Dow sheds 638 pts. ahead of inflation data and $5 gas, mortgage rates spike: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

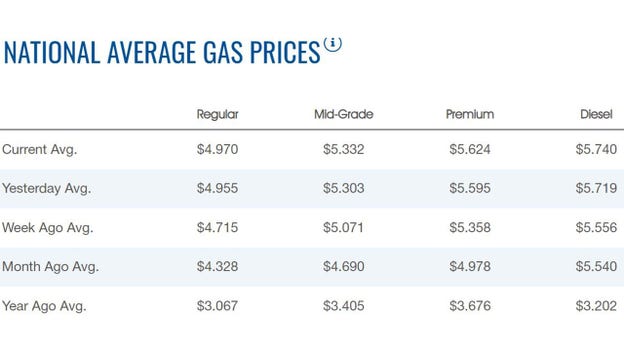

U.S. stocks closed at the lows of the session on Thursday ahead of the Consumer Price Index, due Friday, which is expected to show inflation remained near a 40-year high. Bond yields advanced again with the 10-year crossing 3% and the 2-year hitting 2.815%, the highest since December 2018. In commodities, oil closed at $121.51 with gas prices expected to hit $5 a gallon overnight.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CMG | $1,383.02 | +11.12 | +0.81% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,677.87 | -233.03 | -0.71% |

Dow laggards include Boeing, Disney, Visa and Apple, while Home Depot, 3M and Saleforce are notching modest gains.

U.S. stocks fell across the board as rising bond yields created fresh headwinds for riskier assets. Additionally, weekly jobless claims ticked up to the highest level since mid-January. In commodities, oil hovered at $120 per barrel with gas prices about three cents shy of $5 a gallon.

Initial claims rose to the highest since mid January.

U.S. equity futures traded higher Thursday morning, following a day that saw stocks snap a two-day winning streak. Traders will keep an eye on the latest jobless claims report as well as interest rate news from the European Central Bank.

The average price for a gallon of gasoline in the U.S. rose to a record on Thursday at $4.97, according to the latest numbers from AAA. The price on Wednesday was $4.955. The price of diesel increased to $5.74 from $5.719.

Oil prices trimmed recent gains with U.S. West Texas Intermediate crude trading above $120 a barrel. Brent crude futures traded around $123 a barrel. Both benchmarks closed Wednesday at their highest since March 8.

Data from the Energy Information Administration showed the U.S. posted a record fall in strategic crude reserves even as commercial stocks rose last week. U.S. gasoline inventories unexpectedly dropped, indicating demand for the motor fuel during peak summer despite sky-high pump prices.

Bitcoin was around $30,000, trading down for the past two days heading into Thursday. The cryptocurrency is down almost 4% during that time. Bitcoin is off almost 5% month-to-date and down more than 34% year-to-date. Ether was closing in on $1,800 and Dogecoin was around 8 cents.

Live Coverage begins here