Latest Market News: Peloton skids, gas at all-time high, Biden’s inflation plan

Get the latest market news on stocks, bonds and commodities with FOX Business. Real-time updates on the markets and corporate news that will impact your portfolio.

Coverage for this event has ended.

Don Luskin and Rep. Lee Zeldin provide insight on record-high inflation on 'Making Money.'

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TWTR | $47.96 | -1.84 | -3.69% |

Former D.C. Democratic Party Chairman Scott Bolden and Gianno Caldwell, Fox News political analyst, weigh in after Biden's speech on America's inflation problem.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NFLX | $173.10 | -7.87 | -4.35% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KMX | $92.81 | -1.89 | -2.00% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FOXA | $33.21 | -1.39 | -4.02% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BHVN | $141.90 | +58.53 | +70.21% |

| PFE | $48.64 | -0.40 | -0.82% |

Pfizer's $11.6 billion, all-cash bet on Biohaven, the maker of the number one prescribed migraine drug NURTEC pleased investors.

"We believe Pfizer is uniquely positioned to help the portfolio reach its full potential given our leading scale and capabilities, including comprehensive field force engagement with Primary Care Physicians, specialists and health systems delivering the right information at the right time" said Nick Lagunowich, Global President, Pfizer Internal Medicine.

Peloton shares are getting punished down over 20% in pre-market trading, while CEO Barry McCarthy says the company is making progress investors don't see it.

Peloton CEO Barry McCarthy in a letter to shareholders says the company is making progress in its turnaround plan. "I’ve been in the CEO role of Peloton since February 9. During those three months I’ve focused on: 1. stabilizing the cash flow 2. getting the right people in the right roles and 3. growing again. We’re making progress on all three priorities."

U.S. equity futures are higher on Tuesday, a day after Wall Street's benchmark S&P 500 index tumbled 3.2%, hitting its lowest point in more than a year.

Meanwhile, oil prices extended the previous day’s declines on Tuesday, with West Texas Intermediate futures trading at around $101.20 a barrel and Brent crude futures trading at about $103.85 per barrel.

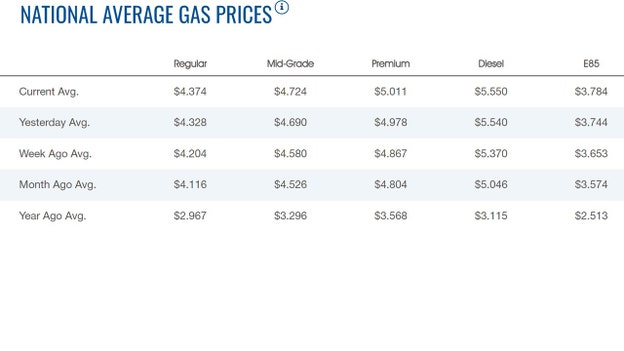

Gas prices hit a new all-time high on May 10, 2022, amid rising inflation and President Biden's restrictions on oil and gas production.

According to AAA's average gas price calculator, the national average cost of a regular gallon of gasoline hit $4.374 on Tuesday, the highest since September 2014, when the average monthly cost hit $3.387.

The prices come as the European Union edges toward oil sanctions on Russia amid the Kremlin's invasion of Ukraine. It also comes amid record-high inflation, with the consumer price index reaching 8.5% in March.

Critics claim that President Biden's energy policies – restricting drilling on federal lands and blocking the completion of the Keystone XL pipeline – have created a "supply problem" in the market.

Biden initially announced a moratorium on drilling on federal lands, but a federal judge in Louisiana blocked the moratorium after 13 Republican attorneys general sued.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TWTR | $47.96 | -1.84 | -3.69% |

Tesla CEO Elon Musk, who is in the process of acquiring Twitter, said the social media platform obviously has a "strong" left-wing bias, commenting on Twitter's apparent lack of action against a Rewire News Group journalist who tweeted a call for violence against pro-lifers.

"Twitter obv has a strong left wing bias," Musk tweeted.

He had been responding to conservative influencer Mike Cernovich. Cernovich highlighted a tweet from Rewire News Group journalist Caroline Reilly, who responded to an arson attack against a pro-life non-profit by calling for more violence.

U.S. stocks were trending higher overnight after across-the-board losses Monday.

Tuesday will also see earnings season roll on, with Fox News and Fox Business Parent Fox Corporation scheduled to post fiscal results ahead of Tuesday’s opening bell, along with food distributor Sysco Corp., music and entertainment firm Warner Music Group, hospitality giant Hyatt Hotels and cruise operator Norwegian Cruise Line.

In the afternoon attention will turn to integrated oil and gas firm Occidental Petroleum, video game maker Electronic Arts, cryptocurrency exchange Coinbase Global and high-end hotel and casino operator Wynn Resorts among others.

Wall Street's benchmark S&P 500 index tumbled 3.2% on Monday, hitting its lowest point in more than a year.

The Federal Reserve is trying to cool inflation that is running at a four-decade high, but investors worry that might trigger a U.S. downturn. That adds to pressure from Russia's war on Ukraine and a Chinese slowdown.

On Wall Street, the S&P 500 sank to 3,991.24. That leaves Wall Street’s benchmark down 16.8% from its Jan. 3 record.

The Dow Jones Industrial Average fell 2% to 32,245.70. The Nasdaq composite slid 4.3% to 11,623.25 as tech stocks to the brunt of the selling.

Energy stocks also fell. Marathon Oil and APA Corp. each sank more than 14%.Stocks have declined as the Fed turns away from a strategy of pumping money into the financial system, which boosted prices.

Cryptocurrency was trending higher early Tuesday morning as Bitcoin, Ethereum and Dogecoin all showed gains after losses the last week.

At 4 a.m. Eastern Time, Bitcoin was trading at approximately $31,588, up 4.69%, or $1,414.

In the last week, Bitcoin was lower by 21.6% and the losses extended over the past month to nearly 30%.

Ethereum and Dogecoin registered higher prices Tuesday, with Ethereum trading at approximately $2,310, up 5.83%, or $127 per coin, while Dogecoin was trading at 11.33 cents per coin, up 8.05%, or higher by $0.008 cents.

Oil prices dropped more than 1% on Tuesday, extending the previous day's steep declines as coronavirus lockdowns in top oil importer China, a strong dollar and growing recession risks fed worries about the outlook for global demand.

Brent crude was down $1.19, or 1.1%, at $104.75 a barrel at 0607 GMT after slipping to as low as $103.19.U.S. West Texas Intermediate crude fell $1.07, or 1%, to $102.02 a barrel after hitting an intraday low of $100.44.

On Monday, both benchmarks posted their biggest daily percentage falls since March, dropping by 5% to 6%.

The falls reflected trends in global financial markets, as investors shed riskier assets on worries about interest rate rises and resulting impact on economic growth.Oil prices were boosted last week after the European Commission proposed a phased embargo on Russian oil. However, the approval has been delayed amid requests from Eastern European members for exemptions and concessions.

A new version, currently being drafted, is likely to drop a ban on EU tankers carrying Russian oil, after pressure from Greece, Cyprus and Malta, a EU source said.

"Clearly, (EU) members are struggling to come to an agreement, which suggest that we may see a further watering down of the proposed package," Patterson said.

Financial markets are also heeding concerns that some European economies could suffer distress if Russian oil imports were curtailed further, or if Russia retaliated by cutting off gas supplies.

German officials are quietly preparing for any sudden halt in Russian gas supplies, Reuters reported. An emergency package could include taking control of critical firms.

A halt to Russian gas supplies to Germany would trigger a deep recession and cost half a million jobs, a senior economist said in an interview published on Tuesday.

Hungary has also restated its position that it will not accept a new round of proposed sanctions on Russia until its concerns are addressed.In the United States, crude, distillates and gasoline inventories likely fell last week, a preliminary Reuters poll of the weekly data showed on Monday.

Live Coverage begins here