5 Uranium Statistics That Will Blow You Away

Investors are right to be mindful of uranium's image problems. But the negatives surrounding uranium and nuclear power can offer up long-term buying opportunities, too. Since the 2011 Fukushima disaster in Japan, uranium prices have been in a downtrend, pulling down the prices of miners like Cameco Corp (NYSE: CCJ). But if you are willing to take a contrarian view, here are five uranium stats that might make you want to buy into the long-term growth potential of nuclear energy and the fuel that runs it.

Image source: Getty Images.

1. Bigger than you think

Carbon dioxide is the environmental 'bad guy' of the moment. There's no point in arguing if that's backed up by science or not because carbon-heavy fuels like coal are slowly being replaced by alternative fuel options like solar and wind. But here's the interesting thing: Nuclear power doesn't release carbon dioxide. And it's an always-on power source, making it a good option for baseload power.

Just how good? Uranium happens to be the single largest contributor to carbon-free power in the United States. These numbers ebb and flow over time, but according to Energy Fuels (NYSEMKT: UUUU), a small, U.S.-focused uranium miner, nuclear power made up 60% of the "clean" power generated in the United States in 2015. And nuclear power plants ran at 90% of capacity, far above solar, wind, and even hydro power plants.

Nuclear is a bigger player in the "clean energy" market than you may realize. Image source: Energy Fuels Investor Presentation.

2. Nuclear in China

So, whether you realize it or not, nuclear power is a huge contributor to the U.S. clean energy sector, providing reliable, carbon-free baseload power. That hasn't gone unnoticed around the world.

China, the world's most populous nation, has 35 reactors up and running today. For comparison, the United States, a mature market, has around 60 nuclear power plants. But China is still trying to satisfy its citizens' demand for electricity. According to Cameco, the world's largest independent uranium miner, China has 20 more facilities under construction right now.

However, those 20 reactors could be just the start. According to Energy Fuels, the giant nation has plans to build 177 more reactors. It's unlikely all of them will actually get built, but even half of that number would represent huge growth in nuclear power -- and huge growth in demand for uranium.

3. Nuclear in India

China isn't the only large developing nation looking to nuclear and uranium to satiate the growing demand for electricity. India, another global giant, is leaning toward nuclear power to fulfill its population's needs as well. Right now, the country has 22 nuclear power plants up and running, with five under construction. And it has another 64 planned or proposed, according to Energy Fuels. That's not as exciting as what's going on in China, to be sure, but if all of the nuclear facilities lined up in India get built, the country will rival, if not surpass, the United States' plant count.

Key nuclear power plants being built today. Image source: Cameco Corporation Investor Presentation.

4. Beyond the giants

China and India are clearly two of the largest and most exciting opportunities for nuclear power today. It's simple math: they are the two largest nations in the world. But they aren't the only markets looking to build nuclear power plants. For example, there are 57 nuclear reactors under construction today, only around 25 of which are in China and India. So, these two nations are likely to be the largest sources of future uranium demand, but not the only sources.

5. Open and shut

There's a huge number of new nuclear power plants coming online around the world, with particularly noteworthy growth in China and India. What about all the facilities that are getting shut down, or that will soon need to be shuttered? That's the news that's been making the headlines, particularly in the United States. The answer is that new construction is expected to more than offset retirements, leading to a net increase in nuclear power and uranium demand.

The long-term uranium math. Image source: Energy Fuels Investor Presentation.

In fact, new nuclear power plants are expected to increase demand so much that the current supply of uranium is projected to fall well short of satisfying the market's long-term needs. Clearly, there will be companies happy to supply the uranium the market is projected to demand, and that's exactly where the growth potential for companies like Cameco comes from.

Cameco, for reference, has 410 million pounds of proven and probable reserves and another 750 million pounds of measured, indicated, and inferred resources. It has ample capacity to meet higher world demand. Although in today's low uranium price world it's focused on operating as lean as possible, it hasn't stopped investing for the future. For example, it recently opened the Cigar Lake mine, which it claims has uranium grades 100 times the world's average.

The high-quality mine has allowed Cameco to offset more costly production with Cigar Lake uranium, leading to a 14% decline in its internal production costs through the first nine months of 2016. It's also worth highlighting that the company produced 6% more uranium over that span. More production, lower costs...that's a win-win for Cameco. The Cigar Lake mine should be up to full capacity in 2017, suggesting there's more cost-savings benefit to come.

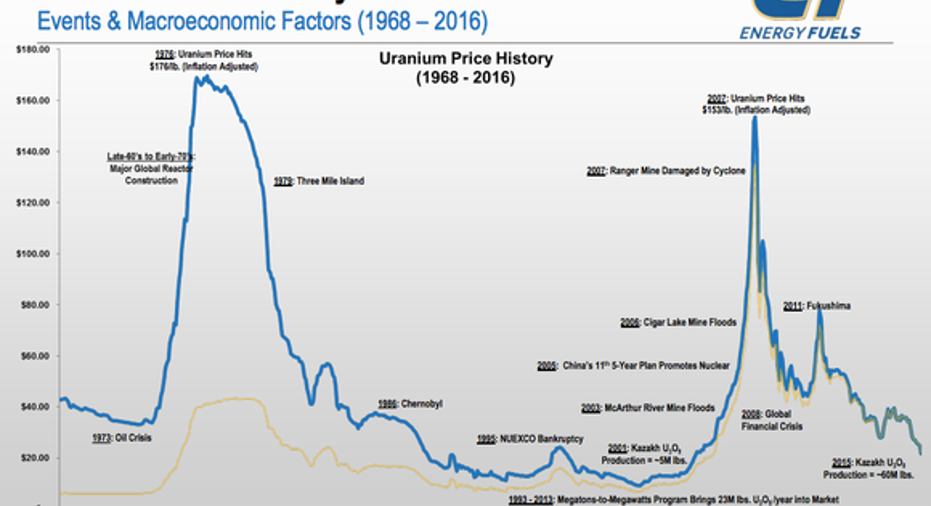

The long-term ups and downs of uranium. Image source: Energy Fuels Investor Presentation.

Look beyond the image

Nuclear power has a bad name, but it's an integral part of the global power market. More importantly, it's set to become an even bigger player in the future. That said, today's supply-and-demand dynamics have pushed uranium prices down to extremely low levels. This, in turn, has put pressure on uranium miners' top and bottom lines. The end result is that shares of uranium miners like well-situated Cameco are in the doldrums.

If the five uranium statistics noted above do truly blow you away, you might want to take the time to do a deep-dive into the nuclear power fuel -- and spend some time digging into Cameco, which is probably the best opportunity for those interested in the space.

10 stocks we like better than Cameco When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now...and Cameco wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017.

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.