1 Thing ConocoPhillips is Focused on Getting Right

Image Source: ConocoPhillips.

The deep downturn in the oil market is forcing the industry to adjust to what appears to be a new normal. For ConocoPhillips , that not only means having the right portfolio for what lies ahead, but also allocating capital to deliver the best returns possible. In order to improve its returns the company has had to reset how it thinks about allocating capital, which was a topic that CEO Ryan Lance addressed on the company's first-quarter conference call.

Having the right allocation principals

On the call, Lance pointed listeners to the following slide and said,

Source: ConocoPhillips Investor Presentation.

Lance wanted to assure investors that its guiding capital allocation principals haven't changed since it became an independent E&P company, however, it has had to adjust to the current environment by resetting the elements of that plan. Lance then detailed these adjustments and by noting that,

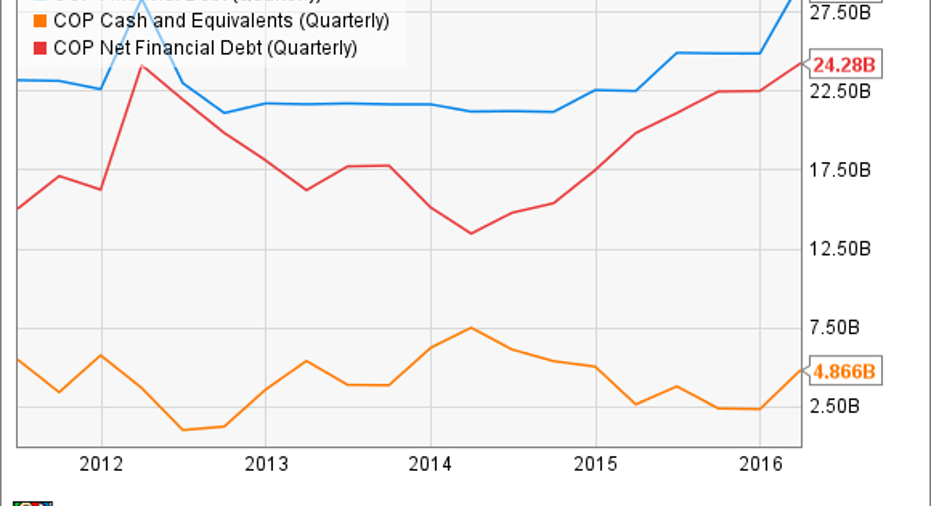

As Lance notes, the company has shifted its top priority from maintaining its dividend at its prior rate to de-levering its balance sheet. That being said, it is worth noting that the company currently has less than $25 billion in net debt:

COP Financial Debt (Quarterly) data by YCharts

While total debt outstanding jumped last quarter to more than $29 billion, that's largely due to the fact that the company took advantage of the opportunity to raise $4.6 billion in low-cost debt last quarter. That debt bolstered its cash position, putting it in a much stronger position to weather a long downturn in oil prices. In other words, the company isn't about to start shedding assets to pay down debt, but that it will look for ways to prudently trim its debt as opportunities arise to get its absolute debt below the target level.

Getting the right returns

Next, Lance turned his attention to how the company will invest in growth going forward. He said that,

Lance points out that the company is shifting how it views growth going forward, with it no longer focused on absolute production growth, but also growth on a per-share basis. As such, the focus will be on returns, which is much more in line with what larger peers like ExxonMobil are focused on. This would seem to indicate that ConocoPhillips will allocate more capital to share buybacks in the future if that would deliver the highest return growth on a per-share basis. Buybacks have always been a big part of ExxonMobil's value proposition, with the company buying back 40% of its outstanding shares since Exxon merged with Mobil:

Source: ExxonMobil Investor Presentation.

These buybacks have provided a big boost to ExxonMobil's per-share production, which was up 48% from 2003 to 2013 despite the fact that its absolute production grew by a mere 1% annually over that same time-frame.

Exxon's focus on growth per-share instead of absolute growth for the sake of growth has also resulted in the company delivering strong returns on capital employed, which have led its peer group over the past five years:

Source: ExxonMobil Investor Presentation.

Given Exxon's success at generating peer-leading returns, ConocoPhillips sees this model being one worth emulating.

Investor takeaway

Lance concluded his discussion on the company's capital allocation reset by saying that, "financial returns are at the core of our value proposition. If we get the returns right, the rest will follow. We are committed to getting the returns right." In other words, the company firmly believes that by investing with a focus on returns over growth it will deliver much better performance through the commodity price cycle. That should lead to much less volatility for shareholders, both for the stock price and the dividend.

The article 1 Thing ConocoPhillips is Focused on Getting Right originally appeared on Fool.com.

Matt DiLallo owns shares of ConocoPhillips. The Motley Fool owns shares of ExxonMobil. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.