STOCK MARKET NEWS: Inflation report sends Dow to worst day since June 2020

U.S. stocks tumbled after the latest read on inflation came in higher than expected, raising prospects for a 100 basis point interest rate hike by the Federal Reserve later this month. The Dow Jones Industrial Average lost almost 4%. The S&P 500 lost more than 4% for the worst day this year and the Nasdaq dropped 5%. Two-year Treasury yields rose to the highest since Thursday, November 1, 2007. Oil futures lost ground after Labor Department data showed declining gasoline prices in August were offset by gains in rent and food costs. In currencies, the dollar index rose 1.377%, with the euro down 1.32% to $0.9985.

Coverage for this event has ended.

U.S. stocks ended a four-day winning streak after the latest read on inflation came in higher than expected.

CME’s FedWatch shows a 32% chance the Fed will raise interest rates by 1% when it meets later this month. On Monday, FedWatch predicted a 0% chance of a 1% increase. The odds of a 75 basis point hike went to 69% from 91%.

The Dow Jones Industrial Average tumbled more than 1,200 points. The S&P 500 slid 4% for the worst day this year and the Nasdaq lost 5%.

Two-year Treasury yields rose to the highest since Thursday, November 1, 2007.

Nymex Crude for October delivery snapped a three-day winning streak with the largest one day dollar and percentage decline since Wednesday, September 7.

The Federal Open Market Committee, the Federal Reserve's policy-setting committee, is likely to raise its short-term interest rate target by a full percentage point at its policy meeting next week, because of the emergence of upside inflation risks, Nomura analysts said on Tuesday.

In a research note published following a hotter-than-expected U.S. August Consumer Price Index report, the investment bank also said it was raising its forecast for the terminal rate by 50 basis points to 4.50%-4.75% by February 2023.

The Federal Reserve will release its policy decision at the close of its two-day meeting next week, on Sept. 20-21.

The consumer price index unexpectedly climbed 0.1% last month from July, and gained 8.3% in the 12 months through August, the Labor Department reported on Tuesday.

Economists had expected a small monthly decline amid falling energy prices, paving the way for the U.S. central bank to perhaps slow the pace of its rate hikes in coming months. But the report showed accelerating inflation in services and a particularly worrisome rise in the cost of rent, which tends to be sticky from one month to the next.

The fed funds target is currently 2.25%-2.50%, following the Fed's 75-basis-point hike in July.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SBUX | $89.09 | 0.02 | 0.02 |

Starbucks is reinventing itself to modernize its stores to cut down the time it takes to deliver coffee. The $450 million of investment comes as sales by branded coffee shops recover to 96% of pre-pandemic levels.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TWTR | $42.17 | 0.76 | 1.85 |

Twitter Inc's shareholders have approved the contested buyout by billionaire Elon Musk. The move sets up a court battle next year over whether Musk can back out of the deal.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| EMN | $86.56 | -8.31 | -8.76 |

Eastman Chemical is lower Tuesday. The specialty materials company cut its adjusted earnings per share forecast to $2.00 from $2.46 and announced price increases.

“Demand has slowed more than expected in August and September, in particular in the consumer durables and building and construction end markets and the European and Asian regions,” said chair and CEO Mark Costa.

“At the same time, logistics have been challenged by an acceleration of marine logistics issues on the U.S. East Coast, particularly impacting high-value specialty products in Advanced Materials bound for other regions.”

Eastman will announce third-quarter 2022 financial results after the close of U.S. equities markets on Thursday, October 27.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HYMC | $1.01 | 0.21 | 27.04 |

| AMC | $9.54 | -0.68 | -6.67 |

| APE | $5.43 | -0.29 | -5.07 |

Hycroft Mining Holding is surging in Tuesday trading. The gold and silver development company that’s 22% owned by AMC Entertainment announced initial drill results from its 2022-2023 exploration program.

Alex Davidson, Vice President, Exploration commented, "These initial drill results confirm the higher-grade opportunities identified in the 2021 drill program. While we have only just begun investigating the planned targets of our 2022-23 drill program, these results are very encouraging and further confirm the importance of additional drilling to explore the untapped potential of the Hycroft deposit.”

| Symbol | Price | Change | %Change |

|---|---|---|---|

| APP | $26.91 | -1.60 | -5.61 |

| U | $37.40 | -4.91 | -11.60 |

Shares of Unity Software Inc fell 10% on Tuesday after AppLovin Corp withdrew its buyout offer for the gaming software maker, cementing Unity's planned purchase of ironSource Ltd.

Unity had last month rejected a $17.54 billion all-stock bid from AppLovin that included the condition its $4.4 billion pursuit of Tel Aviv-based ironSource cannot go ahead.

AppLovin, whose services compete with ironSource in helping developers grow and monetize their apps, said late on Monday it would not table a higher bid and had pulled its initial offer.

An acquisition would have helped AppLovin build machine-learning capabilities using Unity's platform that has been used for games such as "Pokemon Go." AppLovin now plans to focus on fast-growing categories such as connected TV and offerings for manufacturers.

Analysts, however, expect AppLovin to face strong competition from Unity and ironSouce's merger deal alongside a weakening mobile ad market.

"Without AppLovin's further involvement, Unity's merger with ironSource is likely to close, creating a stronger competitor to AppLovin soon," said Oppenheimer analyst Martin Yang.

The consumer price index increased 8.3% in August on an annual basis, a smaller figure than the 8.5percent increase for the period ending July, but higher than expectations.

The energy index increased 23.8 percent for the 12 months ending August, a smaller increase than the 32.9-percent increase for the period ending July. The food index increased 11.4 percent over the last year, the largest 12-month increase since the period ending May 1979.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VMW | $118.68 | 0.56 | 0.47 |

The U.S. Securities and Exchange Commission said on Monday it has charged cloud computing company VMware Inc with misleading investors by obscuring its financial performance.

The company was charged with misleading investors about its order backlog management practices, which the agency said enabled it to push revenue into future quarters by delaying product deliveries to customers, thereby concealing the company's slowing performance relative to its projections.

Without admitting or denying the findings in the SEC's order, VMware consented to a cease-and-desist order and will pay an $8 million penalty, the SEC said. VMware confirmed in a statement of its own that it reached a settlement with the SEC and agreed to pay the penalty without admitting or denying the SEC’s findings.

"VMware shifted tens of millions of dollars in revenue into future quarters, building a buffer in those periods and obscuring the company’s financial performance as its business slowed relative to projections in fiscal year 2020," the SEC said.

"Although VMware publicly disclosed that its backlog was 'managed based upon multiple considerations,' it did not reveal to investors that it used the backlog to manage the timing of the company’s revenue recognition," the regulator added.

In May, chipmaker Broadcom Inc said it will buy VMware in a $61 billion cash-and stock deal.

"The SEC Staff has confirmed that it does not intend to recommend enforcement action against any current or former VMware officers or other member of management in connection with the investigation, and this settlement concludes the matter," VMware said in its statement on Monday.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RENT | $4.93 | 0.45 | 10.04 |

Shares of Rent the Runway plunged more than 22% before the bell on Tuesday, as more Americans paused their subscription to the clothing rental firm as they feel the pinch of red-hot inflation.

Soaring prices of gasoline and groceries have forced shoppers to curb spending on apparel and other discretionary items, bruising sales of clothing companies that were just beginning to recover from pandemic lows amid easing supply chain issues.

Rent the Runway lowered its annual sales forecast late on Monday and said it would cut about 24% of its corporate workforce as it seeks to rein in costs.

Rent the Runway reported 124,131 active subscribers at the end of the second-quarter, down 8% from the prior three-month period, with the company blaming an increase in the number of people pausing or choosing to not renew their subscription. Active subscribers were still up 27% compared to a year earlier.

The company said while it saw subscriber numbers bounce back in August and September, it was still difficult to predict how consumers would behave given an uncertain macro backdrop.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in August on a seasonally adjusted basis after being unchanged in July, the U.S. Bureau of Labor Statistics reported today.

Over the last 12 months, the all items index increased 8.3% before seasonal adjustment, a smaller figure than the 8.5% increase for the period ending July.

Increases in the shelter, food, and medical care indexes were the largest of many contributors to the broad-based monthly all items increase. These increases were mostly offset by a 10.6% decline in the gasoline index. The food index continued to rise, increasing 0.8%over the month as the food at home index rose 0.7%.

The energy index fell 5.0% over the month as the gasoline index declined, but the electricity and natural gas indexes increased. The energy index increased 23.8 percent for the 12 months ending August, a smaller increase than the 32.9-percent increase for the period ending July.

Fund managers are "super bearish" with average allocations to cash at the highest since 2001 and allocation to global stocks at an all-time low, according to Bank of America's (BofA) monthly survey of global fund managers for September.

The results come even as MSCI's gauge of stocks around the world has rallied 3% so far in September, though after a bruising first half the index is still down 16% this year.

The survey also marks a return to doom and gloom after August's iteration found investors were bearish but no longer "apocalyptically" so.

BofA, which polled 212 investors overseeing $616 billion in assets from Sept. 2-8, said 72% of those surveyed said they expected a weaker economy next year, and the most crowded trade was long U.S. dollar.

The U.S. currency is typically seen as a safe haven in times of economic difficulty.

In contrast, investors were staying away from equities which typically rise in good times, and the survey found investors had a record underweight position in stocks.

They found the net percentage of investors who said they were overweight stocks was -52% compared to -26% the previous month, a lower level than during the financial crisis.

Cryptocurrency prices were mixed early Tuesday, with Bitcoin and Dogecoin lower and Ethereum higher.

At approximately 4:30 a.m. ET, Bitcoin was trading at more than $22,275 (-0.30%), or lower by about $71. For the week, Bitcoin was trading higher by more than 12.6%. For the month, the cryptocurrency was lower by more than 8.35%.

Ethereum was trading at approximately $1,715 (+0.40%), or higher by $6.90.

For the week, Ethereum was trading higher by nearly 5.2%. For the month, it was trading lower by 12.75%.

Dogecoin was trading at $0.063672 (-0.05%), or lower by approximately $0.000029.

For the week, Dogecoin was higher by more than 1.15%. For the month, the crypto was lower by nearly 11.85%.

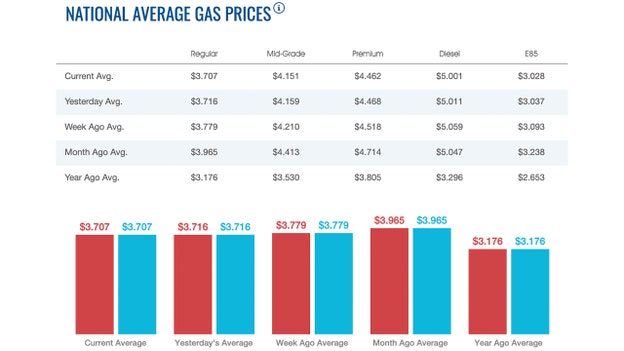

The average price of a gallon of gasoline nationwide Tuesday was $3.707. On Monday, the price was $3.716. On Sunday, the price was $3.718, according to AAA.

Gas has been on the decline since hitting a high of $5.016 on June 14, nearly 13 weeks ago.

A week ago, the nationwide average price for a gallon of gasoline was $3.779 A month ago, that same gallon of gasoline cost $3.965. A year ago, a gallon of gasoline cost $3.176.

Analysts and traders say wholesale gasoline prices are expected to keep falling in coming months as U.S. refiners overproduce fuel to try to rebuild low stocks of diesel and heating oil.

The price of a gallon of diesel Tuesday cost $5.001 On Monday, the price was $5.011. On Sunday, the price was $5.013 per gallon.

A week ago, the nationwide average price for a gallon of diesel sold for $5.059. A month ago, that same gallon of diesel cost $5.047. A year ago, a gallon of diesel cost $3.296.

Inflation likely slowed in August for the second consecutive month. Still, consumer prices are expected to remain painfully high, keeping the pressure on the Federal Reserve to go big at its policy-setting meeting next week.

The Labor Department is releasing the highly anticipated consumer price index report on Tuesday morning, providing a fresh look at how hot inflation ran in August.

Economists expect the gauge, which measures a basket of goods, including gasoline, health care, groceries and rent, to show that prices surged 8.0% in August from the previous year — down from the 8.5% reading in July and a marked decline from the 40-year high of 9.1% notched in June.

On a monthly basis, inflation is projected to have decreased by 0.1%. Still, the report is expected to show underlying momentum in inflation: core prices, which exclude the more volatile measurements of food and energy, are expected to climb 6.0% annually, snapping a four-month streak of slowing growth and marking the fastest pace since April.

On a monthly basis, prices likely climbed 0.3%, driven by prices in areas like housing and rent. Fueling the price spikes are several issues related to the COVID-19 pandemic and the rousing economic rebound from the worst downturn in nearly a century.

In the wake of lockdown orders that saw a broad swath of the country shuttered, the economy staged a stunning comeback, powered by unprecedented government spending, emergency steps by the Fed, and the widespread distribution of vaccines.

As Americans — flush with stimulus cash — ventured out to shop, eat and travel, businesses struggled to meet the demand, reporting difficulties in onboarding new employees and buying enough supplies to satisfy the need.

To attract new talent, many businesses hiked wages — but to offset those increases, employers have reported raising the prices of their products. The matter was complicated by bottlenecks at ports and freight yards and a lack of shipping containers, snarling the global supply chain.

Since early spring, however, the Russian war in Ukraine has further exacerbated the inflation crisis by elevating food and energy prices.

Oil and gasoline prices have declined sharply over the summer, although economists have cautioned the situation remains uncertain due to the ongoing conflict in Europe.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,381.34 | 229.63 | 0.71 |

| SP500 | $4,110.41 | 43.05 | 1.06 |

| I:COMP | $12,266.41 | 154.10 | 1.27 |

U.S. stocks were posting solid gains early Tuesday morning as investors and Fed officials await the release of August’s Consumer Price Index report by the Bureau of Labor Statistics in the morning.

Stocks were looking to build on gains Monday by the S&P 500, which gained 43.05 points, or 1.1%, to 4110.41 after it closed higher for the week on Friday. The Dow Jones Industrial Average added 229.63, or 0.7%, to 32381.34, while the technology-heavy Nasdaq Composite climbed 154.10, or 1.3%, to 12266.41.

All three indexes logged their fourth consecutive trading day of advances. Indexes have charted a steady rise in recent sessions as concerns about large interest-rate hikes have been alleviated. Tumbling commodity prices have lifted hopes that the worst of inflation has passed.

Meanwhile, the labor market has remained a key source of economic strength. Gauges of business activity have been stronger than expected.

On Wednesday, the U.S. government is due to report August inflation at the wholesale level.

Fed officials have affirmed support for substantial rate hikes and to keep borrowing costs elevated for long enough to make sure inflation is extinguished. Investors hope receding inflation pressures might prompt the Fed to back off.

Similar hopes earlier were dashed when chair Jerome Powell said in August that rates would stay high. Surveys show traders expect the Fed this month to raise rates for the fifth time this year and by 0.75 percentage points, three times its usual margin. Then, traders expect the U.S. central bank to hold rates steady through the first half of 2023.

Meanwhile, Asian stocks followed Wall Street higher on Tuesday.

Shanghai, Tokyo, Hong Kong and Sydney advanced.

The Shanghai Composite Index gained less than 0.1% to 3,253.92 and the Nikkei 225 in Tokyo added 0.2% to 28,614.53. The Hang Seng in Hong Kong rose 0.4% to 19,442.89. The Kospi in Seoul soared 2.9% to 2,452.69 and Sydney's S&P-ASX 200 rose 0.7% to 7,013.70.

India's Sensex opened up 0.6% at 60,504.83. New Zealand declined while Southeast Asian markets gained.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $72.37 | 1.27 | 1.79 |

| CVX | $162.50 | 2.53 | 1.58 |

| XOM | $97.61 | 1.11 | 1.15 |

Oil prices rose in volatile trade on Tuesday as worries about tight fuel supplies ahead of winter offset investor concerns about lower demand in China, the world's biggest crude importer, and further increases in U.S. and European interest rates.

Brent crude had risen 50 cents, or 0.5%, to $94.50 a barrel by 0644 GMT, while WTI crude increased by 52 cents, or 0.6%, to $88.30 a barrel. Both contracts fell by more than $1 earlier in the session.

Worries over tighter inventories continue to support prices. In the United States, the Strategic Petroleum Reserve (SPR) fell 8.4 million barrels to 434.1 million barrels in the week ended Sept. 9, the lowest since October 1984, according to data released on Monday by the Department of Energy.

President Joe Biden in March set a plan to release 1 million barrels per day over six months from the SPR to tackle high U.S. fuel prices, which have contributed to inflation.

U.S. commercial oil stocks are expected to have fallen for five weeks in a row, dropping by around 200,000 barrels in the week to Sept. 9, a preliminary Reuters poll showed on Monday.

The American Petroleum Institute (API), an industry group, will issue its inventory report at 4:30 p.m. EDT (2030 GMT) on Tuesday.

The U.S. Energy Information Administration (EIA) reports at 10:30 a.m. EDT (1430 GMT) on Wednesday.

Prospects for a revival of the West's nuclear deal with Iran remained dim. Germany expressed regret on Monday that Tehran had not responded positively to European proposals to revive the 2015 agreement. U.S. Secretary of State Antony Blinken said that an agreement would be unlikely in the near term.

Capping gains on oil prices on Tuesday were renewed concerns about lower global fuel demand, as China, the world's second-largest oil consumer, continues to impose COVID-19 curbs.

The number of trips taken over China's three-day Mid-Autumn Festival holiday shrank, with tourism revenue also falling, official data showed, as strict COVID-19 rules discouraged people from travelling.

Live Coverage begins here