Cypress Semiconductor Keeps Going Strong

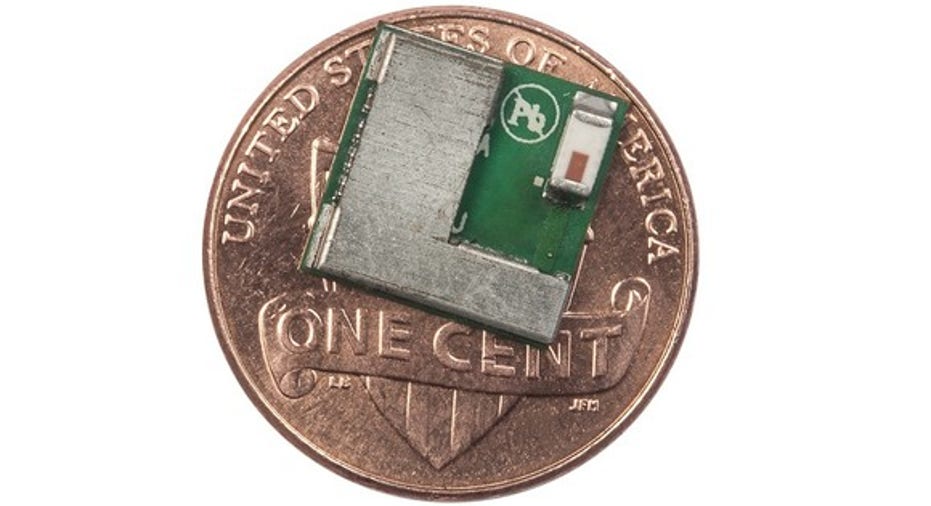

Image source: Cypress Semiconductor.

Cypress Semiconductor Corporation (NASDAQ: CY) released stronger-than-expected third-quarter 2016 results Thursday after the market close. Shares of the semiconductor specialist initially rose nearly 3% in Friday's early trading as investors cheered the news, only to pull back and close down around 1.5% as the broader market declined.

Let's take a closer look at how Cypress kicked off the second half of the year.

Cypress Semiconductor results: The raw numbers

| Metric |

Q3 2016 Actuals |

Q3 2015 Actuals |

Growth (YOY) |

|---|---|---|---|

|

Adjusted revenue |

$530.1 million |

$470.1 million |

12.8% |

|

Adjusted net income |

$53.5 million |

$60.0 million |

(10.8%) |

|

Adjusted EPS |

$0.15 |

$0.17 |

(11.8%) |

Adjusted (non-GAAP) revenue includes $6.25 million in revenue from intellectual property licensed to Samsung, which was excluded from GAAP revenue because of purchase accounting for the Spansion merger. YOY: year over year. Data source: Cypress Semiconductor.

What happened with Cypress this quarter?

- These results were near the high ends of the guidance ranges Cypress provided last quarter, which called for adjusted revenue of $510 million to $540 million, and adjusted earnings per share of $0.12 to $0.162.

- Revenue climbed 16% sequentially from last quarter, driven by a combination of seasonality and initial contributions from the wireless Internet of Things business acquired from Broadcom on July 5, 2016. Adjusted earnings per share also increased 25% sequentially.

- Based on generally accepted accounting principles (GAAP), Cypress Semi achieved net income of $9.4 million, or $0.03 per share.

- Gross margin improved to 40.5%, up from 37.8% last quarter, driven by continued execution of the company's gross-margin improvement plan. Excluding the emerging-tech division, core margins were 40.6%.

- Factory utilization increased to 56% as the company completes its "lean inventory" initiatives, and is expected to increase to above 60% in the fourth quarter.

- Inventory at the end of the quarter was $247.7 million, up 12% sequentially from last quarter due to a combination of an increase in MCU inventory to support demand, and additional inventory from the Broadcom Wireless Internet of Things (IoT) acquisition.

- Lean inventory initiatives have resulted in net inventory reduction of $160 million since Cypress closed the Spansion merger in early 2015.

- Cypress has also realized $175.8 million in annualized synergies from that merger -- up from $165.5 million last quarter -- and still expects to reach $180 million in synergies by the end of 2016.

- Cypress recognized roughly $400,000 in additional synergies this quarter from the Broadcom IoT acquisition.

- Adjusted revenue by business segment includes:

- 9% sequential growth in programmable systems, to $182.3 million.

- a 2% sequential decline from memory products, to $239.6 million.

- a 2% sequential decline from emerging technologies, to $19.4 million.

- 248% sequential growth from data communications, to $88.7 million, which reflects contributions from the Broadcom IoT acquisition.

- Adjusted revenue by geography was broken down as follows:

- Japan represented 21% of total sales, up from 20% last quarter.

- Europe represented 12% of sales, compared to 15% last quarter.

- Americas represented 12% of sales, down from 13% last quarter.

- The China/rest-of-world division represented 55% of sales, up from 52% last quarter.

What management had to say

Cypress CEO Hassane El-Khoury praised his company's "strong execution," noting its plan to improve gross margin remains on track thanks to the company's focus on efficiency and execution. El-Khoury added:

Looking forward

For the current quarter, Cypress anticipates adjusted revenue of $510 million to $540 million. Within that, the base business expected to decline 1%, which is well ahead of the 3% to 4% declines dictated by typical seasonality. This also includes $60 million to $65 million in revenue from the Broadcom IoT acquisition.

Trending toward the bottom line, adjusted gross margin in the fourth quarter is expected to fall around 50 basis points, sequentially, to roughly 40%, driven by typical seasonality. Cypress expects fourth-quarter adjusted earnings per diluted share of $0.12 to $0.16.

In the end, this may not have been Cypress Semiconductor's most exciting report, as it was notably absent any significant surprises. But if anything, these results were modestly better than expected, and the company is doing right by shareholders -- focusing on efficiency and acquisition synergies, even as it methodically pursues more promising growth opportunities than the overall semiconductor industry can offer. With that in mind, I think investors should be happy with Cypress Semiconductor's position today.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Steve Symington has no position in any stocks mentioned. The Motley Fool recommends Cypress Semiconductor. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.