Stocks rise, gas prices hit new record, Biden's crypto plan: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RTX | $98.23 | +3.38 | +3.56% |

Raytheon shares rally on news missile defense system headed to Poland

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UGA | $57.74 | -6.91 | -10.69% |

| USO | $74.59 | -10.86 | -12.71% |

| BNO | $31.24 | -4.48 | -12.54% |

Why gas prices may not come down anytime soon.

The U.S. economy is sitting on a record number, 11.263 million, open jobs.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $33,273.63 | +640.99 | +1.96% |

| SP500 | $4,253.41 | +82.71 | +1.98% |

| I:COMP | $13,096.55 | +301.00 | +2.35% |

U.S. stocks rebounded as commodity prices eased.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BITO | $24.15 | +0.59 | +2.50% |

| BITQ | $14.44 | +0.35 | +2.48% |

| GCC | $28.07 | +0.66 | +2.39% |

"Digital assets, including cryptocurrencies, have seen explosive growth in recent years, surpassing a $3 trillion market cap last November and up from $14 billion just five years prior" says White House...

What to Know:

Specifically, the Executive Order calls for measures to:Protect U.S. Consumers, Investors, and Businesses by directing the Department of the Treasury and other agency partners to assess and develop policy recommendations to address the implications of the growing digital asset sector and changes in financial markets for consumers, investors, businesses, and equitable economic growth. The Order also encourages regulators to ensure sufficient oversight and safeguard against any systemic financial risks posed by digital assets.

Protect U.S. and Global Financial Stability and Mitigate Systemic Risk by encouraging the Financial Stability Oversight Council to identify and mitigate economy-wide (i.e., systemic) financial risks posed by digital assets and to develop appropriate policy recommendations to address any regulatory gaps.

Mitigate the Illicit Finance and National Security Risks Posed by the Illicit Use of Digital Assets by directing an unprecedented focus of coordinated action across all relevant U.S. Government agencies to mitigate these risks. It also directs agencies to work with our allies and partners to ensure international frameworks, capabilities, and partnerships are aligned and responsive to risks.

Promote U.S. Leadership in Technology and Economic Competitiveness to Reinforce U.S. Leadership in the Global Financial System by directing the Department of Commerce to work across the U.S. Government in establishing a framework to drive U.S. competitiveness and leadership in, and leveraging of digital asset technologies. This framework will serve as a foundation for agencies and integrate this as a priority into their policy, research and development, and operational approaches to digital assets.

Promote Equitable Access to Safe and Affordable Financial Services by affirming the critical need for safe, affordable, and accessible financial services as a U.S. national interest that must inform our approach to digital asset innovation, including disparate impact risk. Such safe access is especially important for communities that have long had insufficient access to financial services. The Secretary of the Treasury, working with all relevant agencies, will produce a report on the future of money and payment systems, to include implications for economic growth, financial growth and inclusion, national security, and the extent to which technological innovation may influence that future.

Support Technological Advances and Ensure Responsible Development and Use of Digital Assets by directing the U.S. Government to take concrete steps to study and support technological advances in the responsible development, design, and implementation of digital asset systems while prioritizing privacy, security, combating illicit exploitation, and reducing negative climate impacts.

Explore a U.S. Central Bank Digital Currency (CBDC) by placing urgency on research and development of a potential United States CBDC, should issuance be deemed in the national interest. The Order directs the U.S. Government to assess the technological infrastructure and capacity needs for a potential U.S. CBDC in a manner that protects Americans’ interests. The Order also encourages the Federal Reserve to continue its research, development, and assessment efforts for a U.S. CBDC, including development of a plan for broader U.S. Government action in support of their work. This effort prioritizes U.S. participation in multi-country experimentation, and ensures U.S. leadership internationally to promote CBDC development that is consistent with U.S. priorities and democratic values.

The interest rate for 30-year fixed-rate mortgages decreased to 4.09% from 4.15% compared to the prior week.

That helped lift demand for mortgage applications by 8.5%, according to the weekly survey from the Mortgage Banker's Association.

U.S. equity futures traded higher Wednesday morning in a bounce-back after a volatile trading session that saw stocks fall. Continue reading

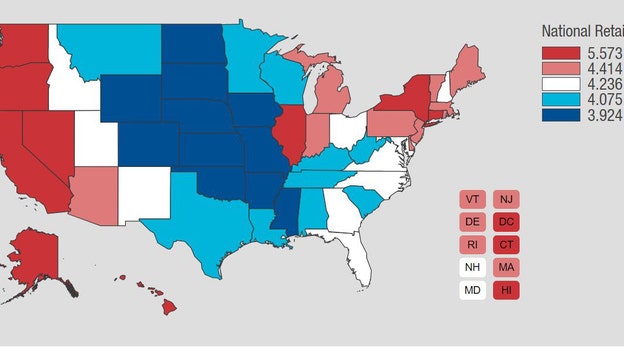

The average price for a gallon of gasoline in the U.S. hit a new record high on Wednesday, jumping 8 cents from the day before to $4.252 according to the latest numbers from AAA.

The previous record was $4.173, set on Tuesday March 2022.

Oil prices turned lower overnight, giving back earlier gains, following President Biden's ban on imports of Russian crude. Continue reading

Bitcoin is back on the rise after snapping a five-day losing streak on Tuesday. Bitcoin has a history of volatility and is down more than 7% month-to-date and off more than 16% year-to-date. Continue reading

Live Coverage begins here