STOCK MARKET NEWS: Stocks gain as 10-year Treasury yield spikes, homebuilders in focus

Stocks saw choppy trading, bond yields spike as investors brace for another expected rate hike by the Federal Reserve later in week. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Nissan is recalling as many as 203,000 pickup trucks over concern they could roll away while parked, the National Highway Traffic Safety Administration said.

The recall covers 2020-2023 model year Titans and Frontiers equipped with 9-speed transmissions.

In June, Nissan recalled Nissan Titan and Frontier vehicles manufactured from December 13, 2019 to June 14, 2022 due to potential non-engagement of the parking pawl.

The automaker then received a report of a 2022 Frontier that moved after being placed in the “P” Park position.

Following an investigation that suggested the issue may be different from the prior recall, the automaker decided to conduct a new recall campaign due to the safety risk of a potential rollaway condition after parking the vehicle. Nissan’s investigation is ongoing, and the final recall remedy is still under development. At this time, Nissan is not aware of any confirmed field incidents to date related to the subject condition.

Auto news website Jalopnik reported the recall Friday.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UBER | $31.49 | -0.44 | -1.38 |

Uber Technologies Inc said on Monday a hacker affiliated with the Lapsus$ hacking group was responsible for a cyber attack that forced the ride-hailing company to shut several internal communications temporarily last week.

Uber said the attacker had not accessed any user accounts and the databases that store sensitive user information such as credit card numbers, bank account or trip details.

"The attacker accessed several internal systems, and our investigation has focused on determining whether there was any material impact," Uber said, adding that investigation was still ongoing.

The company said it was in close coordination with the FBI and the U.S. Department of Justice on the matter.

Friday's cybersecurity incident had brought down Uber's internal communication system for a while and employees were restricted to use Salesforce-owned office messaging app Slack.

Uber said the attacker logged in to a contractor's Uber account after they accepted a two-factor login approval request following multiple requests, giving the hacker access to several employee accounts and tools such as G-Suite and Slack.

The hacking group, Lapsus$, has targeted firms including Nvidia, Microsoft Corp and Okta Inc, an authentication services company relied on by thousands of major businesses.

Lapsus$ could not be immediately reached for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $14.93 | 0.21 | 1.43 |

Ford Motor is reaffirming its full year adjusted earnings before interest and tax (EBIT) guidance of between $11.5 billion to $12.5 billion, despite limits on availability of certain parts as well as higher payments made to suppliers to account for the effects of inflation.

The second largest US-based automaker said supply shortages will result in a higher-than-planned number of “vehicles on wheels” built but remaining in Ford’s inventory awaiting needed parts, at the end of the third quarter.

The company believes that those vehicles — an anticipated 40,000 to 45,000 of them, largely high margin trucks and SUVs — will be completed and sold to dealers during the fourth quarter.

Inflation-related supplier costs during the third quarter will run about $1.0 billion higher than originally expected.

The U.S. Energy Department said on Monday it will sell up to 10 million barrels of oil from the Strategic Petroleum Reserve, for delivery in November, extending the timing of a plan to sell 180 million barrels from the stockpile to tame fuel prices.

President Joe Biden's plan announced in March of the largest release of oil from SPR in history had aimed to sell 180 million barrels by the end of October. So far, only 155 million barrels have been sold and the next sale will bring the total to 165 million barrels, the department said.

The sale will be of oil low in sulfur, known as sweet crude, from the SPR's sites in Big Hill, Texas and West Hackberry, Louisiana. Contracts will be awarded no later than Oct. 7. The SPR holds oil in heavily-guarded former salt caverns along the Gulf of Mexico coast.

There is no date set for selling a full 180 million barrels.

High gasoline prices have been a vulnerability for the Biden administration and the deliveries will take place in the same month as the Nov. 8 midterm elections in which the president's fellow Democrats hope to keep control of Congress. U.S. gasoline pump prices have fallen from above $5.00 a gallon in June to about $3.68 today.

The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite closed higher across the board Monday after bouncing between losses and gains for most of the session. Investors are counting down to another expected rate hike by the Federal Reserve on Wednesday. In commodities, oil edged up to $85.73 per barrel.

Ark Invest’s Cathie Wood and billionaire Elon Musk warn that another interest rate hike from the Federal Reserve could unleash deflation.

The two took to Twitter Monday to say the Biden administration should not look to the 1970s for clues on how to battle inflation.

Shoppers will no longer be able to use Wegmans Food Markets popular self-checkout app. The grocery chain has discontinued the tool that allows customers to scan and bag items as they shop.

"Unfortunately, the losses we are experiencing prevent us from continuing to make it available in its current state," Wegmans told FOX Business.

Wegmans operates a total of 107 stores in New York, Pennsylvania, Virginia, New Jersey, Maryland, Massachusetts and North Carolina.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GBL | $17.77 | -2.25 | -11.24 |

GAMCO Investors is lower Monday. The investment advisor and broker is moving to the OTCQX platform from the New York Stock Exchange (NYSE), the firm said in a regulatory filing.

The firm formally known as Gabelli Asset Management filed a formal notice with the NYSE to voluntarily delist shares. The last day of trading on the NYSE will be October 6.

GAMCO’s board determined that the burdens associated with operating as a registered public company outweigh any advantages to the company and its stockholders.

The decision was based on careful review of numerous factors, including

• the significant cost savings of no longer preparing and filing periodic reports with the Securities and Exchange Commission;

• the reduction of significant legal, audit and other costs associated with being a reporting company; as well as

• substantial costs and demands on management’s time under the Sarbanes-Oxley Act of 2002, SEC rules and NYSE listing standards.

GAMCO will continue to provide information to its stockholders and to take such actions to enable a trading market in its common stock to exist.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WIX | $83.24 | 9.55 | 12.96 |

| GDDY | $75.37 | 0.41 | 0.55 |

Starboard Value LP has built a 9% stake in website development platform Wix.com Ltd, the activist hedge fund disclosed in a regulatory filing on Friday.

Starboard had been building the stake, and spoke to Wix about how it can improve operations, Reuters reported earlier in the day, citing sources familiar with the matter.

Wix has been struggling with losses since the fourth quarter of 2021 amid a slowdown in e-commerce driven by rampant inflation and people making fewer purchases online in the wake of the COVID-19 pandemic. It has adopted a three-year cost-cutting program in a bid to boost its ailing stock price.

Starboard supports Wix's bid to become profitable and believes the company has a significant opportunity to improve its margins and grow further, sources said.

The fund has been discussing its ideas with Wix's management and is not seeking board seats at this time, the sources added. Details of Starboard's suggestions to Wix could not be learned.

The sources requested anonymity because the matter is confidential. Wix and Starboard did not immediately respond to requests for comment.

Wix, an Israel-based company whose stock is listed in the United States, has a market value of roughly $4.4 billion. Its shares have lost 54% of their value this year on concerns about clients not paying enough for its products.

Wix has announced cost cuts it projects will save $150 million a year and grow its profit margins. The company also authorized a $500-million share buyback program.

Starboard is also an investor in another website development services company, GoDaddy Inc, where it amassed a stake last year.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CP | $73.80 | 0.60 | 0.82 |

| CSX | $29.60 | 0.11 | 0.37 |

| UNP | $214.24 | 2.24 | 1.06 |

| NSC | $234.87 | 0.89 | 0.38 |

The tentative deal between railroads and their unions may not have ended the threat of a strike. Union members must approve the agreement reached by their leaders.

Members of the International Association of Machinists and Aerospace Workers District 19 have already rejected the pact, although they agreed to postpone a strike until Sept. 29 to allow more time for negotiations and to allow other unions to vote.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $307.10 | 3.75 | 1.24 |

Tesla completed a project to expand production capacity at its Shanghai plant on Monday, according to a statement on a Shanghai government platform for companies' environmental information disclosures.

Tesla will test the production lines for the upgrade during From Sept. 19 to Nov. 30, the statement added.

Reuters previously reported Tesla had been ramping up its output to reach a target of producing around 22,000 units of Model 3 and Model Y cars per week at the Shanghai plant.

Tesla did not respond to a Reuters request for comment.

The U.S. automaker planned to invest up to 1.2 billion yuan ($170 million) to expand production capacity at its Shanghai factory that would allow it to employ 4,000 more people at the site, state-backed Beijing Daily newspaper reported last November.

The project was originally expected to be finished in April, the Chinese media reported then.($1 = 7.0169 Chinese yuan renminbi)

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RL | $95.84 | 2.35 | 2.51 |

Ralph Lauren shares are higher in Monday trading. The luxury fashion company expects revenue growth to accelerate over the next three fiscal years to compound annual growth rate (CAGR) of mid- to high-single digits in constant currency.

Operating margin is expected to expand to at least 15% by Fiscal 2025 in constant currency, driven by a combination of modest gross margin expansion and operating expense leverage balanced with continued investments in the Company’s long-term strategic priorities.

The owner of brands including Chaps, Lauren and Polo is also raising its quarterly dividend by 9% to $0.75 per share at the beginning of Fiscal 2023, representing an annual dividend of $3.00 per share.

The company plans to return approximately $2 billion on a cumulative basis through fiscal 2025 through its regular quarterly cash dividends and share repurchases, subject to the authorization of its board and overall business and market conditions.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VWAPY | $14.52 | -0.18 | -1.22 |

| POAHY | $6.79 | 0.12 | 1.80 |

Volkswagen shares dipped on Monday as investors gave a muted reaction to news the automaker is targeting a valuation of up to 75 billion euros ($75 billion) for sports car brand Porsche, in what could be Europe's third biggest IPO ever.

Porsche aims to win over investors with its track record of success and high margins, even as shares of other luxury carmakers like Ferrari and Aston Martin have suffered this year in the tumult on European stock markets.

Uncertainties around governance of the two companies and the strong grip of Volkswagen's top investors on strategy at both could explain the lack of enthusiasm from markets, Ingo Speich, head of sustainability and corporate governance at top-20 Volkswagen investor Deka Investment, said.

The valuation announced on Sunday for Porsche AG of 70 billion-75 billion euros is slightly below some investors' estimates of up to 85 billion euros, but still far outstrips the valuation of other German carmakers like BMW's 49 billion euros or Mercedes-Benz' 61 billion.

It also comes close to Volkswagen's own market capitalization of 88 billion euros.

Shares in Porsche SE, Volkswagen's largest shareholder which will take a big stake in Porsche AG, were 2.42% higher, topping Germany's DAX blue-chip index.

Volkswagen said on Sunday it would price preferred shares in the flotation of Porsche AG at 76.50-82.50 euros per share.

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index of builder sentiment fell for the ninth straight month in September as the combination of elevated interest rates, persistent building material supply chain disruptions and high home prices continue to take a toll on affordability.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TOL | $44.71 | 1.05 | 2.40 |

| LEN | $77.74 | 1.95 | 2.57 |

| DHI | $72.80 | 1.68 | 2.36 |

| KBH | $29.00 | 0.63 | 2.22 |

U.S. stocks fell across the board as investors look ahead to the Federal Reserve’s expected rate hike on Wednesday. This as the 10-year Treasury yield spiked to 3.5%, the highest level since 2011. In commodities, oil fell 2% to the $81 per barrel level.

U.S. equity futures are lower on Monday as investors await the Federal Reserve's two-day policy meeting later this week.

Dow Jones Industrial Average futures are down 283 points, or 0.92%, while the S&P 500 and Nasdaq Composite fell 0.92% and 1%, respectively.

Oil prices also slumped on Monday, with West Texas Intermediate crude futures trading at $82.75 a barrel and Brent crude futures trading at about $89.25 per barrel.

Meanwhile, the 10-year Treasury yield rose to 3.5% for the first time since 2011.

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin were all lower early Wednesday.

At approximately 4:30 a.m. ET, Bitcoin was trading at more than $18,477 (-4.78%), or lower by more than $925. For the week, Bitcoin was trading lower by nearly 11%. For the month, the cryptocurrency was almost 16.5%.

Ethereum was trading at approximately $1,300 (-2.33%), or lower by nearly $31. For the week, Ethereum was trading lower by nearly 24.5%. For the month, it was trading lower by approximately 28%.

Dogecoin was trading at $0.056449 (-1.77%), or lower by approximately $0.001019. For the week, Dogecoin was lower by nearly 10%. For the month, the crypto was lower by nearly 23.3%.

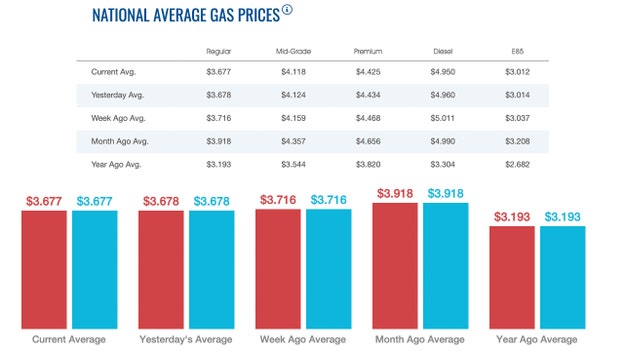

The average price of a gallon of gasoline dropped slightly to $3.677 early Monday morning. The price on Sunday was $3.678, according to AAA. Saturday's price was $3.682.

Gas has been on the decline since hitting a high of $5.016 on June 14, nearly 14 weeks ago. One week ago, the nationwide average for a gallon of gasoline was $3.716. A month ago, that same gallon of gasoline was $3.918. One year ago, a gallon of gasoline sold for $3.193.

Diesel's price early Monday morning was $4.95. On Sunday, the price was $4.96 per gallon.

One week ago, the nationwide average for a gallon of diesel was $5.011. A month ago, that same gallon of diesel was $4.99. One year ago, a gallon of diesel sold for $3.304.

Stubborn inflation continues to bring pain as it chips away at consumers' buying power, but the impact could be more far-reaching as the high cost of living upends Americans' plans for their golden years, one expert warns.

Dr. David Phelps argues in his latest book, "Inflation: The Silent Retirement Killer," that decades of unchecked government spending coupled with the actions of the Federal Reserve made today's inflation inevitable and warns that investors must adjust and prepare for the long haul.

While the Labor Department's latest consumer price index shows the cost of everyday goods rose 8.3% year-over-year in August, Phelps told FOX Business the actual hit to Americans' wallets is likely twice that. What's worse, he says, is that he sees inflation sticking around because with federal spending run amok, there is little the central bank can do to rein it in.

Phelps predicted the inflation surge last fall when he began writing his book, saying he read the tea leaves as the government continued to print trillions of dollars to fight the pandemic with programs like unemployment benefits "on steroids," stimulus payments, and the long-extended pause on student loan payments. But he says the writing was already on the wall that inflation would balloon – COVID spending just accelerated it.

"Even pre-COVID we had years and years of increasing budget deficits and national debt – it's just been stacking, stacking, stacking," Phelps said. "The government being able to kick the can down the road was going to break."

Still, never-ending "pandemic" perks like student loan forgiveness continues to fuel inflation further, with no end in sight.

Phelps expects the U.S. economy to be anemic for the next decade or so, which he says changes the picture for many of the people relying entirely on a 401(k), a model which relies on the conventional idea that the economy is always going to grow.

People thought they were going to have this nest egg that, by financial metrics, would be enough," he says. "So I think the wake-up call is to understand it's not going to be the same. We are in a different time altogether today… they're going to need probably more than they thought they were going to need, which is not good."

Now, he says, people need to protect themselves, and warns that fixed income streams like annuities will not be able to produce the lifestyle needs of people who will depend on them years down the road.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $30,822.42 | -,139.40 | -0.45 |

| SP500 | $3,873.33 | -28.02 | -0.72 |

| I:COMP | $11,448.40 | -,103.95 | -0.90 |

U.S. stocks were lower Monday as investors braced for another expected rate hike by the U.S. Federal Reserve later this week.

On Friday, a stark warning from FedEx about rapidly worsening trends in the economy gave investors more to worry about. The S&P 500 fell 0.7%, while the Nasdaq lost almost 1%. The Dow lost almost half a percent.

The S&P 500 fell 0.7% to 3,873.33. It’s now down 18.7% so far this year. The Dow Jones Industrial Average dropped 0.5% to 30,822.42 and the Nasdaq slid 0.9% to 11,448.40.

Makers of household goods, which are typically considered less risky investments, held up better than the rest of the market. Campbell Soup rose 1.3%.

Higher interest rates tend to weigh on stocks, especially the pricier technology sector.

Technology stocks within the S&P 500 are down more than 26% for the year and communications companies have shed more than 34%. They are the worst performing sectors within the benchmark index so far this year.

The housing sector is also hurting as interest rates rise. Average long-term U.S. mortgage rates climbed above 6% this week for the first time since the housing crash of 2008. The higher rates could make an already tight housing market even more expensive for homebuyers.

Reports this week from the government showed that prices for just about everything but gas are still rising, the job market is still red-hot and consumers continue to spend, all of which give ammunition to Fed officials who say the economy can tolerate more rate hikes.

Markets have been on edge because of stubbornly high inflation and the increases in interest rates being used to fight it. The fear is that the Fed and other central banks might overshoot their policy targets, triggering a recession. Most economists forecast that the Fed will jack up its primary lending rate another three-quarters of a point when the central bank’s leaders meet this week.

“Fact is, hawkish expectations built on the ‘hot under the hood' U.S. inflation print means that markets have good reason to be braced for headwinds amid prospects of higher (for longer) rates; and arguably ‘higher for longer' USD (dollar) as well," Vishnu Varathan of Mizuho Bank said in a commentary.

The S&P 500 sank 4.8% for the week, with much of the loss coming from a 4.3% rout on Tuesday following a surprisingly hot report on inflation. All the major indexes have now posted losses four out of the past five weeks.

Meanwhile, in Asia on Monday, Hong Kong's Hang Seng lost 1.1% to 18,558.18 while the Shanghai Composite index shed 0.6% to 3,106.57. Australia's S&P/ASX 200 edged 0.1% lower, to 6,732.20. In Seoul, the Kospi sank 1.2% to 2,355.31. J

apan's central bank meets Wednesday and Thursday amid rising pressure to counter a sharp decline in the yen, which is trading near 145 to the dollar after sharp increases in the value of the greenback. That has raised costs for businesses and consumers, who must pay more for imports of oil, gas and other necessities.

However the Bank of Japan has held firm so far in maintaining an ultralow benchmark rate of minus 0.1% in hopes of stimulating investment and spending.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $69.90 | 0.14 | 0.20 |

| CVX | $156.45 | -4.17 | -2.60 |

| XOM | $93.21 | -1.62 | -1.71 |

Oil prices dipped on Monday as fears of a global recession caused concerns that fuel demand growth will slow, though supply worries ahead of the European Union embargo on Russian oil in December limited declines.

Brent crude futures for November settlement fell 46 cents, or 0.5%, to $90.89 a barrel by 0701 GMT.

U.S. West Texas Intermediate (WTI) crude futures for October delivery was at $84.46 a barrel, down 65 cents, or 0.8%. The October WTI contract expires on Tuesday and the more active November contract as at $84.12, down 64 cents.

Both contracts climbed more than $1 earlier on Monday. Last week, oil futures slid more than 1% on concerns that another interest rate hike by the Federal Reserves could slow global growth. Despite fears of dampening fuel demand, ongoing supply concerns capped price declines.

"The market still has the start of European sanctions on Russian oil hanging over it. As supply is disrupted in early December, the market is unlikely to see any quick response from U.S. producers," ANZ analysts said Monday.

Easing COVID-19 restrictions in China could also provide some optimism, the analysts said. China has started easing COVID curbs in Chengdu, a southwestern city of more than 21 million people, which has helped to soothe concerns about demand in the world's No. 2 energy consumer.

China's gasoline and diesel exports also rebounded, easing high local inventories, after Beijing issued fresh quotas.

Meanwhile, Kuwait Petroleum Corporation's (KPC) chief executive said on Sunday its customers still demand the same volumes with no change. The Gulf state currently produces more than 2.8 million barrels per day of oil in accordance with its OPEC quota, he said.

Oil loading and exporting operations from Iraq's Basrah oil terminal are back to their normal rates on Saturday, Basrah Oil Company said, a day after being halted due to a spillage which has now been contained.

In Nigeria, Shell's 200,000 barrels per day Bonga deep water storage and offloading vessel is scheduled for maintenance in October, a spokesperson said on Sunday.

Live Coverage begins here