3 Cheap Stocks You Can Buy Today

You don't have to wait until market crashes to buy shares of decent companies on the cheap. Sometimes, the market's fixation on short-term outlooks can ignore the long-term possibilities of a company that investors may want to own for years at a time.

Three companies that have been punished recently by the market's shorter-term thinking and are cheap as a result are Alliance Resource Partners (NASDAQ: ARLP), Hawaiian Holdings (NASDAQ: HA), and Cooper Tire & Rubber (NYSE: CTB). Here's a look at why these stocks are so inexpensive and why investors may want to put these stocks on their radar.

Image source: Getty Images.

I'm not dead yet

It's hard to believe how cheap shares of Alliance Resource Partners are today. At an enterprise value to EBITDA of 2.8 times, the market is pricing this company for a fast and painful death. Yet if you look at the prospects of coal mining over the next few years and the profitability of the company today, it would seem those concerns are overblown.

It's clear that the path to higher coal use in the U.S. isn't there. Even the most optimistic outlook for the industry says that 500 GW of coal-fired plants will retire over the next few years as they reach the end of their economic life. When it comes time to replace those facilities, chances are coal will no longer be the preferred option. Today, natural gas, wind, and utility-scale solar power are all more economical power sources, and that is before federal or state tax incentives.

That said, there will still be several coal-fired power plants in use over the next decade, and it's becoming more likely that they will use coal from the region where Alliance has most of its assets, the Illinois Basin. According to the U.S. Energy Information Administration, coal volumes from the Illinois Basin should remain constant until 2040 while volumes from other basins are expected to decline 25%-40%.

What's probably even more important than the prospects for coal overall is that Alliance continues to be a solid, low-cost operator. Throughout the long slump in coal pricing, the company has remained profitable and has generated large amounts of free cash flow that have more than covered its distribution to shareholders. Also, thanks to Alliance's master limited partnership corporate structure, investors are able to extract cash from the business as it slowly declines.

Alliance isn't a buy-and-hold-forever stock, but there are some legs left in this coal miner. With its current distribution yield of 8.1%, it seems like an awfully cheap stock with a good chance of generating decent returns over the next several years.

Most profitable, lowest valuation

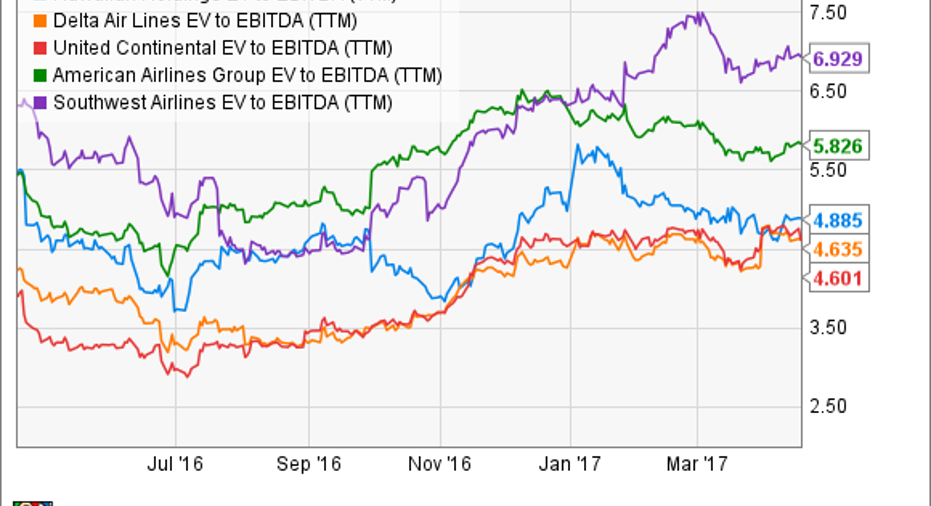

One would assume that the company with some of the best profit margins and returns in its industry would trade at a premium. That isn't the case in the airline industry, though. Despite the fact that Hawaiian Holdings consistently has some of the highest profit margins and returns on capital employed in the airline business, it trades at a modest enterprise value-to-EBITDA ratio of 4.9 times. That is very much in line with larger competitors Delta Air Lines and United Continental and significantly below the other top industryperformer, Southwest Airlines.

HA EV to EBITDA (TTM) data by YCharts.

The likely reason Wall Street is down on Hawaiian Holdings is that the company is about to experience a sharp increase in costs. On top of rising fuel costs, the company recently signed a new pilot contract that will add $25 million-$30 million to annual costs. All told, Hawaiian expects non-fuel costs per available seat mile to increase 6%-8% year over year. It should be noted, though, that some of those costs will be recouped as the company starts to retire its aging fleet of Boeing 767s and goes to the more fuel-efficient Airbus A321neo. Also, Hawaiian expects to grow revenue per available seat mile by 6.5%-8%, so most of those costs will be offset.

What is surprising is that many of these issues -- rising fuel and labor costs, fleet turnover -- are not unique to Hawaiian, yet the market seems to be more enamored with the larger domestic carriers. Those issues hardly seem like enough reason for Hawaiian's shares to trade at the low end of valuations in the airline industry, and it makes shares look pretty cheap today.

Strong returns in an under-the-radar market

When you think of automotive tires, the knee-jerk reaction would be to say that it is a business inherently tied to the success of the automotive industry. While that is true for most tire manufacturers, it doesn't necessarily apply to Cooper Tire & Rubber. In the North American market, Cooper Tire focuses almost exclusively on replacement and aftermarket tires rather than providing equipment for automotive manufacturers. This means that Cooper's business isn't as directly tied to automotive sales as many other tire manufacturers. Instead, it is going to more closely follow the broader economy -- consumers tend to put off replacement tires and other basic maintenance to vehicles during recessions.

Granted, the replacement tire business isn't a fast-growing one. Cooper even admits this and only expects 1% compounded annual growth for replacement tires in the North American market. It is looking to make up for that tepid growth, though, by making a big push into the Asian and South American markets, where annual growth rates are projected to be in the 4%-9% range. Cooper is even hoping to get into original equipment sales in these markets because of the high growth rates. This past year was the first that those investments started to pay off as its international segment returned to profitability after some tough years due to labor-related issues at its Chinese manufacturing facility.

All that said, Cooper Tires is a boring business that continues to churn out strong rates of returns and rewards shareholders at a decent rate. It has maintained an average return on invested capital of 17% over the past seven years. While its dividend yield is embarrassingly low -- 0.9% -- and it hasn't raised its payout since 1998, the company has made a point of buying back lots of shares lately to boost shareholder returns.

If it can maintain this track, and it seems reasonable to assume that it will, then it would seem that Cooper Tires' enterprise value-to-EBITDA ratio of 3.8 times is grossly undervaluing this stock.

10 stocks we like better than Hawaiian HoldingsWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Hawaiian Holdings wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of April 3, 2017

Tyler Crowe has no position in any stocks mentioned. The Motley Fool recommends Alliance Resource Partners. The Motley Fool has a disclosure policy.