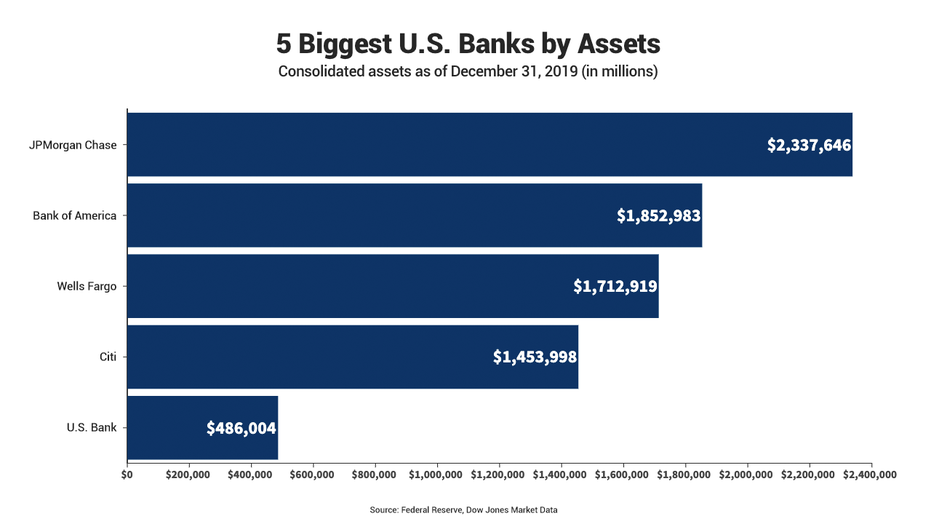

5 biggest US banks

US banks had $16.9T of assets as of Dec. 31, 2019

U.S. banks have seen their sizes grow dramatically since the 2008-2009 financial crisis.

Financial firms had $16.9 trillion of consolidated assets as of Dec. 31, 2019, up 48 percent from the end of 2008, according to Federal Reserve data. The total number of banks rose to 1,836 from 1,722 over that time.

33% KEPT HOUSE PAYMENTS CURRENT AFTER WINNING CORONAVIRUS REPRIEVE: BANK CEO

JPMorgan Chase was the largest U.S. bank at the end of 2019 with $2.338 trillion in consolidated assets. About 77 percent, or $1.808 trillion, of those assets were domestic. The bank had 4,982 U.S. branches and 33 overseas.

Bank of America was the second-largest U.S. bank, holding $1.853 trillion of consolidated assets at the end of last year. The bank held $1.747 trillion, or 94 percent, of those assets domestically. Bank of America had 4,242 domestic branches and 27 foreign branches.

Wells Fargo was the No. 3 U.S. bank by consolidated assets at $1.713 trillion. Of that, $1.653 trillion, or 97 percent of its assets were domestically owned. Wells had 5,441 U.S. branches and 11 overseas.

Citibank was the fourth-biggest American bank by assets with $1.454 trillion. About 59 percent of assets were held in the firm’s 700 domestic locations. Citi had 170 branches abroad.

CLICK HERE TO READ MORE ON FOX BUSINESS

U.S. Bank rounds out the top five with $486 billion of consolidated assets, 98 percent of which are U.S.-based. The firm had 2,842 U.S. branches and one outside of the country.