Stocks lower, oil dips, Fed minutes released: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

House Republicans and Democrats interrupted and talked over a group of energy executives in a testy hearing Wednesday over who is to blame for high gas prices.

The S&P 500 and Nasdaq are back near their session lows as investors dig into the latest Fed minutes. Stocks initially pared their losses when the minutes were released.

Most Federal Reserve officials agreed last month that surging inflation and an incredibly tight labor market could warrant a half-point interest rate hike at future meetings as policymakers look to combat soaring prices.

Minutes from the U.S. central bank's March 15-16 meeting show that many policymakers believe the current economic conditions could necessitate a quicker normalization of policy than initially expected.

FS Investments chief market strategist Troy Gayeski says this year's stock market won't be a 'disaster,' but it will be challenging.

Treasury Secretary Janet Yellen on Wednesday warned of major consequences for the global economy as a result of the Russian-Ukraine war, including severe disruptions to the global flow of food and energy.

"Russia’s actions represent an unacceptable affront to the rules-based, global order, and will have enormous economic repercussions in Ukraine and beyond," Yellen said in prepared remarks during her annual testimony before the House Financial Services Committee.

Her comments come as the U.S., European Union and Group of Seven coordinated new sanctions on Russia – including a U.S. ban on new investment in the country and fresh penalties targeting top Russian security officials and President Vladimir Putin's adult children – in response to reported Russian atrocities in the Ukrainian town of Bucha.

Former Kansas City Fed President Thomas Hoenig argued on Wednesday that a recession in the U.S. could potentially happen "sooner than next year" amid the central bank's expected aggressive tightening measures.

The House Energy and Commerce Committee Wednesday will grill a group of six major U.S. oil executives, with Democrats seeking to hold them "accountable" for allegedly fleecing Americans with high gas prices. Republicans, meanwhile, are expected to hammer the Biden administration's energy policies as they seek to pin the issue on Democrats ahead of the midterms.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BP | $29.91 | +0.21 | +0.72% |

| CVX | $166.34 | +2.94 | +1.80% |

| DVN | $58.38 | -0.12 | -0.21% |

| XOM | $84.27 | +1.49 | +1.80% |

| PXD | $246.59 | +2.25 | +0.92% |

| SHEL | $55.58 | +0.67 | +1.22% |

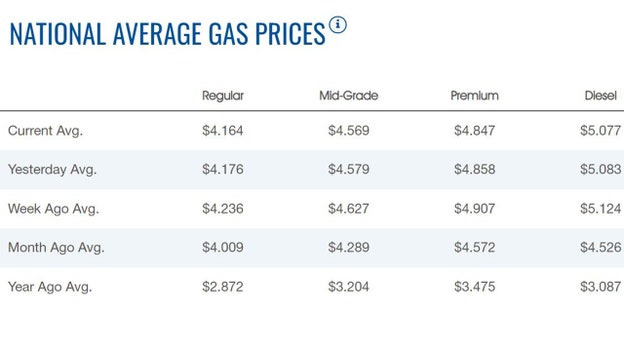

According to AAA, the national average gas price stands at $4.16 per gallon on Wednesday.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $34,389.74 | -251.44 | -0.73% |

| SP500 | $4,473.73 | -51.39 | -1.14% |

| I:COMP | $13,908.30 | -295.86 | -2.08% |

U.S. stocks slid Wednesday morning, a day after a Federal Reserve official's comments fueled expectations of more aggressive rate hikes.

U.S. equity futures traded lower Wednesday morning, the day after a Federal Reserve official's comments fueled expectations of more aggressive U.S. rate hikes. Continue reading

Oil futures were trading higher Wednesday morning, clawing back from earlier losses. Continue reading

Bitcoin traded around $45,000 on Wednesday morning. Bitcoin is down more than 1% year-to-date. Continue reading

The average price for a gallon of gasoline in the U.S. slipped on Wednesday to $4.164, according to the latest numbers from AAA. The price on Tuesday was $4.176. The previous record high was $4.33, set on Friday March 11, 2022.

Live Coverage begins here