.66 |

Manchester United is commencing a process to explore strategic alternatives for the club.

The process is designed to enhance the club's future growth, with the ultimate goal of positioning the club to capitalize on opportunities both on the pitch and commercially.

As part of this process, the board will consider all strategic alternatives, including new investment into the club, a sale, or other transactions involving the company.

Earlier, the club said forward Cristiano Ronaldo will leave with immediate effect.

An explosive interview with TalkTV this month — in which Ronaldo also said he did not respect manager Erik ten Hag — had put him on shaky ground at the club he rejoined in August 2021 after winning eight major trophies with them from 2003-2009.

Shares are up 1.77% year to date.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HPQ | $29.38 | 0.22 | 0.75 |

HP is trimming its workforce. The information technology company expects to reduce gross global headcount by approximately 4,000-6,000 employees. These actions are expected to be completed by the end of fiscal 2025.

Fiscal fourth quarter revenue fell to $14.8 billon; the expectation was $14.73 billion.

Non-GAAP net earnings was 85 cents, topping the estimate of 84 cents.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ADSK | $208.90 | 2.40 | 1.16 |

Autodesk is lower in extended trading. The software maker lowered its full year guidance.

• The company now sees billing growth up 16%-18%, compared to the previous forecast of $18%-21%.

• Revenue is expected to grow 14% compared to 14%-15%.

• Non-GAAP earning per share is forecast at $6.56-$6.62, down from $6.52-$6.71.

Fiscal third quarter total revenue rose 14% to $1.280 billion compared to the estimate of $1.281 billion.

Non-GAAP diluted earnings per share for the three months ended October 31 was $1.70, matching the estimate.

Total billings increased 16 percent to $1.360 billion.

Subscription plan revenue was $1.188 billion, an increase of 14% as reported, and 15% on a constant currency basis. On a sequential basis, subscription plan revenue increased 2% as reported and on a constant currency basis.

U.S. stocks turned in a broad rally rising 1% across the board ahead of a heavy docket of economic data due Wednesday including new home sales, durable goods and consumer sentiment. Also helping equities, Best Buy’s quarterly results which sent the stock 12.8% higher, its best percentage gain since May 2020. In commodities, oil rose over 1% to $80.95 per barrel.

President Joe Biden is extending the moratorium on student loan payments to no later than June 30, 2023.

The pause will give the Supreme Court time to consider his plan to forgive up to $20,000 in student loan debt per borrower.

U.S. District Judge Mark Pittman blocked the move earlier this month, calling the program an "unconstitutional exercise of Congress’s legislative power and must be vacated."

The administration is appealing.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WMG | $30.72 | 3.74 | 13.86 |

Warner Music Group is higher in Tuesday trading. The entertainment and record label conglomerate topped Wall Street revenue and profit estimates.

Fourth quarter revenue rose 9% to $1.5 billion, which is higher than the estimate of $1.41 billion.

Adjusted net income was $170 million compared to $69 million for the three months ended September 30.

The company reported profits of 28 cents per share, 23 cents higher than the same quarter last year when the company reported EPS of 5 cents. Profits of 13 cents per share were anticipated by the thirteen analysts providing estimates for the quarter.

“The momentum in our business is strong, underpinned by global subscriber growth, subscription price increases, and the expansion of emerging platforms,” said CFO Eric Levin.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JACK | $70.84 | -14.11 | -16.61 |

Jack In The Box Inc. on Tuesday reported fiscal fourth-quarter net income of $45.9 million.

On a per-share basis, the San Diego-based company said it had profit of $2.17. Earnings, adjusted for non-recurring gains, came to $1.33 per share.

The results missed Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of $1.35 per share.

The burger chain posted revenue of $402.8 million in the period, exceeding Street forecasts. Nine analysts surveyed by Zacks expected $392.4 million.

For the year, the company reported profit of $115.8 million, or $5.45 per share. Revenue was reported as $1.47 billion.

ack In The Box expects full-year earnings in the range of $5.25 to $5.65 per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CP | $80.58 | 1.42 | 1.79 |

| CNI | $125.89 | 1.72 | 1.38 |

| CSX | $31.94 | 0.65 | 2.08 |

| NSC | $250.36 | 1.10 | 0.44 |

| UNP | $213.17 | 0.90 | 0.42 |

America’s railroads say they are "ready, willing and able" to work towards new contract agreements after a fourth U.S. railroad union rejected a tentative dealt brokered by the Biden administration.

All 12 unions involved in negotiations must ratify their new agreements to avert a potential work stoppage, which would decimate already fragile supply chains in the middle of the Christmas shopping rush. While eight have already agreed to the deal negotiated by the Presidential Emergency Board (PEB) appointed by President Biden, a strike could happen as early as Dec. 9.

Sam Bankman-Fried's FTX, his parents and senior executives of the failed cryptocurrency exchange bought at least 19 properties worth nearly $121 million in the Bahamas over the past two years, official property records show.

Separately, attorneys for FTX said on Tuesday that one of the company's units spent $300 million in the Bahamas buying homes and vacation properties for its senior staff, and that FTX was run as a "personal fiefdom" of Bankman-Fried. No further details were given.

Most of FTX's purchases registered in the documents seen by Reuters were luxury beachfront homes, including seven condominiums in an expensive resort community called Albany, costing almost $72 million. The deeds show these properties, bought by a unit of FTX, were to be used as "residence for key personnel" of the company. Reuters could not determine who lived in the apartments.

Investor home purchases fell 30.2% year over year nationwide in the third quarter, said real estate brokerage Redfin.

The decline was the largest since the Great Recession aside from the second quarter of 2020, when investor activity plummeted due to the onset of the pandemic.

Overall home purchases nationwide were down 27.4%.

Investor purchases slumped 26.1% on a quarter-over-quarter basis, the largest quarterly decline on record with the exception of the start of the pandemic. That compares with a 17.4% quarterly drop in overall home purchases.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LYV | $67.64 | 0.70 | 1.05 |

A U.S. Senate antitrust panel will hold a hearing on the lack of competition in the ticketing industry after Ticketmaster's problems last week managing the sale of Taylor Swift tickets, Senator Amy Klobuchar, chair of the panel, said on Tuesday.

"The high fees, site disruptions and cancellations that customers experienced shows how Ticketmaster’s dominant market position means the company does not face any pressure to continually innovate and improve," Klobuchar said. "That’s why we will hold a hearing on how consolidation in the live entertainment and ticketing industry harms customers and artists alike."

Senators Klobuchar and Mike Lee, the top Republican on the committee, did not provide a date for the hearing or a list of witnesses.

Ticketmaster did not immediately respond to a request for comment, but has previously blamed presale problems for Swift's Eras tour, her first tour in five years, on unprecedented demand and an effort to keep out bots run by ticket scalpers.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MDT | $77.13 | -5.16 | -6.27 |

Medtronic Plc on Tuesday lowered its full-year outlook for profit and revenue growth, blaming a stronger dollar and a slower-than-anticipated recovery in supply chain disruptions, sending the medical device maker's shares down nearly 6%.Medtronic lowered its fiscal 2023 adjusted profit forecast range to between $5.25 and $5.30 per share, from $5.53 to $5.65, as it continues to implement expense reductions under an ongoing restructuring plan.

The company expects a 36 cent currency-related headwind to its bottom line for the fiscal year 2024, finance chief Karen Parkhill said.

Medtronic cut its revenue growth expectations for fiscal 2023 to 3.5% to 4%, from 4% to 5%. The company said cost-cutting measures will likely offset lower revenue and inflationary pressures in the second half of the year.

Total revenue for the second quarter ended Oct. 28 came in below analysts' expectations at $7.59 billion, which was also hurt by a sluggish recovery in non-urgent procedures.

However, Medtronic posted an adjusted profit above estimates at $1.30 per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DKS | $115.73 | 8.79 | 8.22 |

Dick's Sporting Goods Inc. (DKS) on Tuesday reported fiscal third-quarter profit of $228.5 million.

On a per-share basis, the Coraopolis, Pennsylvania-based company said it had net income of $2.45.

The results exceeded Wall Street expectations. The average estimate of 10 analysts surveyed by Zacks Investment Research was for earnings of $2.24 per share.

The sporting goods retailer posted revenue of $2.96 billion in the period, also surpassing Street forecasts. Seven analysts surveyed by Zacks expected $2.7 billion.

Dick's expects full-year earnings in the range of $11.50 to $12.10 per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BURL | $186.97 | 29.33 | 18.61 |

Burlington Stores in higher in Thursday trading. The off-price retailer adjusted its full year forecasts.

Full year comparable store sales are expected to decrease in the range of down 15% to down 14% (versus down 15% to down 13%), on top of the 15% increase during Fiscal 2021; this translates to a 3-year geometric comparable store sales stack of down 2% to down 1% (compared to down 3% to down 1%) versus fiscal 2019.

Adjusted earnings per share are seen to be in the range of $3.77 to $4.07 ($3.70 to $4.30 previously forecast), as compared to $6.00 on a GAAP basis and $8.41 on a non-GAAP basis last year.

The Burlington, New Jersey-based company reported fiscal third-quarter earnings of $16.8 million.

It had profit of 26 cents per share. Earnings, adjusted for one-time gains and costs, were 43 cents per share.

The results did not meet Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of 52 cents per share.

The discount retailer posted revenue of $2.04 billion in the period, which also missed Street forecasts. Six analysts surveyed by Zacks expected $2.05 billion.

The Associated Press contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ZM | $74.76 | -5.50 | -6.85 |

Shares of Zoom Video Communications Inc have tumbled about 90% from their pandemic peak in October 2020 as the former investor darling struggles to adjust to a post-COVID world.

The stock was down Tuesday after the company cut its annual sales forecast and posted its slowest quarterly growth, prompting at least six brokerages to cut their price targets.

"Zoom has a fundamental flaw — it has needed to spend heavily to keep hold of market share. Spending to cling onto, rather than grow, market share is never a good place to be and was a sign of trouble ahead," Hargreaves Lansdown equity analyst Sophie Lund-Yates said.

The company's operating expenses surged 56% in the third quarter as it spent more on product development and marketing. Its adjusted operating margin shrank to 34.6% from 39.1% a year earlier.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ANF | $21.98 | 3.35 | 18.01 |

Abercrombie & Fitch Co on Tuesday posted a surprise third-quarter profit and forecast a smaller-than-expected drop in current-quarter sales as it remains "cautiously optimistic" for the holiday season.

The Ohio-based retailer's shares were up about 14% in premarket trading after the company also reported better-than-expected third-quarter sales even as inflation dampened discretionary consumer spending.

The company's attempt to revamp its inventory to get rid of casual and athleisure apparel that have fallen out of fashion and bring in new styles have helped its Abercrombie label post a 10% jump in third-quarter sales.

Abercrombie and Gap Inc's Banana Republic have performed well as wealthier shoppers opt for dressier clothing over casuals for post-pandemic outings even as soaring prices encourage consumers on lower incomes to rein in spending.

Abercrombie expects fourth-quarter net sales to fall about 2% to 4% in fiscal 2022, compared with analysts' average estimate of a 6.3% drop, according to Refinitiv IBES data.

Excluding items, Abercrombie reported a profit of 1 cent per share in the third quarter, compared with estimates of a loss of 16 cents.

The company's net sales fell 2.8% to $880.1 million, but beat estimates of $831.1 million.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DLTR | $149.85 | -15.39 | -9.31 |

Dollar Tree Inc said its full-year profit would be at the lower end of its forecast, with the discount store retailer's margins under pressure from decades-high inflation.

Dollar Tree has been hit by slowing demand for everything from toys and party supplies to homeware, which are typically more profitable than food and other perishables.

Industry bellwethers Walmart Inc and Target Corp issued gloomy holiday sales forecasts last week, with Target pointing to a sharp fall in demand for discretionary goods.

Dollar Tree is also grappling with higher freight costs and price cuts at its Family Dollar banner that were rolled out in the second quarter.

Dollar Tree now expects annual profit at the lower half of its previously estimated range of $7.10 per share to $7.40 per share.

The company raised its forecast for fiscal 2022 net sales to between $28.14 billion and $28.28 billion, compared with its previous outlook of $27.85 billion to $28.10 billion.

Dollar Tree's total same-store sales rose 6.5% in the third quarter, beating estimates of a 4.7% jump, according to Refinitiv IBES data.

The company reported a quarterly profit of $1.20 per share, beating estimates of $1.18.

Lawyers involved in the unwinding of FTX will be in court today for the first of a series of hearings on how to work through the bankruptcy. Estimates range in the billions for what be recoverable according to reports.

U.S. stocks rallied in early trading as investors took in positive results from Best Buy which reported better-than-expected profits, revenue and comp-store sales. Additionally, a slew of economic reports, including durable goods and minutes from the Federal Reserve's October meeting will be frontloaded to Wednesday for the Thanksgiving holiday. In commodities, oil rose over 1% to the $81 per barrel level.

A U.S. rail strike could threaten the already fragile economy costing billions per day.

Cryptocurrency prices edged lower early Tuesday with Bitcoin, Ethereum and Dogecoin all showing losses.

At approximately 5 a.m. ET, Bitcoin was trading at nearly $15,677 (-0.65%), or lower by $103.

For the week, Bitcoin was trading lower by 5.17%. For the month, the cryptocurrency was lower by nearly 17.7%.

Ethereum was trading at approximately $1,083 (-2.2%), or lower by more than $24.4.For the week, Ethereum was trading lower by nearly 10.85%.

For the month, it was trading lower by approximately 14.75%.

Dogecoin was trading at $0.073288 (-1.75%), or lower by approximately $0.001307.

For the week, Dogecoin was lower by more than 13.1%. For the month, the crypto was higher by more than 25.5.%.

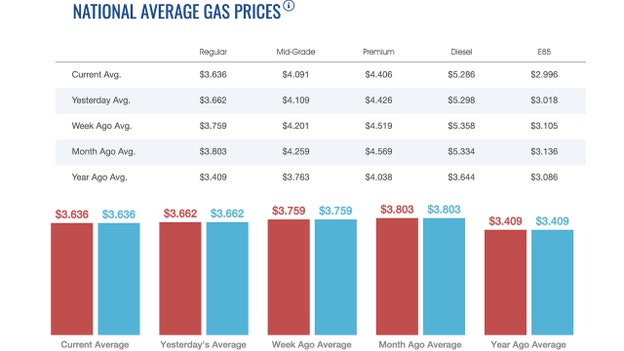

The nationwide price for a gallon of gasoline slipped Tuesday to $3.636. On Monday, a gallon of gasoline cost $3.662, while on Sunday it sold for $3.671, according to AAA.

One week ago, a gallon of gasoline cost $3.759. A month ago, that same gallon of gasoline cost $3.803. A year ago, a gallon of gasoline cost $3.409.

Gasoline hit an all-time high of $5.016 nationwide on June 14, nearly 24 weeks ago.

Diesel prices declined on Tuesday morning to $5.286 per gallon, after falling to $5.298 on Monday. On Sunday, a gallon of diesel cost $5.307.

One week ago, a gallon of diesel cost $5.358 A month ago, that same gallon of diesel cost $5.334. A year ago, a gallon of diesel cost $3.644.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $69.03 | 0.00 | 0.00 |

| CVX | $181.24 | -1.75 | -0.96 |

| XOM | $110.97 | -1.11 | -0.99 |

Oil rose on Tuesday after top exporter Saudi Arabia said OPEC+ was sticking with output cuts and could take further steps to balance the market, outweighing global recession worries and concern about China's rising COVID-19 case numbers.

Saudi Arabian Energy Minister Prince Abdulaziz bin Salman on Monday was also quoted by state news agency SPA as denying a Wall Street Journal report that said OPEC was considering boosting output and sent prices plunging by more than 5%.

Brent crude rose 37 cents, or 0.4%, to $87.82 by 0915 GMT. U.S. West Texas Intermediate (WTI) crude was up 46 cents, or 0.6%, at $80.50.

"Crude oil prices are trying to recover their losses," said Avatrade analyst Naeem Aslam. "That Saudi Arabia has denied there was any discussion about an increase in oil supply with OPEC and its allies has supported the market today."

The United Arab Emirates, Another big OPEC producer, denied it was holding talks on changing the latest OPEC+ agreement, while Kuwait said there were no talks on an output hike.

OPEC, Russia and other allies, known as OPEC+, meet on Dec. 4, a day before the start of European and G7 measures in retaliation for Russia's invasion of Ukraine, which could support the market.

On Dec. 5. a European Union ban on Russian crude imports is set to start, as is a G7 plan that will allow shipping services providers to help to export Russian oil, but only at enforced low prices.

Live Coverage begins here