Dow tumbles 880 points, S&P, Nasdaq post worst week since January: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

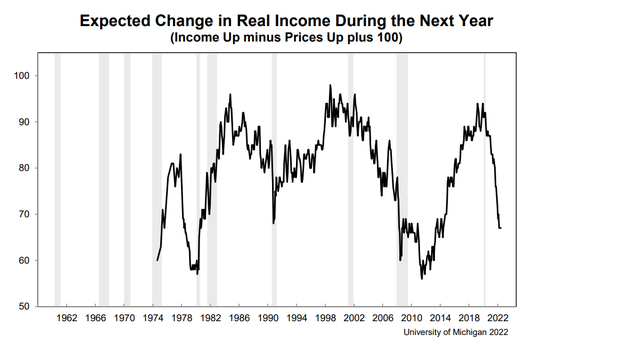

U.S. stocks sank on Friday after consumer inflation jumped 8.6% a 40-year high and consumer sentiment sank to an all-time low as tracked by the University of Michigan’s consumer survey. The Dow Jones Industrial Average fell 880 points or 2.7%, while the S&P lost 2.9% and the Nasdaq Composite 3.5%. For the week, all three of the major averages fell between 4.6% and 5.6%. In commodities, oil added 1.5% to $120.67 while gas prices sit two cents away from $5 a gallon.

The University of Michigan's Consumer Sentiment survey fell to a reading of 50.2 - the lowest on record..."comparable to the trough reached in the middle of the 1980 recession" according to the survey.

"All components of the sentiment index fell this month, with the steepest decline in the year-ahead outlook in business conditions, down 24% from May. Consumers' assessments of their personal financial situation worsened about 20%. Forty-six percent of consumers attributed their negative views to inflation, up from 38% in May; this share has only been exceeded once since 1981, during the Great Recession" wrote Director Joanne Hsu.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRM | $187.11 | -2.08 | -1.10% |

| BA | $133.73 | -5.90 | -4.23% |

| CVX | $177.52 | -3.61 | -1.99% |

| WMT | $121.02 | -1.28 | -1.05% |

The Dow Jones Industrial Average fell over 700 points mid-morning following the CPI Index which jumped by 8.6% - a 40-year high.

Salesforce and Boeing led the selling, while Chevron and Walmart fell the least.

U.S. stocks cratered across the board with all three of the major averages down over 1% in early trading after the consumer price index rose 8.6% in May, a fresh 40 year high. Bond yields continued to climb with the 10-year yield hitting at 3.11%. In commodities, oil hovered at $120 per barrel.

U.S. equity futures traded cautiously ahead of a much anticipated key reading on inflation. Investors will react to the broadest and most popular measure of price inflation in retail goods and services.

Economists are searching for evidence that inflation has peaked and sky-high prices are finally starting to fall, but they are unlikely to find much good news in a key report that will be published on Friday.

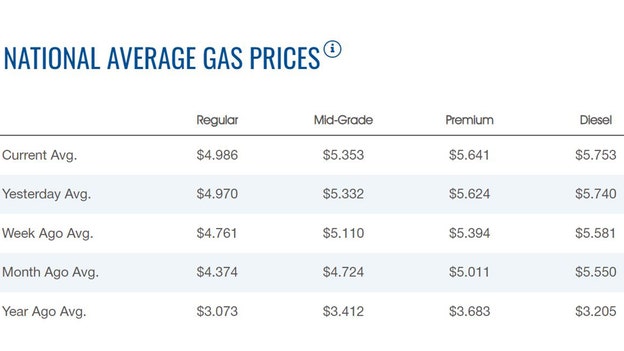

The price of gasoline in the U.S. continues a slow crawl toward $5 a gallon. The price on Friday morning was $4.986, according to AAA.

The price on Thursday was $4.97. The price of diesel increased to $5.753 from $5.74.

Oil prices rose on Friday, remaining near three-month highs even as new COVID-19 lockdown measures took effect in Shanghai. U.S. West Texas Intermediate crude traded around $121, after dropping 0.5% on Thursday.

WTI was set for a seventh straight weekly increase.

Brent crude futures traded around $123 a barrel after a 0.4% decline the previous day.

Bitcoin is down three consecutive days heading into Friday, losing 4% over that time. The cryptocurrency is off 5% for the month and down more than 34% year-to-date. Ether is around $1,800. Dogecoin is around 8 cents.

Live Coverage begins here