Stock Market News: Dow jumps 825+points, companies react to Roe v. Wade

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Stocks surged to end the week as Federal Reserve officials hinted at when the tightening cycle could ease towards the back half of the year. All 11 S&P sectors rallied with materials and financials pacing the gains, while energy rose the least. In commodities, oil slipped ending the week at $107.62 per barrel.

Weekly Performance:

Nasdaq +7.5%

S&P 500: +6.5%

DJIA: +5.4%

The Air Line Pilots Association (ALPA), the largest pilots union, approved a tentative deal that would boost the pay for 14,000 United pilots.

The union said the deal also includes better overtime and premium pay, a new retirement plan, a new eight-week paid maternity leave benefit and improved scheduling provisions.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UAL | $35.81 | -0.91 | -2.48% |

Texas Attorney General Ken Paxton says previously passed state legislation will prohibit abortions at any term of a pregnancy.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLK | $128.82 | +1.90 | +1.50% |

| XLY | $141.59 | +2.19 | +1.57% |

U.S. stocks rose 1%+ across the board on Friday as investors digested balanced remarks from Federal Reserve Chairman Jerome Powell on managing the economy and inflation. All 11 of the S&P’s largest sectors rose with technology and consumer discretionary companies leading in early trading. In commodities, oil hovered around the $105 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SWBI | $14.36 | +1.26 | +9.62% |

The Supreme Court rejected tougher rules in New York for concealed carry rights. Following the decision Smith & Wesson's CEO weighed in on the company's earnings call.

U.S. stock futures are trading higher on Friday morning, looking to end the week on a positive note after a three-week losing streak.

Meanwhile, oil prices are higher, with West Texas Intermediate crude futures trading at around $105.70 a barrel and Brent crude futures trading at about $111.50 per barrel.

U.S. equity futures ware trading higher on Friday morning, adding to gains from the previous session with markets heading for its first weekly gain after three weeks of punishing losses.

Headlining the economic reports that traders will be watching are sales of new single-family homes.

Oil prices gained on Friday, but were heading for a second weekly decline, as tight supply was overshadowed by concern that rising interest rates could push the world economy into recession.

U.S. benchmark crude oil was at $105 per barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the basis for pricing for international trading, was at $110 per barrel.

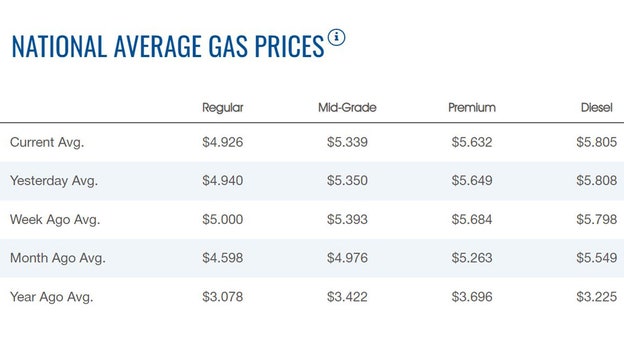

The price of a gallon of regular gasoline slipped on Friday morning to $4.926, according to AAA. The price on Thursday was at $4.94. Gas has declined for seven straight days. Diesel slipped as well to $5.805 down from $5.808.

Bitcoin is trading near $21,000 and gained in three of the last five days heading into Friday. The cryptocurrency is off more than 34% month-to-date and down more than 55% year-to-date.

Bitcoin is down more than 69% from its all-time high of $67802.30 back in November. Ether is trading at $1,100. Dogecoin is at 6 cents.

Live Coverage begins here