STOCK MARKET NEWS: Fed decision on tap, Musk-Twitter shakeup continues, NYC salary ranges ahead

Stocks begin week on choppy note though the Dow posts best October performance on record, the Fed meeting and jobs data is also in focus later in the week and Elon Musk keeps tweaking Twitter. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DAL | $34.05 | -0.62 | -1.79 |

Pilots of Delta Air Lines have voted to authorize a strike, if necessary, to achieve a new contract.

99% percent of pilots who cast ballots voted in favor of a strike.

“A strike is not an action we take lightly and one we hope to avoid, if possible. However, we will no longer accept further delays or excuses from management: we are willing and ready to strike,” the Delta Master Executive Council said.

The pilots say they last received a pay raise in 2019 and continue to fly under a contract signed in 2016.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GT | $12.80 | 0.28 | 2.24 |

Goodyear Tire & Rubber is lower in extended trading. The tire maker matched Wall Street revenue estimates but missed on profit.

Third quarter net sales rose 7.6% to $5.3 billion, driven by strong price/mix. The number matched the analyst estimate.

Americas unit volume fell 7% reflecting weaker replacement industry and non-recurrence of dealer restocking in 2021 in North America. Net sales rose 11.4%.

Adjusted net income for the three months ended September 30 was $116 million, compared to $206 million a year ago. Lower adjusted net income reflects reduced merger adjusted segment operating income, higher interest expense and the unfavorable impact of foreign currency exchange.

Adjusted earnings per share was 40 cents, lower than the estimate of 54 cents.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CAR | $236.63 | -6.71 | -2.76 |

Avis Budget Group Inc. (CAR) on Monday reported third-quarter net income of $1.03 billion.

On a per-share basis, the Parsippany, New Jersey-based company said it had profit of $21.67. Earnings, adjusted for one-time gains and costs, came to $21.70 per share.

The results beat Wall Street expectations. The average estimate of five analysts surveyed by Zacks Investment Research was for earnings of $14.80 per share.

The car rental company posted revenue of $3.55 billion in the period, also surpassing Street forecasts. Four analysts surveyed by Zacks expected $3.52 billion.

Avis Budget shares have climbed 14% since the beginning of the year. In the final minutes of trading on Monday, shares hit $236.46, a rise of 36% in the last 12 months.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FLS | $28.68 | 0.00 | 0.00 |

Flowserve Corp. on Monday reported third-quarter net income of $38.4 million.

On a per-share basis, the Irving, Texas-based company said it had net income of 29 cents. Earnings, adjusted for non-recurring gains, came to 9 cents per share.

The results fell short of Wall Street expectations. The average estimate of four analysts surveyed by Zacks Investment Research was for earnings of 24 cents per share.

The company that makes pumps, valves and other parts for the oil and gas industries posted revenue of $872.9 million in the period, which also missed Street forecasts. Four analysts surveyed by Zacks expected $876.5 million.

Elon Musk has assured the European Commission that Twitter will abide by tough European rules on illegal online content policing now that the social network has passed under his ownership, European Union sources said on Monday.

In a previously unreported exchange last week, Musk told Thierry Breton, the EU's industry chief, that he planned to comply with the region's Digital Services Act, which levies hefty fines on companies if they do not control illegal content.

The self-described free speech absolutist agreed to hold a meeting with Breton, a former French finance minister, in the coming weeks, two EU officials familiar with the discussions told Reuters. The exchange came after Breton took to Twitter to warn Musk about the new European legislation on Friday. "In Europe, the bird will fly by our EU rules," Breton tweeted on Friday.

The tech-heavy Nasdaq Composite fell over 1% on the final trading day of the month as the Dow Jones Industrial Average and S&P 500 followed suit. Investors took a pause ahead of the Federal Reserve's expected rate hike on Wednesday and the monthly jobs report due Friday. In commodities, oil slipped over 1% to $86.53 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DG | $255.47 | -4.97 | -1.91 |

A pricing audit of 20 Dollar General stores in southwestern Ohio found each store had too many pricing errors to meet regulatory standards.

“This is a serious problem,” said Butler County Auditor Roger Reynolds. “A customer could be charged substantially more than the listed shelf price and that amounts to a form of consumer fraud. During these inflationary times, people turn to stores like these to get some bargains. Instead, in too many instances they are being over charged.”

Job candidates will be able to see salary information before applying for a job in New York City.

Effective Nov. 1, the New York City Human Rights Law requires employers to include a good faith pay range in all job advertisements.

Any advertisement for a job, promotion, or transfer opportunity that would be performed in New York City is covered by the new law.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| META | $94.56 | -4.64 | -4.68 |

Instagram parent Meta Platforms in lower in Monday trading.

The company said it is aware of reports that some users are having difficulty accessing their accounts. “We're looking into it and apologize for the inconvenience,” the social media site said.

The Verge reported that some users were told their accounts were suspended, with the problem concentrated among iPhone users.

The Verge noted 10,000 followers disappeared from its site, apparently due to the outage.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GPN | $116.59 | -8.72 | -6.96 |

Global Payments Inc. on Monday reported third-quarter earnings of $290.5 million.

The Atlanta-based company said it had profit of $1.05 per share. Earnings, adjusted for non-recurring costs and stock option expense, came to $2.48 per share.

The results did not meet Wall Street expectations. The average estimate of 10 analysts surveyed by Zacks Investment Research was for earnings of $2.49 per share.

The electronics payment processing company posted revenue of $2.29 billion in the period. Its adjusted revenue was $2.06 billion, which topped Street forecasts. Eight analysts surveyed by Zacks expected $2.05 billion.

Global Payments expects full-year earnings in the range of $9.53 to $9.75 per share, with revenue in the range of $8.4 billion to $8.47 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| EA | $125.79 | -2.45 | -1.91 |

| DIS | $105.86 | -0.09 | -0.08 |

Electronic Arts is teaming up with Walt Disney unit Marvel Entertainment on a long-term deal to develop at least three new action adventure games that will be available for consoles and PC, the companies announced.

Each game will have an own original story set in the Marvel universe. The first title in-development will be a single player, third person, action-adventure Iron Man game coming out of Motive Studios.

The Iron Man game will feature an original narrative that taps into the rich history of the character, channeling the complexity, charisma, and creative genius of Tony Stark, and enabling players to feel what it’s like to truly play as Iron Man.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SXC | $7.20 | 0.36 | 5.34 |

SunCoke Energy is higher in Monday trading.

The metallurgical coke producer reported record third quarter financial results.

Revenue for the three months ended September 30 rose 41% to $516.8 million, primarily reflecting the pass-through of higher coal prices and favorable export coke pricing.

Analysts expected $385.55 million.

Net income was $41.4 million, up from $23 million a year ago.

Earnings per share was 49 cents, higher than the analyst estimate of 18 cents.

The company revised its full year outlook based on higher export margins in its domestic coke plants and a coal price adjustment benefit.

2022 consolidated adjusted EBITDA is expected to surpass the guidance high end of $285 million compared to the previous forecast of adjusted EBITDA between $270 million to $285 million.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DIS | $105.47 | -0.48 | -0.45 |

Shanghai's Disney Resort abruptly suspended operations on Monday to comply with COVID-19 prevention measures, with all visitors at the time of the announcement directed to stay in the park until they return a negative test for the virus.

The Shanghai government said on its official WeChat account the park was barring people from entering or exiting and that all visitors inside the site would need to await the results of their tests before they could leave.

A Shanghai Disney Resort spokesperson said the resort was still operating "limited offerings" and that they were following measures in line with guidelines from Chinese health authorities.

Videos circulating on China's Weibo platform on Monday showed people rushing to the park's gates, which were already locked.

Reuters was not able to verify the authenticity of the videos and the Shanghai Disney Resort did not respond when asked about on how many visitors were inside.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WYNN | $65.22 | 6.92 | 11.87 |

Wynn Resorts rose as much as 12% in Monday morning trading. The developer and operator of high-end hotels and casinos revealed that billionaire Tilman Feritta owns 6.1% of Wynn’s stock, a joint regulatory filing said.

The filing did not say what plans—if any—Feritta plans for his investment.

Fertitta Entertainment’s brands include the Landry’s restaurant chains, the Houston Rockets professional basketball team and Golden Nugget hotels and casinos.

New Twitter owner Elon Musk is not done criticizing the company’s former board of directors.

Musk claims the former board and their attorneys deliberately hid evidence from court proceedings. If true, the evidence may serve as a basis for arguments that the billionaire significantly overpaid when he acquired Twitter for $44 billion.

Musk officially acquired the social media platform on Oct. 28.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ON | $63.41 | -4.07 | -6.03 |

Onsemi is lower in Monday trading on a flat fourth quarter forecast.

The semiconductor maker is forecasting forth quarter revenue of $2.01 to $2.14 billion and diluted earnings per share of $1.20 to $1.36.

Third quarter revenue rose 26% year-over-year to $2.19 billion and earning per share came in at $1.45.

Third quarter revenue, along with profit, did beat Wall Street estimates.

Twelve analysts surveyed by Zacks expected revenue of $2.12 billion and earning per share of $1.31.

“We remain confident in our long-term outlook as we continue to win where semiconductor content growth is accelerating for vehicle electrification, energy infrastructure, advanced safety and factory automation,” said Hassane El-Khoury, president and CEO.

The Associated Press contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DE | $403.33 | 6.48 | 1.63 |

| ADM | $96.81 | 1.93 | 2.03 |

Chicago wheat futures jumped Monday as Russia's withdrawal from a Black Sea export agreement raised concerns over global supplies.

The most active wheat contract on the Chicago Board of Trade (CBOT) Wv1 was up 6.1% at $8.79-1/2 a bushel at 1221 GMT, having touched $8.93 for its highest since Oct. 14.

Wheat futures hit a record high of $13.64 a bushel in March.

“This only adds to an existing set of inflationary pressures. Commodity prices, which had receded in relevance somewhat since the summer, are now back at the top of the agenda,” said AJ Bell investment director Russ Mould.

Moscow suspended its participation in the Black Sea deal on Saturday in response to what it called a major Ukrainian drone attack on its fleet in Russia-annexed Crimea.

Kyiv said Russia was making an excuse for a prepared exit from the accord and Washington said it was weaponizing food.

On Monday Russia said it would be dangerous for Ukraine to continue exporting grain via the Black Sea because it could not guarantee the safety of shipping in these areas.

Ukraine diplomat Oleg Nikolenko tweeted: “Ukraine wants to continue grain exports to those in need.”Reuters contributed to this report.

Investors took a breather as the trading week kicks off with stocks drifting lower as the Dow Jones Industrial Average looks at its best monthly percentage gain since 1976 on pace for a 14%+ jump. Later in the week, the Federal Reserve is expected to hike rates again. In commodities, oil fell to the $87 per barrel level as China ramped up COVID-19 restrictions.

Wall Street is watching the upcoming Midterms closely for clues on major shifts in Washington in both the House and Senate.

Cryptocurrency prices for Bitcoin and Ethereum were lower overnight, while Dogecoin prices turned higher early Monday.

At approximately 5:30 a.m. ET, Bitcoin was trading at nearly $20,503 (-0.58%), or lower by $119.

For the week, Bitcoin was trading higher by nearly 5.4%. For the month, the cryptocurrency was higher by nearly 6%.

Ethereum was trading at approximately $1,585.8 (-0.31%), or lower by more than $4.90.

For the week, Ethereum was trading higher by almost 16.6%. For the month, it was trading higher by approximately 19.65%.

Dogecoin was trading at $0.11983 (+1.91%), or higher by approximately $0.00225.

For the week, Dogecoin was higher by more than 95.10%. For the month, the crypto was higher by more than 90.4%.

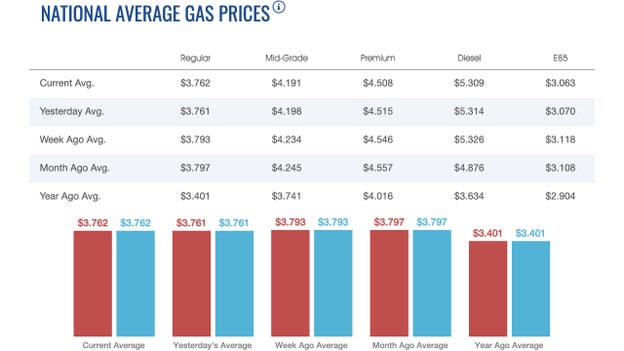

The recent decline in gas prices came to a halt over the weekend.

The average price of a gallon of gasoline on Monday was $3762, up a penny from Friday, according to AAA.

One week ago, a gallon of gasoline cost $3.793. A month ago, that same gallon of gasoline cost $3.797. A year ago, a gallon of gasoline cost $3.401.

Gas hit an all-time high of $5.016 on June 14, nearly 20 weeks ago.

Diesel's price dropped slightly nationwide on Monday, falling to $5.309, after costing $5.314 over the weekend.

One week ago, a gallon of diesel cost $5.326. A month ago, a gallon of diesel cost $4876. A year ago, a gallon of diesel cost $3.634.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,861.80 | 828.52 | 2.59 |

| SP500 | $3,901.06 | 93.76 | 2.46 |

| I:COMP | $11,102.45 | 309.78 | 2.87 |

U.S. stocks fell sharply overnight as investors await the next Fed move later this week.

Wall Street ended last week higher after Apple and other big companies reported strong profits and a closely watched measure of inflation accelerated in September.

The Fed is widely expected at this week's meeting to announce another rate hike of 0.75 percentage points, three times its usual margin.

Investors are looking for signs officials are satisfied that earlier increases imposed to cool inflation that is near a four-decade high are working and future increases can be smaller.

Investors worry rate hikes by the Fed and other central banks to cool inflation might tip the global economy into recession. The U.S. central bank has raised its benchmark lending rate to a range of 3% to 3.25% from close to zero in March.

“The tone from Fed Chair Jerome Powell will be important” after this week's meeting, said Yeap Jun Rong of IG in a report. Investors are looking for “increased concerns on economic conditions” instead of the “current head-on resolve to tame inflation.”

On Wall Street, the benchmark S&P 500 index rose 2.5% on Friday after U.S. government data showed consumer prices rose 6.2% over a year earlier September, the same as the previous month’s rate.

Core inflation, which removes volatile food and energy prices to show the underlying trend, accelerated to 5.1% from August’s 4.9%. Powell and other Fed officials have said they are ready to keep interest rates elevated until they are sure inflation is extinguished.

The Dow Jones Industrial Average rose 2.6% and the Nasdaq composite climbed 2.9%.

Earlier in the week, Facebook operator Meta Platforms Inc. lost nearly a quarter of its stock market value after reporting a second straight quarter of revenue decline.

TikTok. Microsoft Corp. and Google’s parent company, Alphabet Inc., also reported slowdowns in key areas.

Also Friday, government data showed wage increases for American workers were in line with expectations. Powell has cited wages as one measure the Fed is watching as it decides whether to raise rates.

Meanwhile, Asian stocks mostly rose Monday ahead of what is expected to be a Federal Reserve decision this week to raise interest rates again amid investor hopes the U.S. central bank will scale back plans for more increases.

Tokyo, Sydney and Seoul advanced while Hong Kong and Shanghai declined. Oil prices fell. The euro stayed below $1.

The Nikkei 225 in Tokyo gained 1.8% to 27,587.46, as the government reported that retail sales rose in September, though industrial production weakened. The Shanghai Composite Index shed 0.8% to 2,893.48 after a manufacturing survey showed a weakening in production and demand.

Hong Kong's Hang Seng dropped 1.3% to 14,671.10. The Kospi in Seoul added 1.1% to 2,293.61 and Sydney's S&P-ASX 200 gained 1.2% to 6,863.50. New Zealand and Southeast Asian markets also gained.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $72.82 | -0.80 | -1.09 |

| CVX | $179.98 | 2.08 | 1.17 |

| XOM | $110.70 | 3.15 | 2.93 |

Oil prices fell over $1 on Monday following weaker-than-expected factory activity data out of China and on concerns its widening COVID-19 curbs will curtail demand.

Brent crude futures dropped $1.10, or 1.2%, to $94.67 a barrel by 0710 GMT, after slipping 1.2% on Friday.

U.S. West Texas Intermediate (WTI) crude was at $86.83 a barrel, down $1.07, or 1.2%, after settling down 1.3% on Friday.

Brent and WTI, however, are on track for their first monthly gains since May, up 7.7% and 9.3% respectively, so far.

Factory activity in China, the world's largest crude importer, fell unexpectedly in October, an official survey showed on Monday, weighed down by softening global demand and strict COVID-19 restrictions that hit production.

Chinese cities are doubling down on Beijing's zero-COVID policy as outbreaks widen, dampening earlier hopes of a rebound in demand. Strict COVID-19 curbs in China have dampened economic and business activity, curtailing oil demand.

China's crude oil imports for the first three quarters of the year fell 4.3% from the same period a year earlier - the first annual decline for this period since at least 2014 - as Beijing's drastic COVID-19 curbs hit fuel consumption hard.

A further risk to oil demand comes from Europe, said CMC Markets analyst Leon Li, as the continent "is likely to enter a recession this winter," he said.

The euro zone is likely entering a recession with its October business activity contracting at the fastest in nearly two years, according to a S&P Global survey, as rising costs of living keeps consumers cautious and saps demand.

European Central Bank policymakers are also standing behind plans to keep raising interest rates, even if it pushes the bloc into recession and stirs political resentment.

Meanwhile, some of the largest U.S. oil producers on Friday signalled that productivity and volume gains in the Permian Basin - the nation's top shale field - are slowing.

The warnings came just as U.S. oil exports rose to a record last week, partly pushing WTI prices up 3.4%. Brent rose 2.4% last week, notching its second consecutive weekly gain.

Live Coverage begins here