3 Things Alcoa Corp Needs to Prove in 2017

The big news for aluminum giant Alcoa Corp (NYSE: AA) in 2016 was its separation from Arconic Inc (NYSE: ARNC), Alcoa's former specialty parts business. Now that the break up is done, Alcoa starts 2017 with a clean slate and a completely different business outlook. That means it has a lot to prove to investors. Here are three key issues you'll want to watch closely.

Image source: Alcoa Corp.

1. That it's focused on the future

There's no way around the fact that 2016 was a year of change for Alcoa. It culminated with the breakup of Alcoa and Arconic in early November. That means the fourth quarter was the first full period in which Alcoa's results were "purely" based on its aluminum business. At first blush, it wasn't a great start, since the company lost $0.68 a share.

But you need to take that with a grain of salt because the number changes to a profit of $0.14 a share if you strip out one-time charges. Those one-time items included the permanent shut down of the company's Suralco refinery and the write down of natural gas assets in Australia. Both of those were house cleaning moves that should allow Alcoa to start 2017 with its best foot forward.

The big question for investors is whether or not that non-GAAP $0.14 a share is a reasonable number or not. Right now it looks like there's a huge amount of uncertainty, with analyst earnings estimates for 2017 ranging from a low of $0.23 a share to a high of $1.19. Only time will tell what 2017 earnings will be, but Alcoa's price advance of around 60% since the separation from Arconic suggests investors have high expectations.

2. Capable of generating profits

Beyond earnings, Alcoa also needs to show that its business can generate cash. That's the real lifeblood of a business, not GAAP or even adjusted earnings. On that score, the fourth quarter included some one-off items that helped increase the aluminum company's cash balance by $296 million. That gives it a nice cushion of around $850 million as it enters 2017 a stand-alone company.

The problem is that a good portion of the cash it generated in the fourth quarter came from events driven by the separation from Arconic. In other words, 2017 will be the first time that investors get to see how much cash Alcoa can really generate from its aluminum businesses. If free cash flow is a problem, then Alcoa's outlook may not be as positive as investors are pricing in today.

3. That it can adjust to a shifting marketplace

Another key issue to watch is Alcoa's steps to adjust with the changing aluminum market. For a long time that's meant closing or selling older and less efficient operations, which includes the fourth-quarter decision to permanently shut Suralco. There's been a lot of heavy lifting so far, helping push Alcoa's costs dramatically lower. For example, its place on the alumina cost curve has declined to the 17th percentile from the 30th in 2010. In aluminum it went from the 51st percentile to the 38th.

Now that Alcoa is a stand-alone company, it can't stop. The Suralco decision is a good indication that it isn't done streamlining yet. Still, as 2017 progresses, Alcoa needs to prove that it has what it takes to keep the momentum going.

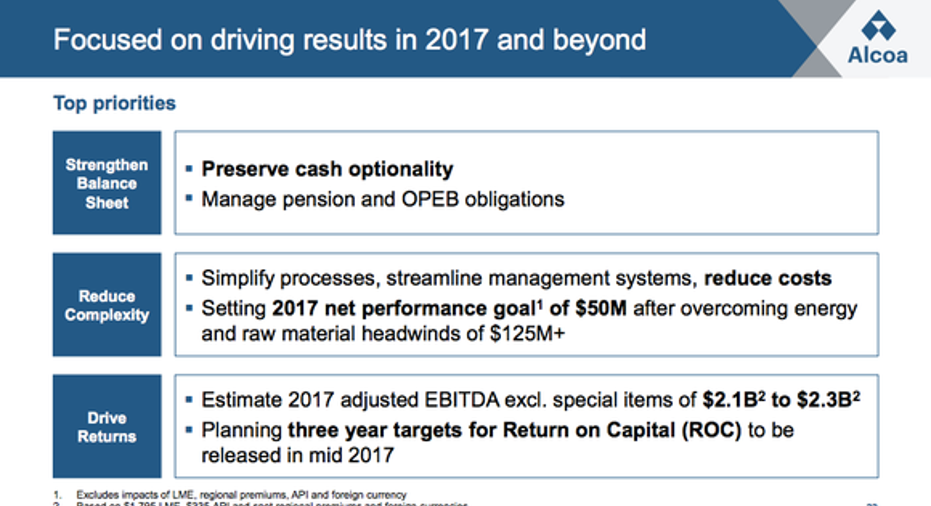

Alcoa's 2017 goals include generating cash and saving money.Image source: Alcoa Corp.

On that front, the company is targeting permanent cost savings of $50 million this year, beyond the impact of factors outside of its control, like commodity prices. That's down from previous years, but a lot has been accomplished already. As we move through 2017, watch to ensure Alcoa can live up to this goal, if not exceed it.

Time for change

Alcoa ended 2016 with a bit of a thud if you look at GAAP earnings. However, once you take out one-time items its business looked a lot better. This year is when Alcoa can prove that a stand-alone aluminum company can be profitable and generate cash, the lifeblood of a business. While it's doing both these things, it also needs to show that it hasn't stopped changing with the times by continuing to improve its operations. That covers a lot of ground, but with 2016 finally put to bed, Alcoa really does have a huge amount to prove in the new year.

10 stocks we like better than Alcoa When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Alcoa wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.