Dow adds 303 points after Fed's historic move, retail sales slump: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $30,668.27 | +303.44 | +1.00% |

| SP500 | $3,789.91 | +54.43 | +1.46% |

| I:COMP | $11,099.15 | +270.81 | +2.50% |

U.S. stocks closed higher across the board but off the best levels of the session following the Federal Reserve’s 75 basis point rate hike, the most since 1994. Chairman Powell indicated, during his press conference, a second 50 to 75 basis point hike could be on the table at the next meeting to tame record high inflation. In commodities, oil fell 3% to $115.31 per barrel.

The Federal Reserve on Wednesday raised its benchmark interest rate by 75-basis points for the first time in nearly three decades as policymakers intensify their fight to cool red-hot inflation. Follow updates from Fed chairman Jerome Powell's press conference here.

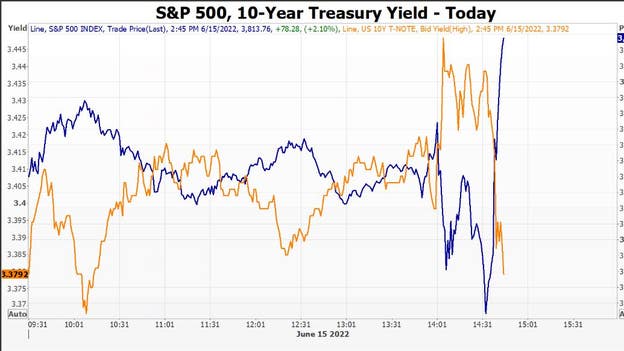

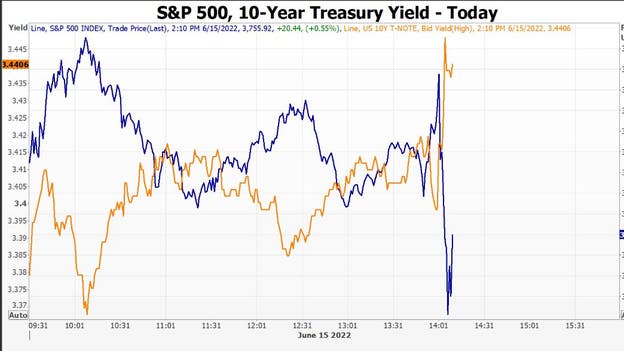

Stocks hit session highs and bond yields dipped after Fed chief Powell told reporters that additional 75-basis point rate hikes would not be common.

Stocks are paring their gains, with the Dow and S&P 500 flat for the session, as the 10-year Treasury yield pops in reaction to the Fed’s 75-basis point rate hike.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $12.39 | +0.18 | +1.52% |

U.S. stocks rose Wednesday ahead of a potential 0.75% interest rate hike by the Federal Reserve with a decision due at 2pm ET. Elsewhere, energy companies are in focus after President Biden threatens emergencies powers if output is not boosted to combat record gas prices sitting at $5.01 a gallon. In commodities, oil hovered around the $115 per barrel level.

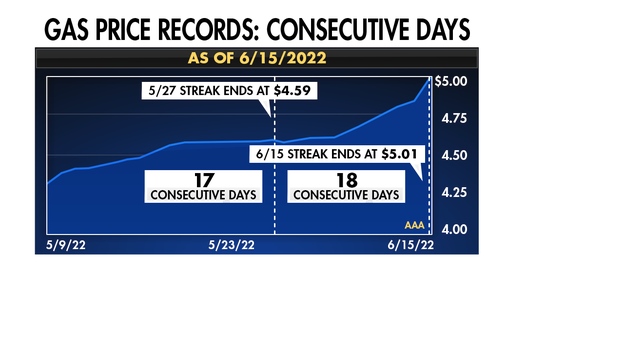

Americans are paying $5.01 per gallon nationally for gas and in some states such as California gas is nearing $10.

Retal car giant Hertz announced it will buyback another $2 billion in stock, on top of the $2 billion disclosed in November 2021.

"The increased authorization underscores the confidence that management and the board have in the direction of the Company," said Stephen Scherr, Hertz chief executive officer. "We remain committed to our capital allocation strategy that utilizes organic cash flows and appropriate leverage to invest in technology, modernize our fleet, and return capital to shareholders."

U.S. equity futures pointed to gains ahead of the Federal Reserve policy meeting and following a day that saw stocks finish mixed. In addition to the Fed decision, traders will be studying data on retail sales, import & export prices, manufacturing and homebuilding.

The Federal Reserve is expected to ratchet up its fight to tame scorching-hot inflation on Wednesday with the first 75-basis point rate hike in close to three decades, a move that threatens to slow U.S. economic growth and exacerbate financial pressure on Americans.

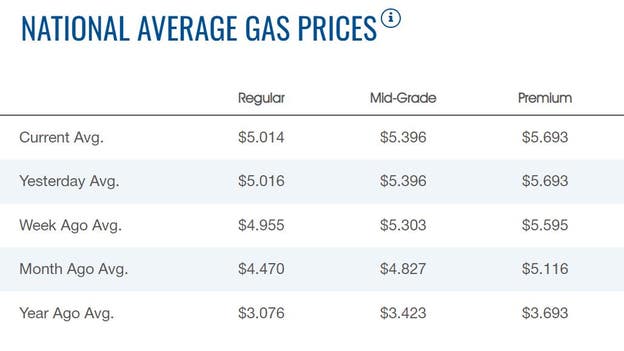

The price of a gallon of regular gasoline slipped slightly Wednesday morning to $5.014, according to AAA. The price on Tuesday was $5.016. Gas hit an historic milestone over the weekend reaching $5 a gallon. Diesel is at $5.78 up from $5.775.

Oil prices fell Wednesday morning after a day that saw declines on worries over fuel demand ahead of a Federal Reserve meeting. WTI crude futures traded around $117 a barrel. Brent crude futures traded around $120 a barrel. On the demand side, China's latest COVID-19 outbreak raised fears of a new phase of lockdowns.

Bitcoin traded below $21,000 on Wednesday morning, heading for a nine-day losing streak. The cryptocurrency is down more than 30% during that stretch. Bitcoin is off more than 30% for the month and down more than 52% year-to-date. Ether was trading around $1,000 and Dogecoin at 5 cents.

Live Coverage begins here