Stocks wrap one of the most volatile weeks on record, China retaliates: Live Updates

China hiked tariffs on American imports from 84% to 125% in its latest retaliatory action against President Donald Trump’s this as the Dow, S&P 500 and Nasdaq Composite are wrapping up a wild week on Wall Street.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $39,295.31 | -,298.35 | -0.75 |

| SP500 | $5,224.02 | -44.03 | -0.84 |

| I:COMP | $16,239.22 | -,148.09 | -0.90 |

Stocks finished the final trading session of the week in the green on Friday as investors eyed the latest tariff-related developments and big bank earnings.

The Dow Jones Industrial Average rose 619.05 points, or 1.56%, while the S&P 500 and Nasdaq Composite climbed 1.8% and 2%, respectively.

China announced on Friday that it will raise tariffs on American goods to 125% from 84%. China indicated that it made the move in response to the U.S. raising tariffs, but indicated it does not plan to retaliate against any potential additional U.S. tariff increases.

"The US's imposition of abnormally high tariffs on China seriously violates international economic and trade rules, and also violates basic economic laws and common sense. It is a completely unilateral bullying and coercive practice," the Chinese finance ministry said.

The White House said Friday afternoon that it's "optimistic" China will make a deal.

Helping to boost stocks in premarket trading was news that the European Union's trade chief Maros Sefcovic will visit Washington on Sunday for tariff talks.

"The trade commissioner is going to Washington to try and sign deals," European Commission trade spokesperson Olof Gill told Ireland's RTE radio, Reuters reported. "That is what we are focused on."

However, Gill said "all options are on the table should that not lead to a good outcome."

Stocks rallied in early afternoon trading as big banks kicked off the first-quarter earnings season on a positive note.

JPMorgan Chase, Wells Fargo and Morgan Stanley all reported before the bell on Friday.

In Thursday's session, stocks tumbled, with the Dow finishing down 1,014.79 points, or 2.5%. The S&P 500 and Nasdaq Composite fell 3.46% and 4.31%, respectively.

Consumer sentiment declined sharply in April as 12-month inflation expectations surged to the highest level since 1981 amid President Donald Trump's escalating trade war.

The University of Michigan's Surveys of Consumers on Friday reported that its Consumer Sentiment Index dropped to 50.8 this month from 57 in April, a steeper decline than the 54.5 forecasted by economists polled by Reuters. It marked the fourth straight monthly decline in consumer sentiment.

"Sentiment has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year," said Surveys of Consumers Director Joanne Hsu. "Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month."

The report found that the share of consumers expecting to face unemployment in the year ahead increased for the fifth consecutive month. That metric is now more than double the survey's November 2024 reading and is at its highest level since 2009.

This is an excerpt of an article by FOX Business' Eric Revell

Small business owners are worried about their chances of survival under President Donald Trump's tariff plan, which has sparked the start of a possible trade war and wiped out trillions in value from the stock market.

Sarah Wells, who started her small business in 2013 and imports from China, is one of them. After more than a decade in business, she has paused innovation, raised prices and is now only reordering a fraction of the products she once did, as tariffs continue to weigh on her business.

Until now, Wells said she has absorbed the higher costs because her customer base is new parents, but it has gotten to a point where it is "unsustainable."

Alfred Mai, the founder of San Francisco-based card game company ASM Games, said the skyrocketing costs of labor, materials and fulfillment in recent years ate into his companies' margins because he did not want to pass the costs onto consumers.

"It’s staggering and almost impossible to keep up with," he told FOX Business. "This is absolutely devastating for my business."

This is an excerpt from an article by FOX Business' Daniella Genovese

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WFC | $63.11 | -3.22 | -4.85 |

Wells Fargo CEO Charlie Scharf on Friday called for a "timely resolution" to the Trump administration's tariff plan.

"“We support the administration’s willingness to look at barriers to fair trade for the United States, though there are certainly risks associated with such significant actions," Scharf said in the company's quarterly earnings report. "Timely resolution which benefits the U.S. would be good for businesses, consumers, and the markets."

The chief executive said the bank expects "continued volatility and uncertainty," and is prepared for a "slower economic environment" this year.

Scharf said the "the actual outcome will be dependent on the results and timing of the policy changes."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JPM | $227.11 | -7.23 | -3.09 |

JPMorgan Chase CEO Jamie Dimon commented on the economy and tariffs in the bank's latest quarterly earnings report.

"The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and “trade wars,” ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility," Dimon said.

The JPMorgan chief executive said earlier this week that President Donald Trump's tariffs are likely to "increase inflation" on both foreign and domestic goods, and raised concerns over what their impact will be on America's economic alliances.

"As for the short-term, we are likely to see inflationary outcomes, not only on imported goods but on domestic prices, and input costs rise and demand increases on domestic products. How this plays out on different products will partially depend on their substitutability and price elasticity. Whether or not the menu of tariffs causes a recession remains in question, but it will slow growth down," Dimon said.

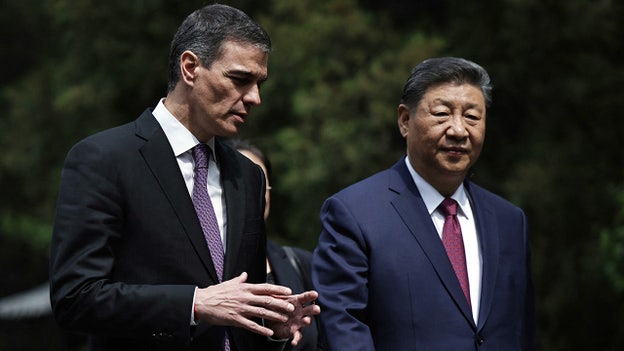

Chinese President Xi Jinping reportedly told Spain's prime minister Friday that Beijing and the European Union must stand together to oppose "unilateral acts of bullying."

The comments came after China said it would raise its tariffs against the U.S. to 125%.

"China has always regarded the EU as an important pole in a multipolar world, and is one of the major countries firmly supporting the EU's unity and growth," Xi told Spanish Prime Minister Pedro Sanchez in Beijing, according to a Xinhua news agency report cited by Reuters.

"China and the EU should fulfill their international responsibilities, jointly safeguard the trend of economic globalization and the international trade environment, and jointly oppose unilateral acts of bullying," the Chinese president added.

Sanchez said China and the U.S. need to hold negotiations over the tariff escalations and that he hopes the European Commission will reach the “best possible” deal between Washington and the EU, according to Reuters.

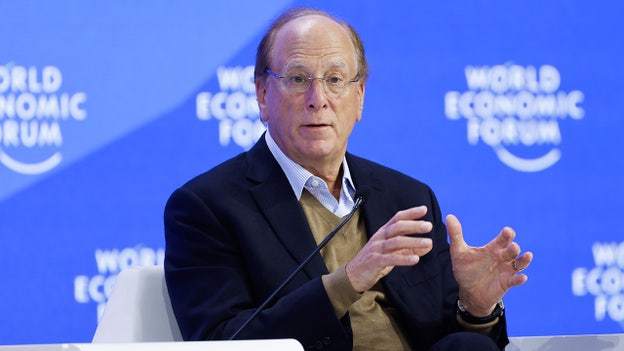

BlackRock CEO Larry Fink said in an earnings release that "Uncertainty and anxiety about the future of markets and the economy are dominating client conversations.

“We've seen periods like this before when there were large, structural shifts in policy and markets -- like the financial crisis, COVID, and surging inflation in 2022,” he continued. “We always stayed connected with clients, and some of BlackRock’s biggest leaps in growth followed.”

“BlackRock’s positioning and connectivity with clients are stronger than ever, and it’s clear in our results. We delivered 6% organic base fee growth in the first quarter, representing our best start to a year since 2021 and secular strength against a complex market backdrop,” he also said. “We are helping clients navigate market and policy changes, while also providing insights on long-term structural growth opportunities.”

Australia has rejected China’s offer to work together to combat President Donald Trump’s tariffs.

"We’re not about to make common cause with China," Australian Deputy Prime Minister Richard Marles told Sky News on Wednesday. "We are not going to be holding hands with China in respect of any contest that is going on in the world."

Trump issued a 90-day pause on tariffs for nations across the globe -- except China. Australia is among the countries that, for the next 90 days, will face only the baseline 10% tariff.

China's ambassador to Australia Xiao Qian wrote this week in an opinion column for the Australian newspaper The Age that “Under the new circumstances, China stands ready to join hands with Australia and the international community to jointly respond to the changes of the world," according to Reuters.

President Donald Trump and his administration's negotiation blitz with dozens of nations after pausing reciprocal tariffs will solidify him as the U.S.'s "deal-maker-in-chief" as he focuses on bringing parity to the country's chronic trade deficit, administration officials told Fox Digital.

On Wednesday, Trump put a 90-day pause on reciprocal, customized tariffs he had imposed on dozens of nations, which was an abrupt change of course after saying there would not be a pause to them, just negotiations. Simultaneously, the Trump administration upped the ante on its tariff on China to 125%.

A Trump administration official told Fox News Digital that the pause came about after Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick encouraged Trump to put those tariffs on ice after receiving an outpouring of good-faith commitments from trading partners to renegotiate the deals in ways that were favorable to the U.S.

Trump agreed, with the admin official underscoring that while the administration was "obviously" watching the volatile market on Wednesday morning, Trump's top priority is how to "best address our national emergency of trade deficits."

"When these countries were coming to us, making good-faith commitments to sit down with us and really hash out a favorable deal, that's what prompted a 90-day pause," the official explained.

China announced on Friday that it will hike tariffs on American imports from 84% to 125%.

The move represents the latest escalation of an ongoing trade war between the U.S. and China, which is led by the Chinese Communist Party.

China indicated that it made the move in response to the U.S. raising tariffs, but added it does not plan to retaliate against any potential additional U.S. tariff increases.

"The US's imposition of abnormally high tariffs on China seriously violates international economic and trade rules, and also violates basic economic laws and common sense. It is a completely unilateral bullying and coercive practice," the Chinese finance ministry said.

"Given that at the current tariff level, there is no market acceptance for U.S. goods exported to China, if the U.S. continues to impose additional tariffs on Chinese goods exported to the U.S., China will ignore it."

Live Coverage begins here