Stocks up, oil rises, Fed's Bullard on rate hike: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

From the White House:

"President Joseph R. Biden, Jr. spoke today with President Xi Jinping of the People’s Republic of China (PRC). The conversation focused on Russia’s unprovoked invasion of Ukraine. President Biden outlined the views of the United States and our Allies and partners on this crisis.

President Biden detailed our efforts to prevent and then respond to the invasion, including by imposing costs on Russia. He described the implications and consequences if China provides material support to Russia as it conducts brutal attacks against Ukrainian cities and civilians.

The President underscored his support for a diplomatic resolution to the crisis. The two leaders also agreed on the importance of maintaining open lines of communication, to manage the competition between our two countries.

The President reiterated that U.S. policy on Taiwan has not changed, and emphasized that the United States continues to oppose any unilateral changes to the status quo. The two leaders tasked their teams to follow up on today’s conversation in the critical period ahead."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FDX | $218.61 | -9.92 | -4.34% |

FedEx shares sank after warning of a slowdown in the current quarter.

"Staffing levels and the rapid acceleration in labor costs have stabilized and our network is operating at normal levels. Despite improvement in the labor headwind, volume levels in Q3 were softer than we had previously forecasted, in part due to omicron surge slowing customer demand. As such, we expect our second half Ground margins will be lower than our previous expectations and not reach double digits" said COO Raj Subramaniam.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $34,341.07 | -139.69 | -0.41% |

| SP500 | $4,400.63 | -11.04 | -0.25% |

| I:COMP | $13,594.80 | -19.98 | -0.15% |

Triple Witching, the quarterly expiration of stock and option indexes, is expected to add to more volatility.

President of the St. Louis Federal Reserve disagreed with the size of this week's 25 basis point interest rate hike.

"In my view, raising the target range to 0.50% to 0.75% and implementing a plan for reducing the size of the Fed’s balance sheet would have been more appropriate actions" he said Friday in a statement. "The combination of strong real economic performance and unexpectedly high inflation means that the Committee’s policy rate is currently far too low to prudently manage the U.S. macroeconomic situation."

The major futures indexes suggested a decline of 0.6% when trading begins on Wall Street.

U.S. West Texas Intermediate crude futures climbed $1.23 or 1.2%, to $104.30 a barrel, adding to an 8% jump on Thursday. Brent crude was up $1 to $107.57.

U.S. equity futures were trading lower early Friday after Wall Street extended a rally into a third day and oil prices pushed higher, surpassing $105 per barrel. Continue reading

Oil prices moved into the final trading day of the week extending a rally. It marks the third volatile week of trade as there was slim progress in peace talks between Russia and Ukraine. Continue reading

Bitcoin is trading above $40,000 after a day that saw its three-day winning steak snapped. The cryptocurrency is off more than 2% month-to-date and down 12% year-to-date. Continue reading

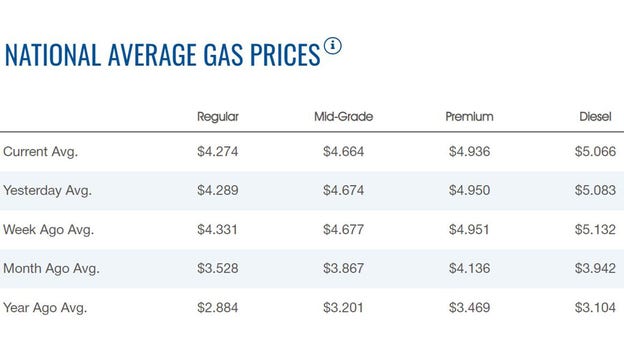

The average price for a gallon of gasoline in the U.S. slipped on Friday to $4.274 according to the latest numbers from AAA. The price on Thursday was $4.289. The previous record was $4.33, set on Friday March 11, 2022.

Live Coverage begins here