What Is the Difference Between an Absolute Measure of Forecast Error and a Relative Measure of Forec

Absolute errorThe numerical difference between a forecasted quantity and the actual result is known as absolute error. If you predict that you'll run a mile in eight minutes and you run it in nine, your absolute error is one minute.

In investing, absolute errors are expressed in dollars. For example, at the beginning of 2015, Amazon.com stock was trading for about $313 per share. Let's say you forecast that Amazon would be trading for $500 by Dec. 1. Well, on Dec. 1, Amazon opened at approximately $674. So your forecast's absolute error would be $174.

This is the formula:

It's also worth noting that you don't need to worry about positive and negatives when stating absolute error. If you predict a stock's value to be $100, whether it becomes $105 or $95, you were "off by $5" either way.

Relative errorExpressed as a percentage, relative error takes the price of the investment (or other quantity) into consideration when expressing the difference between a forecasted value and actual value.

For example, consider the following hypothetical situations:

- You predict that Amazon's share price will be $650 on the last trading day of 2015, and the actual price turns out to be $655.

- You predict that Microsoft's share price will be $60 on the last trading day of 2015, and the actual price turns out to be $55.

In both examples, your prediction was $5 off from the actual price, so your absolute error is the same in each case. However, your Amazon prediction was far more accurate since you're trying to predict the value of a much more expensive stock.

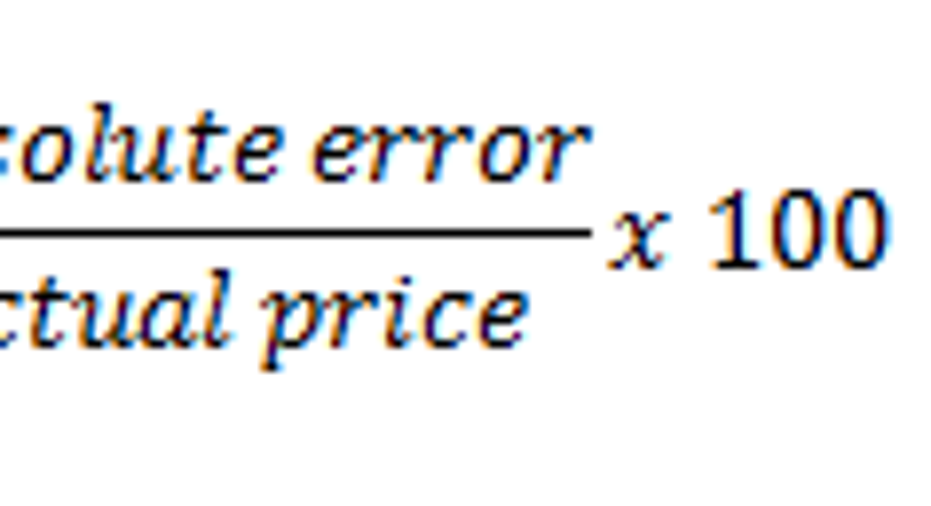

Relative error takes the different share prices into account and expresses the error as a percentage of the actual value:

In the Amazon example, your relative error would be:

In the case of your Microsoft prediction, your relative error would be:

What this means is that even though both predictions were just $5 off from the actual price, the Amazon prediction was much more accurate, because it was closer to the actual price when considering the price of the stock.

For comparisons, it's all relativeWhile both ways of expressing error can be useful when evaluating investment forecasts, relative error is by far the best way to compare forecasts of different stocks' prices and their accuracy.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors based in theFoolsaurus. Pop on over there to learn more about our Wiki andhow you can be involvedin helping the world invest, better! If you see any issues with this page, please email us atknowledgecenter@fool.com. Thanks -- and Fool on!

The article What Is the Difference Between an Absolute Measure of Forecast Error and a Relative Measure of Forecast Error? originally appeared on Fool.com.

the_motley_fool has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Amazon.com. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2015 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.