Stocks end worst week since pandemic amid inflation, recession fears: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:COMP | $10,798.35 | +152.25 | +1.43% |

| SP500 | $3,674.84 | +8.07 | +0.22% |

| I:DJI | $29,888.78 | -38.29 | -0.13% |

The Nasdaq Composite and S&P 500 led a mixed market Friday, while the Dow Jones Industrial Average pulled back as investors wrapped the worst stretch since the pandemic amid inflation and recession fears. In commodities, oil fell 9.2% to $109.56 per barrel for the week.

Weekly Losses - Worst Since 2020

Nasdaq: -4.8%

Dow: -4.8%

S&P 500: -5.8%

Frost Bank CEO Phillip Green discusses the impact of the Fed's rate hike on the company and customers.

Henrik Fisker, CEO and founder of Fisker, discusses Fisker's new electric vehicle, The Ocean, which will debut later this month.

Sal & Mookie's Pizza co-owner Jeff Good provides insight into how scorching-hot inflation is deeply impacting the restaurant industry.

U.S. stocks were mixed in early trading Friday and are headed for the worst week since the pandemic as recession fears overshadow the Federal Reserve's efforts to fight inflation, a move reiterated by Chairman Powell on Friday. In commodities, oil slipped to the $113 level as gas prices held above $5 a gallon.

U.S. equity futures are higher on Friday following a dismal session that saw the Dow fall below 30,000 for the first time since January 2021.

Meanwhile, oil prices turned slightly lower , with West Texas Intermediate crude futures trading at around $117.30 a barrel and Brent crude futures trading at around $119.70 per barrel.

U.S. equity futures are poised to rally following a day that saw drastic selling sparked by concerns that economic activity will be depressed by interest rate hikes aimed at cooling inflation. Traders will be watching for the industrial production report for May.

Bitcoin is poised to snap a 10-day losing streak, trading around $20,000. The cryptocurrency was down more than 34% during that time. Bitcoin is off more than 34% month-to-date and more than 55% year-to-date. Ether traded around $1,000 and Dogecoin at 5 cents.

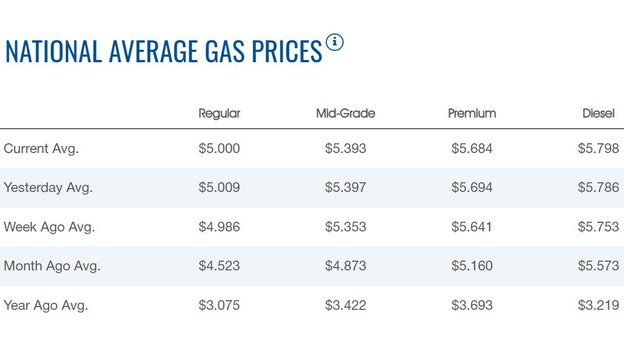

The price of a gallon of regular gasoline slipped slightly Friday morning to $5.00, according to AAA. The price on Thursday was $5.009. Gas hit an historic milestone over the weekend reaching $5 a gallon. Diesel rose to a record at $5.798 up from $5.786.

Oil prices moved higher on Friday despite concerns about global economic growth and a series of interest rate hikes around the world. U.S. West Texas Intermediate (WTI) crude futures traded at $118 a barrel. Brent crude futures were at $120 a barrel. U.S. crude futures would see their first dip in eight weeks.

Live Coverage begins here