3 Charts That Show Why Amazon is Amazing

Longtime Fool readers are no doubt familiar with Amazon (NASDAQ: AMZN). The company revolutionized the book distribution business, then most of retail, then logistics, then corporate infrastructure with its cloud business; it is currently setting its sights on India, TV and film, drones, artificial intelligence, and just about everything else under the sun.

Since the company is in so many industriesand has a high-profile CEO who now owns a newspaper and a rocket business, it can be easy to get caught up in the daily headlines. Still, with the company at all-time highs, current and prospective investors may want to step back and appreciate the big picture. Here are a few charts that show why Amazon is amazing.

Image source: Getty Images.

"Your margin is my opportunity"

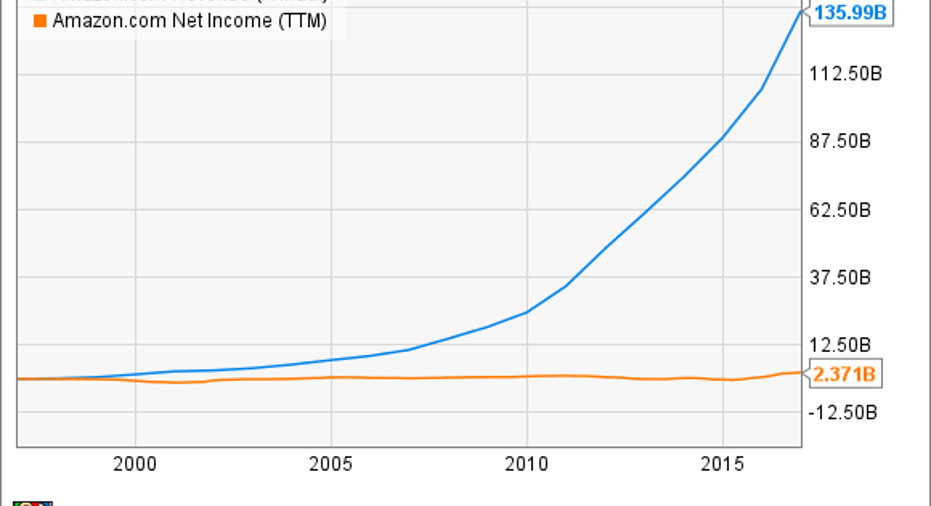

The following chart looks unlike any other company I've come across, except for Netflix. That should terrify any retailer, especially those who have traditionally, you know, delivered profits, buybacks, and dividends to investors. Amazon CEO Jeff Bezos once said, "Your margin is my opportunity," and he wasn't kidding:

AMZN Revenue (Annual) data by YCharts.

As you can see, Amazon has never indulged shareholders with GAAP profits. Therefore, it never has to take them away. This freedom from margins means that Amazon can go into just about any business it wants and disrupt it from below. Given that the company is branching out into basically anything related to retail or technology, it's a wide-open space Amazon can explore, equipped with the fastest horse.

It's killing the mall (or, them all)

The next chart shows Amazon taking sales from mall-based and other power-center retailers (Wal-Mart is left off since its $450 billion sales would skew the chart). As you can see, competitors' lines are relatively flat:

AMZN Revenue (Annual) data by YCharts.

Meanwhile, Amazon seems to be soaking up the extra sales, as the undisputed leader in e-commerce. While other stores are also investing in omnichannel and boosting their own online strategies, they're all playing catch-up.

Now Amazon is contemplating opening brick-and-mortar stores, taking on legacy retailers on their home turf: the in-store experience. Given Amazon's rabid focus on customer satisfaction, you can bet there will be something interesting about the Amazon bookstore coming to a town near you.

It's dominating the cloud despite competition

Amazon now has a cash cow, and it's scary: AWS (Amazon Web Services) is a small business relative to the retail segment, but it is growing like wildfire and earns 26% operating margins. In the most recent quarter, AWS grew a whopping 47% and now sports a $14 billion run rate:

Data: Synergy Research. Chart by Author.

As the chart above shows, AWS is the dominant first-mover in the industry. And while the secret is out that cloud computing is the future, competitors have not made a dent. The industry seems to be coalescing around AWS and services from Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and IBM (NYSE: IBM).

While those companies are growing market share, it has not come at the expense of AWS, but rather, from smaller upstarts. This is because, as the Wall Street Journal reported last weekend, building a cloud infrastructure costs huge amounts of money, and only the top dogs can compete. Amazon, Microsoft, and Alphabet spent a whopping $31.5 billion in capital expenditures in 2016. That's impossible to compete with if you're not already one of the largest companies.

This is leading to what is known as an oligopoly with a strong secular tailwind -- a profitable combination indeed. According to Gartner, the IaaS (infrastructure as a service) industry is set to grow 37% this year, and will continue torrid growth for the foreseeable future. If AWS can just maintain its share, Amazon looks like it will have even more cash to deploy into new markets and opportunities.

Bottom line: Amazon's unique record of reinvestment and experimentation is a formidable advantage, and it is not slowing down.

10 stocks we like better than AmazonWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Amazon wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of April 3, 2017

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten is an employee of LinkedIn and is a member of The Motley Fool's board of directors; LinkedIn is owned by Microsoft. Billy Duberstein owns shares of GOOG, Amazon, IBM, and Microsoft. The Motley Fool owns shares of and recommends GOOG, GOOGL, Amazon, Gartner, and Netflix. The Motley Fool recommends Nordstrom. The Motley Fool has a disclosure policy.