3 Reasons Bank of America Should Have a Very Good Year

Image source: Getty (via iStock/Thinkstock).

Things are looking good for Bank of America (NYSE: BAC). It turned the corner from the financial crisis in 2015. It reported dramatically improved earnings in 2016. And for the reasons discussed below, it's headed for an even better year in 2017.

1. Interest rates

Banks are complicated, particularly universal banks like Bank of America. When you think about banks, in turn, I recommend that you simplify how they operate in your head.

I do this by analogizing them to a bookstore. A bookstore makes money by selling books. The higher the price of the books, the more revenue the bookstore earns.

Banks are the same, but they sell money instead of books. When a bank makes a loan, it's selling you the use of its money. The price at which it does so is the interest rate. Higher rates therebyequate to higher revenue.

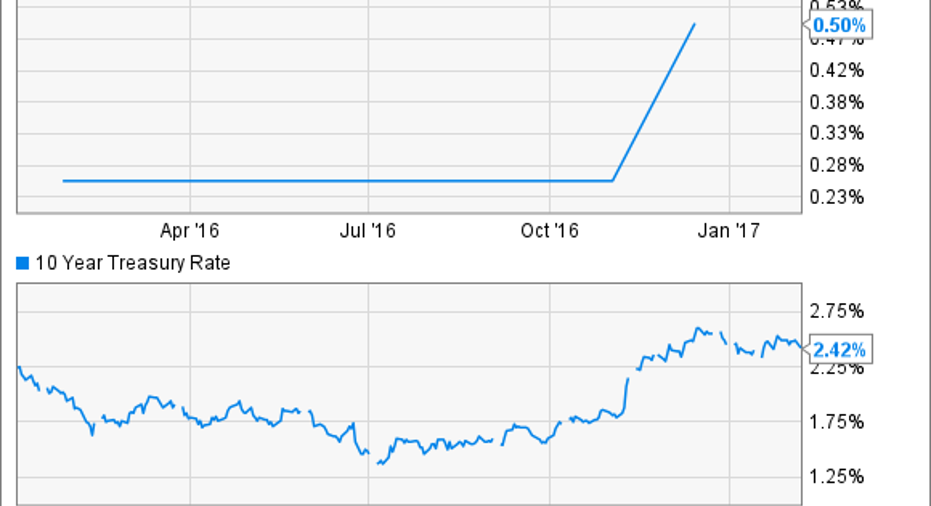

This has been a problem for banks over the past eight years, as interest rates dropped to historic lows in the wake of the financial crisis. But this is changing. Long-term rates shot up after the presidential election in November. Short-term rates followed suit one month later.

U.S. Target Federal Funds Rate data by YCharts.

The net result is that Bank of America should earn $600 million worth of additional net interest income each quarter this year, according to the bank's estimate.

2. Lower expenses

It probably goes without saying, but a bank that spends less on operating expenses will be more profitable than a less-efficient bank. In this respect, banks are like any other type of company.

But running a lean operation is especially important for banks. Not only do lower expenses mean more revenue will fall to the bottom line, and thus be available to distribute to shareholders, but it also reduces the pressure on banks to take shortcuts in other areas of their operations that can lead to trouble.

I'm talking specifically about the relationship between efficiency and loan losses. In short, efficient banks have less of an incentive to artificially juice their returns by lending money at high rates to poor credit risks.

This is why Bank of America's various cost-cutting initiatives over the past few years should be welcomed with open arms by its shareholders. Since CEO Brian Moynihan took over at the beginning of 2010, the North Carolina-based bank has trimmed its annual expense base by roughly $20 billion.

And it's not done. Last year, Moynihan announced a new initiative to slash an additional$3 billion in annual operating expenses by 2018. These cuts are already in progress and should further fatten Bank of America's bottom line this year.

3. Trading revenue

If there's one aspect of Bank of America's operations that's hard to predict, it's the bank's trading operations.

One of the services it offers to clients is facilitating the purchase and sales of securities.Let's say, for example, that one of its clients wants to offload $10 million worth of mortgage-backed securities. Bank of America will help it do so by buying the securities and then finding a different institution to sell them to, generating a profit from commissions as well as the spread between what the securities cost Bank of America to purchase and what it earned from selling them.

The downside to trading operations is that they're innately volatile. When events in the markets cause investors to stay on the sidelines, Bank of America and other market makers don't make money from trading, as there aren't enough securities changing hands.

But with all of the volatility ignited by the current presidential administration, there's reason to believe trading volumes will remain elevated as investors reposition their portfolios in response to the president's latest threat on Twitter. Bank of America benefited tremendously from this in the fourth quarter of last year and could very well see that trend continue throughout 2017.

In short, while Bank of America's stock certainly isn't as cheap as it was last year, current and prospective investors in the nation's second biggest bank by assets can stay optimistic that its top and bottom lines are heading in the right direction, which should ultimately be reflected in the price of its shares.

10 stocks we like better than Bank of AmericaWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now...and Bank of America wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017.

John Maxfield owns shares of Bank of America. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.