Stocks slip after Trump’s new tariffs, Bitcoin hits record, Ford recall: Live Updates

The Dow, S&P 500 and Nasdaq retreat from record highs as President Trump rolled out a fresh tariff against Canada, following Brazil hit. Meanwhile, the Federal Reserve and Chairman Powell are under fire for spending on renovations. Bitcoin, however, hit a new all-time high. Ford recalls nearly 1 million vehicles. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

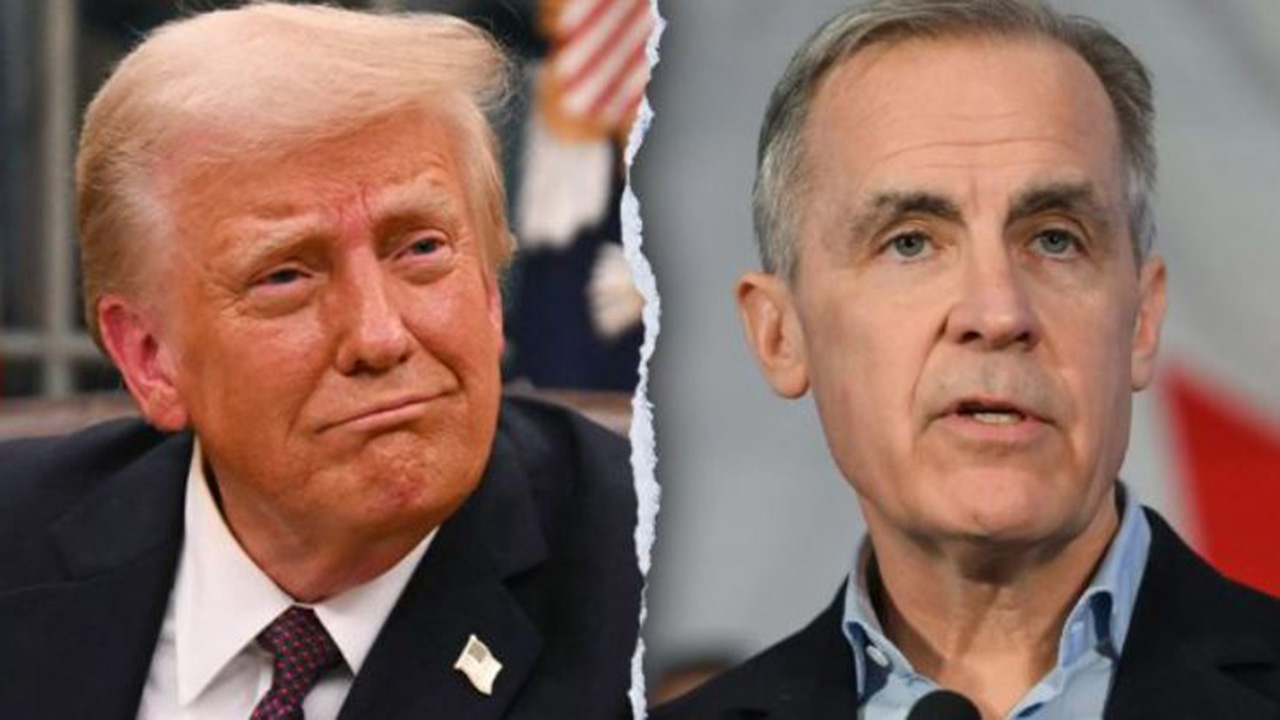

President Donald Trump is threatening to impose an additional tariff of 35% on Canadian goods on Aug. 1, after accusing the U.S. neighbor to the north of failing to stop the flow of fentanyl into the country and instead retaliating with its own tariffs.

Stocks closed lower on Friday as investors eye escalating tariff tensions.

The Dow Jones Industrial Average fell 279.13 points, or 0.63%, while the S&P 500 and Nasdaq Composite were down 0.33% and 0.22%, respectively.

President Donald Trump announced the U.S. will impose an additional tariff of 35% on Canadian goods on Aug. 1, after accusing the U.S. neighbor to the north of failing to stop the flow of fentanyl into the country and instead retaliating with its own tariffs.

"As you will recall, the United States imposed Tariffs on Canada to deal with our Nation’s Fentanyl crisis, which is caused, in part, by Canada’s failure to stop the drugs from pouring into our Country," Trump wrote in a letter addressed to Canadian Prime Minister Mark Carney. "Instead of working with the United States, Canada retaliated with its own tariffs. Starting August 1, 2025, we will charge Canada a Tariff of 35% on Canadian products sent into the United States, separate from all Sectoral Tariffs."

Any goods shipped in a way that evades the 35% tariff, Trump said, will be subject to the higher tariff.

Silver is quietly beating gold this month as investors pump money into precious metals. Silver has gained over 7%, while gold is little changed.

For the year, despite grabbing the headlines with record levels, gold is slightly trailing silver up 27% while silver's gain 33%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SLV | $33.75 | 0.75 | 2.27 |

| GLD | $306.20 | 0.68 | 0.22 |

And copper prices hit a record this week after President Trump said 50% tariffs on the industrial metal will begin on August 1.

,

JPMorgan Chase CEO Jamie Dimon had some choice words for Democrats who prioritized diversity, equity and inclusion initiatives. He also sounded off on New York City mayoral candidate Zohran Mamdani as "more a Marxist than a socialist."

The Treasury Department on Friday said revenue from tariffs increased 301% in June from the prior year.

Tariff collections on an annual basis have totaled $113 billion this year, or an 86% increase from the prior year.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WMT | $94.55 | -0.31 | -0.33 |

Over 800,000 water bottles are being recalled from Walmart after some customers report permanent physical damage.

Ford is recalling 850,000 cars, trucks and SUVs over a malfunction that puts drivers at risk for potential accidents.

Ford shares have gained over 23% this year.

On Friday, Bitcoin hit a new all-time intra-day high $118K before pulling back and Thursday it registered an all-time closing high in what was the fifth day of gains out of six, as tracked by Dow Jones Market Data Group.

For 2025, the largest crypto by market value has advanced 21.41% and is up a whopping 124.33% from its 52-week intraday low of $49,314.04 reached in August 2024.

Sen. Cynthia Lummis, R-Wyo., a longtime proponent of crypto, gives her take on what's fueling the digital currency.

The Federal Reserve is being accused of free-wheeling spending by the OMB.

"While continuing to run a deficit since FY23 (the first time in the Fed's history), the Fed is way over budget on the renovation of its headquarters. Now up to $2.5 billion, roughly $700 million over its initial cost. These renovations include terrace rooftop gardens, water features, VIP elevators, and premium marble. The cost per square foot is $1,923--double the cost for renovating an ordinary historic federal building. The Palace of Versailles would have cost $3 billion in today's dollars! Unfortunately, Powell's recent testimony to Congress has led to serious questions that now require additional oversight from OMB, in conjunction with the National Capital Planning Commission. Today, I sent the letter below to Chairman Powell to get to the bottom of this largesse" wrote Director Russ Vought in a post on X which linked to the full letter.

Council of Economic Advisors Director Kevin Hassett also weighed in on what he described as "runaway spending."

"And the bottom line is that President Trump's objective is to take all of government and make it better and make it work better for the American people. And government has gotten very big throughout Washington. And one of the places that hasn't really responded yet to the downsizing that you're talking about is the Federal Reserve. And I'm sure that whatever new leadership the president chooses for the new Federal that they're going to pay close attention to the runaway spending, to the actual losses after years and years of profits, and so on" he told Larry Kudlow on FOX Business Thursday.

It's no secret President Trump is unhappy with Chairman Jerome Powell as he continues lobbing verbal insults at the Fed Head during remarks and on social media. Hassett is rumored to be in the running to replace Powell, if and when the President decides to make the move.

Fresh off his multi-day Venice wedding to longtime girlfriend Lauren Sanchez, Amazon founder Jeff Bezos has sold two separate chunks of stock, disclosed in filings with the Securities and Exchange Commission this week.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $222.26 | -0.28 | -0.13 |

On July 3rd, he sold over 2.9 million shares at an average price of $223.83 netting more than $665 million, the SEC filing listed.

On July 8th, he sold over 484 million shares for an average price of $223.95 for $108 million, per the filing.

The sales were part of a plan disclosed back in March. As of July 9, he remains the largest individual shareholder with over 902 million shares or 8.5% of the company.

Live Coverage begins here