Stocks jump, Apple nears $3T, job openings near record levels: LIVE UPDATES

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAPL | $178.96 | +3.36 | +1.91% |

Market Cap: $2.9T

Apple became the fist U.S. company to hit $3T in market value in January 2022.

The Chamber of Digital Commerce founder and CEO Perianne Boring provides insight on the application of bitcoin on 'Making Money.'

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ICE | $135.18 | -0.08 | -0.06% |

The Federal Trade Commission announced in a press release Tuesday:

"The Federal Trade Commission is taking action against Intuit Inc., the maker of the popular TurboTax tax filing software, by issuing an administrative complaint against the company for deceiving consumers with bogus advertisements pitching “free” tax filing that millions of consumers could not use. In addition, to prevent ongoing harm to consumers rushing to file their taxes, the Commission also filed a federal district court complaint asking a court to order Intuit to halt its deceptive advertising immediately."

Americans continued to quit their jobs at an aggressive pace in February, underscoring how persistent turmoil in the labor market has made it difficult for employers to fill open positions.

The Labor Department said Tuesday that 4.4 million Americans, or about 2.9% of the workforce, quit their jobs in February. That's down from the previous high of 4.5 million in November, but well above the pre-pandemic level of about 3.6 million.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HOOD | $15.88 | +3.07 | +23.97% |

Normal Trading Hours: 9:30 AM to 4 PM ET

Robinhood Extended Trading Hours

Pre-Market will be available 2.5 hours earlier, starting at 7 AM ET

After-Hours trading continues for 4 more hours, until 8 PM ET

That’s an extra six and a half hours of trading, every single day.

U.S. equity futures were higher on Tuesday, as investors await the release of key economic data.

At 9 a.m. ET, S&P CoreLogic Case-Shiller will release its latest national home price index.

The Conference Board will release its consumer confidence index for March at 10 a.m. ET.

Meanwhile, Brent crude oil futures traded around $114 a barrel while West Texas Intermediate traded near $108 per barrel.

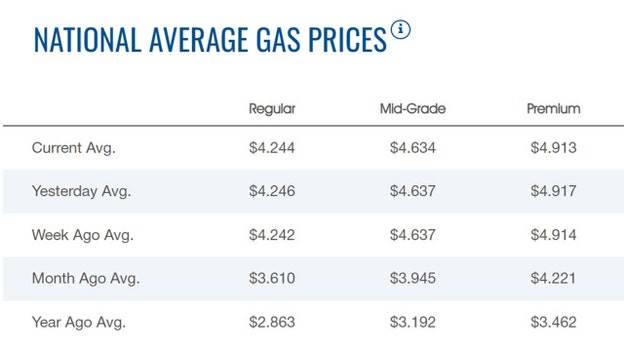

The average price for a gallon of gasoline in the U.S. dropped slightly on Tuesday to $4.244, according to the latest numbers from AAA. The price on Monday was $4.246.

The previous record high was $4.33, set on Friday March 11, 2022.

U.S. stocks were volatile early Tuesday, but were edging slightly higher after finishing higher Monday to start the week.

Stocks closed slightly higher following a choppy session, and bond yields remained near their highest levels in three years, with investors preparing for a campaign of interest-rate increases from the Federal Reserve.

Will Smith’s assault of Chris Rock on stage during the Oscars may have helped boost ticket prices for the comedian’s Ego Death World Tour 2022.

Less than 24 hours after Smith slapped Rock for making a joke at his wife’s expense, ticket prices have spiked.

Tickets for Rock’s next comedy show at Boston’s Wilbur Theatre on Wednesday are being sold for a minimum of $441, according to Ticket Club. Rock is scheduled to perform back-to-back shows Wednesday, Thursday and Friday at the Wilbur Theatre. Tickets for his next scheduled stand-up performance, at Atlantic City’s Borgata Events are starting at a minimum $226.

Meanwhile, TickPick, a secondary ticketing marketplace, said Monday morning it had sold more tickets overnight to see Chris Rock than in the past month combined.

Oil prices dropped about 7% to settle at their lowest level in more than a week, as a worsening COVID-19 outbreak in China threatened to hurt energy demand. Hopes for progress in peace talks between Russia and Ukraine helped ease some concerns over risks to energy supplies.

West Texas Intermediate crude for May delivery dropped about 7% to settle at $103.63 a barrel on the New York Mercantile Exchange. May Brent crude, the global benchmark, sank 6.8% to end at $106.96 a barrel on ICE Futures Europe.

"Global markets seem to be a bit nervous about the effectiveness of China's zero-tolerance policy toward Covid and the potential for more demand and supply chain disruptions as we might be only dealing with the tip of the iceberg," said Stephen Innes, managing partner at SPI Asset Management, in a note to clients.

Meanwhile, the United Arab Emirates' energy minister doubled down Monday on an oil alliance with Russia that's helped buoy crude prices to their highest in years as Moscow's war on Ukraine rattles markets and sends energy and commodity prices soaring.

The minister said Russia, with its 10 million barrels of oil a day, is an important member of the global OPEC+ energy alliance."And leaving the politics aside, that volume is needed today," Suhail al-Mazrouei said.

"Unless someone is willing to come and bring 10 million barrels, we don't see that someone can substitute Russia," he said.

Led by Saudi Arabia and Russia, the alliance has the capacity to increase oil output and bring down crude prices that have soared past $100 a barrel.

Gold futures fell for a second straight session as the U.S. dollar strengthened and investors eyed developments in the Russia-Ukraine war.

April gold fell 0.7% to settle at $1,921.90 an ounce on Comex.

Meanwhile, the dollar was stronger versus major rivals, with the ICE U.S. Dollar Index up 0.3%.

"The dollar has generally been the primary safe haven in recent weeks, but interest in gold, while perhaps somewhat subdued, is still relatively solid," said Rhona O'Connell, head of market analysis, EMEA & Asia, at StoneX, in a note. "Investor sentiment has remained positive in the face of continued geopolitical risk," she said.

President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request, proposing a 20% rate that would hit both the income and unrealized capital gains of the wealthiest Americans.

The "Billionaire Minimum Income Tax" would establish a 20% minimum tax on all U.S. households worth more than $100 million, or about 0.01% of Americans. The White House projected that more than half the revenue generated by the tax would stem from the country's 700 billionaires.

If enacted, the tax would reduce the deficit by about $360 billion over the next decade, representing more than a third of the Biden team's plan to trim the spending gap by $1.3 trillion.

"President Biden is a capitalist and believes that anyone should be able to become a millionaire or a billionaire," the White House said in a statement. "He also believes that it is wrong for America to have a tax code that results in America’s wealthiest households paying a lower tax rate than working families."Under the proposal, the top sliver of U.S. households would be required to pay a tax rate of at least 20% on their full income, or the combination of wage income and whatever they made in unrealized gains. If a billionaire is not paying 20% on their income, they will owe a "top-up payment" that makes up the difference to meet the new minimum. Households that are paying 20% will not be required to pay an additional tax.

Live Coverage begins here