How to Sign Up for a Vanguard Brokerage Account: A Step-by-Step Guide

Image source: Getty Images.

If you're just getting started in personal investing, then you may not yet have an individual brokerage account set up. Opening a new account may seem overwhelming, but it doesn't have to be. To help you with the process, The Motley Fool has put together several how-to articles -- including this one on how to open up an individual Vanguard brokerage account. If you're interested in brokerage accounts from other companies, check out ourbroker comparison page.

What you'll need to get started

You'll need to have the following information on hand to open your Vanguard account:

- Social Security number

- Your birth date

- Email address

- Your U.S. home address

- Employer name and address (if applicable)

Vanguard charges an annual fee of $20 for the brokerage account, but the fee will be waved if you sign up for any premium accounts, have at least $10,000 in Vanguard funds and ETFs, or elect to get your account statements and other paperwork deliveredelectronically. The company charges $7 per trade for the first 25 trades, and then the cost goes up to $20 per trade.If you need help while filling out the online application, there's a number on the right-hand side of the screen that will put you directly in touch with Vanguard customer service.

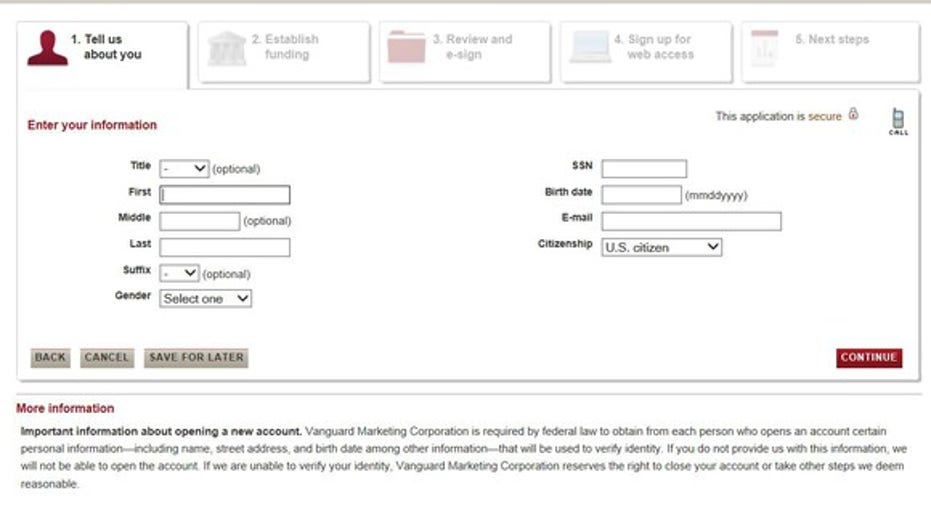

Image source: Vanguard.

Step 1: Fill in your personal information

To get started, Navigate to Vanguard's "Open an account" page and select the option for an individual brokerage account.

Once you've selected your account type, you'll need to fill in all of your personal information (address, phone number, Social Security number, email, and citizenship). You'll also need to fill in your employment information in this section if you're currently working.

As with any brokerage account, Vanguard will ask whether you're associated with a broker-dealer, a stock exchange, or the Financial Industry Regulatory Authority (FINRA). You'll also answer whether you or any members of your household are a10% shareholder, a policymaking executive, or a board member of apublicly held company. It's likely you'll answer "no" to these questions.

Once you've gotten through all of those questions, move on to the next step.

Step 2: Fund your account

Many online brokers leave this step until the very end, or even after you've opened the account, but Vanguard puts it right near the beginning. To fund your new account, all you need is the account and routing numbers of your checking account. If you want, you can also mail in a check later or deposit money from another brokerage.

Image source: Vanguard.

This is a good time to explain Vanguard's money market settlement fund. When you set up your Vanguard online brokerage account, you'll also set up a money market settlement fund where your money is held before it's invested. The account is essentially created in tandem with the brokerage account, but you may naturally be confused about why Vanguard is talking about two accounts during the setup process.

Vanguard says,"In addition, your new brokerage account will have a money market settlement fund (which will be opened with a zero balance) to pay for and receive proceeds from any trades you make." Once you've set up the account, you can find out how much is in your settlement fund by logging in and going to the "balances and holdings" page.Once you've added your account information, move to the next step to review your information.

Step 3: Review and sign

This step is probably the most straightforward. Essentially, all you need to do here is go over the account information you've already entered and make sure everything is accurate.

You'll also officially agree to open the account in this section, so be sure to read through all of the information regarding fees and rules for the account as well.

If your information is correct, and you agree to all the terms, then it's time to set up your online login.

Step 4: Create your online account

Vanguard's last step is to simply set up what it calls your "web access," which is just your online account. As with other online brokers, this online account will allow you to view your account balances and performance whenever you want.

Simply fill out the online user information, add security questions and answers, and submit. Congratulations -- you're all done setting up your Vanguard brokerage account!

Image source: Vanguard.

If you'd like to compare Vanguard's prices to other brokers', then check out The Motley Fool'sspecial broker offers here.And for tips on how to get started investing, read through some of our introductory investing articles here:

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early, in-the-know investors! To be one of them, just click here.

Chris Neiger has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.