3 Flaws With Donald Trump's Tax Plan

Image source: Evan Guest via Flickr.

Last year, according to the Internal Revenue Service, nearly 149 million taxpayers filed federal income tax returns, yielding more than $1.75 trillion in income for the government. Despite these enormous figures, about 80% of taxpayers who filed federal returns also received refunds. You could rightly say that tax time is a period of forced savings for many Americans.

However, with President-elect Donald Trump readying to take office in two months, tax policy in America could be nearing a shift. Not only has Trump proposed an overhaul of the U.S. tax code, but he'll also be working with a Republican-led Congress. It's pretty rare for an incoming president to have a unified Congress of the same party. In other words, tax changes are probably a matter of "when" not "if" at this point.

Trump lays out his vision for individual and corporate taxation

Trump's revised tax proposal, released during the summer, calls for a simplification of the individual income tax schedule from seven brackets to three. For added context, here's what the current individual tax brackets look like:

Table by author. Data source: IRS.

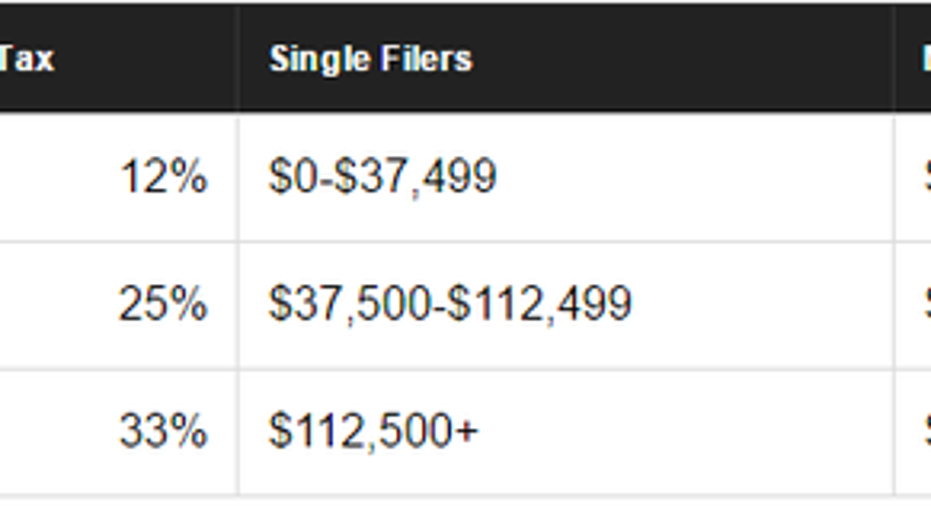

And here's what they'd look like if Donald Trump gets his revised proposal through Congress:

Table by author. Data source: Donald Trump campaign website.

According to Trump, who also aims to axe the Alternative Minimum Tax, estate tax, and gift tax, Americans from top to bottom are going to save money under his tax plan. On paper it would make sense to put more money into the pockets of consumers since we're a consumption-driven economy. If consumers have more money, they'll be more likely to spend it.

Trump also wants to completely reform corporate income taxes. With the exception of Puerto Rico and the United Arab Emirates, the U.S. has the highest marginal corporate income tax rate in the world. Trump's belief is that restrictive corporate taxes are inhibiting hiring and business reinvestment. By lowering the tax rate from 35% to 15%, he'll presumably allow U.S. corporations to be more competitive globally, pumping up the U.S. growth rate in the process.

According to Trump, if the full scope of his tax plan were implemented along with other proposals that include $1 trillion in infrastructure spending over 10 years, America could grow its GDP by as much as 4% per year.

Trump's tax plan could have numerous flaws

Though it's possible Trump could be right, there are a number of potential flaws with Trump's tax plan as it stands now.

Image source: Getty Images.

1. It could increase income inequality

Perhaps the biggest concern with Trump's tax plan is what it might do to further income inequality in America.

An analysis by the Tax Policy Center found that the bulk of the benefit would be felt by upper-income earners. The bottom 80% of income earners would see an effective marginal income tax cut of between 0.6% and 1.7%. For a family earning between $40,000 and $50,000 a year, we're talking about a tax cut of about $560. That's certainly better than nothing, but it's minuscule compared to the tax breaks seen in the upper quintile.

The Tax Policy Center's analysis suggests that the top 20% of income earners will see an effective marginal tax reduction of 3.2%, the top 1% will see their effective marginal tax drop 6.5%, and the top 0.1% could net a 7.3% effective marginal tax decrease. Per Lily Batchelder, a law professor at New York University and visiting fellow at the Tax Policy Center, "A millionaire... would get an average tax cut of $317,000."

Growing income inequality could have adverse effects on society. Most notably, the gap between healthcare and education among the rich and poor could widen. Lower-income folks may not have the financial capacity to seek preventative medical care, or they may not be able to afford college or a trade school to get the skills needed for socioeconomic advancement. Well-to-do individuals and families don't have these financial constraints, thus they often have the educational credentials needed to get higher paying entry-level jobs, and they tend to live longer than lower-income individuals since they have regular access to preventative care.

Trump's tax plan could be a hard sell to the American people given the lopsided benefits for the richest Americans.

Image source: Getty Images.

2. It'll likely increase our national debt

A second worry with Trump's tax plan is that it could balloon our already climbing national debt, which currently stands at more than $19.8 trillion.

On one hand, reducing individual and corporate tax rates and financing a $1 trillion spending plan in infrastructure over 10 years sounds great. It would presumably put more money back in the pockets of businesses and consumers, create new jobs, and lead to faster GDP growth than we're experiencing now. But the other side of the coin is that it would almost assuredly reduce the amount of tax revenue collected by the federal government.

On a static basis, an analysis conducted by the Tax Foundation estimated a 10-year reduction in tax revenue collection of between $4.4 trillion and $5.9 trillion. On a dynamic basis, which factors in the expectation of higher GDP growth and a broader tax base, the net effect is a $2.6 trillion to $3.9 trillion federal revenue reduction over the next decade. In other words, national debt could balloon to around $25 trillion, including regular budget deficits, by 2025.

It's worth noting that not all debt is necessarily bad. But if the federal government allows the national debt to get out of hand, then the percentage of the federal budget being apportioned to service that debt could grow. If this were to happen it could choke some of the most vital social programs, such as Medicare, Medicaid, and Social Security, and it could cause the federal government to drastically pull back on its reinvestment plans in infrastructure and other areas of the economy.

Image source: Getty Images.

3. Certain businesses may receive little help

A final issue with Trump's tax plan is that it won't help all types of businesses. Though the corporate tax rate would be expected to fall to 15%, certain types of pass-through firms, such as partnerships, LLCs, and sole proprietorships, would be facing the top individual corporate tax rate of 33%. In other words, Trump's tax plan isn't very friendly to certain types of small businesses, while at the same time it's bending over backwards to help domestic large corporations.

However, these same large corporations could get the shaft if they operate overseas. Part of Trump's plan includes a special repatriation tax rate of 10% for the nearly $2.5 trillion in corporate profits being held overseas. You might assume once this income is brought back to the U.S. and businesses pay the special 10% rate that would be the end of it. But that's not the case with Trump's proposal. U.S. multinationals could face double taxation since they're already paying tax in the foreign countries they're operating in, and they could be required to pay the new 15% corporate income tax in the U.S. as well.

In short, Trump may be overstating the positive impact his tax plan will have on businesses.

It's important to keep in mind that what Trump proposed on the campaign trail and what actually gets passed through Congress could be different. This means some of these aforementioned flaws could be resolved in the months and years to come. In the meantime, we can only watch and wait to see what's on Trump's plate once he gets into the Oval Office.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies..

Sean Williamshas no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen nameTMFUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.

The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.