STOCK MARKET NEWS: Stocks rebound on wholesale price report, Amtrak cancels long-distance routes

US stocks rebounded from Tuesday’s losses, closing fractionally higher as investors weigh economic reports ahead of next week's Fed meeting. Amtrak cancels long-distance routes ahead of a possible rail strike. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

The Senior Citizen League estimates the Social Security cost-of-living adjustment (COLA) for 2023 will be: 8.7%, based on consumer price data through August. A COLA of 8.7% would increase the average retiree benefit of $1,656 by $144.10 (rounded as done by SSA).

A COLA of 8.7% is extremely rare and would be the highest ever received by most Social Security beneficiaries alive today. There were only three other times since the start of automatic adjustments that it was higher (1979-1981).

District 19 members of the International Association of Machinists and Aerospace Workers have voted against accepting the railroad deal proposed by a Presidential Emergency Board (PEB) appointed by President Biden.

Union leaders had signed on to the agreement, which requires ratification by members.

IAM District 19 represents Locomotive Machinists, Track Equipment Mechanics and Facility Maintenance Personnel at NCCC freight rail carriers.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TWLO | $74.83 | 3.96 | 5.59 |

Twilio gained more than 10% Wednesday. The cloud communications platform will cut 11% of its current workforce, incurring approximately $70-$90 million in restructuring charges, the company said in a regulatory filing.

The company reaffirmed its guidance for the fiscal third quarter.

Amtrak has begun to make initial service adjustments in response to a possible freight railroad service interruption that could occur later this week.

In the Northeast, between Boston, New York and Washington there will be no impact to Acela, and only minimal changes are expected to Northeast Regional services. In addition, Empire Service between New York and Albany; Keystone Service between New York and Harrisburg, Pa.; the Amtrak Hartford Line between New Haven, Conn. and Springfield, Mass.; and the Downeaster between Boston and Brunswick, Maine will not be impacted.

US stocks rebounded from Tuesday’s losses, closing fractionally higher as investors balanced two recent economic reports against bets on what action the Federal Reserve will take on interest rates next week.

The CME FedWatch tool is predicting about a 25% chance of a 100 basis point increase and a 75% chance of a 75 basis point hike.

Wholesale price inflation moderated for a second month in August, coming in at a lower than anticipated 8.7% on an annual basis. Meantime, a report on consumer prices Tuesday rattled stocks. The consumer price index rose 8.3%, surprising economists.

The S&P 500 gained 0.34%, to end at 3,946.01 points, while the Nasdaq Composite added 0.74%, to 11,719.68. The Dow Jones Industrial Average rose 0.1%, to 31,135.09.

The yield on two-year Treasuries rose 0.028 percentage point to 3.782% today, a 52-week high. The 10-year note declined 0.011 percentage point to 3.411%.

Nymex Crude for October delivery gained $1.17 per barrel, or 1.34% to $88.48 today.

Extreme weather conditions are threatening to push food prices higher, said Wells Fargo. Food prices are already outpacing the overall increase in inflation, increasing 11.4% in August compared to 8.3% for all items.

The severe drought in the West and Midwest are cutting yields and quality while Russia’s war in Ukraine has led to sharp increases in fertilizer and diesel fuel costs.

U.S, small businesses are changing traditional business methods to grow, according to the latest Small Business Recovery Report by Kabbage from American Express.

The report finds businesses surveyed have nearly doubled revenue year-over-year between July 2021 and July 2022 while profits remained flat amidst economic hurdles.

In response, companies are facilitating growth by modifying their business tactics — offering increased benefits and flexibility for workers along with investing in digital transformation.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| EQT | $50.86 | 2.95 | 6.16 |

| KMI | $18.51 | 0.34 | 1.87 |

| LNG | $173.04 | 7.37 | 4.45 |

NYMEX natural gas for October delivery is trading higher. The Energy Information Administration predicts record U.S. natural gas consumption in 20222.

Natural gas consumption is expected to increase by 3.6 billion cubic feet per day (Bcf/d) to average 86.6 Bcf/d for the year, the most on record.

Use by the electric power sector is predicted to grow by 4% in 2022 to 32.1 Bcf/d, exceeding the 2020 record by 1%, which is the highest growth rate among all sectors. he electric power sector uses more natural gas than any other U.S. end-use sector.

The co-founder of Terraform Labs is wanted for violating South Korea’s Capital Markets Act. A South Korean court issued arrest warrants for five people, including Do Kwon, Coindesk reported, citing the financial crimes unit of the Supreme Prosecutors' Office.

The summons come following the collapse of Terra and its stablecoin UST. The disintegration lead to the bankruptcy of Three Arrows Capital, a Singapore-based hedge fund with significant exposure to the Terra Network, Coindesk reported.

U.S. stocks opened higher Wednesday after a report on wholesale prices came in lower than expected.

The Dow Jones Industrial Average rose 36.05 points, or 0.12%, at the open to 31,141.02.The S&P 500 opened higher by 8.04 points, or 0.20%, at 3,940.73, while the Nasdaq Composite gained 46.83 points, or 0.40%, to 11,680.41 at the opening bell.

U.S. producer prices fell for second straight month in August as the cost of gasoline declined further, resulting in the smallest annual increase in a year, which could allay fears of inflation becoming entrenched.

All three major U.S. stock indexes notched their biggest one-day percentage declines since June 2020 on Tuesday after a hot consumer price index report cemented bets that the Federal Reserve could go ahead with the third straight 75 basis points increase in rates next week.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GOOG | $105.31 | -6.56 | -5.86 |

Google suffered one of its biggest setbacks on Wednesday when a top European court fined it 4.125 billion euros ($4.13 billion) for using its Android mobile operating system to thwart rivals, offering a precedent for other regulators to ratchet up pressure.

The unit of U.S. tech giant Alphabet had challenged an earlier ruling, but the decision was broadly upheld by the Europe's second-highest court in Wednesday's ruling and the fine was reduced only modestly from 4.34 billion euros.

It is a record fine for an antitrust violation. The EU antitrust enforcer has imposed a total of 8.25 billion euros in antitrust fines on the world's most popular internet search engine in three investigations stretching back more than a decade.

This is the second court defeat for Google which lost its challenge to a 2.42 billion euro ($2.42 billion) fine last year, the first of a trio of cases.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NRBO | $29.90 | 13.23 | 79.32 |

NeuroBo Pharmaceuticals is trading lower. The clinical-stage biotechnology company announced a 1-for-30 reverse split of its common stock.

Any fractional shares created as a result of the reverse stock split will be rounded down to the next whole share and the stockholder will receive cash equal to the market value of the fractional share.

The number of authorized shares of the company's common stock will remain at 100 million, while the number of outstanding shares will be reduced from approximately 26.7 million to approximately 0.9 million.

NeuroBo Pharmaceuticals focuses on developing and commercializing multimodal disease-modifying therapies for viral, neuropathic and neurodegenerative diseases.

U.S. wholesale prices fell 0.1% in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported.

Final demand prices decreased 0.4% in July and advanced 1.0% in June. On an unadjusted basis, the index for final demand moved up 8.7% for the 12 months ended in August.

In August, the decrease in the index for final demand is attributable to a 1.2% decline in prices for final demand goods. In contrast, the index for final demand services advanced 0.4%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ADTX | $0.37 | 0.20 | 113.75 |

Aditxt is trading higher. The biotech innovation company announced a 1-for-50 reverse stock split effective pre-market opening on September 14, 2022As a result of the reverse stock split, every 50 shares of issued and outstanding common stock will be exchanged for one share of common stock, with any fractional shares being rounded up to the next higher whole share. Immediately after the reverse stock split becomes effective, the Company will have approximately 1,156,674 shares of common stock issued and outstanding.

The reverse stock split is primarily intended to bring the company into compliance with Nasdaq’s $1.00 per share minimum bid price requirement for continued listing.

Aditxt focuses on developing and commercializing technologies related to monitoring and modulating the immune system.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $31,104.97 | -1,276.37 | -3.94 |

| SP500 | $3,932.69 | -,177.72 | -4.32 |

| I:COMP | $11,633.57 | -,632.84 | -5.16 |

U.S. stock index futures slipped on Wednesday after a sharp selloff on Wall Street in the previous session on rate hike jitters, while investors waited for more inflation data for cues on the pace of monetary policy tightening.

The three major U.S. stock indexes on Tuesday notched their biggest one-day percentage declines since June 2020 after an unexpectedly hot consumer price index report cemented bets that the Federal Reserve would go ahead with the third straight 75 basis points increase in rates next week.

Markets are currently pricing in a 37% chance of a massive 100 bps increase by the central bank, a view echoed by analysts at Nomura, and expects rates to peak at 4.34% by March 2023.

All 30 stocks in the Dow Jones Industrial Average declined, as did all 11 sectors in the S&P 500. Only five stocks in the broad benchmark finished the session in the green.

The Dow fell 1276.37 points, or 3.9%, to 31104.97. The S&P 500 declined 177.72 points, or 4.3%, to 3932.69. The Nasdaq Composite slid 632.84 points, or 5.2%, to 11633.57. All three indexes posted their steepest one-day losses since June 11, 2020.

The declines left the Dow industrials down 14% in 2022, while the S&P 500 has lost 17% and the Nasdaq Composite has retreated 26%.

Investors had eagerly anticipated Tuesday's release of the consumer-price index, which provided a last major look at inflation before the central bank's interest-rate-setting committee meets next week.

Expectations for the path of monetary policy have held sway over the markets as investors factor higher rates into asset prices and try to project how well the economy will hold up as rates rise.

Analysts had hoped officials would consider easing their pace of interest-rate increases if data continued to show inflation subsiding. The data undercut those hopes, seeming to settle the case for the Fed to raise rates by at least 0.75 percentage point next week.

After the report's release release, stock futures fell, bond yields rose and the dollar rallied. Traders began to consider the possibility that the central bank will raise interest rates by a full percentage point next week.

Fed Chairman Jerome Powell said earlier this month that the central bank is squarely focused on bringing down high inflation to prevent it from becoming entrenched as it did in the 1970s.

With Tuesday's declines, the S&P 500 is up 7.3% from its June low. While investors broadly expect volatility to continue shaking the stock market, some suspect the economy remains strong enough to avert a major leg lower from here.

Meanwhile, Asian stocks were lower Wednesday.

Hong Kong’s Hang Seng index lost 2.6% to 18,831.88 and the Shanghai Composite index declined 0.9%, to 3,234.18. Tokyo’s benchmark Nikkei 225 lost 2.2% to 27,991.82, while Sydney’s S&P/ASX 200 declined 2.4% to 6,839.50. In Seoul, the Kospi lost 1.5% to 2,414.26.

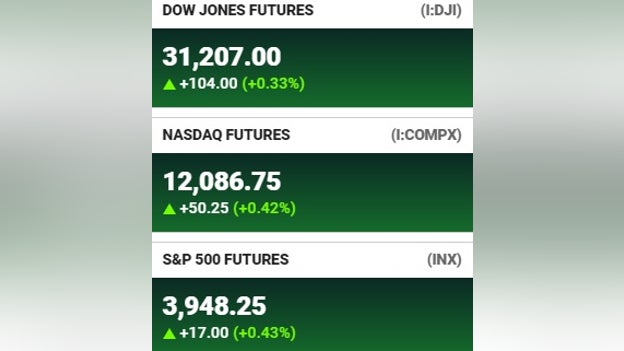

U.S. equity futures are higher on Wednesday after hotter-than-expected inflation data led to a sell-off in the previous trading session.

The Dow Jones Industrial Average is up about 100 points, or 0.33%, while the S&P 500 and Nasdaq Composite climbed 0.43% and 0.42% respectively.

On Tuesday, the Dow tumbled more than 1,200 points while the S&P 500 slid 4% for the worst day this year and the Nasdaq lost 5%.

The Labor Department said Tuesday that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 8.3% in August from a year ago. Prices climbed 0.1% in the one-month period from July.

Cryptocurrency prices were higher early Wednesday.

At approximately 4:45 a.m. ET, Bitcoin was trading at more than $20,350 (+0.93%), or higher by about $188.

For the week, Bitcoin was trading higher by nearly 7%. For the month, however, the cryptocurrency was lower by almost 17.5%.

Ethereum was trading at approximately $1,601 (+1.71%), or higher by nearly $27.50.

For the week, Ethereum was trading higher by nearly 0.7%. For the month, it was trading lower by approximately 20.5%.

Dogecoin was trading at $0.0600523 (+1.59%), or higher by approximately $0.000949.

For the week, Dogecoin was higher by more than 0.8%. For the month, the crypto was lower by nearly 18.25%.

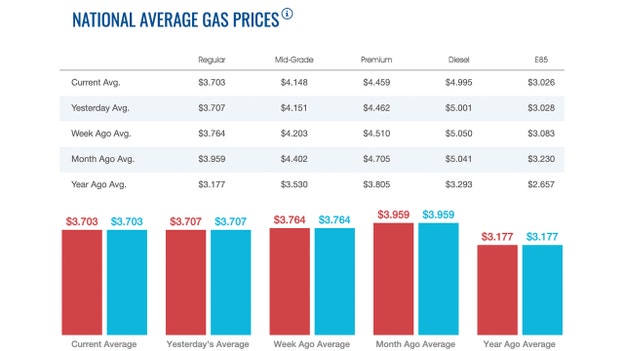

The average price of a gallon of gasoline nationwide Wednesday was $3.703. On Tuesday, the price was $3.707. On Monday, the price was $3.716, according to AAA.

Gas has been on the decline since hitting a high of $5.016 on June 14, 13 weeks ago.

A week ago, the nationwide average price for a gallon of gasoline was $3.764. A month ago, that same gallon of gasoline cost $3.959. A year ago, a gallon of gasoline cost $3.177.

Analysts and traders say wholesale gasoline prices are expected to keep falling in coming months as U.S. refiners overproduce fuel to try to rebuild low stocks of diesel and heating oil.

The price of a gallon of diesel dropped below $5 Wednesday, settling at $4.995. On Tuesday, that same gallon of diesel cost $5.001. On Monday, the price was $5.011.

A week ago, the nationwide average price for a gallon of diesel sold for $5.05. A month ago, that same gallon of diesel cost $5.041. A year ago, a gallon of diesel cost $3.293.

As the Biden administration scrambles with just days to avert a rail strike that threatens to deal a devastating blow to the economy, the White House is facing pressure on multiple fronts as it weighs the political ramifications of a shutdown.

A strike could come as early as just after midnight on Friday if a deal isn't reached ahead of that time between major rail companies and the four unions that have not agreed to the current proposal put forth by the presidential emergency board (PEB) appointed by President Biden.

Labor Secretary Marty Walsh is now involved in the talks, and President Biden himself has reached out to parties involved. But if negotiations are not successful by the deadline, a strike or lockout could be triggered.

According to the Association of American Railroads (AAR), a shutdown would be absolutely devastating, costing upward of $2 billion per day and kneecapping an already fragile supply chain while hurting businesses and consumers alike.

What's worse, other transportation modes can't keep up: the AAR says it would take roughly 467,000 long-haul trucks to pick up the slack, an unlikely prospect given that there is already a shortage of 80,000 truckers in the industry today.

With high stakes, Congress is expected to get involved if a strike is triggered. But that introduces further complications. Whether a strike occurs, the timing of the impasse could hurt the administration and Democrats as a whole, putting vulnerable lawmakers in a tough spot ahead of the upcoming midterm elections in November.

Marc Scribner, a senior transportation policy analyst at the Reason Foundation, says the timing of the potential strike was coordinated and may not help the administration.

"That this might occur right before the midterm elections is entirely self-inflicted by the Biden administration, where two of President Biden's National Mediation Board [NMB] members took the bizarre step in June of terminating board-guided mediation two months early and starting the 90-day countdown to a possible rail strike," Scribner told FOX Business, calling the move "unprecedented."

If the NMB had stuck to the original schedule, Scribner says, the cooling-off period would have ended in mid-November. But instead, the board decided to cut things short.

"This was clearly designed to force a flash right before the midterm elections," Scribner argues, speculating that the administration knows it could rely on a Congress with unified Democratic control.

He added, "But I don't think they thought it through all that well because that puts a lot of pressure on Democrats facing tough races."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $72.01 | -0.36 | -0.50 |

| CVX | $159.41 | -3.09 | -1.90 |

| XOM | $95.33 | -2.28 | -2.34 |

Oil prices inched lower on Wednesday on concerns of another U.S. Federal Reserve interest rate hike next week after consumer prices unexpectedly rose in August, outweighing support from a robust OPEC oil demand growth forecast.

Brent crude futures fell 17 cents, or 0.2%, to $93.00 a barrel by 0633 GMT. U.S. West Texas Intermediate crude was at $87.20 a barrel, down 11 cents, or 0.1%.

Pressuring prices was a hotter-than-expected U.S. inflation report on Tuesday that dashed hopes the Fed could scale back its rate policy tightening in the coming months.

Fed officials are set to meet next Tuesday and Wednesday, with inflation remaining way above the U.S. central bank's 2% target.

In China, tough ongoing COVID-19 curbs are squeezing fuel demand at the world's largest oil importer.

"China's zero-COVID policy remains intact and that will keep any rebounds that emerge over the coming weeks capped," said Edward Moya, a senior market analyst at OANDA, in a note.

On the supply side, U.S. crude stocks rose by about 6 million barrels for the week ended Sept. 9, according to market sources citing American Petroleum Institute figures on Wednesday.

The U.S. government will release inventory data at 10:30 a.m. ET Wednesday.

Lending some support to oil prices, the Organization of the Petroleum Exporting Countries (OPEC) on Tuesday reiterated forecasts for growth in global oil demand in 2022 and 2023, citing signs that major economies were faring better than expected despite headwinds such as surging inflation.

Oil demand will increase by 3.1 million barrels per day (bpd) in 2022 and by 2.7 million bpd in 2023, OPEC said in a monthly report, leaving its forecasts unchanged from last month.

Live Coverage begins here