3 Facts About Claiming Social Security At 70

Image source: Flickr user 401kcalculator.org

59 million Americans receive Social Security and tens of millions more are fast-approaching retirement age, but that doesn't mean that everyone knows everything about this important program. Here are three facts that everybody should know if they plan to file for Social Security at age 70.

No. 1: Bigger Social Security checks

If you're in a position where you won't need the monthly cash from Social Security to pay your bills before you reach 70, holding off on claiming your Social Security can pay off.

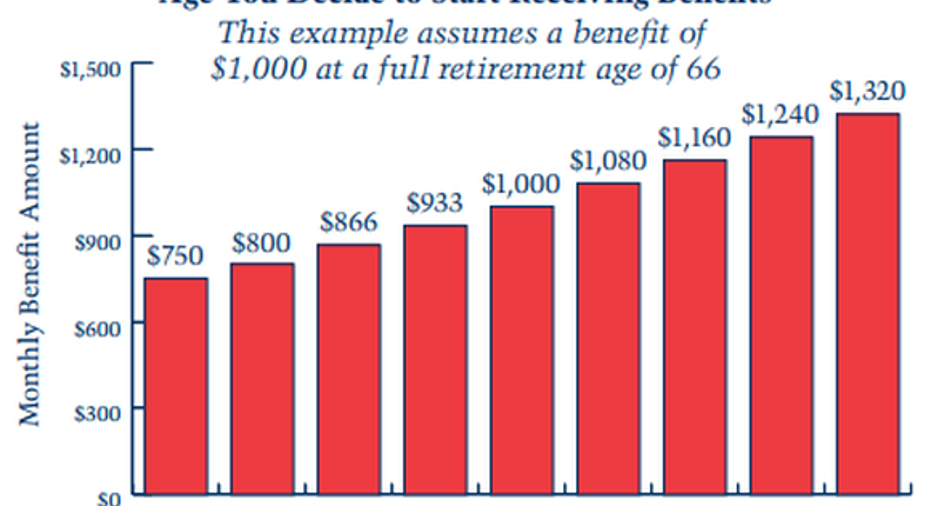

Social Security is designed so that the income that is paid out to recipients will be the same over a lifetime regardless of when you claim. This means that the monthly Social Security income is lower for people who file for Social Security earlier and higher for people who file for their Social Security later.

Currently, Social Security's full retirement age, or the age at which you can receive 100% of your monthly benefit, is 66. However, you can claim Social Security as early as age 62. If you do so, then your monthly check will be 25% lower than it would be at age 66. If you choose to hold off and file for Social Security at 70, then your monthly Social Security income will be 32% bigger than it would be at 66, and 76% bigger than it would be if you claimed at age 62.

Image source: SSA

Also, waiting until 70 to claim could further increase your Social Security income if you continue to work. Social Security calculates your benefit based on your highest 35 earning years. Therefore, each additional year you work removes a lower income earning year from your work record, potentially increasing your benefit. Because of this fact, working from age 62 to 70, rather than claiming Social Security at 62, could conceivably remove eight low income earning years from this calculation.

Because Social Security benefits paid to your spouse and children under 18 after you die will be determined by the amount you receive, consider the implications of waiting on survivors before determining when you'll claim.

Overall, because the full retirement age increases to age 67 depending on your birth month and birth year, the percentage of income received above and below your full retirement age may differ from these figures. Regardless, claiming Social Security at age 70 will result in more Social Security income per month than claiming when you're younger.

No. 2: Medicare Impact

If you claim Social Security early, you'll be automatically enrolled in Medicare when you approach 65. However, if you choose to delay claiming Social Security until age 70, then you'll need to remember to file for Medicare yourself.

If that's the case, plan on signing up for Medicare three months before reaching age 65. If you don't, then you may end up paying a late enrollment penalty for as long as you have coverage. Your monthly premium for Part B Medicare could be 10% higher for each full 12-month period that you could have had Part B, but didn't enroll.

Additionally, Medicare premiums are typically withdrawn directly from Social Security checks. So, if you decide to delay receiving Social Security until 70, then you'll receive a monthly bill for those premiums. The premium for Medicare Part B, the form of Medicare that pays for non-hospital care, such as doctor visits, is $121.80 in 2016. So, plan ahead for that expense.

No. 3: Tax considerations

Depending on your situation, when you claim Social Security could have an impact on your tax bill. If you claim Social Security prior to reaching full retirement age and you continue to work, then you may pay more in taxes than you might otherwise.

No one pays the IRS taxes on more than 85% of their Social Security income, but if your combined income (adjusted gross income + nontaxable interest + one half of your Social Security benefit) is above certain levels, you will have to pay taxes on some of your benefit.

If you're single and your combined income is between $25,000 and $34,000, you may have to pay taxes on up to half of your Social Security benefit. If you earn more than $34,000 in combined income, then you could be taxed on 85% of your benefit.

If you're married with a combined income that's between $32,000 and $44,000, then you could pay taxes on up to half your benefit. Couples earning more than $44,000 in combined income could end up being taxed on up to 85% of their Social Security income.

Image source: Blackrock

Since earned income can push you above these Social Security tax thresholds, you may determine that there are tax advantages associated with delaying when you claim Social Security until you stop working altogether.

The article 3 Facts About Claiming Social Security At 70 originally appeared on Fool.com.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.