STOCK MARKET NEWS: Dow, S&P pace stock rally, bond yields ease, tech earnings on tap

Apple and Meta set up a for a huge week of tech earnings as investors also digest fresh concerns about a deepening U.S. recession. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UHAL | $545.04 | 10.69 | 2.00 |

AMERCO, the parent of U-Haul International, Oxford Life Insurance Company, Repwest Insurance Company and Amerco Real Estate Company is changing its name and declaring a 9-for-1 stock dividend of shares of a newly-created series of non-voting common stock, the company said.

AMERCO will become U-Haul Holding Company by year end to help alleviate any perceived disconnect by institutional or retail investors alike.

“Long-term stockholders have encouraged the Company to change its name to attract new stockholders who may be unaware that AMERCO is the parent company of one of the most recognized brands in North America,” the company said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAN | $8.10 | -0.61 | -7.00 |

The Aaron’s Company is surging in after hours trading. The lease-to-own company topped Wall Street revenue and profit estimates.

Third quarter revenues rose 31% to $593.38 million. Wall Street was looking for $561.89 million.

The net loss was $15.62 million compared to a year ago net profit of $24.35 million.

Non-GAAP earnings per share was 31 cents, better than the estimate of 12 cents.

E-commerce revenue grew year-over-year by 11.1% at the Aaron's Business and by 18.0% at BrandsMart.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DFS | $96.48 | 1.80 | 1.90 |

Discover Financial Services is lower in extended trading. The digital banking and payment services company topped Wall Street revenue expectations but missed on profit.

Total third quarter revenue net of interest expense rose 25% to $3.48 billion. The analyst estimate was $3.37 billion.

Net income was $1 billion, down from $1.09 billion.

Diluted earnings per share was $3.54, lower than the estimate of $3.78.

Digital Banking pretax income of $1.3 billion for the quarter was $251 million lower than the prior year period reflecting a higher provision for credit losses and higher operating expenses, partially offset by increased revenue net of interest expense.

The total net charge-off rate of 1.71% was 25 basis points higher versus the prior year period reflecting credit normalization across the portfolio.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BYND | $12.06 | -0.57 | -4.51 |

Beyond Meat is adding steak. Seared steak tips will be available at Kroger and Walmart stores nationwide, as well as at select Albertsons and Ahold divisions and other retailers across the country.

A new product may help lift shares, which are down 81% year to date.

Beyond Steak is packed with 21 grams of protein per serving and offers nutritional benefits, including being low in saturated fat and having 0 mg of cholesterol with no added antibiotics or hormones.

Earlier this month, the meat substitute company announced it would reduce its current workforce by approximately 200 employees, representing approximately 19% of the company's total global workforce.

At the time, Beyond Meat also said it expects to report third quarter 2022 net revenues of approximately $82 million, a decrease of approximately 23% versus the prior-year period.

Full year 2022 net revenues are expected to be in the range of approximately $400 million to $425 million, representing a decrease of approximately 14% to 9% compared to the full year 2021.

Beyond Meat reports earnings on November 9 after the market close.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAPL | $149.51 | 2.24 | 1.52 |

Subscribing to Apple Music, AppleTV+ and Apple One will cost more.

Apple Music will now cost $10.99 per month, or $109 per year, for its individual plan and $16.99 for its family plan.

AppleTV+ will cost $6.99 per month, or $69 per year, up from $4.99 per month and $49.99 per year.

Apple One bundle for individuals will increase to $16.95 per month, while the family bundle will increase to $22.95 per month. The premier bundle will increase to $32.95 per month.

The Dow Jones Industrial Average and the S&P 500 rose over 1% apiece, while the Nasdaq Composite trailed but still capped off a winning session for stocks ahead of a busy week for tech-earnings and economic data points including the first read on 3Q GDP amid rising recession worries . In commodities, oil fell 0.5% to $84.58 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AA | $39.13 | -1.93 | -4.70 |

| DAL | $33.38 | 0.81 | 2.47 |

| JBLU | $7.50 | 0.34 | 4.82 |

| LUV | $33.78 | 0.68 | 2.05 |

| UAL | $41.95 | 1.50 | 3.72 |

A trade group representing airlines says a traveler service dashboard would raise the cost of travel for everyone and goes beyond the scope and intent of its original purpose.

The Department of Transportation launched the dashboard last month to help travelers understand what guarantees, refunds or compensation U.S. airlines when flights are canceled or delayed.

Airlines for America says the dashboard “threatens to cause unnecessary, additional confusion for the traveling public regarding the range of reasons and causes for delays, which include weather and air traffic control staffing.”

Professional economic forecasters see a 50-50 chance of an economic ‘soft landing’, according to the latest survey by the National Association for Business Economics.

“NABE Outlook Survey panelists forecast slower growth and higher inflation in both 2022 and 2023 than they previously expected,” said NABE President David Altig, executive vice president and director of research, Federal Reserve Bank of Atlanta. “In addition, panelists have raised their expectations for how high interest rates will rise.”

Treasury Secretary Janet Yellen says the Biden administration is taking a broad range of complementary actions to combat rising prices. The actions range from de-congesting our ports to bringing down the costs of prescription drugs.

“Let me be very clear: inflation in the United States remains far too high. Our Administration’s top economic priority is to rein it in,” Yellen said.

The Treasury Secretary further noted: “it’s important to recognize that we now face serious global headwinds and challenges with elevated inflation.”

Yellen spoke at the Securities Industry and Financial Markets Association's (SIFMA) annual meeting in New York.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $203.34 | -11.10 | -5.18 |

Tesla has cut starter prices for its Model 3 and Model Y cars by as much as 9% in China, reversing a trend of increases across the industry amid signs of softening demand in the world's largest auto market.

The price cuts, posted in listings on the electric vehicle (EV) giant's China website on Monday, are the first by Tesla in China in 2022, and come after Tesla began offering limited incentives to buyers who opted for its insurance last month.

The price cuts also follows Tesla Chief Executive Elon Musk's comment last week that "a recession of sorts" was under way in China and Europe, and Tesla said it would miss its vehicle delivery target this year.

Musk told analysts last week that demand was strong in the current quarter and that he expected Tesla to be "recession-resilient".

China Merchants Bank International (CMBI) said Tesla's price cuts underlined the growing competitive risk for EV makers in China, with industry-wide sales projected to slow into 2023.

Tesla is now China's third best-selling EV maker after BYD Motor and SAIC-GM-Wuling, and is the only foreign player in the top 15 list published by the China Passenger Car Association.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SBUX | $83.37 | -5.24 | -5.91 |

| LVS | $33.91 | -5.17 | -13.22 |

| WYNN | $55.43 | -3.37 | -5.73 |

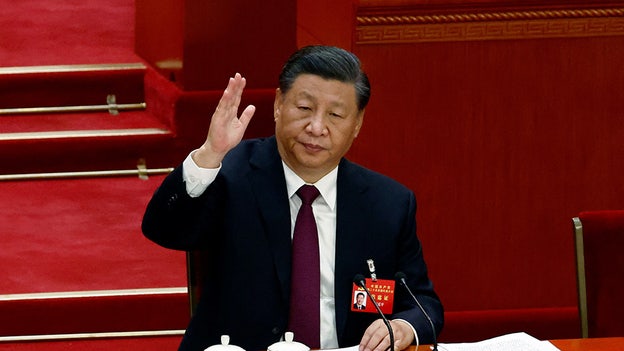

Starbucks, Las Vegas Sands and Wynn Resorts are trading lower on concerns about their exposure to China.

Some investors are concerned China will prioritize ideology-driven policies at the cost of private sector growth.

President Xi Jinping secured a precedent-breaking third leadership term on Sunday and introduced a top governing body stacked with loyalists, cementing his place as the country's most powerful ruler since Mao Zedong.

"The concern is that the Chinese government is continuing to move to a more socialist economic model under Xi which may require Chinese companies to place ever more focus on social goals rather than profitability," said Rick Meckler, a partner at Cherry Lane Investments in New Vernon.

At the end of third quarter, Starbucks stores in the U.S. and China comprised 61% of the company’s global portfolio, with 15,650 stores in the U.S and 5,761 stores in China.

Las Vegas Sands and Wynn Resorts operate casinos and resorts in Macau. Recent results were impacted by COVID-19 restrictions.

Sands China has net revenues of $915 million (HK$7.18 billion) in the first half of 2022, a decrease of 43.5%, compared to US$1.62 billion (HK$12.58 billion) in the first half of 2021.

Operating revenues from Wynn Macau were $58.6 million for the second quarter of 2022, a decrease of $125.4 million from $184.0 million for the second quarter of 2021.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| META | $125.18 | -4.83 | -3.72 |

Technology focused investment firm Altimeter Capital Management says Meta Platforms needs to streamline and focus to “get its mojo back.”

“Like many other companies in a zero rate world — Meta has drifted into the land of excess — too many people, too many ideas, too little urgency. This lack of focus and fitness is obscured when growth is easy but deadly when growth slows and technology changes,” Altimeter founder Brad Gerstner wrote in an open letter.

Altimeter has been long-term shareholders of Facebook’s parent.

It wants to see Mark Zuckerberg’s company double annual free cash flow to $40 billion, double down on artificial intelligence and cap metaverse related investments.

“The facts are startling. In the last 18 months, Meta stock is down 55% (compared to an average of 19% for its big-tech peers). Your P/E ratio has fallen from 23x to 12x and now trades at less than half the average P/E of your peers,” Gerstner said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PHG | $12.96 | -0.11 | -0.84 |

Royal Philips is cutting 4,000 jobs as part of a turnaround for the health technology company.

The group also reported third quarter financial results. Sales fell 5% to 4.3 billion euros ($4.2 billion).

Comparable order intake decreased 6% on the back of 47% growth in the third quarter of 2021.

Income from operations amounted to a loss of EUR 1.5 billion, mainly due to the previously disclosed EUR 1.5 billion non-cash goodwill and R&D impairment, compared to an income of EUR 358 million in Q3 2021.

Looking ahead, the company sees prolonged operational and supply challenges, a worsening macro-economic environment and continued uncertainty related to COVID-19 measures in China, which will be partly offset by Philips’ productivity and pricing actions.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ARKO | $9.75 | 0.45 | 4.84 |

ARKO is acquiring Pride Convenience Holdings, which operates 31 convenience stores to expand its footprint into Massachusetts.

ARKO will pay $230 million plus the value of inventory.

At closing, ARKO intends to finance approximately $28.0 million of the cash purchase price plus the value of inventory and other closing adjustments.

The remaining approximately $202 million is expected to be funded by Oak Street Real Estate Capital. Oak Street is expected to acquire the real estate assets of Pride as part of the transaction. The Company would lease the real estate assets from Oak Street.

Pride is a leading convenience store operator in the Northeast with many large format stores, including two high-volume Travel Centers for long-haul truckers and two modern City Stop locations that cater to short-haul truckers. Additionally, Pride operates a centralized kitchen that provides fresh baked goods and food daily to all Pride stores.

ARKO is a Fortune 500 company that owns 100% of GPM Investments and is one of the largest operators of convenience stores and wholesalers of fuel in the U.S.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SCHL | $38.21 | 4.58 | 13.62 |

Scholastic rose as much as 16% in Monday trading. The children's publishing, education and media company announced a plan to repurchase of up to $75 million of shares through a modified "Dutch Auction" tender offer.

The anticipated cash purchase price per share is expected to be not less than $35.00 and not more than $40.00, less any applicable withholding taxes and without interest.

"This decision to purchase approximately 6% of our outstanding shares of common stock represents both a major investment in our own stock at what we believe are very attractive prices and a first step as we review Scholastic's capital allocation framework in light of our improved margin profile and long-term free cash flow outlook," said CEO Peter Warwick.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MYOV | $26.71 | 2.17 | 8.84 |

Japan's Sumitomo Pharma Co and its subsidiary said on Sunday they would purchase the remaining shares of Myovant Sciences at an improved $27 per share, after the U.S. drugmaker rejected a lower offer earlier this month.

Sumitomo and its wholly owned unit, Sumitovant Biopharma, hold about 52% of Myovant's outstanding stock and will acquire the rest in a deal that values Myovant at about $2.59 billion, the companies said in a statement.

Myovant had rejected Sumitomo's previous proposal to acquire the remaining shares at $22.75 each, saying the bid significantly undervalued the company.

The deal provides Sumitomo access to Myovant's clinical assets being developed for preventing pregnancy and treating infertility in women, in addition to the company's FDA-approved drugs for prostate cancer and managing menstrual bleeding.

For the quarter ended June 30, 2022 Myovant reported $36 million in U.S. sales of its prostate cancer drug Orgovyx, and $4 million in sales of Myfembree which is used to help manage heavy menstrual bleeding.

Myovant's contraceptive medicine, which it is developing in collaboration with Pfizer, is currently being tested in a late-stage study.

The deal will be funded through cash on hand and external debt and is not subject to a financing condition, the companies said.

British government bond prices rose sharply on Monday as former finance minister Rishi Sunak cruised to victory in the race to succeed Liz Truss as prime minister, removing at least one source of uncertainty for bond investors.

Sunak's rivals, former prime minister Boris Johnson and cabinet minister Penny Mordaunt, dropped out of the Conservative Party leadership race on Sunday and Monday.

Gilt jumped briefly on the news that Sunak, a former finance minister, had won the contest. Despite falling back later, they retained the hefty gains racked up earlier in the day when Sunak's victory looked increasingly likely.

As of 3:05pm (1404) GMT, yields across short- and medium-dated gilts dropped by around 30 basis points on the day, with 20- and 30-year gilt yields down more than 20 bps.

Johnson quit the race late on Sunday, admitting that he could no longer unite the Conservative Party following one of the most turbulent periods in British political history.

Other major government bond markets also rallied on Monday as downbeat business surveys prompted investors to reel in bets on future interest rate hikes by central banks, although British debt outperformed.

The spread between 10-year German and British government bond yields narrowed sharply to 146 bps, after rising above 165 bps on Friday.

U.S. stocks rose as the trading week kicked off and as investors look ahead to earnings from tech giants Apple, Amazon and Meta. Additionally, all eyes remain on Twitter as the deal to purchase the social media giant nears for Elon Musk. In commodities, oil drifted down to the $84 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAPL | $147.27 | 3.88 | 2.71 |

| AMZN | $119.32 | 4.07 | 3.53 |

| TWTR | $49.89 | -2.55 | -4.86 |

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin all turned lower early Monday.

At approximately 5 a.m. ET, Bitcoin was trading at nearly $19,310 (-1.3%), or lower by $254.

For the week, Bitcoin was trading higher by nearly 1.55%. For the month, the cryptocurrency was higher by nearly 1.28%.

Ethereum was trading at approximately $1,335.2 (-2.07%), or lower by more than $28.2.

For the week, Ethereum was trading higher by almost 4.3%. For the month, it was trading higher by approximately 2.3%.

Dogecoin was trading at $0.059579 (-1.2%), or lower by approximately $0.000725.

For the week, Dogecoin was higher by nearly 2.35%. For the month, however, the crypto was lower by more than 5.05%.

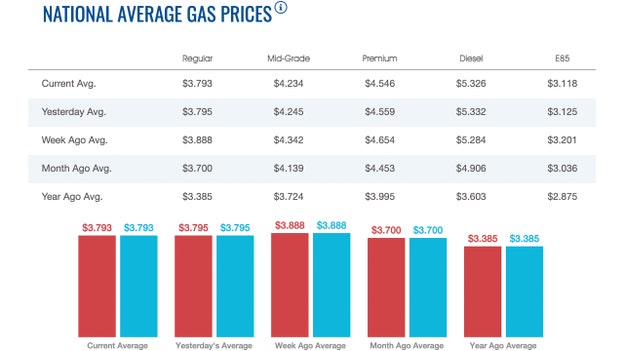

Gas prices slipped slightly early Monday morning, continuing the trend for the last week, according to AAA.

The price of a gallon of gasoline on Monday was $3.793. On Sunday, that same gallon of gasoline cost $3.796 nationwide. On Saturday, a gallon of gasoline nationwide cost $3.803.

One week ago a gallon of gasoline cost $3.888 One month ago, that same gallon of gasoline cost $3.70 nationwide. One year ago, a gallon of gasoline cost $3.385 per gallon.

Gas hit an all-time high on June 14 of $5.06 per gallon nationwide, approximately 19 weeks ago.

Meanwhile, the price a gallon of diesel fell for the first in more than a week to $5.326 early Monday. That’s down slight more than half a cent from Sunday’s price of $5.332 and Saturday’s $5.334.

On week ago, a gallon of diesel cost $5.284, while a month ago, the cost was $4.906. One year ago, a gallon of diesel nationwide sold for 3.603.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DIS | $102.04 | 3.45 | 3.50 |

Two Disney annual passholders have filed a lawsuit against Walt Disney World over the park's reservation system that was implemented during the COVID-19 pandemic.

The system requires passholders and guests with tickets ranging from one to 10 days to make a reservation in order to visit. The plaintiffs allege that the theme park company is breaching its passholders' contract by restricting access to the theme parks, according to FOX 35 Orlando.

The lawsuit was filed in Florida federal court on Tuesday by individuals identified as "E.K." and "M.P.," who have both been Walt Disney World passholders for several years, according to the lawsuit.

The lawsuit states E.L. and M.P. both purchased premium passes, which reportedly did not have "blockout dates" where passholders are unable to visit Disney's theme parks due to high attendance.

However, during the pandemic in 2020, Walt Disney World added a park reservation system for all visitors to manage crowd size, and that system remains in place today.

"It was believed by the Plaintiffs and other members of the class that this reservation system would only be temporary and would end once the threat of the pandemic lessened because they had not been subjected to this system pre-pandemic," the lawsuit obtained by FOX 35 states.

"By restricting access to the park, Disney effectively unilaterally modified all Platinum Pass holders’ and Platinum Plus pass holders’ contracts. These pass holders were forced to reluctantly agree to the terms of this new agreement, having no meaningful alternative."

The plaintiffs are also challenging the limits on "park hopping," a feature that allows guests to visit multiple parks on the same day. Both passholders and day guests with "park hopper" tickets can still visit multiple parks, but not until 2 p.m., Disney's website states.

"Plainly put, by choosing not to honor the term ‘no Blockout Dates,’ Disney has engaged in breach of implied contract, breach of the implied covenant of good faith and fair dealing, and unfair and deceptive trade practices. Plaintiffs have initiated this lawsuit to remedy the foregoing and to seek actual damages, punitive damages, and injunctive relief," the lawsuit states.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $31,082.56 | 748.97 | 2.47 |

| SP500 | $3,752.75 | 86.97 | 2.37 |

| I:COMP | $10,859.72 | 244.87 | 2.31 |

U.S. stocks edged lower early Monday after the major averages displayed encouraging results for the week for the first time since June on Friday.

Stocks showed their best three-week stretch since November 2020, boosted by the prospect of a slower pace to interest hikes by the Fed as well as third-quarter earnings reports results.

Major indexes started Friday with declines before turning higher, finishing the session near their highs of the day. The Dow added 748.97 points, or 2.5%, to 31082.56. The S&P 500 added 86.97 points, or 2.4%, to 3752.75. The technology-focused Nasdaq Composite added 244.87 points, or 2.3%, to 10859.72.

All three major indexes ended with weekly gains of at least 4.7%, a reprieve after a prolonged period of volatility that has been marked by big swings for stocks and bonds around the globe.

Investors have been focusing on corporate earnings as they search for clues about how inflation and rising interest rates are shaping global economies.

The Federal Reserve is expected to raise interest rates another three-quarters of a percentage point at its meeting in November. That's triple the size of the Fed’s usual move.

The dollar's growing strength against the yen and other currencies has added to inflationary pressures in those countries by pushing up the costs of imports and of debt repayments.

Meanwhile, Asian shares were mixed Monday, as benchmarks fell in Hong Kong and Shanghai after Beijing reported that the Chinese economy gained momentum in the last quarter.

Benchmarks were higher in Tokyo, Sydney and Seoul.

Market watchers are keeping a cautious eye on inflationary pressures and any signs of risk for regional slowdowns. The second-largest economy grew at a 3.9% annual pace, up from the previous quarter's 0.4%, but that still was among the slowest expansions in decades as the country wrestled with repeated closures of cities to fight virus outbreaks.

Japan’s benchmark Nikkei 225 added 0.5% in afternoon trading to 27,029.83. Australia’s S&P/ASX 200 gained 1.5% to 6,779.40. South Korea’s Kospi gained 0.9% to 2,232.59. Hong Kong’s Hang Seng lost 6.3% to 15,185.93, while the Shanghai Composite index shed 1.9% to 2,982.50.

The future for London’s FTSE 100 edged lower after former Prime Minister Boris Johnson announced he will not run to lead the Conservative Party. Former Treasury chief Rishi Sunak is now the favorite to replace Liz Truss, who quit last week after her tax-cutting economic package caused turmoil in financial markets.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $70.57 | 0.39 | 0.56 |

| CVX | $173.19 | 4.23 | 2.50 |

| XOM | $105.86 | 1.93 | 1.86 |

Oil prices slid more than 1% on Monday after Chinese data showed that demand from the world's largest crude importer remained lackluster in September as strict COVID-19 policies and fuel export curbs depressed consumption.

Brent crude futures for December settlement slid $1, or 1.1%, to $92.50 a barrel by 0609 GMT after rising 2% last week. U.S. West Texas Intermediate crude for December delivery was at $84.02 a barrel, down $1.03, or 1.2%.

Although higher than in August, China's September crude imports of 9.79 million barrels per day were 2% below a year earlier, customs data showed on Monday, as independent refiners curbed throughput amid thin margins and lackluster demand.

"The recent recovery in oil imports faltered in September," ANZ analysts said in a note, adding that independent refiners failed to utilize increased quotas as ongoing COVID-related lockdowns weighed on demand.

"This was exacerbated by falling refinery margins and product export curbs," the analysts said. Saudi Arabia and Russia were neck and neck as China's top two suppliers in September.

Uncertainty over China's zero-COVID policy and property crisis are undermining the effectiveness of pro-growth measures, ING analysts said in a note, even though third-quarter gross domestic product (GDP) growth beat expectations.

"This was exacerbated by falling refinery margins and product export curbs," the analysts said.

Saudi Arabia and Russia were neck and neck as China's top two suppliers in September.

Uncertainty over China's zero-COVID policy and property crisis are undermining the effectiveness of pro-growth measures, ING analysts said in a note, even though third-quarter gross domestic product (GDP) growth beat expectations.

Live Coverage begins here