Top Gas Stocks to Buy in 2017

Natural gas' growing presence on the world stage demands the attention of investors. But how you buy into the fuel is the important question. Royal Dutch Shell(NYSE: RDS-A)(NYSE: RDS-B), Enterprise Products Partners (NYSE: EPD), and Rice Energy (NYSE: RICE) are three top gas stocks that could find their way onto your buy list in 2017. However, each offers slightly different exposure to natural gas.

Image source: Royal Dutch Shell.

Big, diversified

Most investors wouldn't think of Royal Dutch Shell as a natural gas stock. And for good reason, since it's one of the world's largest integrated energy companies. So if you're looking for a pure play on natural gas, this isn't the right option. However, with a portfolio that includes oil, chemicals, and, increasingly, natural gas, it provides a more conservative investment for those interested in both gas and diversification.

That said, natural gas is going to be a big part of Shell's future. The most notable proof of that was the company's decision to buy natural gas-focused BG Group for around $53 billion in the middle of an oil downturn. That purchase, completed in early 2016, leaves Shell with the largest natural gas business of any of the energy majors. And it is by far the largest player in liquefied natural gas.

Shell is huge in liquefied natural gas, and is gassier than its peers. Image source: Royal Dutch Shell.

That last piece is particularly important. Natural gas is a growing force in the utility space in the United States. However, it is also increasingly in demand around the world. And liquefying natural gas is how you transport the fuel when pipelines aren't an option. Add in Shell's 6.5% yield to the mix, and more conservative income investors seeking a diversified energy stock with a natural gas bent should find their interests piqued.

The middleman

Another income-focused way to get exposure to natural gas is to invest in toll-taker Enterprise Products Partners. This limited partnership owns pipelines and other midstream assets that customers pay fees to use. In many cases, the amount of product moving through Enterprise's nearly 50,000 miles of pipes, and its other assets, doesn't even matter -- companies pay whether they use the capacity they've contracted for or not. This makes Enterprise's business extremely stable, like a toll on highway. That helps explain the partnership's impressive 49 quarters of consecutive distribution increases.

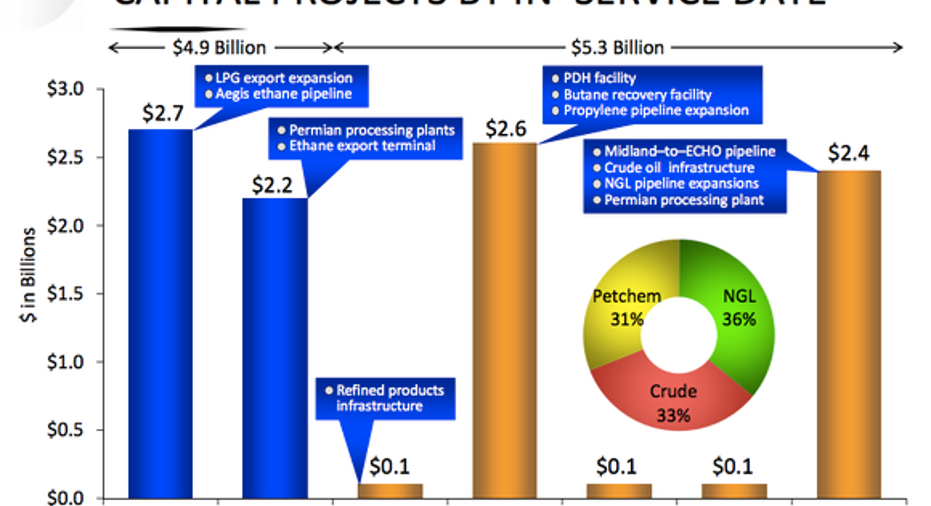

Enterprise Product Partners' growth projects. Image source: Enterprise Products Partners.

That said, Enterprise has to build to grow. And on that score, it has roughly $5.3 billion worth of new projects under construction. As they come on line over the next couple of years, the revenue generated should support additional distribution increases for this partnership, which currently yields 6%. That disbursement looks solid, too, with distribution coverage through the first nine months of 2016 of 1.2 times. If you're looking for a way to generate income from natural gas without the risk of commodity price moves, Enterprise should be on your short list.

Drilling for it

No list of natural gas investments would be complete without a U.S. gas driller like Rice Energy. As it goes, Rice isn't the largest player in the space, but it's focused in a key domestic shale region and is set to materially increase the size of its operations in 2017.

Its big move was the $2.7 billion, late 2016 acquisition of Vantage Energy, a company with Marcellus shale properties abutting Rice's holdings. The acquisition increased Rice's land holdings by 55%, with a massive 95% increase in the desirable Marcellus region. The best part is that Rice believes the deal will be immediately accretive, so investors should start to see the bottom-line benefit in 2017.

Rice Energy production profile. Image source: Rice Energy.

Since it's a pure-play driller, investors have to take on the volatility of commodity prices. However, if you are looking for a gas investment that's got growth potential, Rice is for you. To put a number on that, the company expects to grow production by roughly two thirds in 2017. That's an impressive growth profile.

Although production growth doesn't necessarily equate to profit growth, natural gas prices have been heading higher over the last year. And Rice's enhanced growth profile will put it in prime position to capture the upside of higher gas prices.

Three different ways to play

Investors looking at natural gas have a plethora of options. Income investors looking for something of a hedged bet should take a deep dive into Royal Dutch Shell. This global energy giant is shifting itself toward a natural gas-focused future even though it still has notable oil exposure. Enterprise Products Partners is another income-focused company, but one that makes money by transporting natural gas. That largely toll-taker business is much more stable than drilling. Rice Energy, meanwhile, is a driller in the highly prolific Marcellus Shale region. More important, it recently completed an acquisition that will materially increase its scale. That should interest investors with a growth bent.

10 stocks we like better than Enterprise Products Partners When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Enterprise Products Partners wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Reuben Brewer has no position in any stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.