Stocks volatile, US hits Russia's central bank, oil and gold pop

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SHEL | $52.06 | -2.17 | -4.01% |

Shell CEO, in an emotional statement, explains the bold move the oil giant is taking.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ICE | $127.79 | -0.65 | -0.51% |

| NDAQ | $170.24 | -2.48 | -1.44% |

U.S. stock exchanges took an unusual step amid Russia's aggression in Ukraine.

Markets slammed by Russian sanctions, deepening crisis in Ukraine

Icahn is warning that geopolitical events between Russia and Ukraine may complicate America's inflation problem...

The risk of a Russian debt default is at a record high following major sanctions by the West.

The cost to insure Russia’s 5-year government debt surged today to a high of 1,321 basis points today. That means it now costs $1.32 million per year for five years to insure $10 million of Russian debt. That’s up sharply from around $120 thousand at the start of the year.

Pershing Square's Bill Ackman has advice for President Biden amid Russia's invasion of Ukraine.

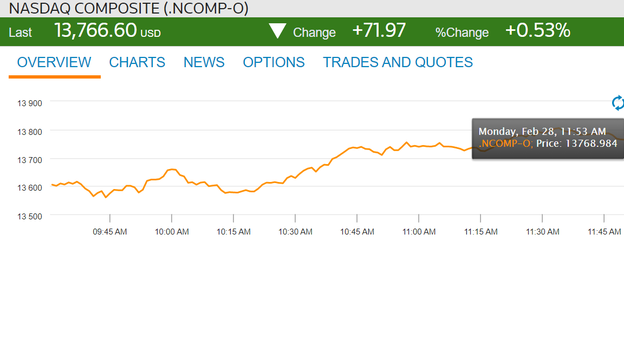

The Nasdaq gave up modest gains as U.S. stocks took a leg lower in afternoon trading

| Symbol | Price | Change | %Change |

|---|---|---|---|

| YNDX | $18.94 | -1.38 | -6.79% |

| ERUS | $19.44 | -5.54 | -22.18% |

Moscow extended the closing of its stock exchange beyond one day. Russian related stocks and ETFs tanked.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:COMP | $13,760.25 | +65.63 | +0.48% |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FHN | $23.68 | +5.45 | +29.85% |

| TD | $81.36 | -1.06 | -1.29% |

In its biggest deal ever, TD Bank is buying First Horizon...

"First Horizon is a great bank and a terrific strategic fit for TD. It provides TD with immediate presence and scale in highly attractive adjacent markets in the U.S. with significant opportunity for future growth across the Southeast," said Bharat Masrani, Group President and Chief Executive Officer, TD. "Working with the First Horizon team, TD will build upon the success of its strong franchise and deliver the legendary customer experiences that differentiate us in every market across our footprint" said Masrani in the deal announcement.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RTX | $101.07 | +2.92 | +2.98% |

| LMT | $428.74 | +22.05 | +5.42% |

| NOC | $433.82 | +24.09 | +5.88% |

Defense stocks jumped in part due to Germany's announcement to boost defense spending.

| Symbol | Price | Change | %Change |

|---|---|---|---|

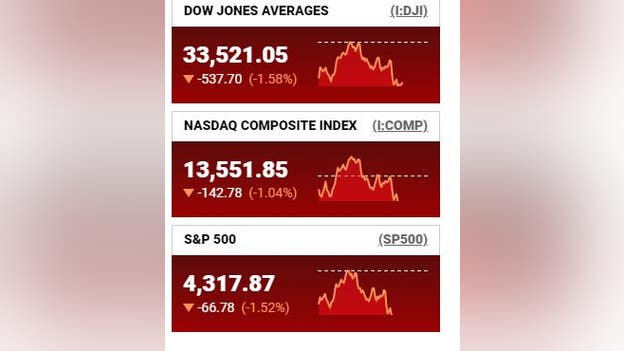

| I:DJI | $33,649.97 | -408.78 | -1.20% |

| SP500 | $4,344.61 | -40.04 | -0.91% |

| I:COMP | $13,622.32 | -72.31 | -0.53% |

Stocks down across the board in early trading...

Economists are growing more worried about rising inflation and Federal Reserve that may have missed the mark...

The U.S. Treasury Department, effective immediately, will freeze all American assets held by Russia's central bank. The move help curb some losses in U.S. stock futures...

Dow Jones Industrial Average futures were down nearly 500 points early Monday morning as the situation in Ukraine continues to grow more grave and reports Belarus may join the fighting and support Russian efforts to take over the country.

S&P 500 futures and Nasdaq futures were both down around 1.5%.

The end of the month usually brings a raft of economic data, but for now the conflict is eclipsing other issues.

The Russian central bank on Monday raised its key interest rate to 20% from 9.5% to counter risks of rouble depreciation and higher inflation.

Russia has also ordered companies to sell 80% of their foreign currency revenues, the central bank and the finance ministry said.

E.ON, Europe's largest operator of energy networks, rejected demands to shut down the Nord Stream 1 gas pipeline as part of sanctions against Russia for invading Ukraine, the company told Rheinische Post newspaper on Monday.

After the German government put the Nord Stream 2 pipeline on hold last week, Polish Prime Minister Mateusz Morawiecki on Saturday called for shutting down Nord Stream 1, which has transferred Russian gas to Germany since 2011.

Nord Stream is a joint venture of Russia's Gazprom, Germany's oil and gas producer Wintershall DEA, PEG Infrastruktur E.ON , Dutch Gasunie and French Engie.

E.ON, which holds a 15.5% stake in Nord Stream 1, said the project was "completely different from the ongoing discussions about the Nord Stream 2 line."

US stocks were down nearly 500 points early Monday morning as the situation in Ukraine continues to grow more grave and reports Belarus may join the fighting and support Russian efforts to take over the country.

In New York, the future for the S&P 500 was 1.6% lower and that for the Dow industrials declined 1.3%.

On Friday, the S&P 500 climbed 2.2%, notching its first weekly gain in three weeks. The Dow Jones Industrial Average rose 2.5% and the Nasdaq composite gained 1.6%. The Russell 2000 index rose 2.3%.

The end of the month usually brings a raft of economic data, but for now the conflict is eclipsing other issues.

"It’s all about the Russia-Ukraine situation and evolutions in that situation will drive market sentiment and direction," Jeffrey Halley of Oanda said in a commentary.

Cryptocurrency was trading lower early Monday morning with all of the major coins in the red.

Bitcoin was trading at around $38,340, down 1.63%, while Ethereum and Dogecoin were lower by 4.64% at nearly $2,630 and 12.4 cents, down 1.36%, respectively, Coindesk reported.

Washington is considering a novel area for possible further sanctions against Russia: cryptocurrencies.Targeting the country's access to cryptocurrencies, such as bitcoin and ether, would take sanctions policy into uncharted territory. Blocking transactions would be challenging, since by nature private, digital currencies are designed to exist without borders and for the most part outside the government-regulated financial system.

The Biden administration is in the early stages of exploring the area, with the aim of disrupting economic activity in the country, The Wall Street Journal reported Friday, citing an administration official.

The ruble plunged nearly 30% to an all-time low versus the dollar around midnight Eastern Time Monday, while the euro sank after Western nations announced fresh sanctions to punish Russia for its invasion of Ukraine, including blocking some banks from the SWIFT international payments system.

The ruble plunged to a record low of less than 1 U.S. cent after Western nations moved to tighten sanctions against Russia, blocking some of its banks from the SWIFT global payments system.

Safe-haven currencies including the U.S. dollar and yen were in demand after Russian President Vladimir Putin put nuclear-armed forces on high alert on Sunday, the fourth day of the biggest assault on a European state since World War Two.

The ruble dropped to as low as 119 per dollar RUB=EBS, and was last down 28.77% at 118.

Live Coverage begins here