STOCK MARKET NEWS: Dow jumps 765 points, oil soars on OPEC speculation, US dollar gets stronger

Investors jump back into stocks after a rough September giving the 4Q a solid start. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RIVN | $31.89 | -1.02 | -3.10 |

Electric vehicle maker Rivian said it produced and delivered more vehicles in the third quarter than it did in the second quarter.

Rivian produced 7,363 vehicles at its manufacturing facility in Normal, Illinois in Q3 and delivered 6,584 vehicles during the same period.

That’s up from the second quarter, when the company produced 4,401 vehicles and delivered 4,467 vehicles.

Rivian believes it is on track to deliver on the 25,000 annual production guidance previously provided.

The company produces a pickup truck and sport utility vehicle.

Oil prices jumped nearly $4 a barrel on Monday as OPEC+ considered reducing output by more than 1 million barrels per day (bpd) to buttress prices with what would be its biggest cut since the start of the COVID-19 pandemic.

Brent crude futures for December delivery rose $3.72 to $88.86 a barrel, a 4.4% gain. U.S. West Texas Intermediate crude rose $4.14, or 5.2%, to $83.63 a barrel.

Oil prices have declined for four straight months since June, as COVID-19 lockdowns in top energy consumer China hurt demand while rising interest rates and a surging U.S. dollar weighed on global financial markets.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, known collectively as OPEC+, is considering an output cut of more than 1 million barrels per day (bpd) ahead of Wednesday's meeting, OPEC+ sources have told Reuters.

Most traders were expecting cuts of about 50,000 bpd, said Dennis Kissler, senior vice president of trading at BOK Financial.

If agreed, it will be the group's second consecutive monthly cut after reducing output by 100,000 bpd last month.

Investors scooped up stocks across the board after all three of the major U.S. benchmarks fell over 8% last month. The Dow Jones Industrial Average notched a gain 765 points, while 11 of the S&P’s 11 main sectors rose led by materials and energy, while consumer discretionary companies rose the least. In commodities, oil surged over 5% to $83.63 per barrel ahead of Wednesday’s OPEC meeting.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLE | $76.28 | 4.25 | 5.91 |

| XLB | $70.39 | 2.38 | 3.50 |

| XLY | $142.98 | 0.53 | 0.37 |

The red-hot housing market is chilling at the quickest since January 2009, said Black Knight Data & Analytics.

July and August 2022 marked the largest single-month price declines in more than 13 years and rank among the eight largest on record.

Median home prices fell 0.98% in August, only marginally better than July’s upwardly revised 1.05% monthly decline.

Sellers are likely being deterred by both falling demand and prices, along with a growing disincentive to give up historically low interest rate mortgages in a sharply rising rate environment, Black Knight said.

Sentencing for Elizabeth Holmes was delayed as the founder of defunct blood testing firm Theranos seeks a new trial on fraud and conspiracy charges.

the sentencing hearing had been set for Oct. 17.

Last month her attorneys filed for a new trial, citing “newly discovered evidence.”

Norwegian Cruise Line is eliminating COVID-19 testing, masking and vaccination requirements beginning Oct. 4, the company said.

The cruise ship operator says the change brings it more in line with other global travel organizations.

With the easing of the cruise line's health and safety protocols, NCL will continue to follow the travel guidelines as required by the destinations it visits. For all country specific travel requirements, travelers should visit www.ncl.com/travel-requirements-by-country.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| INTC | $27.03 | 1.26 | 4.89 |

| CVX | $150.80 | 7.13 | 4.96 |

| CAT | $171.92 | 7.84 | 4.78 |

| JNJ | $162.11 | -1.25 | -0.77 |

The Dow Jones Industrial Average staged a strong start to the 4Q rising over 700 points. Intel, Chevron and Caterpillar led the advance while J&J was the only member in the red.

UBS managing director and senior portfolio manager Jason Katz on how to find the market bottom.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RKT | $6.57 | 0.24 | 3.88 |

Rocket Companies is up more than 4 percent in Monday trading. The owner of Rocket Mortgage and other business lines announced a new chief financial officer and general counsel in a regulatory filing.

Current CFO Julie Booth and General Counsel Angelo Vitale are retiring, effective October 3.

Brian Brown will replace Booth. He is Chief Accounting Officer.

Tina John, the company’s Deputy General Counsel, will replace Vitale.

Founded in 1985, Rocket Companies is a Detroit-based FinTech platform company consisting of personal finance and consumer technology brands including Rocket Mortgage, Rocket Homes, Amrock, Rocket Auto, Rocket Loans, Rocket Money (formerly known as Truebill), Rocket Solar, Rocket Mortgage Canada (formerly known as Edison Financial), Lendesk, Core Digital Media, Rocket Central and Rock Connections.

The Wall Street Journal Dollar Index rose 6.56 points or 6.74% in the third quarter to 103.95, marking the largest one quarter point gain since the fourth quarter of 2016 when Donald Trump beat Hillary Clinton in the U.S. presidential election.

The dollar’s strength brings advantages and disadvantages. Experts say a stronger dollar helps importers buy foreign goods at cheaper prices but also lessens foreign demand for U.S. goods.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| APRN | $3.42 | -2.36 | -40.83 |

Blue Apron plunged as much as 40% in Monday morning trading. The delivery meal kit provider announced a plan to sell up to $15 million of shares through Canaccord Genuity.

The company expects to use proceeds from the offering for general corporate purposes.

Blue Apron said the offering, along with a private placement, gift card sponsorship deal and cost savings will provide the company with enough cash to operate for at least 12 months.

If Blue Apron does not receive the remaining $69.4 million due under the RJB private placement purchase agreement and the gift card sponsorship agreement, the company says it will only have enough cash to meet its cash needs though the first quarter of 2023.

Last week Blue Apron announced that chief financial officer Randy Greben was leaving to accept a position at another company and plans to resign his role, effective October 17, 2022.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HLT | $122.55 | 1.93 | 1.60 |

| PTON | $7.21 | 0.28 | 4.11 |

Hilton hotel guests will be able to pedal on Peloton bikes across the chain’s nearly all 5,400 U.S. Hilton-branded hotels by year end, both companies announced.

Peloton is teaming with Hilton to add at least one Peloton Bike in every Hilton fitness center.

A recent Hilton survey of U.S. travelers indicated an overwhelming 98 percent of respondents are prioritizing wellness activities while on the road, and within the Peloton community, 90 percent of Members report that they are more likely to stay at hotels with Peloton Bikes.

The British pound advanced against the dollar after the UK government retreated from plans to abolish its top 45 pence tax rate, but later surrendered most gains.

U.K. Finance Minister Kwasi Kwarteng tweeted that controversy over the move had became a “distraction.”

The decision initially lifted the pound higher against the dollar, with AJ investment director Russ Mould saying that sterling jumped from $1.1088 to $1.12646 in less than two hours.

However the pound quickly gave up much of its gains and was flat to lower against the dollar by mid-morning U.S. time.

U.S. manufacturing activity grew at its slowest pace in nearly 2-1/2 years in September as new orders contracted, likely as rising interest rates to tame inflation cooled demand for goods.

The Institute for Supply Management (ISM) said on Monday that its manufacturing PMI dropped to 50.9 this month, the lowest reading since May 2020, from 52.8 in August.

A reading above 50 indicates expansion in manufacturing, which accounts for 11.9% of the U.S. economy. Economists polled by Reuters had forecast the index slipping to 52.3.

Some of the slowdown in manufacturing reflects the rotation of spending from goods to services. Government data last Friday showed spending on long-lasting manufactured goods barely rising in August, while outlays on services picked up.

The ISM survey's forward-looking new orders sub-index fell to 47.1 last month, also the lowest reading since May 2020, from 51.3 in August. It was the third time this year that the index has contracted.

All three of the major averages jumped as the 4Q kicked off winding down what may be the worst year for stocks since 2008. In commodities, oil jumped 6% ahead of OPEC’s Wednesday meeting which, per reports, may bring a production cut.

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin were all higher early Monday.

At approximately 4:30 a.m. ET, Bitcoin was trading at approximately $19,210 (+0.60%), or higher by more than $100.

For the week, Bitcoin was trading higher by nearly 1.7%. For the month, the cryptocurrency was down more than 4.3%.

Ethereum was trading at approximately $1,290 (+0.83%), or higher by more than $10.6.

For the week, Ethereum was trading lower by nearly 1%. For the month, it was trading lower by approximately 19%.

Dogecoin was trading at $0.059762 (+0.72%), or higher by approximately $0.000425.

For the week, Dogecoin was lower by nearly 3%. For the month, the crypto was lower by approximately 3.5%.

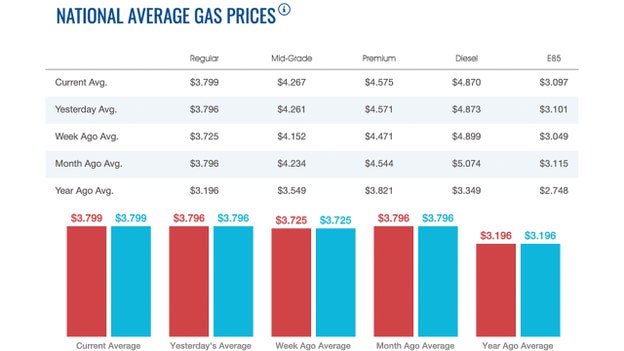

The recent run of gasoline price increases nationwide resumed on Monday, one day after a slight decrease.

Monday’s price for a gallon of gasoline nationwide was $3.799. On Sunday, the price slipped to $3.796, down from Saturday's $3.80 a gallon, according to AAA.

One week ago, the price of a gallon of gasoline nationwide was $3.725. One month ago, the price was $3.796. One year ago, the price of a gallon of gasoline stood at $3.196.

Gasoline hit an all-time record high on June 14 of $5.016, approximately 16 weeks ago.

Meanwhile, diesel fell Monday, selling for $4.87 per gallon. On Sunday, the price is at $4.873 a gallon.

One week ago, the price of a gallon of diesel nationwide was $4.899. One month ago, the price was $5.074. One year ago, the price of a gallon of diesel stood at $3.349.

Major concealed carry insurance providers in the U.S. say they have seen unprecedented growth in the past few years, as rising crime rates continue to drive more Americans to take their personal safety into their own hands by buying a firearm for self-defense.

Delta Defense, which runs the U.S. Concealed Carry Association (USCCA) and provides self-defense liability insurance coverage as part of membership in the education and training organization, has seen its membership numbers more than double from 300,000 in 2020 to nearly 700,000 today. A decade ago, USCCA's membership was at 50,000.

Tim Schmidt, CEO of Delta Defense and President and Co-founder of the USCCA, attributes the surge to the "millions of brand new gun owners there are in the wake of primarily all the riots that happened in early 2020."

He told FOX Business, "A lot of people came to the realization that ‘Holy cow I need to be able to defend myself, so I'm going to buy a gun.'"

And those new gun owners are seeking out education, training and further protection.

Competitor U.S. LawShield, which launched in 2009 and also provides education, training and concealed carry insurance, saw an enormous surge in membership starting in 2020, too.

"We had this combination in the last two or three years of COVID, civil unrest, gigantic increases in crime across the country – and we saw a very, very unprecedented growth in our company."

CEO Kirk Evans told FOX Business, saying that his organization is also currently sitting at around 700,000 members. Evans said another reason the industry has seen so much growth is because of increasing diversity among gun owners.

"You could not go a week in the last year or two without seeing an article about ‘women make up the largest demographic of new permit holders’ or ‘African Americans have shown the highest increase’ or minorities as the biggest increase in blank or people in San Francisco running out to buy a firearm," he said. "This is not a white conservative group anymore."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $28,725.51 | -,500.10 | -1.71 |

| SP500 | $3,585.62 | -54.85 | -1.51 |

| I:COMP | $10,575.62 | -,161.89 | -1.51 |

U.S. stocks were whipsawing as investors await the beginning of the fourth quarter when the markets open on Monday morning.

Wall Street closed out a miserable September on Friday with the S&P 500's worst monthly skid since the coronavirus pandemic crashed global markets. It’s now at its lowest level since November 2020 and is down by more than a quarter since the start of the year.

The Fed has been at the forefront of the global campaign to slow economic growth and hurt job markets just enough to undercut inflation but not so much that it causes a recession.

On Friday, the Fed’s preferred measure of inflation showed it was worse last month than economists expected. That should keep the Fed on track to keep hiking rates and hold them at high levels a while, raising the risk of it going too far and causing a downturn.

Vice Chair Lael Brainard was the latest Fed official on Friday to insist it won't pull back on rates prematurely.

The S&P 500 fell 1.5% to close at 3,585.62 Friday. The Dow Jones Industrial Average dropped 1.7% to 28,725.51. The Nasdaq composite slid 1.5% to 10,575.62. The tech-heavy index sank 10.5% in September and is down 32.4% so far this year. Smaller company stocks also had a rough September. The Russell 2000 ended the month down 9.7%.

On Friday, it lost 0.6% to 1,664.72. Other worries hang over global markets, including Russia's invasion of Ukraine. A U.K. government plan to cut taxes sent bond markets spinning recently on fears it could make inflation even worse.

Bond markets calmed a bit only after the Bank of England pledged last week to buy however many U.K. government bonds are needed to bring yields back down. The stunning and swift rise of the U.S. dollar against other currencies, meanwhile, raises the risk of creating so much stress that something cracks somewhere in global markets.

Meanwhile, Asian shares were mostly lower on Monday. Tokyo rose while other regional markets declined. Shanghai was closed for China’s weeklong National Day holidays.

Japan's Nikkei 225 index gained 1.1% to 26,215.79 after a Bank of Japan quarterly survey showed sentiment among manufacturers has darkened, reflecting rising costs, the weakening yen and lingering pandemic-related restrictions.

The headline measure for the “tankan,” measuring sentiment among large manufacturers, was plus 8, down from plus 9 the previous quarter. The tankan measures corporate sentiment by subtracting the number of companies saying business conditions are negative from those responding they are positive.

“Today’s Tankan survey suggests that while the services sector is benefitting from the subsiding virus wave, the outlook for the manufacturing sector continues to worsen," said a report from Capital Economics. It noted it was the third consecutive decline in sentiment for the world's third largest economy.

The BOJ has kept interest rates below zero in a longstanding effort to encourage inflation and keep deflation at bay as the country ages and its population shrinks. That has kept the value of the yen weak relative to the U.S. dollar, which has been strengthening as the Federal Reserve raises rates to combat decades-high inflation.

The dollar was trading at 145.04 yen early Monday, up from 144.68 yen late Friday. The euro was at 97.98 cents, up from 97.96 cents.

Elsewhere in Asia, Hong Kong's Hang Seng index fell 0.9% to 17,073.81. Australia's S&P/ASX 200 slipped 0.3% to 6,456.90. Taiwan's Taiex lost 0.9% and Bangkok's SET declined 1.3%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $65.28 | -1.49 | -2.23 |

| CVX | $143.67 | -1.10 | -0.76 |

| XOM | $87.31 | -1.37 | -1.54 |

Oil prices jumped more than 3% in early Asian trade on Monday, as OPEC+ considers cutting output by more than 1 million barrels a day, for its biggest reduction since the pandemic, in a bid to support the market.

Brent crude futures rebounded $2.36, or 2.8%, to $87.50 a barrel by 0622 GMT, after settling down 0.6% on Friday.

U.S. West Texas Intermediate crude was up 2.9%, or $2.27, at $81.76 a barrel, after the previous session's loss of 2.1%.

Oil prices have tumbled for four straight months since June, as COVID-19 lockdowns in top energy consumer China hurt demand, while rising interest rates and a surging U.S. dollar weighed on global financial markets.

To support prices, the Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, is considering an output cut of more than 1 million bpd ahead of Wednesday's meeting, OPEC+ sources told Reuters.

If agreed, it will be the group's second consecutive monthly cut after reducing output by 100,000 bpd last month. But analysts expect the hit to supply from the cut will be markedly lower than the headline number, as many OPEC+ members are producing far less than their quotas.

With just a handful of producers hitting output targets, it is likely that only they would have to cut, ING analysts said in a note.

OPEC+ missed its production targets by nearly 3 million bpd in July, two sources from the producer group said, as sanctions on some members and low investment by others stymied its ability to raise output.

"Anything less than 500,000 barrels a day would be shrugged off by the market. Therefore, we see a significant chance of a cut as large as 1 million barrels a day," ANZ analysts said in a note.

While prompt Brent prices could strengthen further in the immediate short term, concerns over a global recession are likely to limit the upside, consultancy FGE said. "If OPEC+ does decide to cut output in the near term, the resultant increase in OPEC+ spare capacity will likely put more downward pressure on long-dated prices," it said in a note on Friday.

Live Coverage begins here