DISH Network's Subscriber Losses Are Going to Get Worse

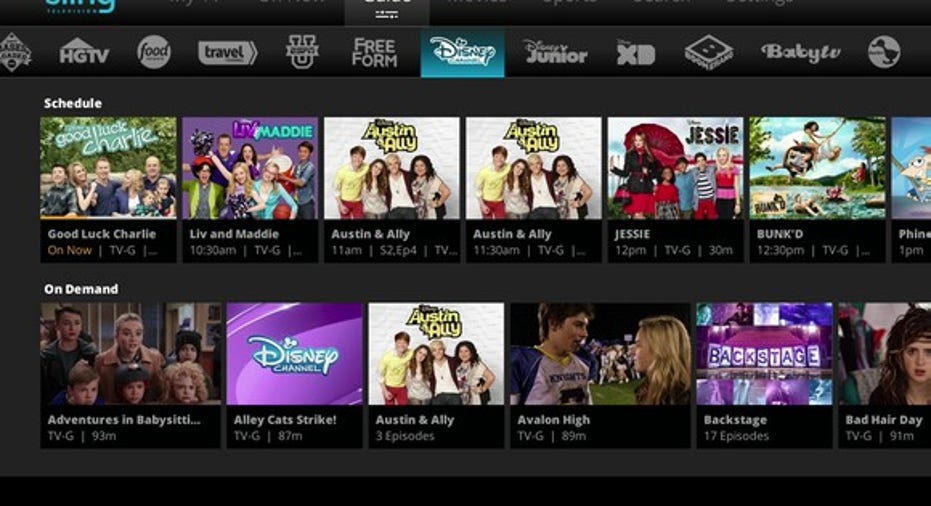

Image source: Sling TV.

Subscriber losses at DISH Network (NASDAQ: DISH) continue to pile up. The satellite TV provider lost 116,000 subscribers last quarter.Comparatively, rival AT&T's (NYSE: T) DirecTV added 323,000 subscribers during the same period.

But there's one factor masking DISH Network's subscriber losses. Its over-the-top Sling TV subscribers are lumped into the same subscriber category as its traditional satellite TV subscribers. With the impending launch of competing over-the-top services from AT&T, Hulu, and YouTube, Sling TV probably won't be able to bolster DISH's subscriber numbers as much.

How big is Sling TV?

DISH's management won't disclose how many Sling TV subscribers it counts. It reportedly had around 600,000 subscribers by the end of last year. Analyst Craig Moffett believes the company gained another 135,000 in the first quarter, 49,000 in the second quarters, and an additional 204,000 in the third quarter.

Those estimates bring Sling's subscriber count close to 1 million. DISH's total subscriber count fell to 13.643 million at the end of the third quarter, so Sling is now a meaningful portion of its total subscriber count.

Interestingly, Sling's lower subscription price hasn't prevented DISH from raising its prices on its satellite TV subscribers. DISH's average revenue per subscriber climbed 3.6% year over year to $89.44 per month. Additionally, management claims it's able to generate similar operating profit from Sling TV compared with its satellite business because of lower customer acquisition costs. Indeed, operating income climbed 12% year over year last quarter.

The competition is coming

AT&T is expected to launch DirecTV Now later this month. The service will provide about 100 channels for just $35 per month. Comparatively, Sling has a couple of tiers priced at $20 per month and $25 per month that offer between 20 and 30 channels, or you can subscribe to both for $40 per month.

AT&T is able to leverage its size as the largest pay-TV provider in the U.S. to keep its costs down. Additionally, it has nearly 80 million phone customers it can market its television service too. In fact, AT&T has already been taking advantage of its position in the wireless market to drive more customers to DirecTV's satellite business. It's planning to allow its wireless customers to stream DirecTV Now without it counting against their data caps (although the FCC recently voiced concern over that policy). If it's able to do that, it's a serious competitive advantage over other streaming services.

What's more, Hulu and YouTube plan to launch similar services. Hulu has a market of 12 million subscribers to sell into. YouTube has hundreds of millions of people coming to its website every day. The marketing power and reach of each company doesn't bode well for Sling TV.

For DISH, that means growing Sling TV subscribers will become increasingly difficult. And with the losses it's taking from its satellite business, that means subscriber losses could continue well into next year as it looks to get its footing.

With the pressure on prices from services like DirecTV Now, it's unclear whether investors can expect it to continue increasing its average revenue per subscriber. The combination means slower revenue growth and pressure on operating margins.

Forget the 2016 Election: 10 stocks we like better than DISH Network Donald Trump was just elected president, and volatility is up. But here's why you should ignore the election:

Investing geniuses Tom and David Gardner have spent a long time beating the market no matter who's in the White House. In fact, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and DISH Network wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of November 7, 2016

Adam Levy has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.