3 Reasons Union Pacific Stock Could Rise

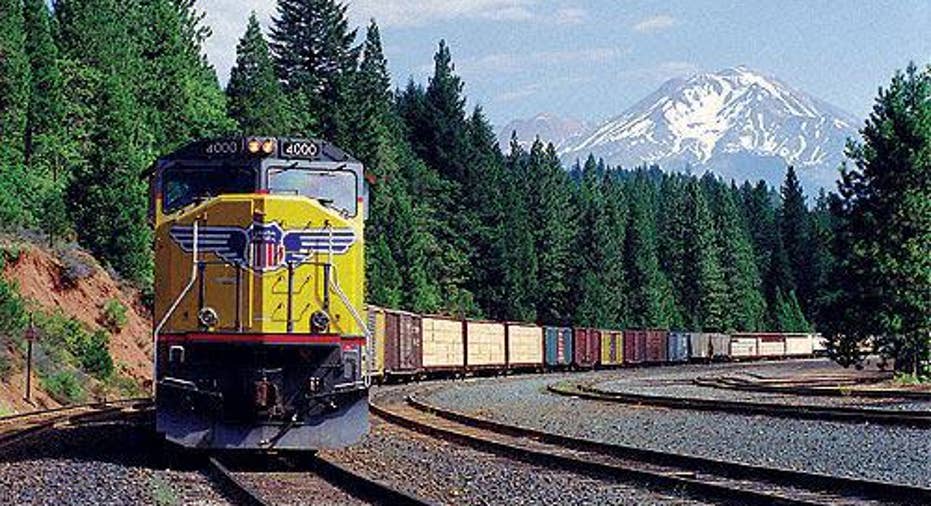

Image: Union Pacific.

Railroad company Union Pacific has had to deal with a tough environment in its part of the transportation sector over the past year, and its stock has lost a third of its value since early 2015 as a result. A big part of that has been weakness in some of the key industries that railroads serve, and bullish investors hope that Union Pacific can bounce back once some of the pressure it has labored under lately starts to let up. Let's take a look at three of the biggest reasons why Union Pacific stock could earn back some of its recent losses.

Hard-hit commodity markets could recoverUnion Pacific relies on a wide variety of commodity-shipping customers for its overall success. Most of the attention that the railroad has gotten on this front has been in the energy industry, where Union Pacific was instrumental in picking up demand from oil and natural gas exploration and production companies. Because of the remote areas in which energy products were available, producers had to be innovative in finding ways to get those products to market. Union Pacific picked up the slack, and that left it exposed to falling production levels when price started to sag.

Yet other commodities have also hurt Union Pacific. Weakness in the agricultural sector has hurt the business of shipping not only grains and other crops but also the fertilizers and chemicals needed to grow them. Low coal prices have led to reduced volumes from that industry as well. If these markets start to turn -- and some have already pointed to signs of a rebound in certain hard-hit areas -- then Union Pacific stock could gain ground as well.

Foreign-currency weakness could reverseFor years, the strength of the U.S. dollar has created a new dynamic in global trade. U.S. companies have seen the value of the business they do abroad fall in dollar terms, and foreign competitors have had the advantage of reaping more valuable dollars for the business they do within the U.S. market.

Union Pacific relies on healthy export markets, and so a strong dollar is bad for its customers and by extension its own business. However, some signs have recently emerged that the dollar's gains have at least paused and could reverse themselves to some extent.

In particular, the dollar has fallen back against the euro and the Japanese yen so far in 2016. The move has reflected the belief that the Federal Reserve will be slower in its efforts to raise interest rates in the U.S. because of concerns about its impact on the domestic and global economy. The tentative nature of economic growth right now has many economists believing that an aggressive push higher in rates could push the U.S. into recession.

The dollar's strength has been predicated on the idea that the U.S. would remain strong even as other countries endured further economic weakness. With the fate of major economies across the globe seeming to be increasingly linked together, exporters like the clients that Union Pacific serves could get some much-needed relief if the dollar gives up some of its gains from recent years.

Strength in the consumer sector could continueOne area that has been a saving grace for Union Pacific and its railroad peers has been demand for key consumer items. For instance, U.S. automakers enjoyed record sales in 2015, and the railroad network played a vital role in getting many of those vehicles to dealers and ultimately to the consumers who bought them. Union Pacific has also seen relatively strong performance in its intermodal business, which includes shipping consumer products both through traditional brick-and-mortar distribution channels as well as in responding to e-commerce demand.

Many have predicted that the U.S. economy could be reaching its apex and be at risk of falling back. However, at least so far, that hasn't happened. If the domestic economy thrives because of the health of the U.S. consumer -- a theme that we've seen play out many times in the past -- then Union Pacific will be in position to benefit.

Union Pacific investors have had to deal with big losses in the stock. But if some of these factors start helping Union Pacific rather than hurting it, then the railroad stock could bounce back in 2016.

The article 3 Reasons Union Pacific Stock Could Rise originally appeared on Fool.com.

Dan Caplinger has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.